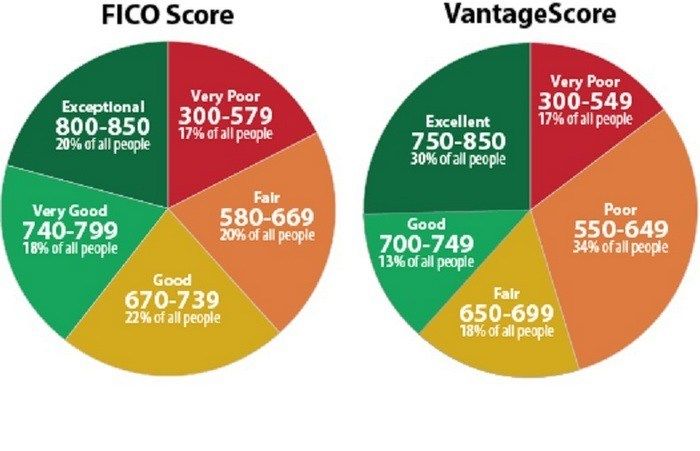

Do you have a goal of purchasing a new home or refinancing your current mortgage this year? If so then it is more important than ever to pay close attention to your credit and to take steps toward improving it if necessary. You do not need perfect credit in order to qualify for a mortgage. That is a myth. However, you do need to have credit reports and scores which can meet a mortgage lender’s qualification standards.

When you apply for a new mortgage your lender will most likely have a minimum credit score requirement which is necessary in order to be eligible to qualify for a mortgage. Yet even if your credit scores exceed this minimum score requirement that does not mean that you will be all clear for loan approval from a credit standpoint.

Even if you have very good credit scores there are still certain items on your credit reports which can potentially be deal killers. Check out these 3 credit complications which could put the brakes on your next mortgage approval.

Tax Liens

Not every item on your credit reports has an expiration date. Unpaid tax liens, for example, are allowed to remain on your credit reports indefinitely. There is no requirement in the Fair Credit Reporting Act (FCRA) that outstanding tax liens ever be removed from your credit reports. As a result, even an old unpaid tax lien can potentially make it difficult or perhaps impossible to qualify for a mortgage.

If possible, your best bet is to pay off any outstanding tax liens prior to applying for a mortgage. However, if paying off the lien in full simply is not an option you may still be able to qualify for a mortgage if you have entered into a repayment plan with the IRS or your state tax authority, provided you have made enough consecutive payments to satisfy your mortgage underwriter.

Judgments

Unlike outstanding tax liens, unsatisfied judgments do have a time limit when it comes to credit reporting. The FCRA requires that judgments be removed from your credit reports after 7 years from the date filed – paid or unpaid. However, if an unpaid judgment is still recent enough to be showing up on your credit reports then it could potentially cause you complications if you plan to fill out a mortgage application in the near future.

As is the case with outstanding tax liens, the best course of action you can take is to satisfy any outstanding judgments prior to applying for your new home loan. However, in some cases you may still be able to qualify for a mortgage with an unpaid judgment provided that you have entered into a payment agreement and can prove that you have made at least 6 months worth of timely and consecutive payments on the debt.

Child Support Arrears

Believe it or not, FICO (the most popular brand of credit scores currently used by lenders) actually does not consider your child support account when calculating your credit scores. The account will not impact your FICO credit scores positively or negatively. Yet even if your child support arrears are not lowering your credit scores that does not mean that those child support arrears will not cause complications when you apply for a mortgage. They could prevent you from qualifying for a mortgage.

Each type of mortgage loan has different approval criteria, but most of them have a cap on the amount of derogatory collections a borrower may have on his or her credit reports and still remain eligible for a new mortgage. Child support which is in arrears is considered by most lenders to be “derogatory credit.” As a result your child support arrears could potentially have to be paid down or paid off in full before you can receive a mortgage approval.

First Steps

If you plan to apply for a new mortgage in the near future, a great place to start is by checking your credit reports. You can claim a free copy of your 3 credit reports online each year at AnnualCreditReport.com. Want a professional review your credit with you? CLICK HERE to schedule a credit report review with 1 of our Credit Pros today.