Save money and stop missing out on important opportunities.

The Credit Pros has been helping people like you repair their credit score by updating or removing inaccurate items on credit reports for over a decade.

Our commitment is to making sure that everyone has a fair shot at good credit. Founded by a team of credit law experts, The Credit Pros wants to make sure that everyone has access to the same information and can learn what it takes to build good credit for a lifetime.

Not only do we offer credit repair, but we also provide financial and credit education tools and resources to help our clients understand what’s on their report (e.g. like specific

negative items, etc.) and how their credit score works. With this education and our AI-based credit management tools, our clients can work to take control of their financial future and live a life without credit worries.

Your credit score determines how much you pay to borrow money to cover modern day essentials including housing, cars, credit cards and loan interest rates.

Use the slider below to see how your credit score range impacts how much you pay for the same items over time. Then ask yourself, can you afford NOT to fix your credit?

Home Loan

Car Loan

Loan

Credit card

Loan Type

30 Year Fixed Mortgage

60 Month New Auto

Personal Loan (2yrs)

Revolving Credit

Loan Amount

APR

Monthly Payment

Total Interest

The Credit Pros offers affordable plans to help you increase your credit score so you pay less for the essentials (and the extras) in life.

Easy-to-read credit reports and personalized score insights

Tools & tips to help you understand your score and take the next step.

Credit Monitoring is Included at No Additional Charge which can help you spot potential identity theft.

A credit report is a track record of both your personal and financial credit information. It includes information taken from public records, personal identification and debt information. Your report will show things like your payment history, your debt balances, items in default, items in collections, and who you owe money to.

If you have unpaid debts, you might see entries from various debt collectors on your credit report and may receive harassment calls from unknown numbers (that are likely debt collectors).

Here are some examples:

TransWorld Systems Inc. (TSI): 888-899-6650

Spectrum (Charter Communications): 844-206-9035

Credit Collection Services (CCS): 978-444-5700

AT&T: 877-910-0501

Portfolio Recovery Associates: 866-430-0311

T-Mobile: 877-819-6042

These entries indicate that these agencies are attempting to collect on debts you may or may not owe, which could impact your overall credit score and potentially contain inaccurate information. The Credit Pros can help you validate debt collections, correct errors on your report, and more.

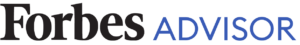

Your credit score is a 3-digit number between 300 and 850 that shows how creditworthy you are. Lenders use your credit score to decide whether or not you qualify for loans. They also use your credit score to determine your interest rate.

Credit scores are calculated using a 5-part formula, calculated based on the following factors: payment history, amounts owed, length of credit history, mix of types of credit, and amount of new credit.

It only takes 90 seconds to sign up. Start fixing errors on your credit report and get help to increase your credit score. Your information is safe with us. We treat your data as if it were our own.

Privacy and Cookies

We use cookies on our website. Your interactions and personal data may be collected on our websites by us and our partners in accordance with our Privacy Policy and Terms & Conditions