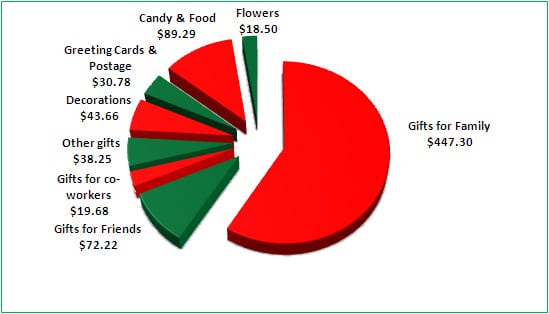

The temptation to overspend during the holidays is very high. Yet overdoing it when it comes to holiday spending will almost certainly spell trouble for your finances and your credit, causing additional holiday debt. Naturally the best course of action when it comes to holiday spending is to set a firm budget ahead of time and stick with it, only spending what you can truly afford.

The truth, unfortunately, as you are reading this article is that it may be too late for preventative measures. Yet even if you have already charged way too much this holiday season, throwing up your hands in frustration and shrugging off the impact of those holiday shopping binges is not wise either. You do not need to panic, but you do need to plan to eradicate your holiday debt.

Assess the Damage

Creating and following through with a plan to repair the damage caused when you overspend during the holidays is essential. This is especially true if you want to resolve the credit and financial issues you are now facing. To begin it is important to take an open-eyed assessment of the damage your holiday debt has caused. Make a list of your outstanding credit card balances so you will be prepared for your elimination plan. Go ahead and rank your credit card balances from highest down to lowest. You will need this information in the next step of your post-holiday financial fitness plan.

Credit card debt, even when you make all of your monthly payments on time, can take a major toll on your credit scores. You may be in deep when you overspend during the holidays. As a result, another important post-holiday credit improvement step is to take a look at your 3 credit reports and scores. it is important to keep an eye on your credit reports throughout the entire year and to thoroughly check your reports for errors. (Click here to schedule a credit report review with one of our Credit Pros.)

Build the Plan

Once you have your 3 credit reports, credit scores, and a list of your outstanding credit card balances (from highest to lowest) you can start to build your post-holiday debt strategy. Here are a few options to consider.

Balance Transfer

Balance Transfer

Credit cards are notorious for featuring painfully high-interest rates. These high rates can make getting out of holiday debt more difficult, especially if you are working with limited funds. If your credit scores are in decent shape; however, you might consider opening a new credit card with a 0% or low introductory rate balance transfer offer. By transferring your unpaid credit card balances over to a new account with a lower rate you will be able to make more headway in your journey to eliminate debt (provided that you do not charge the balances on your old accounts back up after the transfer). This way, if you are wondering What to Do If You overspend during the holidays, it doesn’t need to cost too much in interest.

Consolidation Loan

Another option to consider if you cannot afford to immediately wipe out your holiday debt is a consolidation loan. Again, your credit scores will likely need to be in decent shape to qualify for the new line of credit. Consolidation loans from your local bank or credit union will generally offer much lower rates than your credit card accounts; however, the rates will probably not be as low as a balance transfer offer. Even though consolidating your credit card debt into a single installment loan may be more expensive than a balance transfer, converting revolving debt into installment debt will give your credit scores a boost. It is still therefore an option to strongly consider.

Aggressive Payments

Facing credit problems currently? If you cannot qualify for a balance transfer due to poor credit then mapping out a payment plan to eliminate your debt may be your best option. (In truth, a debt eliminate plan is still important even if you have consolidated your debt.)

From a credit perspective, it is best to begin making payments on the accounts with the lowest balances first. As each account balance is paid to $0 your credit scores should begin to move upwards. Remember, you can also work with a pro to resolve your other credit issues simultaneously so that your credit issues might not keep you from qualifying for a consolidation loan in the future.

Moving Forward: What to Do If You Overspend During the Holidays

If your goal is to achieve great credit then is very important to break the cycle of overspending. Next year, try not to overspend during the holidays. In fact, while you are working to improve your credit and eliminate debt it would be a wise idea to cut your spending as much as possible. In the spirit of honesty, it might not be much fun to cut spending, reduce your debt, and work on your credit issues. However, while the process may not necessarily be fun, it is absolutely worth it.

Balance Transfer

Balance Transfer