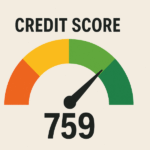

A 759 credit score puts you squarely in the “very good” credit category—just a few points shy of the coveted “excellent” tier that begins at 800. With a 759 credit score, you already qualify for most premium financial products and favorable interest rates, potentially saving you thousands of dollars over your lifetime. But is it worth pursuing those extra points to break into the 800+ club? While the difference between a 759 credit score and 800+ score might seem minimal on paper, even small improvements can unlock additional benefits that may be particularly valuable depending on your financial goals.

This article examines what your 759 credit score means in practical terms and outlines specific strategies to optimize your 759 credit score further. We’ll explore the actual financial advantages of your current 759 credit score, identify the subtle barriers that might be preventing you from reaching the next level, and provide actionable techniques for credit optimization that make sense for someone already in an enviable position. Whether you’re planning a major purchase or simply want to maximize your financial options, understanding how to leverage and improve your already impressive 759 credit score is a worthwhile investment.

Understanding the Value of Your 759 Credit Score

With a 759 credit score, you stand on the edge of major financial opportunities. Every point matters, and aiming for an 800+ credit score can open further doors in the financial landscape.

A 759 credit score places you in an enviable position within the credit spectrum. In FICO’s scoring model, which ranges from 300 to 850, scores between 740 and 799 are classified as “very good,” while VantageScore considers scores between 740 and 799 as “excellent.” With a 759 credit score, you’re positioned near the top of this tier, just shy of the highest category that typically begins at 800. This positioning means you’ve already demonstrated exceptional financial responsibility and discipline in managing your credit obligations.

Lenders view consumers with scores in the 750s, including your 759 credit score, as presenting minimal risk. When financial institutions analyze your application, a 759 credit score immediately signals low risk to lenders. This perception translates into tangible benefits—your 759 credit score means you’ll likely receive approval for most credit products with favorable terms. The approval process itself tends to be smoother and faster, as lenders have fewer concerns about your creditworthiness.

With a 759 credit score, your financial options expand significantly. Taking steps to reach an 800+ credit score can further improve your standing in the eyes of lenders.

The financial advantages of your current score are substantial. With a 759 credit score, you typically qualify for interest rates that are just marginally higher than those offered to consumers with 800+ scores—often just 0.1% to 0.3% difference on major loans. For example, on a $300,000 30-year mortgage, this might translate to a monthly payment difference of just $15-45. Auto loans show similar patterns, with minimal rate differences between the “very good” and “excellent” categories. Credit card approvals are virtually guaranteed for most premium products, though you might occasionally miss out on the absolute highest credit limits or most aggressive promotional offers reserved for those in the 800+ club.

Financial Opportunities Unique to Your 759 Credit Score

With a 759 credit score, you have access to a wide array of premium credit card offerings. Card issuers eagerly compete for consumers in your credit tier, meaning you can qualify for cards with significant sign-up bonuses, generous rewards structures, and valuable perks. Premium travel cards with airport lounge access, travel credits, and enhanced insurance protections are well within reach, thanks to your 759 credit score. While those with 800+ scores might occasionally receive targeted offers with slightly enhanced terms, the difference is typically minimal—perhaps an extra 5,000 bonus points or a slightly higher initial credit limit.

Mortgage and auto financing represent areas where your excellent 759 credit score truly shines. You’ll qualify for conventional mortgages with down payments as low as 3%, jumbo loans with competitive rates, and streamlined approval processes. Most lenders consider borrowers with scores above 740, like your 759 credit score, as their “prime” category, meaning you’re already receiving close to the best available rates. For a $250,000 mortgage, the difference between rates offered to someone with a 759 credit score versus an 800+ score typically amounts to less than $20 per month—a difference that diminishes further when refinancing opportunities arise.

Your excellent 759 credit score provides significant negotiation leverage with lenders. When applying for loans or credit cards, you can confidently:

A 759 credit score allows you to request better terms and conditions, enhancing your borrowing power.

- Request lower interest rates than those initially offered

- Ask for annual fee waivers on credit cards

- Negotiate the removal of certain loan origination fees

- Seek higher credit limits than standard offerings

- Request expedited approval processes

Beyond traditional lending, your 759 credit score yields advantages in insurance markets. Many auto and home insurance providers use credit-based insurance scores in their pricing models, with research showing strong correlations between credit scores and claim frequencies. With your 759 credit score, you likely qualify for preferred rates that can save hundreds annually compared to those with average credit. Some employers in financial sectors also consider credit histories in hiring decisions, particularly for positions involving financial responsibility, making your excellent score an asset in certain career paths.

Strategic Credit Optimization Techniques for Your 759 Credit Score

Fine-tuning your credit utilization represents one of the most powerful levers for optimizing your already impressive 759 credit score. While the general recommendation is to keep utilization below 30%, those aiming to break into the 800+ territory should target a much lower threshold. Maintaining aggregate utilization below 10% across all revolving accounts can provide a meaningful boost, with the most credit-savvy consumers keeping it under 7%. The timing of your credit card payments plays a crucial role here—making multiple payments throughout the month rather than waiting for the statement date can ensure your reported utilization remains consistently low, even if you regularly use your cards for significant spending.

Advanced credit mix strategies become increasingly important at your level. While having a diverse portfolio of credit types (revolving accounts, installment loans, mortgages) generally benefits your 759 credit score, the impact becomes more nuanced for those with already-strong profiles. Rather than taking on unnecessary debt solely for score improvement, focus on maintaining longevity with your existing mix. If your profile lacks certain account types, consider strategic additions—perhaps a credit-builder loan or a small personal loan that can be quickly repaid—but only if the long-term benefits outweigh the short-term score dip from the inquiry and new account.

The principle of diminishing returns becomes particularly relevant when optimizing scores above 750. The effort required to gain each additional point becomes more challenging, while the practical benefits of those points decrease. This reality necessitates a more calculated approach to credit management. Rather than pursuing every possible optimization tactic, focus on those with the highest impact-to-effort ratio. Maintaining perfect payment history remains essential, but obsessing over minor utilization fluctuations may yield minimal returns. Similarly, the strategic timing of new credit applications becomes critical—spacing applications several months apart minimizes the impact of multiple inquiries and allows your 759 credit score to recover between applications.

Age of accounts represents another crucial factor in breaking through to higher score tiers. The average age of accounts and the age of your oldest account significantly influence your score, particularly in the upper ranges. This creates a strategic dilemma regarding unused accounts—while closing unused accounts might simplify your financial management, doing so could reduce your average account age and potentially lower your score. The optimal approach typically involves keeping older accounts active with minimal usage (perhaps a small recurring subscription) while focusing spending on cards that provide the best rewards for your lifestyle. Accounts with annual fees warrant regular cost-benefit analysis to determine if their benefits justify the expense.

Addressing the Ceiling Effect: Breaking Through to 800+

Many consumers with scores in the 750s encounter a frustrating ceiling effect when attempting to break into the 800+ range. Several common barriers may be preventing this final leap. One frequent obstacle is having too many recent inquiries or new accounts, which can suppress scores for up to 12 months. Another common barrier is having a limited credit history length—even with perfect payment behavior, scoring models give substantial weight to the length of credit history, with the highest scores typically requiring 7+ years of established credit. Minor derogatory marks that may seem insignificant, such as a single late payment from years ago or a briefly-used collection account that was paid, can continue to cap your score until they age completely off your report.

Timeline expectations for reaching the next credit tier should be realistic. Moving from the 750s to 800+ typically requires patience, often taking 12-24 months of perfect credit management even when all the right strategies are implemented. This timeline extends further if you have recent inquiries or new accounts that need time to age. The most efficient path involves identifying specific factors in your credit profile that are preventing the breakthrough, then systematically addressing each while maintaining impeccable payment behavior and low utilization.

Identifying and resolving minor derogatory marks becomes increasingly important at your level. Request your full credit reports from all three major bureaus and scrutinize them for inaccuracies or outdated information related to your 759 credit score. Pay particular attention to:

- Late payments that may have been erroneously reported

- Collection accounts that should have been removed

- Incorrect credit limits that artificially inflate your utilization

- Accounts that aren’t yours (potential identity theft)

- Hard inquiries you didn’t authorize

For consumers with near-excellent scores, specialized credit monitoring tools offer valuable insights beyond basic free services. Premium monitoring services that provide regular FICO score updates across all three bureaus can help you track incremental progress and identify which specific actions move the needle regarding your 759 credit score. These services often include score simulators that can predict the impact of various actions, such as paying down specific balances or applying for new credit, helping you prioritize your optimization efforts.

The cost-benefit analysis of pursuing those final points requires honest assessment of your financial goals. If you’re planning to apply for a jumbo mortgage or other significant financing in the near future, the rate improvement from crossing into 800+ territory might save thousands over the loan term, justifying focused effort. Conversely, if you have no major financing needs on the horizon and already qualify for premium credit cards, the practical benefits of those additional points may be minimal. In such cases, maintaining your excellent 759 credit score through consistent responsible behavior may be more sensible than pursuing aggressive optimization strategies.

Maintaining and Protecting Your Excellent 759 Credit Score

Long-term credit management practices become increasingly important once you’ve achieved an excellent 759 credit score. Consistency is paramount—maintain perfect payment history by setting up automatic payments for at least the minimum due on all accounts. Regular review of your credit reports (at least quarterly) helps ensure no errors or fraudulent activity go undetected. Consider implementing a rotating schedule for reviewing each bureau’s report throughout the year. Develop a system for tracking application dates, credit limits, and account anniversaries to make informed decisions about when to request credit line increases, product changes, or fee waivers without triggering unnecessary hard inquiries.

Identity theft prevention deserves heightened attention for individuals with excellent credit, as you represent a particularly attractive target for fraudsters. Beyond basic monitoring, consider implementing a credit freeze or lock with all three major bureaus when not actively applying for new credit. This prevents unauthorized parties from opening accounts in your name. Use unique, complex passwords for all financial accounts and enable two-factor authentication whenever available. Be particularly vigilant about phishing attempts targeting high-credit individuals, which often appear more sophisticated than general scams. Consider using a dedicated credit card with lower limits for online purchases to contain potential exposure.

Life changes can significantly impact your credit profile, requiring proactive management. Marriage may introduce complications if your spouse has a different credit profile—while your scores remain separate, joint applications will consider both profiles. Major transitions like retirement often bring income changes that may affect your debt-to-income ratio and approval odds, even with your excellent 759 credit score intact. Relocating to a new state might necessitate establishing relationships with regional banks or credit unions. During these transitions, maintaining higher cash reserves and avoiding major new credit applications for 3-6 months before and after significant life events helps preserve credit stability.

Recovery strategies become essential if your 759 credit score unexpectedly drops. First, identify the specific cause—a single late payment can drop an excellent score by 40+ points, while a maxed-out card might cause a 25-30 point decrease. For late payments, contact the creditor immediately to request a goodwill adjustment, particularly if you have an otherwise perfect history with them. Document the conversation and follow up in writing. For utilization spikes, aggressive paydown should be prioritized, as this factor updates monthly and provides the quickest recovery opportunity. If collections or serious derogatory items appear, address them immediately through validation requests, settlement negotiations with pay-for-delete provisions, or formal disputes if the information is inaccurate.

Building a relationship with credit bureaus facilitates faster resolution when issues arise. Consider enrolling in their premium services or membership programs, which often provide dedicated customer service lines with shorter wait times and more experienced representatives. Familiarize yourself with the specific dispute processes for each bureau and maintain organized records of all communications. When disputes are necessary, submit them individually rather than bundled, with clear, concise explanations and supporting documentation. For complex issues, consider certified mail with return receipt for critical communications, establishing a clear paper trail. These relationships become invaluable when time-sensitive credit needs arise and rapid corrections are required to maintain your excellent 759 credit score.

Conclusion: Leveraging Your Already Impressive 759 Credit Score

Your 759 credit score already places you in an enviable position—one where you qualify for premium financial products with favorable terms that most consumers can only aspire to reach. The practical difference between your current 759 credit score and the 800+ range often amounts to mere pennies on the dollar in interest rates, though these small margins can accumulate over decades of borrowing. The strategic approach isn’t about obsessively chasing those final points, but rather understanding when they’ll truly impact your financial goals. By maintaining disciplined credit utilization below 10%, protecting your account age, and systematically addressing any minor derogatory marks, you’re positioning yourself for natural progression into the highest credit tier.

The journey from “very good” to “excellent” credit reveals an important truth about financial optimization—it’s not always about reaching an arbitrary number, but about aligning your credit profile with your life goals. Your 759 credit score doesn’t just represent a number; it reflects years of responsible financial behavior and opens doors to opportunities that remain closed to most Americans. Perhaps the most valuable aspect of your 759 credit score isn’t the score itself, but the financial flexibility and peace of mind that comes with knowing you’ve mastered one of the most fundamental aspects of personal finance in a system where the odds aren’t always stacked in consumers’ favor.