Is a 759 Credit Score Good or Bad? 5 Important Factors

Decoding the 759 Credit Score: Good, Bad, or Excellent?

759 credit score is generally considered very good, if not outstanding.

According to FICO.com, approximately 59.2 percent of the U.S. population has a credit score range between 700 to 850.

Lenders and creditors look at your credit score as the first step in deciding whether or not to give you a loan.

So, if you have a 759 credit score, you should seek guidance on the loans you can get.

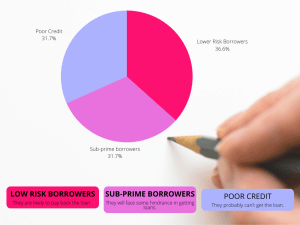

But first, look at the graph to see the average population of the United States that is successful in obtaining credit due to a high credit score.

759 credit scores and borrowers

Borrowers with high credit ratings are usually low-risk because they can pay on time. According to FICO scores, only 1% of borrowers with high credit scores pay late.

Congratulations! Your 759 credit score puts you in the category of low-risk borrowers, which can increase your chances of getting a loan.

Even if you have the privilege of having a high credit rating, there are other factors, such as your monthly income and job status, that lenders may need to see before granting you a loan.

Here, you can get a brief idea of the factors contributing to higher credit scores.

Factors That Affect Credit Scores

Factors are your everyday credit behaviors that significantly impact your credit score.

You might be wondering what else can affect my credit scores to improve when I already have a “very good” 759 credit score.

Even though 759 credit score falls under very good category, the following factors can improve it.

Timely Bill Payment

The most notable factor contributing to a credit score is how timely you pay your monthly bills. Any late payment can hurt your credit score because credit bureaus pay close attention to your payment history.

On-Time Debt Payment

You need to schedule your debt payments so that no payment is delayed and everything is paid on time. This will have a strong impact on improving your credit scores.

Check Your Credit Card Balance Limit

Make sure your credit card balance is lower than the limit. It can have a huge impact on your ratings.

Apply for a Credit Card Only When Needed

Suppose you have applied for several credit cards within a short period. This can harm your credit scores.

When you apply for credit, lenders will request to view your credit reports. This request is considered a hard pull or hard inquiry. Any hard inquiry may result in a lower credit score.

As shown in the chart above, the more hard inquiries you have, the lower your credit score.

Now that you know how to raise your credit score, let’s look at the loans you can qualify for with a 759 credit score.

Creditworthy Auto Loans

So, attaining a good credit score can help you get some outstanding auto loans, but that is not guaranteed.

It will help if you research the best auto loan lenders whose terms facilitate your payment plans.

Here’s a tip, plus a BONUS TIP at the end.

You are in a good position to negotiate deals once you have received auto loan approval through an approval letter.

You can always look for different auto loan lenders, but remember that banks sometimes provide better auto loans than traditional ones.

Note: A pre-approval letter is a hard inquiry.

Just to keep this in mind, you will need to obtain a pre-approval letter after completing your loan payment calculations to avoid increasing your hard inquiry.

Creditworthy Mortgage Loans

An excellent credit history means you will likely get the best mortgage loans. Still, your income-to-expense ratio is vital in getting a mortgage at desirable rates.

Do your calculations on how much you want to spend on the house and how you will repay it.

Please look over several mortgage lenders to compare and select the best option.

Once you have your mortgage approval, it facilitates knowing how much you can borrow.

Creditworthy Credit Cards

Since you have a very good credit score, you can get premium credit cards. Enjoy limitless offers in your desired area of interest.

You can get offers on hotels and airport lounges for premium facilities and travel points.

Here, you can get elite status by using many free facilities on credit cards.

But remember to check out the annual hidden fee, which may outweigh the perks of credit cards.

Related Articles

Frequently Asked Questions

1. What does a credit score mean?

A number ranging from 300 to 850 is called a credit score.

It is created by analyzing the loan amount you got, the payback time frame, and the history of all loan payments.

2. What does a 759 credit score help you with?

A 759 credit score helps you get the excellent benefits of credit cards, mortgages with favorable terms, and ideal interest rates on auto loans.

3. Does a good credit score ensure a credit loan?

Good credit scores aren’t the only thing needed to get a loan, but they help a lot. That’s because you’ll appeal to more potential lenders if your credit scores are high.

After all, they’ll consider you to have fewer risks. But, other factors contribute to ensuring a credit loan.

4. How does keeping track of payments help increase credit scores?

If you make your payments on time, you have a better chance of getting a high credit score because it increases lenders’ confidence in your ability to repay the money you borrow. The fewer lenders that have to hedge their risks with down payments, security deposits, and low credit restrictions, the better.

Key Takeaways and A Bonus Tip:

Improving your credit scores is crucial for maintaining a top-notch credit history. With an excellent credit rating, you can obtain the best available mortgages, auto loans, and credit cards.

Remember that your scores may improve if you monitor your credit behaviors.

It’s time for a practical bonus tip:

If you are already on a credit payment schedule, check the autopay option to pay your credit card bills before they are due. This can help maintain a balanced track record of payments and improve your chances of getting even higher credit scores.

It would be worth investing your money in a cheap yet effective credit repair service. For more information, Contact us at (855) 443-3737.