FICO Scoring Models – Best 3 Versions in 2023

Table of Contents

FICO Scoring Models – Best 3 Versions in 2023

FICO Scoring Models is the most common term among credit users. There is hardly a credit user who finds it new terminology. That is FICO’s impact on the credit world. But, did you know that FICO is not the only one? Yes, there are a whole lot of scoring models in the credit industry. This article will take you through the dominance FICO score has over other such scoring models, and brief you more about its latest versions.

FICO Scoring Models – The Widely Used One

FICO (Fair Isaac Corporation) is the earliest credit score organization that introduced a proper framework for evaluating users’ creditworthiness. Later, many new credit scoring models, like Vantage models, sprouted. But still, FICO has set its own stage among credit users and credit issuers. An analysis says that more than 90% of credit card issuers, lenders, and other financial companies prefer FICO scoring models over others.

If you are a credit user, or a credit lender trying to figure out your borrower’s credit score, you can rely on FICO scoring models. FICO’s scoring model has designed a set of criteria for credit evaluation. They also keep updating their scoring model to stay in tune with the current trend.

How Lenders Use FICO Scores

Loan lenders do not approve loans for everybody who applies for one, or a credit card. They analyze your ability to repay the loan. They do not prefer their capital to become a charged-off debt. To ensure your capacity, they expect a convincing point that demonstrates how capable you are.

This is where they come to credit scores. They rely on the 3-digit credit score of applicants that says their repaying potential. They seek help from three major credit bureaus Equifax, Experian, and TransUnion, who mostly use the FICO scoring models to evaluate your credit scores.

Consider, if you are applying for a home loan in ABC finances. The lender should now turn more interested in understanding your credit behavior. At this point, when they can’t spend their whole time analyzing your performance, they simply get help from any credit reporting agency that uses the FICO scoring pattern.

How Individuals Use FICO Scores

It is not just lenders who look for applicants’ credit scores. Any citizen who is keen on maintaining disciplined financial conduct might look at their credit scores. Frequently checking your credit reports can help you take needed actions to improve your credit scores.

Every individual can check their credit score once a year free of charge. Annualcreditreport.com offers you a complete report of your credit behaviors in recent times. This might push you to become more responsible with your finances and alert you about your recent credit score range. If you were in a risky zone, like a poor credit score range, you might work on improving your scores.

How Is It Calculated?

By closely analyzing your credit behavior in the past, credit lenders determine your responsibility and capacity in repaying this loan. To assist the lenders with this process, FICO has curated a list of criteria that can clearly indicate an applicant’s credit behavior.

5 Primary Factors

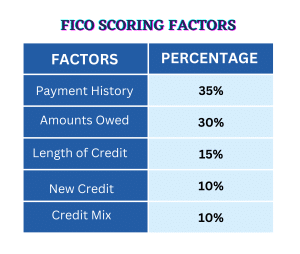

The primary factors used to determine credit scores are listed below.

FICO Scoring Factors

Payment History – This factor holds a large portion of the credit score calculation. This analyzes how regular the users are in their monthly dues. 35% of your credit score is based on this factor. Being on time in payment history positively impacts your credit score.

Credit Utilization Ratio – This considers the current credit balance to start new credit. If the available credit balance is high, the chances of credit approval are also high. As this factor holds 30% importance in your credit score, always make sure you didn’t use most of your credit from the available credit you have.

Length of Credit – The length of the credit is also considered when calculating credit scores. This is also directly proportional to the credit score. This has a good impact on the credit score and holds 15% of the overall credit score.

New Credit Accounts – It is not advisable to have too many credit accounts. You can always get one if it is necessary, but make sure it is necessary and manageable with your available balance and potential.

Credit Mix – The types of credits are also measured during a credit calculation. This doesn’t mean you should maintain a variety of credits for sure. But having different credit accounts has a 10% impact on your credit score.

Credit Score Ranges

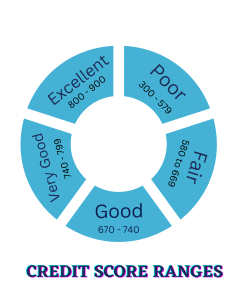

The calculated three-digit FICO scores that range from 300 to 900 is categorized into 5 different ranges. This categorization is devised in a way that the higher the credit score, the higher the creditworthiness.

FICO Scoring Ranges – 5 Ranges

- Poor – Scores between 300 to 579.

- Fair – Scores between 589 to 669.

- Good – Scores between 670 to 740.

- Very Good – Scores between 740 to 799.

- Excellent – Scores between 800 to 900.

Versions of FICO Scores

FICO Scoring Models has introduced many versions right from the day it came into existence to now. The best thing about FICO Scoring Models is that it is designed in a way to adopt changes and keep enhancing them then and there. Here are a few widely used versions of the FICO scoring models.

FICO 8 – The Most Common

FICO 8 is the most commonly used version of all FICO scores that were released in 2009. Though the credit industry has witnessed two more FICO versions. Still, version FICO 8 is ruling the credit world. This version collects data from three credit bureaus and focuses more on credit utilization ratio and payment history. That is, if you are applying for credit, your available credit balance is the primary criterion. Considering the used-up credit and the remaining balance, the credit lenders calculate your creditworthiness.

FICO 9 – Added Advantage

FICO 9 inherits all the features of the earlier versions, and values credit utilization rate and previous history, like FICO 8. The add-on feature in FICO 9 is, it has a different approach when it comes to collection accounts, especially medical collections. That is, if you have any medical or hospital collection on your credit, like surgery collections, it will not affect your credit scores the way other collections do. Though this was released in 2016 and has a few advantages over the older versions, this is still not widely considered as FICO 8.

FICO 10 and FICO 10T – Specialised in Trended Data

This FICO Score 10 Suite was launched recently in 2020 with an updated feature of trended data. This recent update had become the talk of the town during its launch. Credit users were slightly panicked, as it was expected that their credit scores might drop by 20 points. This is the latest FICO scoring version that specialized in traditional and trended data. In addition to the existing criteria, this FICO Score 10 Suite highly regards the last one-year credit history of the individuals.

Credit Score vs. FICO Score

Many tend to use the terms FICO score and credit score interchangeably. Though there are highly relevant, there is a visible difference for sure. Yes. All FICO scores are credit scores. But not all credit scores are FICO scores. The FICO score is a sub-set of a credit score. A FICO score is the name of an evaluating model where the credit score refers to all the scores regardless of the scoring models. Go through this blog on FICO Vs. Credit Score to understand how they differ from each other.

Other Credit Scoring Models

Apart from the popularly known credit scores, like the FICO score there are other credit scores, like Vantage Scores, TransRisk, CE Credit Scores, and Credit Expert Credit Scores.

The FICO Scoring Models – FICO holds a long history in the niche, as it was the first of its kind. This was devised by Mathematician Earl Isaac and Engineer Bill Fair in 1958 to determine creditworthiness and make business decisions. This is successfully standing as the most preferred scoring model of all.

The Vantage Scoring Models – Three major credit bureaus Equifax, Experian, and TransUnion came up with a common scoring pattern called Vantage Score versions. This scoring model was launched in 2006 and managed to stand as the second preferred credit score among credit bureaus, lenders, and users.

TransRisk – This TransRisk score was introduced by the popular credit bureau TransUnion. This scoring model is quite different from others. TarnsRisk highly focuses on analyzing the applicant’s credit. When other score versions talk about the history of a user’s existing credit accounts, TransRisk says the possible risk of availing of a new credit account.

Industry-Specific Scores by FICO Score

Out of multiple FICO score versions, the industry-specific FICO score works uniquely for each industry. In addition to the basic criteria, it also considers information that is more specific to the industry. In, each type of credit application, they have a relevant scoring model. Say, like mortgage lending FICO scores for home loans, FICO auto scores for vehicle loans, and FICO personal scores for personal loans. They also have credit card FICO scores and FICO bankcard scores for credit cards.

Frequently Asked Questions

1. Which is the latest FICO scoring version among the FICO scoring models?

The latest version of the FICO scoring model is the FICO score 10 suite. This model has been in existence since 2020 and has put many credit users at risk of losing their credit scores. But, this was just designed to enhance the quality of lenders’ decisions in terms of credit approvals.

2. Can I get a loan with a low FICO score?

A FICO score is the crucial element for your loan approval. But, it does not mean that you will never secure a loan if you aren’t in a better credit score category. There are a few loan vendors and other loan options that are less dependent on your credit score. But still, having a good credit score is an organic way of qualifying for a loan without any risks.

3. What is the difference between the FICO score and the credit score?

Many would probably mistake FICO scores and credit scores for being the same thing. The actual thing is that they are quite close in terms of context, but not exactly the same. FICO scores specify a scoring model, where credit scores generally refer to all models of credit scores.

Related Reads

After this detailed understanding of FICO scores, it is clear that every credit user must maintain a good FICO score. Yes, your credit lenders are primarily looking for FICO scores to estimate your potential to pay back their loan on time. In this case, you should think of multiple ways to secure a decent position on the credit scale.

To keep you more at ease, credit repair agencies, like TheCreditPros will provide you with end-to-end assistance by regularly analyzing your credit reports, and taking all necessary steps to improve your credit scores.