The FICO score is a credit scoring system that was developed in the 1950s by Fair Isaac & Co. Today, the three major credit reporting bureaus Experian, Equifax and Trans Union all use FICO scores to evaluate the credit worthiness of almost 90% of the adult Americans. FICO scores can range from 300-850 and these scores are calculated on the basis of scoring models and mathematical calculations that are not revealed to the public.

The higher the FICO score, the lower the risk to the creditor and hence if your FICO score is high, you end up with lower interest rates, faster loan approval time, lower insurance premiums and better employment prospects. If your score is low, you may be in need of the services of the best credit repair firm that can help you take repair action via a personalized credit repair program.

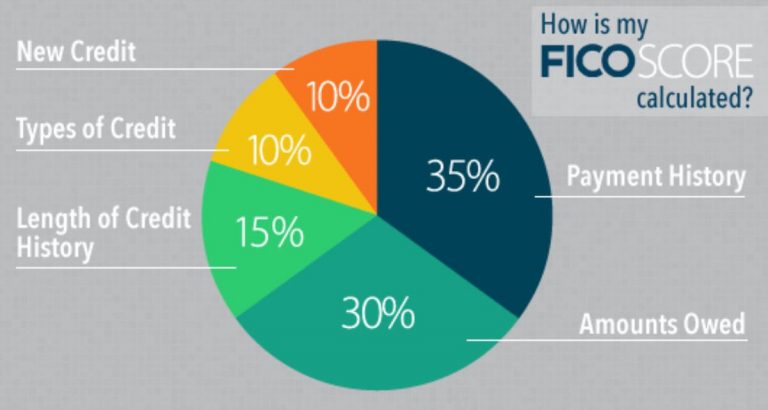

A FICO score of a person is determined by studying a person’s credit history. Late payments, charge offs, judgments/liens, bankruptcies, foreclosures, the total amount of credit used and the total credit that is currently available, credit cards issued, employment history, the amount secured as loans, their repayment history are all considered while determining a person’s FICO score. It is a snap shot of the credit worthiness of a person that is used by creditors when they evaluate any credit application. Persons with a FICO score of less than 500 are said to have a bad credit record and this qualifies them to seek the help.