How Long can Bad Debt Damage My Credit report?

Your credit reports are tools, tools that are routinely used by lenders, banks, creditors, and collection agencies (among many others). Do you wonder how long can bad debt damage my credit report?

Naturally, credit reports are tools that are used to review applications for financing and to help companies decide whom they do and do not wish to do business with in the future. However, your credit reports are also tools that businesses can use to put pressure on you to pay your current and past financial obligations, including bad debt.

Chances are high that if you are facing credit problems, these issues probably did not occur on purpose. In all likelihood, you did not have an epiphany while on the treadmill one morning and say, “I think I will just stop paying all of my bills today.” Instead, most credit problems begin as a result of unfortunate circumstances such as job loss, illness, divorce, etc. Even if you simply made bad choices and overextended yourself financially you likely did not set out with the intention to borrow money and never pay it back. It then turns into bad debt. Just because you have made credit mistakes does not automatically make you a horrible human being.

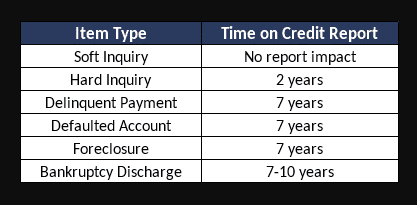

Thankfully, although your creditors and debt collectors would love to leave derogatory items on your credit reports forever, the law prevents this from happening most of the time. Generally, the negative items on your credit reports have an expiration date thanks to a federal law known as the Fair Credit Reporting Act (FCRA). Here is a look at the time limits for some of the derogatory items which might currently appear on your credit reports.

How Long can Bad Debt Damage My Credit report – 7 Year Bad Debt Removal Requirement

Collection Accounts

According to the FCRA collection accounts can only hang around on your credit reports for 7 years from the date of default (aka when the account became 6 months past due) on the original account.

Charge-Offs

Are not permitted to remain on your credit reports for any more than 7 years from the date of default.

Judgments

Must be removed 7 years from the date filed, regardless of whether or not the judgment has been paid or satisfied.

Repossessions

Required to be removed once 7 years have passed from the date of default or “original terminal delinquency.”

Foreclosures

Removed 7 years after the filing date of the foreclosure.

Late Payments

May not remain on your reports for any longer than 7 years from the date the late payment occurred.

Paid Tax Liens

Paid and released tax liens must be removed from your credit reports no later than 7 years after the date of release.

How Long can Bad Debt Damage My Credit report – 10 Year Bad Debt Removal Requirement

Chapter 7 Bankruptcy

May remain on your credit reports for 10 years from the date the bankruptcy is filed.

Chapter 13 Bankruptcy

May remain on your credit reports for 7 years from the date of discharge or 10 years from the date filed, whichever occurs first. In general, the majority of Chapter 13s will remain on your credit reports for a full 10 years.

How Long can Bad Debt Damage My Credit report – No Removal Requirement

Unpaid Federal Student Loans

The FCRA is silent about defaulted federal student loans and how long can bad debt damage credit reports. Instead, the credit reporting requirements for these types of accounts are detailed in the Higher Education Act. There is currently no requirement to remove unpaid federal student loans from your credit reports, ever. Once defaulted student loans are finally paid, however, they are required to be removed from your credit reports after 7 years.

Unpaid Tax Liens

Another item that has no credit reporting expiration date is the unpaid tax lien. These are permitted to remain on your credit reports indefinitely. This is the one kind of bad debt you can’t get rid of.