The Difference Between Credit Reports and Credit Scores

Table of Contents

The Difference Between Credit Reports and Credit Scores

The credit industry often uses terms and abbreviations which are not fully understood by consumers. To make matters worse, sometimes uninformed members of the news media or even some self-proclaimed “experts” will misuse credit terms and perpetuate credit myths, occurrences which only add to consumer confusion about the subject of credit. So, what is the difference between credit reports and credit scores?

One of the biggest credit misconceptions in circulation is a false idea that your credit reports and your credit scores are the same. Yet in reality credit reports and credit scores are not the same at all. The two terms describe two entirely different products, products that are not even created by the same companies.

Your credit reports and credit scores are two different things. A credit report is a statement that has information about your credit activity. Your credit scores are calculated based on the information in your credit report.

Credit Score

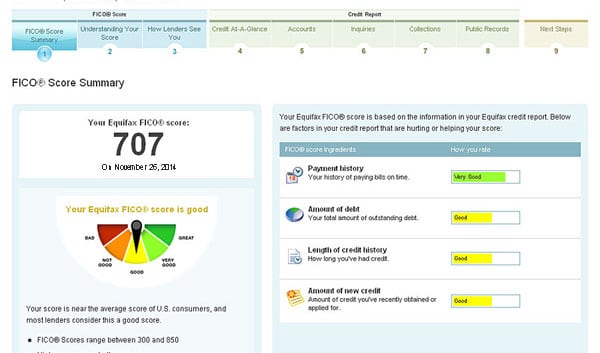

A Credit score is a number that lenders use to evaluate how risky you are as a customer. FICO Score is used to make credit decisions. All credit scores are derived from information in your credit reports. The most important factors to consider when managing your credit scores include:

- Your repayment history, if you have any late payments or any defaults.

- How much money you owe compared to your credit limits, is called the credit utilization ratio.

- How often you have applied for credit recently, called hard inquiries.

- How long you’ve had credit accounts or your age of credit.

- The types of credit you have, like the fixed payments, an auto loan, or variable payments.

Credit Report

Your credit reports give a list of your lines of credit and payment history, but they don’t contain your credit score. The three major credit bureaus, Equifax, Experian, and TransUnion organize the credit reports.

Credit reports may have errors, so it is important to have a look at them carefully. If there is any mistake then find the company that issued the report, and dispute for errors.

Everyone is entitled to free credit reports from each of the three credit-reporting agencies. You can apply for a free credit report every year. By viewing your credit report your credit score will not get affected.

Why the Confusion?

It is not difficult to understand why the terms credit report and credit score are so often confused. There is a list of online articles defining exactly what is the difference between a credit report and a credit score? After all, the two products do serve very similar purposes. Lenders also routinely rely upon both credit reports and scores for a look into how you have managed credit in the past and as a means of predicting how you might manage future credit obligations as well. So what is the difference between credit reports and credit scores?

Understanding Credit Reports

In the United States, credit reports are created and maintained by many companies. However, the three major credit bureaus which create and sell the credit reports most often used by lenders are Equifax, TransUnion, and Experian (Things You Should Know About Credit Bureaus). If you have established a credit history by opening credit cards or taking out any loans in the past then you probably have a credit report with all three major credit bureaus.

The main difference between a credit report and a credit score is simple. Your credit reports are created to show a user-friendly history of how you have managed your current and past financial obligations. If you have a history of making on-time payments, that history will show up in your reports. If you have a history of paying late or skipping payments altogether, that negative history will show up as well. In addition to your payment history, your credit reports also feature important information such as the outstanding balances on your accounts, your credit limits, and your personal identifying information (i.e. name, addresses, date of birth, social security number, etc.), and much more.

Understanding credit reports is key to good financial health. Federal law grants you free access to your three major credit reports each year. To get to know about your free reports you simply need to visit Federal Trade Commission Consumer Information.

It is important to keep an eye on the information contained in your credit reports because, unfortunately, credit reporting errors are quite common.

Understanding Credit Scores

While you may only have three major credit reports you have hundreds of credit scores that are commercially available. This is another main difference between your credit report and credit score. These scores are not directly designed by the three major credit bureaus but by different companies altogether. The two primary brands of credit scores (though certainly not the only brands) are created by FICO and VantageScore Solutions(Introducing VantageScore 4.0). It is worth noting, however, that VantageScore Solutions is owned by Equifax, TransUnion, and Experian. Furthermore, FICO is still by far the most popular brand of credit score used by lenders.

Credit scores take the information contained in your credit reports and then interpret that data into easy-to-use numbers for lenders. The higher your score, the lower your credit risk. This analysis of your reports provides lenders with a more effective and more manageable way to predict the risk of doing business with you.

Credit scoring models pay attention to a variety of factors contained in your credit reports including the following:

Your Payment History

The Amounts You Owe On Credit Obligations (Especially Your Credit Cards)

How Long You Have Had Credit and the Average Age of Accounts On Your Reports

The Mixture of Account Types on Your Credit Reports

How Often You Apply for New Credit

It is also worth nothing that credit scores (unlike credit reports) cannot exist as an independent product. As mentioned above credit scoring models analyze the data contained in your credit reports. Without your credit report data to analyze no credit score can be generated.

Another difference between your credit report and credit score is what you are entitled to get for free. While there are many places where you may be offered free access to your credit scores (online, your credit card issuer, etc.) there is currently no legal requirement for you to be granted a free copy of your credit scores. The exception to this rule is that if you have recently applied for a mortgage the lender may be required to provide you with a score disclosure. You don’t need to see your credit score to understand credit reports, but knowing one of your credit scores can help you know where you stand.

Frequently Asked Questions

What are score factors?

Score factors are codes that are provided with a credit score to explain how items in your credit report influenced the score. These codes can help you understand which items had the greatest impact.

Who calculates credit scores?

Credit scores are from several sources. Lenders may request that a credit score are provided along with your credit report. Credit reporting agencies provide the service of applying the credit scores from several credit score developers.

Credit scores may be calculated by mortgage reporting companies. Lenders may also apply their own, proprietary sources after receiving your credit report.