Streaming services and credit score are often not directly connected, but their payments can still impact financial health. Services like Netflix and Spotify have become staples in many Americans’ lives, offering easy access to entertainment and music. But have you ever considered how these monthly subscription payments might affect your streaming services and credit score? Traditional credit scoring models rarely account for these recurring expenses, leaving many to wonder if their streaming habits could influence their financial standing. This article explores whether paying for your favorite shows and playlists can help or hurt your streaming services and credit score.

We will break down the components of a credit score and look into how credit reporting agencies operate while also examining new services like Experian Boost. These services claim to factor subscription payments into your credit score, potentially offering a fresh perspective on financial responsibility. However, it’s essential to approach this topic with a balanced view, considering both the potential benefits and the risks involved. Are streaming subscriptions a reliable tool for improving your credit, or do they come with hidden pitfalls? Let’s explore the possibilities and find out.

Understanding Credit Scores and Reporting

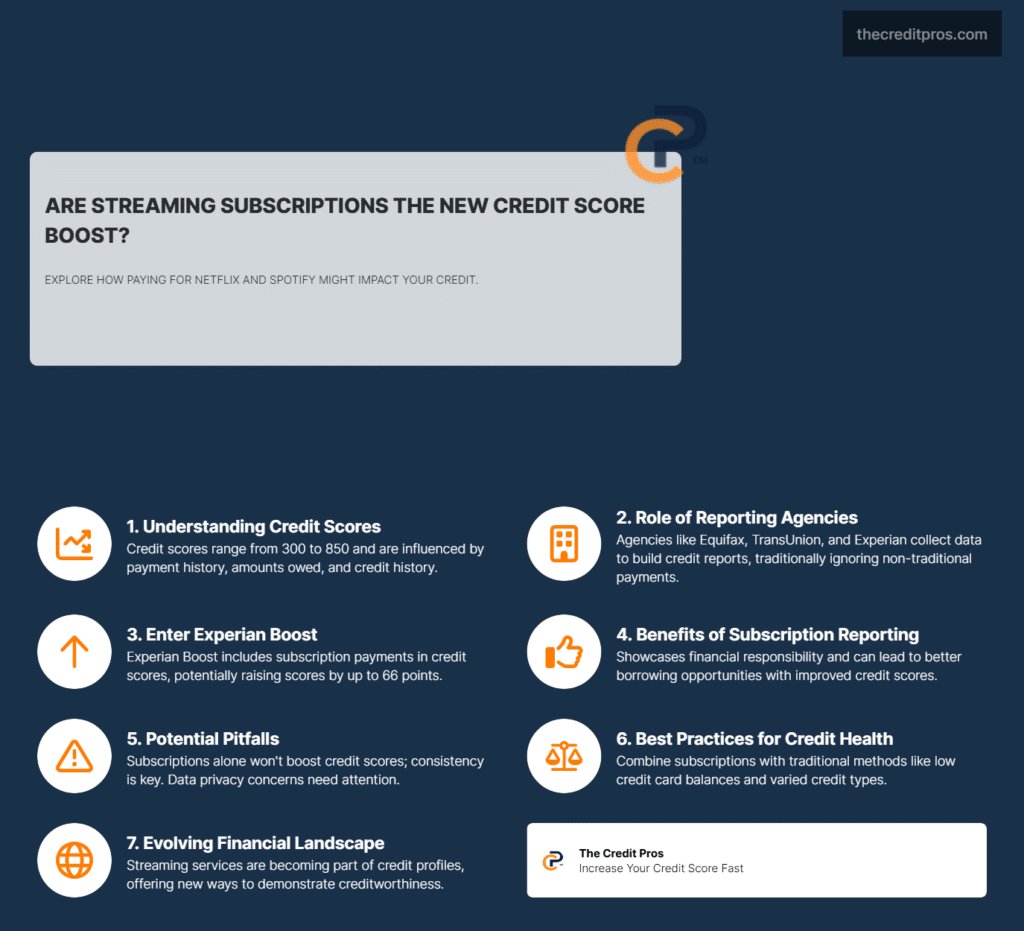

Streaming services and credit score play a growing role in financial discussions, even though traditional scoring models don’t always include them. Credit scores serve as crucial indicators of an individual’s financial health, helping banks and financial institutions assess creditworthiness. These scores typically range from 300 to 850 and are influenced by factors such as payment history, amounts owed, length of credit history, new credit, and types of credit used. Payment history, accounting for 35% of the score, highlights the importance of timely payments—even for recurring expenses like streaming services.

Credit reporting agencies like Equifax, TransUnion, and Experian play a pivotal role in compiling and maintaining this data. They collect financial information from various sources to create comprehensive credit reports, which are then used to calculate credit scores. Traditionally, these agencies focus on credit card payments, loans, and other significant financial obligations. However, the rise of digital transactions and subscription services has added new dimensions to credit reporting.

Streaming services and credit score are increasingly connected as financial tools evolve. Typically, monthly payments such as mortgages, utilities, and loans are factored into credit scores, while non-traditional payments like streaming service subscriptions were historically overlooked. However, services like Experian Boost now allow consumers to include these payments in their credit profiles, providing a more comprehensive view of financial responsibility.

Streaming Subscriptions’ Role in Credit Scoring

Streaming subscriptions, often perceived as entertainment expenses, are now recognized for their potential impact on credit scores. Platforms like Netflix and Spotify, with their recurring billing structures, can serve as evidence of financial reliability. This shift is largely driven by innovations like Experian Boost, which enables consumers to incorporate subscription payments into their credit reports.

Experian Boost integrates streaming services and credit score data by linking users’ bank accounts and verifying subscription payments. According to Experian’s research, this method can potentially raise a user’s credit score by up to 66 points. By incorporating non-traditional payments, it challenges conventional credit scoring models and offers a new perspective on financial management.

However, the acceptance of streaming services and credit score data by financial institutions varies. Some lenders still prioritize traditional credit metrics over newer models. Yet, as financial systems evolve, the credibility of incorporating subscription payments is expected to grow, giving consumers more ways to demonstrate creditworthiness.

Benefits of Using Subscriptions to Enhance Credit

Using streaming services and credit score data to enhance credit profiles offers several benefits. It helps individuals demonstrate financial responsibility by managing recurring payments effectively. Regular, on-time payments for services like Netflix and Spotify can positively impact credit scores, providing an accessible way to showcase financial stability.

- Credit Score Improvement: Consistent payment histories through Experian Boost have shown to enhance credit scores significantly for many users, opening up better borrowing opportunities, such as lower interest rates on loans and mortgages.

- Credit Card Rewards: Using a credit card to pay for subscriptions can yield additional benefits. Many credit cards offer rewards programs that provide cashback or points for purchases. By strategically using credit cards for subscriptions, consumers can earn rewards while building a stronger credit profile, effectively offsetting some costs associated with these services.

Potential Pitfalls and Misconceptions

Despite the advantages, misconceptions and pitfalls exist around using subscriptions to improve credit scores. A common myth is that simply having subscriptions will automatically boost one’s credit score, which isn’t true. Only timely, consistent payments can contribute positively, and even then, only if the credit reporting agency recognizes these payments.

Relying solely on streaming services and credit score benefits poses risks. While they can support credit improvement, they shouldn’t replace traditional methods like responsible credit card use and timely loan payments. A diversified approach is key to maintaining a strong credit profile.

Data privacy concerns arise with incorporating streaming services and credit score data. Experian Boost requires bank access, raising security apprehensions. While such services implement strict security measures, consumers should stay informed about data usage and privacy policies to safeguard their financial information.

Best Practices for Managing Subscriptions and Credit Health

Managing subscriptions effectively to enhance credit health requires strategic planning. Consumers should ensure that all subscription payments are made on time, as missed payments can negatively impact credit scores. Setting up automatic payments can help maintain consistency and prevent late fees.

Monitoring changes in credit scores over time is another best practice. Regularly checking credit reports allows individuals to track the impact of subscription payments and identify any discrepancies or irregularities. This proactive approach can help address issues before they affect creditworthiness.

Balancing streaming services and credit score strategies is essential. While subscriptions help, a strong credit profile also requires low balances, diverse credit, and limited inquiries. Integrating these practices ensures financial stability.

Wrapping Up: The Intersection of Streaming and Credit

Streaming services and credit score management are evolving. Innovations like Experian Boost recognize subscription payments, offering new ways to showcase financial responsibility.

Streaming services and credit score impact go beyond entertainment. While subscriptions can help, they shouldn’t replace traditional credit-building strategies.