Have you ever wondered how a three-digit number could possibly summarize your financial reliability? A credit score, often seen as a financial passport, profoundly influences your ability to borrow money and the terms you’re offered. Yet, the mechanics behind its calculation remain a mystery to many. Each financial behavior has a distinct impact, and understanding these nuances can empower you to improve your score.

This article aims to demystify the complex world of credit scores by breaking down the various credit score factors that contribute to your overall rating. From the well-known impacts of payment history to the subtler influences of credit type diversity, we’ll explore how each component plays a crucial role. Whether you’re looking to secure a loan with favorable terms or simply aiming to enhance your financial health, a deeper understanding of these elements can provide you with the tools you need to manage your credit more effectively.

Section 1: The Foundation of Your Credit Score

Understanding Credit Score Models

Credit scores are calculated using various models, with FICO and VantageScore being the most prevalent. Both models evaluate similar types of information, but they differ slightly in how they weigh this data. FICO, for instance, is used by over 90% of top lenders, and it ranges from 300 to 850. VantageScore, a model developed by the three major credit bureaus—Experian, TransUnion, and Equifax—also operates within this range but uses slightly different criteria to assess creditworthiness.

Primary Components

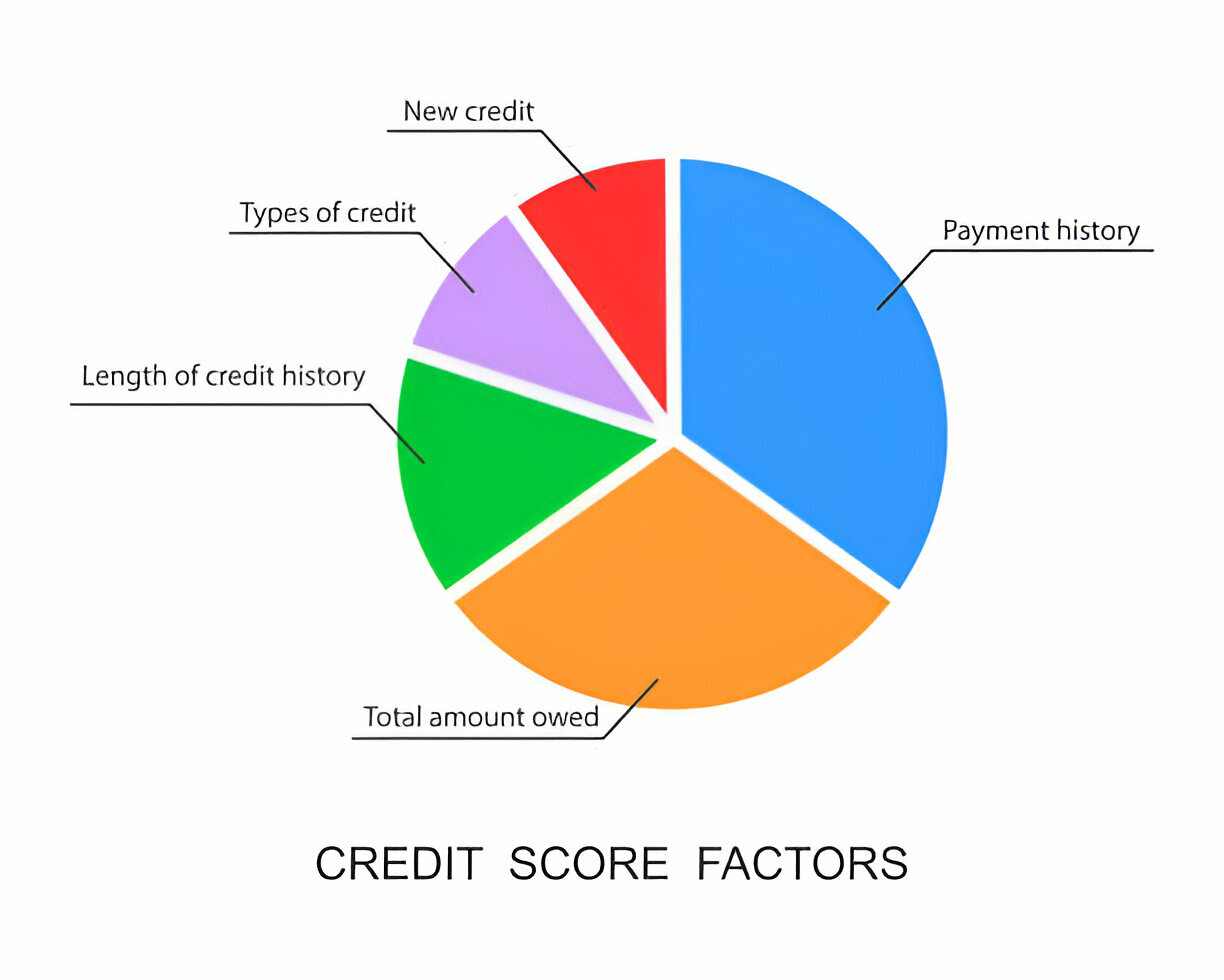

The calculation of your credit score is broken down into five major components, each carrying a different weight:

- Payment History (35%): This is the most significant credit score factors, reflecting whether you’ve made past credit payments on time.

- Amounts Owed (30%): Known as credit utilization, this indicates how much of your available credit you are using.

- Length of Credit History (15%): Longer credit histories are seen as less risky, as they provide more data on spending habits.

- New Credit (10%): Opening several new credit accounts in a short period can be perceived as risky.

- Types of Credit Used (10%): Having a mix of credit types (e.g., mortgage, car loan, credit cards) can positively affect your score.

Section 2: Payment History – The Pillar of Trust

Depth of Payment History

Credit scores are significantly influenced by your payment history across different types of accounts. Credit cards, mortgages, and auto loans each play a role in shaping this component of your score. Consistent, timely payments across these varied types of credit demonstrate to lenders that you are a reliable borrower, which can positively influence your score.

Impact of Late Payments

The effect of late payments on your credit score can vary depending on several factors:

- Recency: More recent late payments affect your score more significantly than older ones.

- Frequency: Multiple late payments will have a greater negative impact than a single instance.

- Severity: The later the payment, the more your score can be negatively affected.

Section 3: Credit Utilization – More Than Just Numbers

Ratio Nuances

Credit utilization ratio, the second most influential credit score factors, is calculated by dividing your total credit card balances by your total credit card limits. The optimal utilization ratio is often cited as below 30%. This percentage is crucial because it demonstrates to creditors that you are not overly reliant on credit.

Beyond the Ratio

However, the impact of credit utilization extends beyond just a simple ratio:

- Number of accounts with balances: Having balances on many accounts can indicate higher risk.

- Diversity of credit lines: Lenders like to see a mix of credit types, as this suggests you can manage different types of credit responsibly.

Section 4: The Influence of Credit History and New Credit

Age of Credit History

The age of your credit history is determined by the average age of your accounts and the age of your oldest account. Older credit accounts can positively impact your score because they demonstrate a long history of managing credit. Here’s how the age of your credit history is considered a credit score factors:

- Average Age: Lenders prefer to see a higher average age on credit accounts.

- Oldest Account: The age of your oldest account can lend considerable weight to your credit history.

Effects of New Credit

Every time you apply for new credit, a hard inquiry is made, which can temporarily lower your credit score. It’s important to understand the nuances of how credit score factors are considered:

- Hard Inquiries: These can affect your score for up to a year, though the impact usually decreases over time.

- Soft Inquiries: Checking your own credit score or pre-approval offers does not affect your score.

By understanding the detailed workings behind each credit score factor, you can better manage your financial behaviors to maintain or improve your credit standing. This knowledge empowers you to make informed decisions about when and how to use credit, ensuring that your credit score remains a true reflection of your financial reliability.

Wrapping Up: The Key to Your Credit Score Factors

Understanding the complexities of credit score factors is crucial for anyone looking to enhance their financial health. This exploration has highlighted the significant roles played by payment history, credit utilization, and the length and diversity of credit history in shaping your credit score. Each component, from timely payments to managing your credit utilization below 30%, contributes uniquely to building a reliable financial profile that lenders trust.

The journey to a better credit score involves demonstrating consistent and responsible financial behavior over time. Remember, your credit score reflects your financial reliability and impacts your future borrowing potential. As you continue to navigate your credit, keep these insights in mind to make informed decisions that support your financial goals. Let the knowledge of how each action affects your credit score factors empower you to take control of your credit destiny.