The Most Important Things To Know About Your Credit Score – Part Two

This is the 2nd in a 5-part series where we explain all of the factors that matter when determining your credit score. To learn about all of the factors, click the links below.

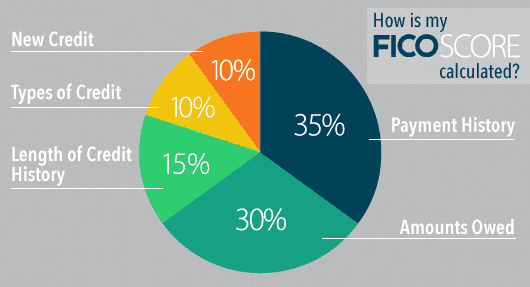

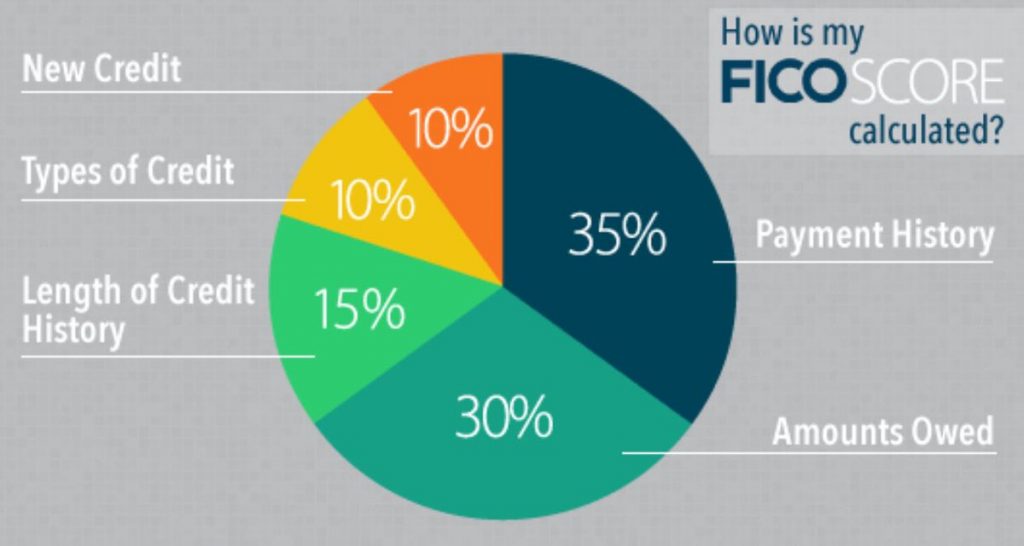

Think making timely payments is all that matters when it comes to your credit scores? Think again. Obviously how you pay your bills is a very important factor in your credit scores, but it only accounts for 35% of your FICO credit scores. This means that the majority of the factors which make up your credit scores have nothing to do with your payment history at all. One of these factors is amounts owed, and it describes a combination of things including credit utilization and your total amounts borrowed.

How Is Your Credit Score Determined?

FICO is the leading credit company that sells credit scores to lenders in the United States. This is why credit scores are also called “FICO scores”. Your FICO score is a numerical representation of how creditworthy you are, and it ranges from 300 to 850.

Credit score formulas calculate your FICO score based upon 5 different categories of information. The data considered within these 5 categories will only be found in your credit reports themselves.

What Is In My Credit Report?

Credit reports contain all the information in your credit profile. This information is provided to credit bureaus by lenders and companies who, in exchange for using your credit profile to determine your creditworthiness, provide information back to the credit bureaus about your credit account.

Your credit report is provided by the major credit bureaus, Equifax, Experian, and TransUnion. These companies are required by the federal government to give you one annual credit report that you can check for free. To get your free credit report, go to https://annualcreditreport.com.

If a piece of information is absent from your credit reports (such as your income, ethnicity, number of dependants, religion, or your checking account balance) then it is not eligible for consideration. This is good news because it means that you know exactly where to look when searching for ways to improve your credit scores.

It’s a common myth that only rich people will have good credit, and that’s simply not true. Your credit score does not take your income into account. However, this doesn’t mean that lenders will not deny you a loan based on your income.

As mentioned above, the top credit report category which factors into your credit scores is known as “Payment History.” Late or missed payments are the worst things you can do for your credit score. Yet other information on your credit reports is also extremely important as well. Learning how to earn the most points possible in each credit scoring category is an essential step you need to take in your credit improvement journey.

Amounts Owed

The second most important category considered by FICO’s credit scoring models is referred to as the “Amounts Owed” category of your credit reports. The amounts owed on your outstanding debts determine 30% of your credit scores. While carrying a lot of debt does not necessarily mean that your credit scores are doomed, you could potentially be in trouble if you are revolving a high percentage of outstanding debt from month to month. Credit card debt is considered the worst kind of debt for your credit profile, and there are several reasons for this which we will explain later.

Important Factors

FICO considers a variety of details when looking at the amounts owed on your credit reports. Here is a list to help you understand some of the most important credit information which is weighed within this category.

- Your Revolving Utilization Ratio on Each Individual Credit Card Account

- Your Revolving Utilization Ratio on All Credit Card Accounts Combined

- Your Number of Accounts with Balances

- The Amount Owed on All Accounts Combined

Each of your credit accounts will be listed on your credit report separately, however, they are all taken into account when calculating your credit score.

Revolving Utilization: A Very Important Factor

While your revolving credit utilization ratio is not the only factor considered when FICO takes a look at your debt, it is without question the most important factor within this credit scoring category. Carrying credit card debt will signify to lenders that you have overextended yourself and, as a result, show that you may be a high-risk borrower.

In case you are unfamiliar with the term revolving utilization ratio, here is a simple definition. Revolving utilization refers to the percentage of your available credit limits which is being used. If, for example, you have a credit card with a $4,000 limit and a balance of $3,000 then your utilization ratio is 75%. Charge that same account up to $4,000 and your utilization ratio climbs to 100%.

The higher your revolving credit utilization ratio climbs the worse the impact is going to be upon your credit scores. Maxing out any credit card account is very likely to have a negative scoring impact, perhaps to an extreme degree.

What Should My Credit Utilization Ratio Be?

A low credit utilization ratio is generally considered to be a credit utilization ratio of 30% or below. This is considered for each credit account, as well as overall on all your credit accounts. If you have a credit utilization ratio of over 30%, it will start to hurt your score. The higher your ratio, the more it will hurt your FICO score.

How Do I Lower My Credit Utilization Ratio?

There are only two ways to lower your credit utilization ratio. The first way is to pay down the balance on your credit card account. The second way is to increase the amount of credit you have.

Keeping good credit allows for one of the most effective credit scores hacks available: increasing your credit limit regularly without increasing the balance you put on your credit cards. It’s one of the ways that people who have good credit early will keep their good credit.

Here’s how you do it. When you get a credit card, keep your utilization ratio on it below 30%. Do not run up a balance larger than 30% on this card. Every year, request a credit limit increase and ask for the maximum that you’re able to get. This will decrease your credit score in the short run thanks to a hard inquiry, however, in the long run, you will be able to maintain a credit utilization ratio that’s so low, that your score will stay high while you’re able to take on higher and higher balances.

This method requires a great deal of financial discipline. It requires that large purchases are never put on credit cards, instead opting to use installment loans at a lower interest rate.

However, if you do not yet have good credit, you need to focus on lowering your credit utilization ratio overall and, most importantly, reducing the total amount of debt owed.

How To Reduce Your Credit Card Debt

“You can’t get ahead by paying 18%” – Charlie Munger, Vice Chairman of Berkshire Hathaway & Investing Legend

Since nearly a third of your FICO scores are based upon the amounts owed on your outstanding debts you could still potentially be facing significant credit score problems even if you routinely pay all of your bills on time. Making a plan to eliminate your credit card debt is a great step toward earning the stellar credit scores you want and need to lead a better life.

For this reason, we recommend using a technique that Dave Ramsey, one of the most famous personal finance gurus, calls “snowballing”. This method is where you pay off the smallest balances first, and then slowly work your way up by paying off each credit card one by one. You commit as much money as you can to paying down your debt and, over time, the “snowball” gets bigger and bigger, allowing you to pay more debt off. To understand more about the credit details contact our experts.

Frequently Asked Questions

What has the biggest impact on your credit score?

Many factors are involved in calculating your credit score. Your payment history has the most impact. If you want a high score make sure that you pay your bills on time. Other factors, like the length of your credit history and your account utilization, also cause credit score fluctuations. Check your credit report to see why your credit scores are changing.

Why do I have more than one credit report?

Each credit bureau (Experian, Equifax, and TransUnion) maintains its proprietary version of your credit report. This means you have three reports instead of just one. Your reports generally contain the same information, although the way it’s reported in each version is unique.