How Credit Scores are Built: Mix of Credit

FICO is the company who creates the brand of credit scores which are used most commonly by lenders in the United States. This means that whenever you apply for a mortgage, a credit card, an auto loan, a personal loan, or many other types of financing there is a very high chance that the lender is going to be reviewing some version of your FICO credit scores during the application process. Understanding how credit scores are built, therefore, is extremely important for anyone who wishes to lead a financially successful life.

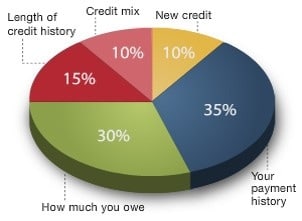

Credit scores are all based upon the same data – the information contained within your credit reports. FICO’s credit scoring models are designed to break your credit reports down into 5 separate categories. The information contained in those 5 categories is weighed and tallied separately. Next the points from each category are added back together in order to create easy-to-use credit scores which are sold to lenders.

The first 3 categories of your credit reports (Payment History, Amounts Owed, and Length of Credit History) collectively account for 80% of your FICO credit scores. The final 2 credit report categories which make up your FICO credit scores (Mix of Credit and New Credit) are worth 10% each.

Certainly changes within these final 2 credit report categories are going to have a much smaller influence over your scores when compared with other types of credit information. However, while you might be tempted to dismiss these small 10% categories as insignificant or even irrelevant, doing so could be a big mistake. These final 2 categories are worth up to 55 points each, a number of points which could still potentially make a huge difference in the types of loans you are eligible to receive, the interest rates you are offered, and even your ability to qualify for a loan at all.

Mix of Credit

Working hard to earn better credit? Your mix of credit is probably one of the most overlooked categories when it comes to credit improvement strategies. Consumers who have a healthy mix of both installment accounts (such as mortgages, auto loans, student loans and personal loans) and revolving accounts (such as general use credit cards, gas cards, and retail store cards) are statistically less risky than those who have experience managing only one type of account.

Most lenders like to see that you have a history of managing a variety of account types well. For this reason if you have been afraid to open a credit card account in the past or if you have heard that credit cards are bad for your credit it might be time to rethink your position. Consumers who have zero credit cards are actually considered to be higher credit risks than those who do have credit cards and, of course, who manage those accounts properly.

Important Factors

FICO considers a variety of factors when reviewing your mix of credit to help determine how credit scores are built. Here is a list which may help you understand a few of the most important details which FICO weighs within this category.

- The Number of Credit Card Accounts on Your Credit Report

- The Number of Installment Loans on Your Credit Report

- The Number of Mortgage Loans on Your Credit Report

- The Number of Finance Company Accounts on Your Credit Report

- The Total Number of Accounts on Your Credit Report

Closed Accounts

You should also understand that paying off or closing an account does not automatically erase the record of the account from your credit history. Because of how credit scores are built, even closed accounts will generally, though not always, continue to remain on your credit reports for either up to 7 years (negative accounts) or up to 10 years (positive accounts). Therefore, a paid off installment loan could still continue to benefit your “Mix of Credit” category for years to come. Conversely, an account with derogatory history such as late payments could continue to hurt your credit scores for many years in the future.