Debt Consolidation – The Truths and Myths

The Truths and Myths about Debt Consolidation A debt statistics survey says that nearly 80% of Americans have Debt. People share

Latest Posts

The Truths and Myths about Debt Consolidation A debt statistics survey says that nearly 80% of Americans have Debt. People share

New Credit Without a Credit History – 3 Ways If you’re just getting started on your financial journey, one of

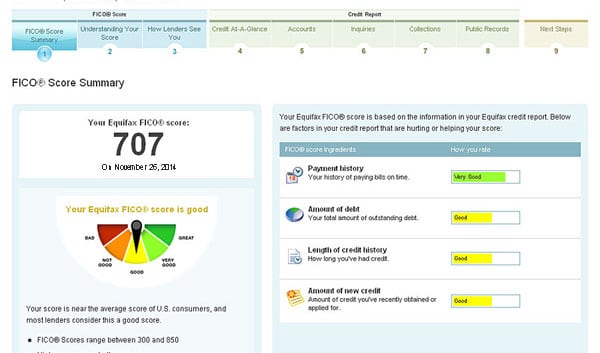

The title of this article actually features a big mistake. The mistake is the idea that you only have 3 credit scores and it is one of those credit myths which resurfaces over and over again. In truth while you do only have 3 credit reports, one from each of the 3 major credit reporting agencies (Equifax, TransUnion, and Experian), you really have hundreds of different credit scores.

Does paying off a collection account raise credit scores? Does the Collection Account Raise Credit Scores? When it comes to

How To Detect Identity Theft – You Need to Know Are you aware of how to detect identity theft? You

How To Protect Your Child from Identity Theft?Table of Contents Do you want to know how to protect your child

Rebuilding Credit After Divorce – Effective WaysTable of Contents In the midst of all of the stress and emotional turmoil

What You Need To Know About The National Consumer Assistance Plan In the spring of 2015 Equifax, TransUnion, and Experian

The Difference Between Credit Reports and Credit ScoresTable of Contents The Difference Between Credit Reports and Credit Scores The credit

Welcome to Part 3 of our powerful series, Credit Cards 101. In parts 1 and 2 of this series you have already learned some important information about how properly managed credit card accounts can be very effective tools to help you build better credit. Of course, while well managed credit card accounts can potentially be great for your credit scores, credit card debt can actually wreak havoc upon your credit scores very quickly. For best results (both financially and from a credit score standpoint) it is important to develop the habit of paying off your credit card balances in full each month.

Information Not Found on Credit Reports No one likes a tattletale, and at times that is exactly what a credit

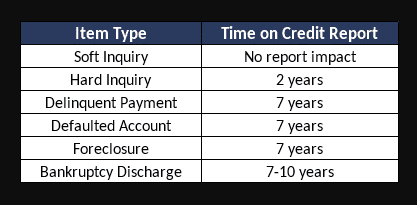

How Long can Bad Debt Damage My Credit report? Your credit reports are tools, tools that are routinely used by

Your privacy matters! We only uses this info to send content and updates. You may unsubscribe anytime.

It only takes 90 seconds to sign up. Start fixing errors on your credit report and get help to increase your credit score. Your information is safe with us. We treat your data as if it were our own.

Privacy and Cookies

We use cookies on our website. Your interactions and personal data may be collected on our websites by us and our partners in accordance with our Privacy Policy and Terms & Conditions