What Your Credit Report Doesn’t Show

No one likes a tattletale, and at times that is exactly what a credit report may feel like. Credit reports, after all, can tell future lenders and even potential employers all about your financial past, including any mistakes you may have made.

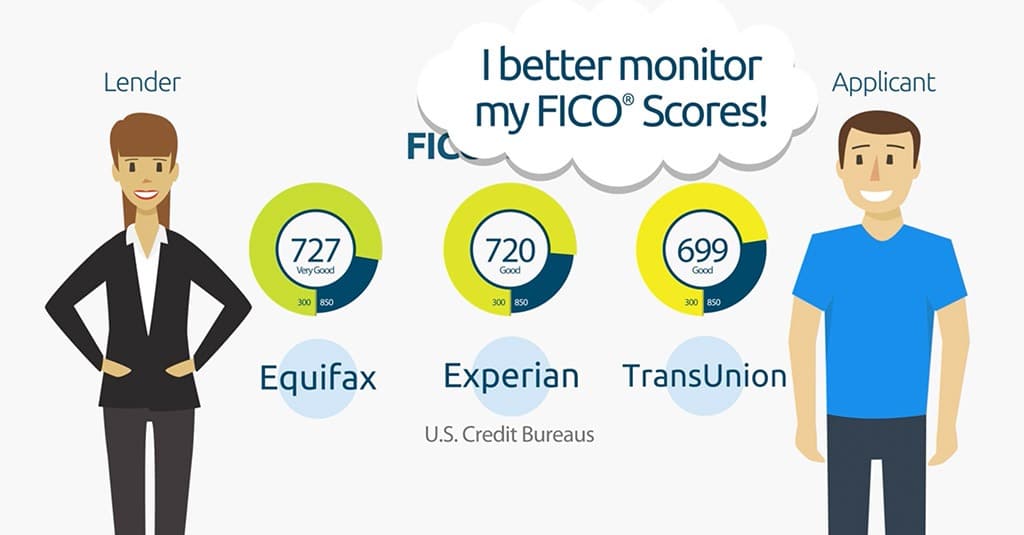

Yet the truth is that your credit reports do not contain a complete picture of your past either. Certain items will not appear on your credit reports either due to legal requirements that the information is excluded or because of policy decisions made by the 3 major credit reporting agencies (Equifax, TransUnion, and Experian) themselves.

Here is a look at some of the different types of information that are not found on your credit reports and, as a result, which will never directly impact your credit scores either.

Criminal Records

Non-financial public records such as arrest records and criminal records will not show up on your 3 major credit reports from Equifax, TransUnion, or Experian. Of course, if a prospective employer requests for you to submit to a background check, information about your criminal past may still rise to the surface. Still, at least you do not have to worry about a criminal mistake from your youth haunting you or potentially damaging your credit scores whenever you apply for a loan or credit card account.

Also Read: Top 3 Mistakes that Can Hamper Your Credit Score

Medical History

Your medical history and even your medical debt (unless an unpaid account has gone into collections) are not included in your credit reports either. Additionally, even if an unpaid medical collection does appear on your credit reports information regarding your medical conditions, diagnoses, or treatments must still be excluded to protect your right to medical privacy.

Certain types of Personal Information

While your credit reports are certainly known to contain personal information such as your name, social security number, date of birth, employer, and both past and present addresses, there is at the same time a lot of personal data which is excluded from credit reports as well. For example, you will never see any of the following information included on a credit report: marital status (either past or present), age, religious beliefs, sexual orientation, gender, nationality, ethnicity, political affiliation, number of dependants, or employment status.

Also Read: 8 Core Habits That Define People with No Credit Card Debt

Prepaid Debit Cards

Despite a lot of bad information which you may find circulating on the internet, the truth is that prepaid debit cards do not appear on your credit reports. As a result, the idea that prepaid debit cards may have the potential to help your credit is a complete myth.

Prepaid cards cannot help you to build your credit, nor do they have any ability to impact your credit scores in any way. Prepaid cards, however, should not be confused with secured credit cards which do generally show up on your credit reports and can impact your credit scores for the positive or negative, depending upon how they are managed.

Income, Salary, and Net Worth

Your salary and information regarding your net worth are also missing from your credit reports. Assets that you own, bank account balances, stock options, IRAs, brokerage accounts, and other wealth-related metrics are all excluded as well. Other sources of income such as alimony, child support, and public assistance will not be found on your credit reports either.

Credit reports are designed to provide lenders with a look into how you manage your financial obligations, but they do not give information regarding your income or net worth. When you apply for financing lender may still request information regarding your income and assets to determine your payment capacity; however, such information will need to be provided by you, the applicant, directly instead of being made available to the lender on a credit report.

Utilities

In general information regarding how you manage your utility payments is not included on your credit reports. The exception to this rule commonly occurs if you have an account that went into default and now appears on your credit reports as a collection. You typically will not see monthly electric bills, gas bills, water bills, cable bills, mobile phone bills, or other similar types of monthly utilities on credit reports.

Alternative Loans

Small-dollar loans such as payday loans, title loans, or loans received when you pawn your possessions are not included on your 3 major credit reports either. However, just as is the case with utility bills, an exception to this rule may occur if you go into default. When you default on these types of debts they could potentially find their way onto your credit reports in the form of collection accounts.

Old Debts

The Fair Credit Reporting Act (FCRA) is the chief federal law that governs credit reporting and serves to protect consumers from a variety of unfair practices. One of the most important protections which the FCRA offers you is the fact that the law places strict time limits (aka statutes of limitation) which dictate how long most types of negative information may remain on your credit reports.

Once the FCRA statute of limitation on an account has expired then old, negative information is required to be “purged” from your credit reports immediately. These specific time limits will vary based upon the account type, but in general, the majority of negative information must be removed from your credit reports within 7-10 years. Notable exceptions to this rule include defaulted student loans and unpaid tax liens, both of which are legally permitted to remain on your credit reports indefinitely.

1. How do I know when to report an error on my credit score report?

Once you discover the error, you need to check with the credit bureau reports from Equifax, TransUnion, and Experian, as it will help you to determine whether your error is in one bureau report or all of them. If the very same error is found in all four credit reports, then a mistake has been made by the lender. The issue will pertain to a specific bureau, and the bureau must be informed about the same.

2. How long does it take for a new credit card to show up on your credit report?

You can expect credit cards to show up on your report within a couple of months. The exact timing will depend on when your credit card company reports information to the credit bureaus. All companies do so roughly once per month. If you happen to get a new card just after the company reported information to the credit bureau, you may have to wait until the end of the next billing cycle for the information to appear on your credit report.