Does the Collection Account Raise Credit Scores?

When it comes to questions regarding your credit scores, more often than not there is no simple answer. Rather, the answer to most credit scoring questions is the frustratingly ambiguous, “It depends.” If you are wondering whether or not paying off an outstanding collection account will raise your credit scores, you might be surprised that the answer is not a clear-cut “yes.” Instead, there is a variety of possibilities. The relationship between collection accounts and credit scores is often ambiguous. Sometimes paying off a collection account raise credit scores, more often it will have little to no impact, and occasionally paying off a collection can even damage your credit scores.

It Depends Upon the Credit Scoring Model

You may not realize it, but you do not have one single credit score. You do not have just 3 credit scores – one from each credit bureau – either. Instead, you have hundreds of different credit scores created by dozens of different credit scoring models and versions.

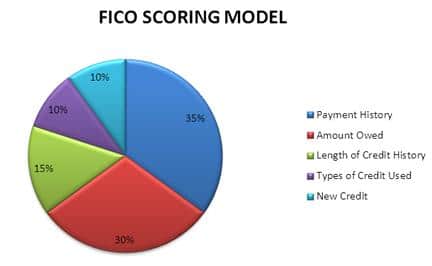

The most popular scoring models, especially among lenders, are created by FICO. Another popular credit scoring brand is VantageScore. Yet even FICO and VantageScore both have multiple generations of their scoring models currently available.

Why is this information important? The fact that there are different brands of scoring models and different model versions (think 1.0, 2.0, 3.0, etc.) means that just because an action (i.e. paying off a collection account) has a positive impact on your credit scores under one scoring model, it does not mean that the same action will help your scores under the different scoring model.

If you pay off a collection account and you pull your VantageScore or FICO 9 credit scores online, you might see those scores move upward as a result. However, since most lenders use more dated versions of FICO’s credit scoring models, paying a collection account probably will not have the same positive impact if a lender were to check your credit scores. Collection accounts and credit scores are complex sometimes!

Older versions of the FICO score are much more concerned with the fact that collection accounts occurred than they are with the balance of those accounts. Under these older FICO models, a collection with a $1,000 balance or one with a $0 balance will have roughly the same negative impact on your credit scores. As a result, if you are paying or settling out collection account raise credit scores for a loan this strategy will most likely not be very effective. Zeroing out an older collection account balance could even trigger a drop in the FICO credit scores a lender sees if the payment caused the account to be updated on your reports.

It Depends Upon the Type of Account

Negative credit card accounts are usually the exception to the rule above. In general, settling or paying off your derogatory credit card balances is going to have at least some positive impact on your credit scores, even if your lender is using an older version of FICO. The reason that paying or settling negative credit card debt will likely have a positive credit score impact, regardless of the scoring model being used, is because almost every credit scoring model is designed to reward you when your credit card balances have a $0 balance. In this way, these revolving accounts are treated quite a bit differently than your average collection account or derogatory installment account. According to the relationship between collection accounts and credit scores, pay off negative credit card accounts first!

It Depends Upon the Rest of Your Credit Reports

As mentioned above, some credit scoring models are designed so that paying off a collection account might have a positive impact on your credit scores. However, even under these models, the impact of paying or settling a few collection accounts is likely to be minimal if the rest of your credit reports are still littered with other derogatory items. For example, if you pay off 3 collection accounts but there are still 15 other derogatory accounts present on your reports then your scores are not likely to move upward very noticeably, if at all.

The Bottom Line

Sometimes settling or paying out a collection account is still a good idea, even if doing so may not help to improve your credit scores. However, there are other times when paying a collection account might hurt your scores or could potentially even open the door for you to be sued (if you are making a partial payment on an older account).

Additionally, if a collection account is reporting incorrectly on your credit reports in any way (such as an incorrect balance, an invalid date opened, etc.) then there may even be legal grounds to ask for the account to be removed from your credit reports entirely.

Remember, just because you have the right to try to tackle collection accounts and other credit problems all on your own does not mean that doing so is a good idea. Hiring a credit professional to guide you and help you exercise your rights might just be your best move.