Why Regular Credit Report Checks Are Essential

The new year is upon us, and many people have resolutions to improve their credit or financial standing. Keep in mind, though: what doesn’t get measured, doesn’t get done! In rebuilding and maintaining good credit, there are reasons to check your credit report. Read out why you should check your credit report every year?

What Is Your Credit Report?

Your credit report is an itemized history of all the credit accounts you’ve opened in the past 7 years. There are four categories of information on your accounts: identifying information, credit accounts, credit inquiries, and public records. There are reasons why a credit report is important.

It includes accounts that you currently owe on, some paid off accounts, collections items, and payment history. It can even include some tax history if you have tax liens or past due IRS accounts.

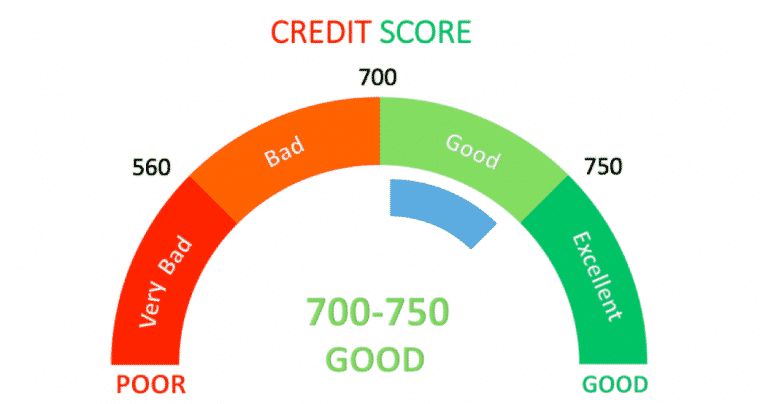

Your credit report does NOT include your credit score. Credit score services are typically provided by third parties, or through a paid service from the credit bureau themselves.

We wrote an entire article on The Difference Between Credit Reports and Credit Scores. Check it out!

Why Should I Check My Credit Report Every Year?

Reason 1: To Detect Fraud

Identity theft is one of the most common white collar crimes in the United States. It can be done through many different means, but the end result is the same: the thief can use your good name to take out loans that they have no intention of ever paying off, leaving you holding the bag!

If you see fraud, you can take the following actions. First, call the lender and report the fraud. Then, call the credit bureau and dispute the fraudulent item. This process is much easier with help from a reputable credit repair company.

Read out how to recover from identity theft

Reason 2: To Catch Mistakes

No matter what credit bureaus may want you to believe, they make mistakes too. Typically, they are clerical errors, resulting in you having a mortgage on your credit report that actually belongs to someone else.

Also read on Top 3 Mistakes that Can Hamper Your Credit Score

Mistakes can be disputed with the credit bureau, just like fraudulent items.

Reason 3: To See Why Your Score Is So Low

Among a number of reasons to check your credit report; If you are tracking your credit score, and you notice that your score is very low, you will want to see if there’s an item on your credit report that’s preventing your score from going up.

Top 3 Easy and Free Ways To Increase Your Credit Score For Life

Normally, credit cards and collections items will be the biggest barrier to having a good credit score. But it could also be fraud.

How Do I Check My Credit Report?

All Americans have the right to check their credit report once a year from each of the three credit bureaus for free. The US government has a website that allows people to do this.

Go to https://www.annualcreditreport.com and follow the instructions. This is a US government site, which you can verify by checking the security certificate.

Once you do this, you can choose which credit report you’d like to see.

One common thing that people do is to check one bureau’s credit report every 4 months. So in January, you might check the Equifax report. Then in May, you might check the Experian report. In September, you might then choose to look at the TransUnion report, and repeat for the next year.

This way, you’re on top of your credit report at all times!