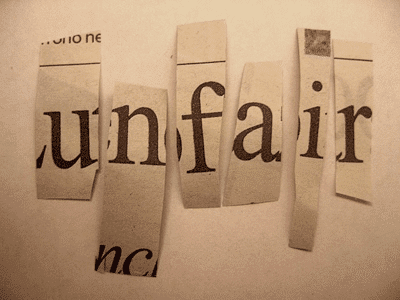

Today’s question, sent to me by Thomas at RE/MAX in New York: How can my client force their cell phone company to report their positive payment history to the credit bureaus? Answer? You can’t. Well, kinda…. Data furnishers like cell phone companies, credit card companies, collection agencies, etc. pay a fee to the credit bureaus to provide them with reporting information. Some, like smaller companies, subscribe to one or two. Some, like major credit card companies, subscribe to all three. Some, regretfully, don’t subscribe at all. What’s more, many companies, like the aforementioned cell-phone provider, only report when there is a negative status. Meaning, if your client pays great for ten years they get NO positive reporting, but if they fall into collections…watch out! The creditor is quick to report the derogatory item to the bureaus. If this doesn’t exactly sound fair, it isn’t. I believe that if a consumer pays a bill on time, they should have it reported – just as they are reported if they DON’T pay. But hey, we don’t make the rules, we just play the game.