Does identity theft damage your credit score?

No one likes to be ripped off, especially by a credit card or debit card thief. While having your credit card or debit card account information stolen can undeniably be quite frustrating, the good news is that fraudulent charges generally will not impact your credit reports and scores at all. There are a few exceptions to this rule; however, so keep reading to learn more about how to protect your credit and ultimately your financial well being in the event that credit or debit card fraud happens to you.

Closing An Old Account

Whenever your credit card is lost, stolen, or when your account information is stolen it is your responsibility to report the situation to your card issuer (assuming the bank has not already caught the theft itself). At this point your card issuer will typically close the old account and a new card with a new account number will be issued in your name to replace the compromised account.

If your new card is reported to the credit bureaus with the same payment history and original date opened as the former card then your credit scores probably will not be impacted at all by the new account. However, if your card issuer reports the replacement card as a new account (new date opened, no previous payment history) then your credit scores actually might be impacted negatively. A card which is issued as a brand new account could lower the average age of accounts on your credit reports – a factor which is considered when your credit scores are calculated.

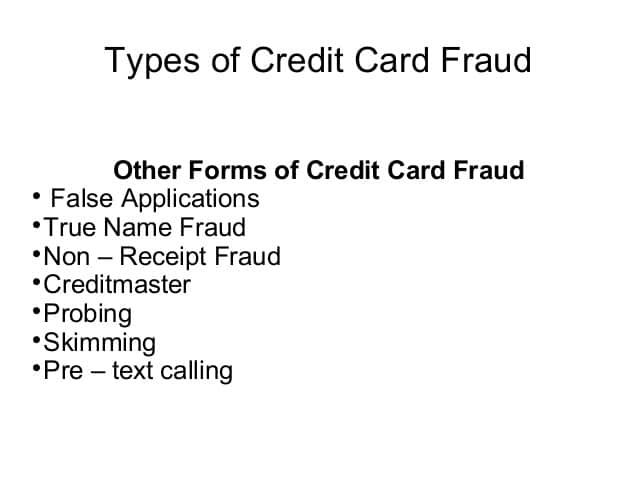

Credit Card Fraud Vs. True Name Fraud

Generally speaking, credit or debit card fraud is not as serious of a problem as true name fraud. True name fraud, also known as identity theft, occurs when someone steals your personal identifying information and then uses that information to open new, fraudulent accounts in your name. This type of theft can wreak havoc upon your credit scores and can be much more difficult to clean up after the fact (especially if you are working without the help of a professional who knows how to help you exercise your rights). Thankfully if thieves steal only your credit or debit card information then, while they may be able to make unauthorized purchases on your account, they most likely will not have the information they would need in order to open additional fraudulent accounts in your name.

Your Responsibility

If you discover that you are a victim of credit or debit card theft it is important to take action right away. Specifically, you need to alert both the issuing bank and the credit bureaus that you have been a victim of fraud. Failing to promptly report a lost card or unauthorized transactions to your bank or card issuer could even result in you being held financially responsible for the theft.

1. Notifying the Card Issuer

Reporting credit card/debit card fraud to your card issuer is important for a few reasons. First, you obviously want to shut down the thief’s ability to continue to use your account for any additional unauthorized purchases. You also want to have any unauthorized charges removed from your account so that you will not be financially responsible for the debt.

Thankfully there are 2 federal laws that protect you in the event that your credit card or debit card information is used by a scam artist. The Fair Credit Billing Act caps consumer responsibility for fraudulent credit card charges at just $50. All of the major credit card issuers currently waive this liability as a matter of customer service. Fraudulent debit card charges are also capped by the Electronic Funds Transfer Act. Under this law consumer responsibility for fraudulent debit charges is capped at a maximum of $500, but you will only be held liable for $50 as long as you report the fraud within 2 days.

-

Can Credit Card Fraud Affect Credit? Notifying the Credit Bureaus can help

Even though credit card fraud is not the same as identity theft, it can still potentially be beneficial to alert that 3 credit bureaus (Equifax, TransUnion, and Experian) that your card information has been stolen as well. You can even place a fraud alert on your credit reports to help warn your current lenders in the event that a thief tries to increase your credit line or request a new card on your existing account.

Plus, if your personal information was somehow also stolen unbeknownst to you then a fraud alert might help to protect you from future fraudulent accounts as well.