Believe it or not, worrying about your credit is actually a good thing. It shows that you are thinking. It shows that you are smart. It shows that you want to take charge of the direction in which your life is headed instead of just sitting back and allowing life to happen. So you might wonder: can student loans impact my credit?

There is no doubt that your credit is going to have a big influence over your life, either for the positive or the negative. Accepting that fact and trying to find ways to improve your credit are both important steps toward achieving long term financial success.

The first thing you should be concerned about when it comes to your credit are the items and accounts which appear on your credit reports. Your credit scores are ultimately calculated from that very information, so any account on your credit reports most likely has at least the potential to impact your credit scores.

If you took out student loans to help finance your education those accounts will influence your credit scores just like anything else that shows up on your credit. Thankfully the way in which those loans will ultimately impact your credit is entirely up to you.

Payment History Matters Most

When it comes to student loans or any other type of account on your credit reports for that matter, how you manage the debt is the factor which is going to have the biggest influence upon your credit scores. Student loans may impact your credit scores in other ways too, but the payment history you establish on these accounts is far more important than any other factors. On-time payments on your student loan accounts have the potential to slowly build up your credit scores. Conversely, late payments or defaults will probably have the opposite effect.

The Impact of Multiple Accounts

The actual number of student loans which appear on your credit reports may impact your credit scores as well. Although you may only make a single monthly payment to your student loan servicer (i.e. NelNet, Navient, FedLoan Servicing, CornerStone, etc.) it is very likely that you will have multiple student loan accounts which show up on your credit reports. The reason why this occurs is because if you used student loan funds to finance your entire education you probably applied for a new, separate loan each time you need to pay for tuition.

Student loans are reported to the credit bureaus on a disbursement by disbursement basis. If the college you attended billed for tuition every semester then, assuming you applied for a loan with each tuition payment, you could easily have 8 separate student loan accounts for an average undergraduate degree. If you attended summer school or graduate school the number of accounts showing up on your credit reports could be significantly higher.

The simple existence of multiple student loans on your credit reports could potentially have a negative impact upon your credit scores. Credit scoring models such as FICO and VantageScore commonly consider how many accounts with balances are currently included in your credit reports. When it comes to accounts with balances and your credit scores, less is better. However, the good news is that if any negative impact does occur due to multiple student loan accounts it will most likely be minor.

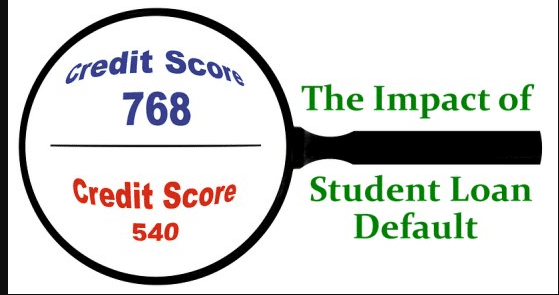

The real danger which multiple student loans may pose to your credit scores occurs when you make late payments, become past due, or worst of all go into default on your loans. It is bad enough for your credit scores whenever a new late payment on a single account occurs. Yet when you pay your student loan servicer late you could unknowingly be making late payments on as many as 8 or more separate student loan accounts. It is easy to understand why even a 30 day late payment reported across multiple student loan accounts all at once could quickly send your credit scores into a nosedive.

The Impact of Balances

It has already been mentioned above that the payment history on your student loans is extremely important and the number of student loan accounts you are carrying may be influential upon your credit scores as well. So what about the balances on your student loan accounts? Do those balances impact your credit scores? The answer is yes, but probably not as much as you think.

Credit scoring models are definitely concerned with the amount of debt you owe, but the truth is that they are most concerned with your outstanding credit card debt. Installment loan balances, such as student loans and mortgages, are far less influential upon your credit scores comparatively.

You might, for example, have a $300 credit card balance on an account with a small credit limit. That small balance (especially if the card is maxed out) will likely matter far more from a credit scoring perspective than significantly higher student loan debts. As a result $300 in credit card debt might have a worse impact upon your credit scores than $90,000 in student loan debt. No one ever said credit scoring was simple to understand.

Is Consolidation Helpful?

In general, as long as you manage your student loan accounts well and consistently make on time payments, student loans have the potential to help instead of hurt your credit scores. Still, for the reasons mentioned above, consolidating your student loans after graduation might not be a bad idea. Here are a couple of pros and cons to help you decide if consolidation is the right choice for you.

Pro: A Single Loan

Consolidating or refinancing your student loans will typically result in your old, multiple loan accounts being paid off and a new, single loan with a balance appearing on your credit reports. The overall balance owed will still be the same on your new loan as it was when your old, multiple loans were added together. However, by using consolidation to reduce the number of accounts with outstanding balances on your credit reports you might help to improve your credit scores slightly.

Additionally, combining a number of loans into a single account can be helpful from a defensive standpoint as well. Hopefully you will never experience the need to pay your student loan payments late and the truth is that even a single late payment could harm your credit scores. However, a late payment on a single account would almost certainly be less harmful than late payments which occurred across a number of accounts.

Con: A Higher Cost

Often consolidating your student loans will result in a lower monthly payment, which can be extremely helpful in the short term from a budgeting perspective. Yet even though your monthly payment may be lower you could still end up paying more in the long run by consolidating those debts.

When you consolidate multiple student loan accounts it is common for your new loan to have a longer repayment period. As a result, even though your monthly payments may be lower, it will often cost you more in overall interest to pay off the new debt due to the longer repayment period. Consolidating may still be the right option for you anyway, but it is important to at least consider the cost ahead of time.