How To Get Credit Card Debt Forgiveness?

Forging a Debt-Free Future: Steps to Achieving Credit Card Debt Forgiveness

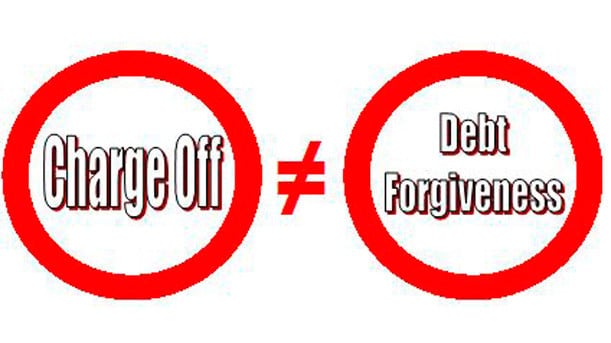

Credit card debt forgiveness is when credit issuers forgive balances as part of the debt settlement agreement. If an issuer thinks you’ll file for bankruptcy or you won’t pay the bill, they may decide that getting some money is better.

Most credit card companies are unlikely to forgive all your credit card debts. They accept a smaller amount in settlement of the balance due and forgive the rest. The credit card company might write off your debt but doesn’t get rid of the debt. You should still pursue debt forgiveness if it’s the best option for you.

Depending on your circumstances and the type of debt you owe, certain options may be given to you:

- Debt forgiveness for less than the full balance.

- Full forgiveness of some debts in some cases.

It’s best to understand your options and their possible consequences when pursuing credit card debt forgiveness to make the best choice for your circumstances.

- Student loan debt.

- Credit card debt.

- Mortgage debt.

- A note on bankruptcy.

- What should I know before considering credit card debt forgiveness?

Student Loan Debt

Student loan forgiveness depends on factors such as your income, employment type, and the amount of money you owe.

Programs that forgive or cancel student loan debt can be hard to come by. More notable programs are only available to those who work in certain professions like education and public service, or for a rare situation like bankruptcy. If you don’t work in these fields and you’re not filing for bankruptcy, there are options to pay off your student loans.

Debt consolidation in student loans

If you have student loan debt, you may be eligible for a direct consolidation loan. This allows you to combine many loans into one, giving you a simpler monthly payment. This is an option to switch to a long-term low payment from a variable rate to a fixed interest rate.

Credit Card Debt

Credit card companies are open to forgiving or negotiating your balances, but debt forgiveness may come with some serious risks.

Debt Management in Credit Cards

A non-profit credit counseling agency may help you find a better payment plan or reduce part of what you owe.

Setting up a debt management plan (DMP) involves making one monthly payment towards all your debt. This includes credit cards, some student loans, and other bills. The credit counseling agency oversees DMP, using the money you deposit with them to pay off your debt.

Credit card debt settlement is when a third party communicates with your credit card company and negotiates with the company to pay less than what you owe.

Debt settlement agencies stop you from making your debt payments to your credit card company. It could hurt your credit reports and scores (explain these). Missing one payment may lead to paying late fees and can result in a major hit on your credit scores.

Mortgage Debt

Like student loans, the federal government offers several options for credit card debt forgiveness other than private lenders.

FHA (Federal Housing Administration) homeowners have access to various programs that help prevent foreclosure or offer other forms of help (elaborate on this part). Among these are the Home Affordable Modification Program, where you qualify to reduce both your monthly payments and a significant portion of your total loan balances.

For other qualified homeowners, the Department of Housing and Urban Development offers programs for credit card debt forgiveness or reduced payments.

A Note On Bankruptcy

Once you explore all options and you’re still unable to repay your debts, you may consider declaring bankruptcy. By doing so, you may face some serious issues which include lowering your credit scores.

Filing for bankruptcy provides options for overcoming unmanageable debt. For example, filing Chapter 7 bankruptcy requires you to liquidate some of your assets to pay your creditors and it may be the only possible path to debt forgiveness.

What should I do Before Considering Credit Card Debt Forgiveness?

Some companies help you avoid or reduce your debt payments for free. It is better to check the company’s rating with the Better Business Bureau before signing documents.

The debt forgiveness organization should be able to provide you with clear time-bound outcomes, explain how all your costs add up over the total duration of your repayment and provide documentation.

Consequences of Credit Card Debt Forgiveness

The main consequence of debt forgiveness is the negative effect it has on your credit. There may also be tax consequences.

- If the creditor mentions uncollectible debt, the consequences include a flaw in your credit report. The creditor will sell the debt to the collector, who will pursue you for the money.

- If the creditor settled the debt with you, it will note on your credit report that the debt was settled for a lesser amount.

- The forgiven amount will be considered taxable income by the government and you must pay taxes on it.

Credit Card Debt Forgiveness after Death

Credit card debt doesn’t die. The responsibility for paying it off goes to your assets which include your cash, real estate, insurance policies, trusts, business stakes, investments, and other assets.

The executor of your assets will make payments on your debts with what is available to them. The executor may sell some of your possessions to cover those debts. Have a quick consultation session with our experts.

Key Takeaway

Discuss with your creditors about debt forgiveness or repayment plans available to you. A nonprofit credit counselor helps you explore your options, including bankruptcy.

There may be a quick fix if you come up with a plan for managing your debts. Ignoring your bills won’t make them go away, but developing a plan may give you hope and a fighting chance.

Frequently Asked Questions

What is Debt Settlement?

Debt relief companies turn to debt settlement as the best debt relief option. With debt settlement, these companies ask the clients to set aside a specific amount of money in a savings account. The goal of this account is to build a sum of money to settle debts later.

What is Debt Consolidation?

Debt consolidation requires you to take out a new financial process to consolidate all your existing debts.

Can credit card debt be written off?

Some of your credit card debt is done through a debt solution. Multiple debt solutions can allow you to write credit card debt off.

Can you get rid of credit card debt without paying?

When you use your credit cards, creditors will expect that you will repay the money. After long periods of missed payments, your creditors may lower these expectations and charge off the accounts, and send them to collections. After this period, there may be opportunities to pursue alternative payment arrangements for less than what you owe.

How can I eliminate my credit card debt legally?

- Make a budget

- A plan for how you’ll spend your money each month.

- It will help you see how you spend your money now and how you might spend money differently.

Is credit card debt forgiven after 10 years?

Some other forms of debt, outstanding credit card debt can’t be forgiven, even after death. Consumers who can’t pay their monthly bills have no good options other than setting up a debt management plan through a credit counselor or, as a last resort, filing for bankruptcy.