You may be familiar with the terms credit reports and credit scores because you used your credit scores for getting loans and viewed your credit report once a year for errors. What you may not know is the purpose of these credit reports and the credit scores.

The credit report shows the complete information regarding your current credit status and the credit scores are calculated based on the information on your credit report. To calculate the credit scores, you may use the.

Your credit report and credit scores are important because lenders ask for your credit report and credit scores to approve loans.

This article covers the differences between and uses for the Credit report and credit scores.

Credit Report and Credit Scores – The Major Difference

A credit report gives clear information about your current credit history and a credit score is a number calculated from your credit report.

While the credit report and credit scores are different, the credit scores are obtained from the credit report. The lenders use the credit report and credit scores for their reference to decide if they should give you loans.

When talking about the credit report’s effect on the credit scores, the credit score improves if you view and rectify your credit report for errors. When you have errors on your credit report, then your credit score lowers.

If your score lowers, then your interest rate goes up, so check your credit report frequently and correct the errors when you are taking a loan.

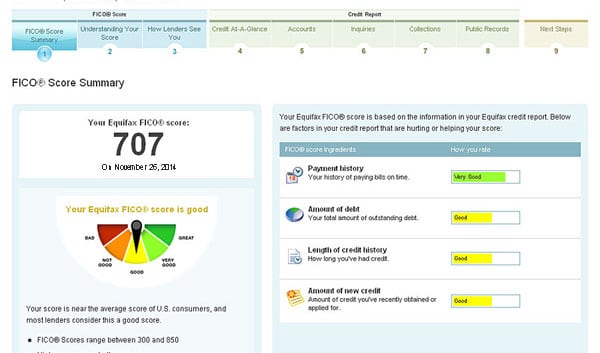

The credit scores are calculated by two different methods, like FICO credit score, and Vantage credit score. Whereas, the credit reports are generated by the three credit bureaus.

You can get your free credit reports by contacting the three major credit bureaus or from AnnualCreditReport.com. Similarly, you can get your free credit scores from any legitimate credit repair companies.

Must Read:

How does a Credit Report Work?

Credit bureaus get your credit information from lenders and other creditors. The credit bureaus, Experian, Equifax, and TransUnion also maintain your personal information and other public records such as any bankruptcies or criminal records.

You will get a credit report from each of the three credit bureaus, which will show a slight variation because not all creditors report to the same bureau.

A credit report is your financial health because it shows all your financial details for the past 10 years. The credit report includes but is not limited to the following information:

- The number of open accounts you have.

- The number of accounts you have closed.

- Your payment history.

- Any negative records.

- Loan amounts and loan balances.

Whenever you apply for a loan or apply for a job, your credit report may affect your approval or hiring, so maintaining your credit report is a must for all individuals.

Who Uses a Credit Score?

When you are planning to take the next big step in your financial world, like getting a mortgage or a car loan, your credit score is important.

Your credit score determines whether you may get loans or if you must improve your scores.

While discussing your credit report and credit scores with the credit card issuers, and lenders, they examine your credit score. The lenders use your credit score to check your creditworthiness.

The lenders see your score before determining if they will offer you loans. The lenders will consider you a risk-free person if your score is higher. The credit scores are calculated by:

- Payment history

- Amounts you owe

- Credit history

- Credit mix

- New credit

Uses of Credit Report and Credit Scores

To distinguish credit report and credit scores uses, insurance companies use the credit report to calculate the proprietary taxes and credit repair companies use the report to check for errors.

In some cases, employers use the credit reports generated by credit bureaus to prevent identity theft, and landlords use the credit reports to calculate the security deposit amount of their applicants.

Next about credit scores, the lenders and the credit cards issuers use your credit scores for evaluating how you return your debt amount.

Some collection agencies use your credit score to judge whether you are capable of returning the borrowed amount or not. Landlords may also look at your credit scores to check if you are financially responsible.

Your credit score makes your lender think about your financial responsibilities, and it makes them determine if you are good at paying off your debts on time.

Also Read:

- Bankruptcy Credit Repair Service 101: All You Need to Know

- The Truth About Cheap Credit Repair Scams

- The Highest is 850 Credit Scores: What does That Get Me?

Conclusion

When comparing credit reports and credit scores, both are important in your financial situation. The first step in building your credit is to know about the differences between credit reports and credit scores.

It is important to check your credit report once a year for any errors, and in the case of any errors, you must contact the credit bureaus and dispute them immediately.

You may check your credit report for errors and any identity theft or fraudulent activities. If you find any suspicious activity, you must contact the Federal Trade Commission.

By disputing errors, you improve your credit scores.

Frequently Asked Questions

Which is more important: a credit score or a credit history?

Credit history is the record that contains managing and repaying your debts, credit card loans, and more. Your credit history is available on your credit reports. Credit scores are calculated depending on your credit reports. Both your credit scores and credit history are important.

Is it better to close a credit card or leave it open with a zero balance?

It is better to keep your credit cards open even if you do not use them. It helps in increasing your credit history and maintaining your credit utilization rate.

Are a credit score and credit report the same thing?

They are not. The credit report is a record of your financial statements for the past 7-10 years. The credit scores are derived from your credit reports.