Your credit score affects everything from your mortgage rate to your cell phone plan, yet most people approaching credit repair make the same costly mistakes, often referred to as credit repair common mistakes, that can add months or even years to their recovery timeline. The difference between a successful credit repair journey and a frustrating cycle of setbacks often comes down to understanding which well-intentioned actions actually work against you. Understanding credit repair common mistakes can help you avoid the pitfalls that delay your progress. Recognizing credit repair common mistakes is essential for effective credit management.

What if the dispute strategy you’re using is actually hurting your credibility with credit bureaus? Or that paying off certain old debts could restart the clock on negative reporting? The path to better credit is filled with counterintuitive decisions and timing considerations that most people discover only after making expensive mistakes. Understanding these common pitfalls before you encounter them can save you significant time, money, and stress while putting you on the fastest route to the credit score you need. By recognizing these credit repair common mistakes, you can better navigate the challenges ahead. Avoiding credit repair common mistakes will significantly enhance your chances of success. Documentation plays a vital role in preventing credit repair common mistakes. Maintaining organized records helps you avoid credit repair common mistakes. Being aware of credit repair common mistakes can save you time and frustration. Always confirm agreements to avoid credit repair common mistakes.

The Documentation Trap: Why Poor Record-Keeping Sabotages Your Success

Understanding how the statute of limitations affects credit repair common mistakes is crucial. Many consumers make credit repair common mistakes when dealing with old debts. Balance transfers can lead to credit repair common mistakes if not managed properly. Bankruptcy decisions are often accompanied by credit repair common mistakes. Procrastination delays recovery and leads to credit repair common mistakes. Dispute strategies can result in credit repair common mistakes if not executed carefully.

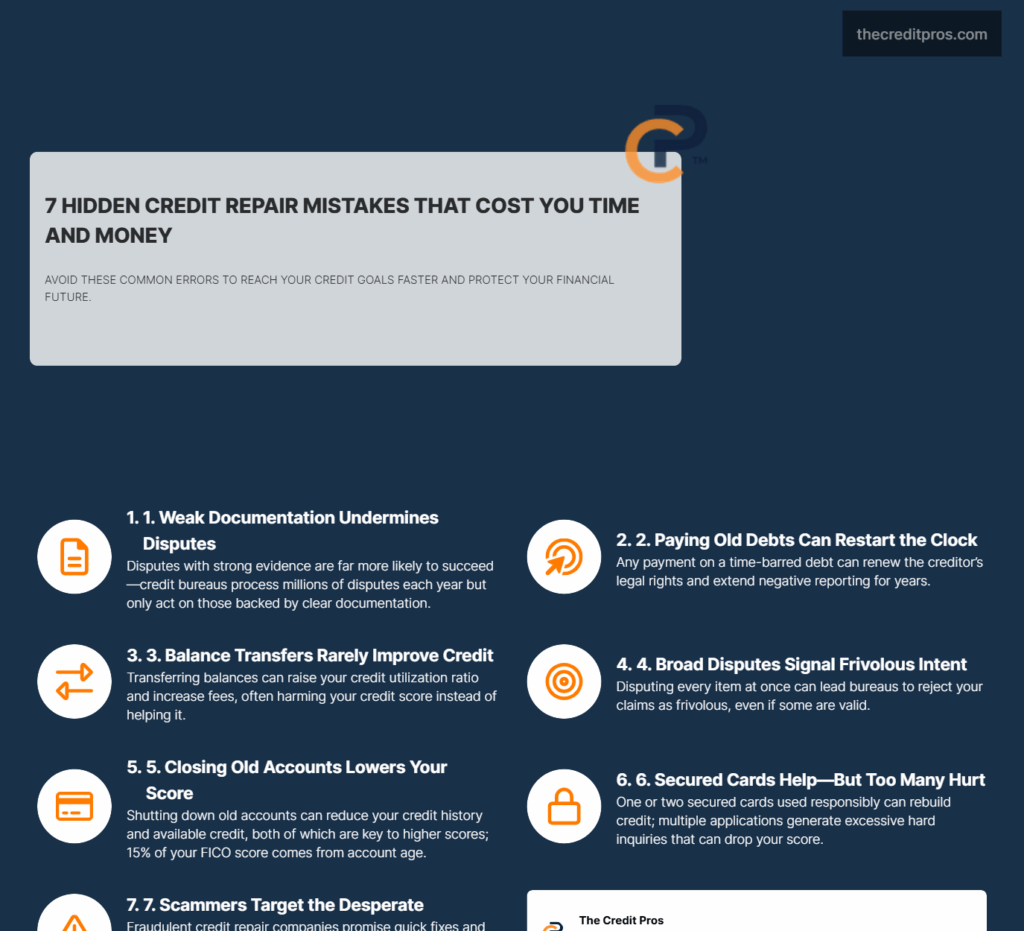

Comprehensive financial documentation serves as the foundation for any successful credit repair effort, yet most consumers underestimate its critical importance until they find themselves unable to substantiate their disputes. Credit bureaus receive millions of dispute letters annually, and those backed by solid documentation carry significantly more weight than unsupported claims. The difference between a successful dispute and a rejected one often comes down to your ability to provide concrete evidence that supports your position. Removing positive history can happen through credit repair common mistakes. Strategic thinking can help you avoid common credit repair common mistakes. Focus on high-impact inaccuracies to mitigate credit repair common mistakes.

The most powerful documentation includes original loan agreements, payment histories, correspondence with creditors, and any written modifications to original terms. Bank statements showing payment dates and amounts prove particularly valuable when disputing late payment notations, while certified mail receipts demonstrate your attempts to communicate with creditors in good faith. These documents create an unassailable paper trail that credit reporting agencies cannot easily dismiss.

Creating a systematic organization approach for your credit repair documentation requires both physical and digital storage solutions. Maintain chronological files for each creditor, including all correspondence, payment records, and dispute submissions. The Federal Trade Commission recommends keeping credit-related documents for at least seven years, which coincides with the maximum reporting period for most negative items. Your filing system should allow quick retrieval of specific documents when responding to credit bureau requests for additional information.

The distinction between certified mail and regular correspondence extends far beyond simple delivery confirmation. Certified mail with return receipts provides legal proof that credit bureaus and creditors received your communications, establishing definitive timelines for their required responses. Under the Fair Credit Reporting Act, credit bureaus have 30 days to investigate disputes, but this timeline only begins when they receive your correspondence. Regular mail offers no such protection, leaving you vulnerable to claims that your dispute was never received. Addressing significant issues first helps you avoid credit repair common mistakes.

Verbal agreements with creditors represent one of the most dangerous pitfalls in credit repair, as they provide no legal protection and can be easily misrepresented later. Creditors may promise payment arrangements or dispute resolutions over the phone, but without written confirmation, these agreements hold no legal weight. Always insist on written documentation of any agreements, including payment plans, settlement offers, or promises to remove negative items upon payment completion.

The Timing Paradox: When Quick Fixes Become Long-Term Problems

The statute of limitations on debt creates a complex timing dynamic that many consumers misunderstand, leading to decisions that inadvertently extend their credit problems rather than resolving them. Each state maintains different limitation periods for various types of debt, typically ranging from three to six years for credit card debt and up to fifteen years for certain secured debts. Once this period expires, creditors lose their legal right to sue for collection, though the debt itself doesn’t disappear from your credit report until the seven-year reporting period concludes. Managing credit utilization wisely prevents credit repair common mistakes.

Making any payment on a time-barred debt can restart the statute of limitations clock, potentially adding years to your credit recovery timeline. This counterintuitive reality catches many well-intentioned consumers who believe paying something is always better than paying nothing. Debt collectors often exploit this misunderstanding by accepting small payments that legally refresh their collection rights. Before making any payment on old debt, verify both the statute of limitations in your state and the original date of delinquency to avoid inadvertently extending your legal exposure.

Closing accounts can lead to credit repair common mistakes you should avoid. Instead of closing accounts, consider options to prevent credit repair common mistakes. Secured credit cards can be effective if you avoid credit repair common mistakes. Scammers exploit credit repair common mistakes made during desperate times. Identifying credit repair common mistakes can protect you from scams. Understand your rights to avoid credit repair common mistakes in the process. Recognize language patterns of credit repair common mistakes to stay vigilant. Understanding legal protections can help you avoid credit repair common mistakes. Recognizing the reality of credit repair common mistakes can safeguard your recovery.

Balance transfers during credit repair create a false sense of progress while potentially worsening your overall credit profile. Moving debt from one account to another doesn’t eliminate the underlying financial obligation and often generates additional fees that increase your total debt burden. More importantly, balance transfers can artificially inflate your credit utilization ratio on the receiving account, which negatively impacts your credit score. The temporary relief from lower promotional interest rates rarely compensates for these broader negative effects on your credit profile.

Filing bankruptcy as a quick solution to credit problems creates consequences that persist far longer than most other negative credit events. Chapter 7 bankruptcy remains on your credit report for ten years, while Chapter 13 bankruptcy appears for seven years. However, the impact extends beyond these reporting periods, as many lenders ask about bankruptcy history in their applications regardless of whether it still appears on your credit report. This means a bankruptcy filing can affect your ability to obtain credit, employment, and housing for decades, making it a solution that should only be considered after exhausting all other options.

The psychological tendency toward procrastination in credit repair compounds problems exponentially over time. Each month of delayed action allows negative items to accumulate additional reporting history, making them appear more established and harder to dispute successfully. Interest charges and fees continue accruing on unpaid debts, while your credit score deterioration can trigger penalty interest rates on existing accounts. The financial cost of procrastination often exceeds the emotional discomfort of addressing credit problems directly. The question isn’t whether you’ll face these credit repair common mistakes challenges, but whether you’ll recognize them in time to avoid becoming another cautionary tale.

The Dispute Strategy Minefield: Precision vs. Shotgun Approaches

Credit bureaus process millions of disputes annually and have developed sophisticated systems to identify and dismiss frivolous challenges to their reporting accuracy. When you dispute every item on your credit report simultaneously, regardless of its accuracy, you signal to the bureaus that your disputes lack merit and may be part of a systematic attempt to manipulate your credit profile. This approach often results in all your disputes being rejected as frivolous, even those with legitimate grounds for removal.

The risk of accidentally removing positive credit history through overly broad disputes represents a significant but often overlooked danger. Positive payment history, especially on older accounts, contributes substantially to your credit score through both payment history and length of credit history factors. When you dispute an entire account rather than specific negative items within that account, you risk having the bureau remove the entire trade line, including years of positive payment history that benefits your score.

Understanding when to dispute with credit bureaus versus approaching creditors directly requires strategic thinking about the specific nature of each inaccurate item. Credit bureaus must investigate disputes about factual accuracy, such as incorrect payment dates, wrong account balances, or accounts that don’t belong to you. However, disputes about the legitimacy of the original debt or contractual disagreements often receive better resolution when addressed directly with the creditor who has access to complete account records and authority to make substantive changes.

High-impact inaccuracies deserve your focused attention over minor discrepancies that have minimal effect on your credit score. A single late payment notation on an otherwise positive account may reduce your score by 10-15 points, while a collections account or charge-off can decrease it by 50-100 points. Prioritizing your dispute efforts on the most damaging items maximizes the potential improvement to your credit score while demonstrating to credit bureaus that your challenges are based on legitimate concerns rather than desperate attempts to remove accurate negative information.

Target these high-impact items first:

- Collections accounts with incorrect balances or dates

- Charge-offs that should show as paid or settled

- Accounts that don’t belong to you (identity theft)

- Duplicate accounts showing the same debt multiple times

- Accounts showing late payments after the date of payoff

The Credit Utilization Paradox: When Closing Accounts Hurts Your Score

Credit utilization calculations become significantly more complex when you close existing credit card accounts, often producing counterintuitive results that damage your score despite reducing your total debt. Your utilization ratio compares your total credit card balances to your total available credit limits across all accounts. When you close an account, you eliminate its credit limit from this calculation while maintaining the same debt levels on remaining cards, potentially pushing your utilization ratio above the recommended 30% threshold that credit scoring models favor.

The length of credit history component of your credit score relies heavily on the age of your oldest accounts and the average age of all your accounts. Closing your oldest credit card account can significantly reduce your credit history length, especially if you have relatively few accounts or if the closed account represents a substantial portion of your total credit history. This factor comprises 15% of your FICO score calculation, making it a significant component that many consumers inadvertently damage through well-intentioned account closures.

The emotional urge to eliminate all credit cards after experiencing financial difficulties represents a natural but potentially counterproductive response. The psychological relief of cutting up credit cards and closing accounts feels like taking control of your financial situation, but this approach often extends your credit recovery timeline. Instead of closing accounts, consider reducing credit limits to levels you’re comfortable with or simply storing the cards in a secure location without using them. This approach maintains your credit history and available credit while removing the temptation to accumulate additional debt.

Secured credit cards offer a strategic rebuilding tool that allows you to demonstrate responsible credit management without the risk of overspending beyond your means. These cards require a cash deposit that typically serves as your credit limit, making approval virtually guaranteed regardless of your current credit score. However, applying for multiple secured cards simultaneously can generate excessive hard inquiries that temporarily reduce your score. Focus on obtaining one or two secured cards with reputable issuers who report to all three major credit bureaus, then use them responsibly for small, regular purchases that you pay off completely each month.

The Scam Vulnerability Window: Protecting Yourself When You’re Most Desperate

Credit repair scammers specifically target consumers during their most vulnerable financial moments, when desperation often overrides critical thinking about unrealistic promises. These predatory companies understand that people with damaged credit feel desperate for quick solutions and may be willing to pay substantial fees for services they could perform themselves. The most common fraudulent promises include guarantees to remove accurate negative information, claims of special relationships with credit bureaus, and offers to create new credit identities through legal loopholes.

The Credit Repair Organizations Act (CROA) provides specific protections for consumers, including mandatory three-day cancellation periods, prohibitions against upfront fees, and requirements for written contracts detailing services and costs. Legitimate credit repair companies must provide you with a copy of your rights under federal law and cannot make guarantees about specific results or timeframes. Any company that demands payment before providing services, guarantees specific outcomes, or advises you to dispute accurate information violates federal law.

Recognizing the specific language patterns used by fraudulent credit repair services helps protect you from their manipulative tactics. Scammers often use phrases like “loopholes,” “secret methods,” or “insider knowledge” to suggest they possess special abilities that you lack. They may claim to have former employees of credit bureaus on their staff or suggest that they can permanently remove accurate negative information through legal technicalities. These claims represent clear violations of federal law and should trigger immediate skepticism about the company’s legitimacy.

The legal framework protecting consumers includes not only CROA but also the Fair Credit Reporting Act (FCRA), which establishes your rights to accurate credit reporting and free annual credit reports. The Fair Debt Collection Practices Act (FDCPA) provides additional protections against abusive collection practices, while the Fair and Accurate Credit Transactions Act (FACTA) enhances identity theft protections. Understanding these laws empowers you to recognize when companies are offering services that violate federal regulations or making promises that exceed their legal authority.

Quick fix promises in credit repair always indicate fraudulent services because legitimate credit repair requires time for investigation, correspondence, and reporting updates. Credit bureaus have 30 days to investigate disputes, and creditors may need additional time to research account histories and make corrections. Even when disputes are successful, credit score improvements often take additional weeks or months to reflect fully across all scoring models. Any company promising dramatic score improvements within days or weeks is either lying about their capabilities or planning to engage in illegal activities that could expose you to additional legal and financial risks.

Wrapping Up: Your Credit Repair Success Depends on Strategic Awareness

Your credit repair journey doesn’t have to be a series of costly credit repair common mistakes and setbacks. Your credit repair journey doesn’t have to be a series of costly mistakes and setbacks. By recognizing that quick fixes often create long-term problems, that precision beats shotgun approaches in disputes, and that scammers specifically target your moments of desperation, you’re already ahead of most consumers who discover these truths too late. The path to better credit isn’t just about removing negative items—it’s about making informed decisions that compound positively over time rather than sabotaging your progress through well-intentioned but misguided actions.