What Credit Score is Needed to Buy a Car in 2023? A Helpful Guide

If you’re planning to purchase a car now, you are almost certainly aware that car prices have gone up since the pandemic, and so have credit requirements. We’re going to talk about the credit score range needed in 2023, for you to buy a car.

In this article, let’s explore the credit score requirements and the application process to buy a car loan.

Car Loans

What Credit Score is Needed to buy a Car – Car Loans

A car loan is a type of vehicle loan that a lender offers to an individual who is willing to buy a car by submitting a loan application. The borrower then uses the money to purchase a car that falls within the loan amount.

Though the definition makes it look feasible, the actual loan approval process can be difficult when you don’t have the necessary requirements. These requirements include credit score, amongst other criteria set by the lenders.

The criteria set by lending agencies or financial institutions differ from one lender to another. This puts pressure on the borrower (you), as you’ll need to face different loan terms and choose the one which best suits the principal amount and interest rates based on your income and financial status.

Requirements to Buy a Car Loan

What Credit Score is Needed to buy a Car – Requirements of a Car Loan

There is no minimum credit score requirement to purchase a car loan. However, the interest rates, EMIs, and loan amounts vary with auto lenders.

Any credit lending agency will have a thorough check of the applications received and process them based on the credibility of the customer applying. Below listed are some potential reasons for the rejection of a loan application and low credit scores:

- Improper debt management in credit history

- Multiple credit applications

- Irregular payments history

As a result of this information, you might be asked for a higher down payment, high-interest rate, and processing fees than usual. Therefore, it is mandatory to keep your credit scores and financial status at an optimum level.

Credit Scores and their Impact on Loan Approval

What Credit Score is Needed to buy a Car – Credit Score Impact

Credit scores still play a major role in the loan approval process even when there are no minimum credit score requirements. This is where it gets tricky; it is possible that the lender sets higher interest rates and EMIs if you have a bad credit score.

On the other hand, a good credit score will help you get the following benefits:

- The chance of getting approved for auto loans is high.

- The interest rate for your loan is less.

- Loan approval from major lending agencies with best criteria.

- You are asked for a lesser down payment when compared to a person with a low credit score.

Credit scores above 670 are considered to be in the good credit range. Based on the popular credit scoring model (Fico) approved by major lending agencies, you must have a good Fico auto score to qualify for a car loan. If you haven’t yet checked your credit score, head over to the homepage of any of the three major credit bureaus (Experian, Equifax, and TransUnion) to know your credit score.

Process Involved in Loan Application

What Credit Score is Needed to buy a Car – Loan Application Process

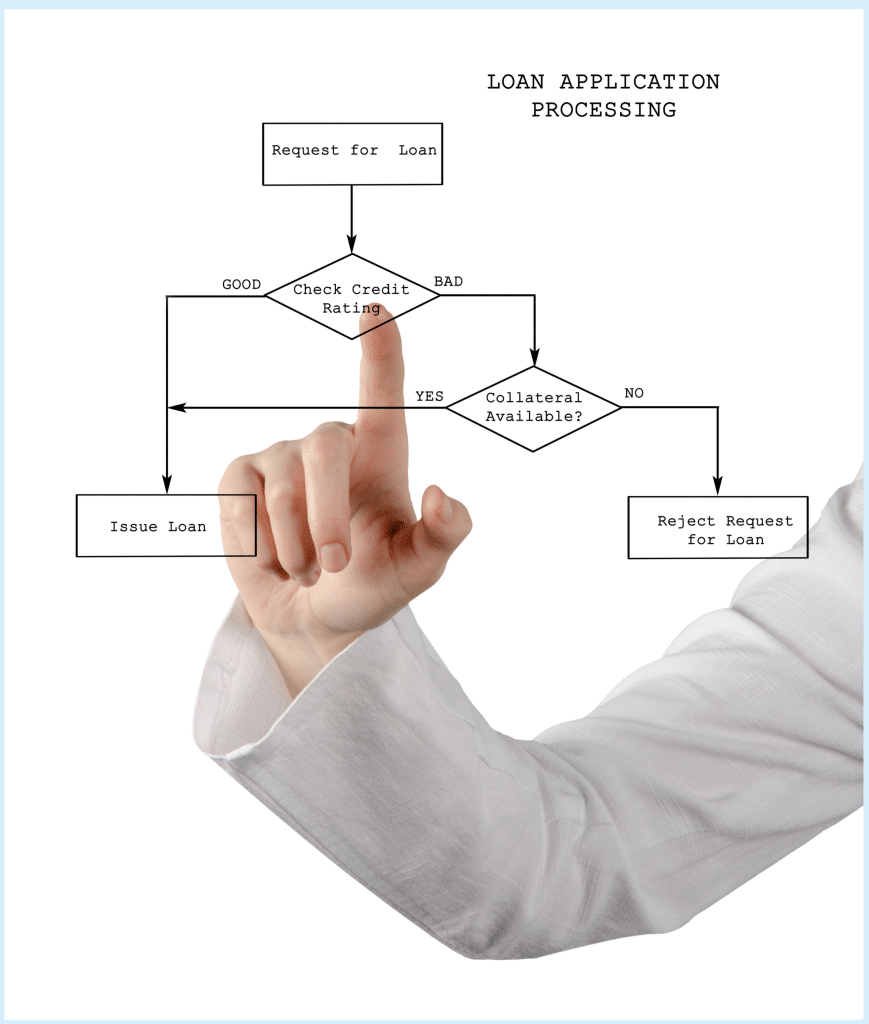

The following are the steps involved in the application for a loan:

- Visit the nearest branch of a bank or credit union.

- Request an auto loan application form from the office.

- Fill out the application with all your correct information.

- Submit the application with all the relevant documents attached to it. For example, salary pay slips, income proof, credit reports, etc.

- The lender will ask for your credit report before processing your application.

When you have a healthy credit history, you will be asked to agree with the criteria set by the lender. Typically, a car loan is a type of secured loan in which the vehicle is used as collateral. If you fail to repay the debt amount in EMIs regularly, the lending agency has the right to seize the vehicle.

Statistics Based on Credit Scores

Let us look at some of the important statistics and possible interest rates you might be charged for variation in credit scores.

- According to Forbes, if you have a credit score below 570 you will be charged an annual percentage rate (APR) of approximately 15%. Whereas, a 750+ credit score will benefit you with a 2-3% APR.

- Most users choose a long-term loan only to avoid the high-interest rate applicable to a short-term loan.

- According to Experian statistics, the average monthly payment for a new vehicle in the third quarter of 2022 was around $700 and for used cars, it was $500.

- According to Experian, auto loan debt in America reached $ 1.43 trillion in the past year.

Frequently Asked Questions

1. How do I qualify for an auto loan?

There is no minimum credit score needed to qualify for a car loan. However, you must have a positive credit history and a good credit score to settle for the best loan terms.

2. Can I get a car loan with a bad credit score?

You can qualify for a car loan with a bad credit score, but with higher interest rates and EMIs. You will be asked to pay a high down payment for your poor credit score. If possible, you can use the co-signer loan option to purchase the loan with the help of a friend or relative who has a good credit score.

3. What is the duration or loan term for a car loan?

The minimum duration of a car loan is five years and it is increased by an increment of 12 months. However, it is not a good idea to take more than 8 years to repay the debt.

4. What is the minimum credit score to buy a car?

To qualify for any loan, the ideal credit score is 700 and above. However, in most cases, lenders approve a credit score of 670 and above to offer the loan.

Closing Thoughts

An auto or vehicle loan helps you buy a car when it is a necessity for your business or for personal needs. In this article, we saw the effect of credit scores on the approval of loan applications and the steps involved in loan processing.

If you have a poor credit score or are trying to figure out a way to repair your credit score, TheCreditPros has been a credit repair services company for more than a decade, producing positive results for customers. Get a free consultation, and repair your credit score with the help of an AI-driven personal credit management system.