Phantom debt is a growing concern that can significantly impact your financial health and peace of mind. Imagine being told you owe money for a debt you don’t recognize or remember. This unsettling scenario is more common than you might think, and understanding what phantom debt is can help you protect yourself. But where does this phantom debt come from, and how can you tell if a debt claim is legitimate or not?

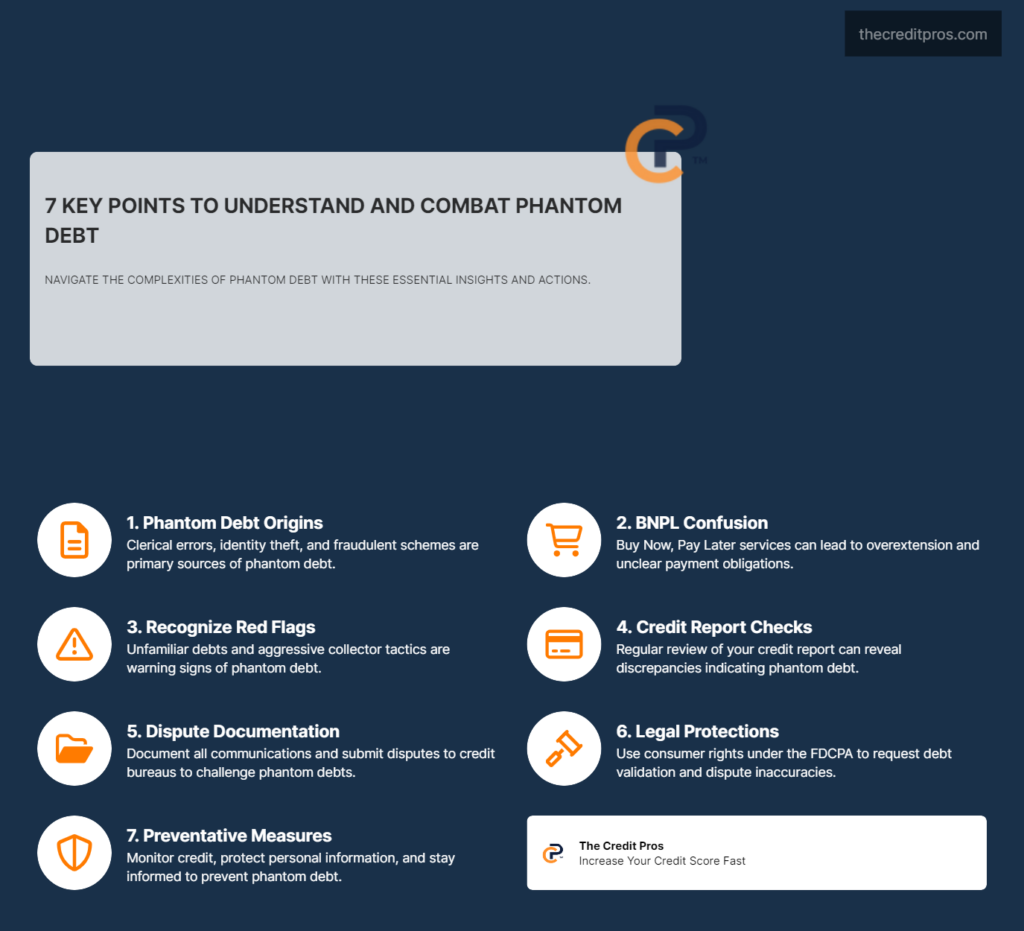

We will explore the origins of phantom debt, including common sources like clerical errors, identity theft, and fraudulent schemes. You’ll learn to recognize the red flags and warning signs that a debt claim might be erroneous or fraudulent. We’ll also provide practical steps to dispute these claims and safeguard your financial well-being. By the end, you’ll be equipped with the knowledge and tools to navigate and combat phantom debt effectively.

1. The Origins of Phantom Debt

Common Sources

Phantom debt can come from various sources, each posing unique challenges for consumers. Clerical errors are a frequent cause, where simple mistakes in data entry or record-keeping lead to inaccurate debt claims. These errors can occur during the transfer of debt information between creditors and collection agencies, resulting in consumers being pursued for debts they don’t owe.

Identity theft is another significant source of phantom debt. When a fraudster uses someone else’s personal information to open accounts or take out loans, the victim may be unaware until they’re contacted by debt collectors. This type of phantom debt can be particularly damaging, as it not only affects credit scores but also requires extensive effort to resolve.

Fraudulent schemes are also a major contributor. Scammers often create fake debt collection agencies to trick individuals into paying debts that don’t exist. These schemes can be sophisticated, using official-looking documents and aggressive tactics to intimidate victims into compliance.

Buy Now, Pay Later (BNPL) and Phantom Debt

The rise of Buy Now, Pay Later (BNPL) services has introduced a new dimension to the phantom debt issue. BNPL services allow consumers to make purchases and pay for them over time, often without interest. However, the ease of access and lack of stringent credit checks can lead to overextension and confusion about outstanding debts.

According to a CNBC report, experts have identified BNPL as a troublesome type of phantom debt. The rapid adoption of BNPL services has led to situations where consumers lose track of their payment schedules, resulting in missed payments and subsequent debt collection efforts. This confusion can be exacerbated by the fact that BNPL debts may not always be reported to credit bureaus, making it difficult for consumers to keep track of their obligations.

Regulatory Gaps

The proliferation of phantom debt is partly due to regulatory gaps in the debt collection industry. While there are laws in place, such as the Fair Debt Collection Practices Act (FDCPA), enforcement can be inconsistent, and many fraudulent activities slip through the cracks. The Federal Trade Commission (FTC) has taken steps to address these issues, including permanently banning certain phantom debt collectors from the industry. However, the lack of comprehensive oversight allows many fraudulent schemes to continue operating.

2. Recognizing Phantom Debt

Red Flags and Warning Signs

Recognizing phantom debt requires vigilance and awareness of certain red flags. One of the primary indicators is receiving a debt collection notice for an unfamiliar debt. If you don’t recognize the creditor or the amount claimed, it’s essential to investigate further.

Other warning signs include aggressive or threatening communication tactics used by debt collectors. Legitimate debt collectors are required to follow specific guidelines, and any deviation from these, such as refusing to provide written validation of the debt, should raise suspicion.

Understanding Your Credit Report

A crucial step in identifying phantom debt is regularly reviewing your credit report. Your credit report contains detailed information about your credit history, including any debts you owe. By carefully examining your report, you can spot any unfamiliar accounts or discrepancies that may indicate phantom debt.

To read your credit report effectively, focus on the following sections:

- Personal Information: Ensure all listed information is accurate.

- Credit Accounts: Verify that all accounts are familiar and correctly reported.

- Inquiries: Check for any unauthorized inquiries that could signal identity theft.

- Public Records: Look for any court judgments or liens that you don’t recognize.

Communication Tactics of Fraudsters

Fraudsters often use specific tactics to convince you that you owe phantom debt. These may include:

- Urgency and Threats: Claiming immediate legal action or arrest if the debt isn’t paid.

- Refusal to Provide Documentation: Avoiding requests to send written validation of the debt.

- Pressure to Pay Quickly: Insisting on immediate payment through unconventional methods like wire transfers or gift cards.

Understanding these tactics can help you identify and avoid falling victim to phantom debt scams.

3. Practical Steps to Dispute Phantom Debt

Documenting Your Case

When disputing phantom debt, thorough documentation is crucial. Keep records of all communications with debt collectors, including dates, times, and the content of conversations. Save any letters or emails received, and take notes during phone calls. This documentation will be invaluable if you need to escalate your dispute or seek legal assistance.

Contacting Credit Bureaus

Disputing phantom debt with credit bureaus involves several steps:

- Obtain Your Credit Report: Request a copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

- Identify Errors: Highlight any debts you believe are erroneous or fraudulent.

- Submit a Dispute: Contact the credit bureaus to file a dispute. Provide all relevant documentation to support your claim.

- Follow Up: Monitor the status of your dispute and ensure that any corrections are made to your credit report.

Legal Protections and Resources

Consumers have several legal protections under the FDCPA and other laws. These protections include the right to request validation of the debt, the right to dispute the debt, and protection from harassment by debt collectors. Familiarize yourself with these rights and utilize available resources, such as the Consumer Financial Protection Bureau (CFPB), to assist in your dispute.

4. Preventative Measures

Monitoring Your Credit

Regular credit monitoring is an effective way to prevent phantom debt. By keeping a close eye on your credit report, you can quickly identify and address any suspicious activity. Many services offer credit monitoring, providing alerts for new accounts, inquiries, and changes to your credit score.

Protecting Personal Information

Safeguarding your personal information is essential in preventing identity theft and phantom debt. Implement the following practices:

- Use Strong Passwords: Create complex passwords and change them regularly.

- Secure Personal Documents: Store sensitive documents in a secure location.

- Be Cautious Online: Avoid sharing personal information on unsecured websites or through email.

Educating Yourself and Others

Staying informed about debt collection practices and sharing this knowledge with others can help prevent phantom debt. Educate yourself on the latest scams and tactics used by fraudsters, and discuss these with friends and family to raise awareness.

By taking these preventative measures, you can protect your financial health and reduce the risk of encountering phantom debt.

Conclusion: Navigating the Maze of Phantom Debt

Phantom debt, originating from clerical errors, identity theft, and fraudulent schemes, poses a significant threat to your financial health. Recognizing the red flags, such as unfamiliar debt claims and aggressive communication tactics, is crucial in identifying these erroneous or fraudulent debts. Regularly reviewing your credit report and understanding the communication tactics of fraudsters can help you stay vigilant.

By documenting your case, disputing errors with credit bureaus, and leveraging legal protections, you can effectively combat phantom debt. Preventative measures, like monitoring your credit and safeguarding personal information, further fortify your defenses. Staying informed and proactive is your best strategy. Phantom debt isn’t just a financial nuisance; it’s a call to action to protect your financial integrity. Are you prepared to defend your financial future against these invisible threats?