Your credit score can make a difference of thousands of dollars in interest payments when financing a home, car, or other major purchase. To build credit for large purchase goals, planning ahead—ideally a full year before your purchase—gives you the time needed to identify problems, implement solutions, and watch your score improve. What specific steps should you take at the 12-month mark versus the critical final 90 days? And how much could a 50-point score improvement actually save you over the life of your loan?

This comprehensive guide breaks down the exact timeline and strategies to build credit for large purchase success. We’ll cover everything from analyzing your current credit position to managing debt strategically, building positive history, and making the final preparations before application day. Whether you’re starting with fair, good, or excellent credit, you’ll discover practical techniques to present the strongest possible financial profile to lenders when it matters most.

Understanding Your Current Credit Position (12 Months Before Purchase)

Starting your credit improvement journey begins with a comprehensive understanding of your current credit status. If you’re looking to build credit for large purchase goals, obtaining your credit reports from all three major bureaus—Equifax, Experian, and TransUnion—provides the foundation for your improvement strategy. Federal law entitles you to one free report annually from each bureau through AnnualCreditReport.com, though many financial institutions now offer free credit monitoring services to their customers.

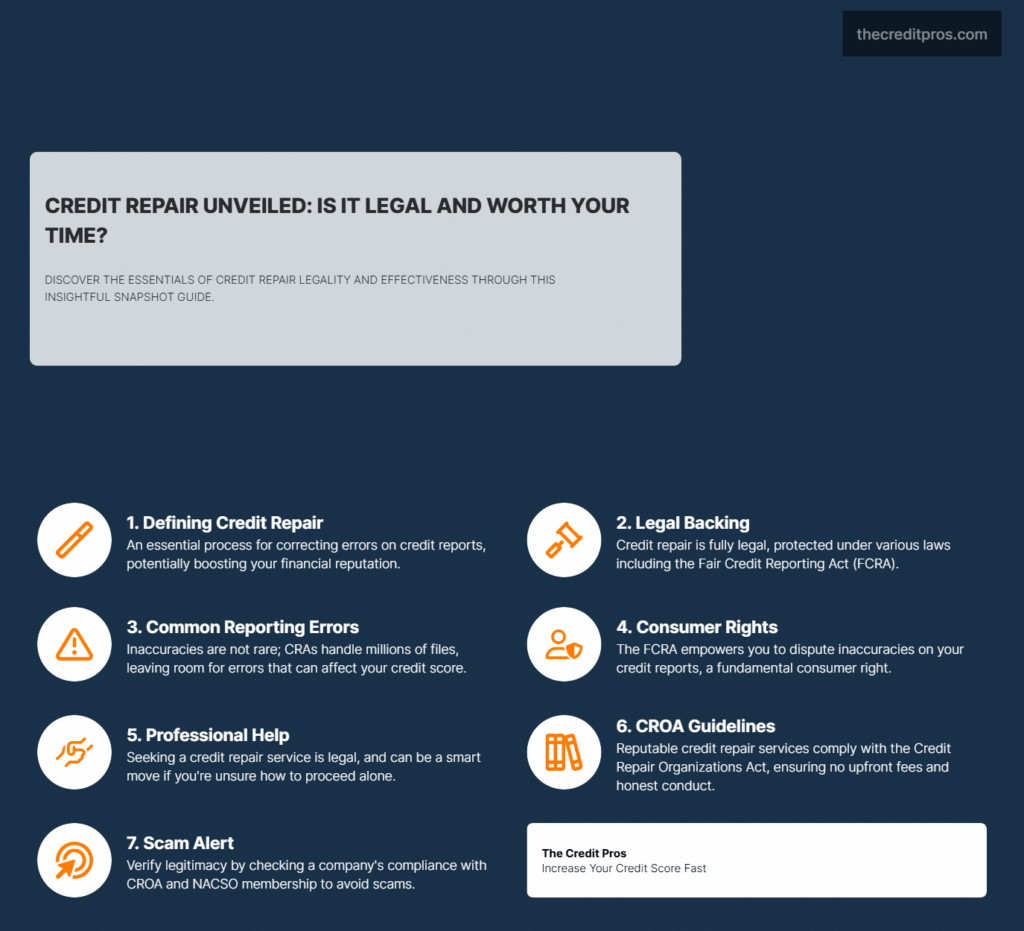

When reviewing your reports, pay meticulous attention to every detail. Look for inaccurate personal information, accounts you don’t recognize, incorrect payment statuses, or outdated negative information that should have aged off your report. Studies show that approximately 25% of credit reports contain errors significant enough to affect scoring, and these errors could be costing you valuable points. Document any discrepancies you find and prepare to dispute them directly with both the credit bureaus and the reporting creditors.

Credit utilization—the percentage of available credit you’re using—significantly impacts your score, accounting for nearly 30% of your FICO calculation. The ideal utilization ratio falls below 30%, though those seeking optimal scores should aim for 10% or less. For example, if you have $10,000 in available credit across all cards, keeping your balances below $3,000 total would maintain acceptable utilization, while balances under $1,000 would position you for higher scores. Pay particular attention to individual card utilization as well, as maxing out even one card while keeping others empty can negatively impact your score.

Assessing your credit history depth is a crucial step when aiming to build credit for large purchase readiness. This involves examining the age of your accounts and the diversity of credit types in your profile. Lenders favor consumers with established credit histories spanning several years and experience managing different credit types. Your credit mix—including revolving accounts (credit cards), installment loans (auto loans, student loans), and potentially mortgages—demonstrates your ability to handle various financial obligations responsibly. If your file lacks diversity, consider whether strategically adding a new account type might benefit your profile, though this should be done early in your 12-month timeline to allow the initial score drop from the new inquiry to recover.

Setting realistic improvement targets is essential when planning to build credit for large purchase goals. If your score falls below 620, you might reasonably aim for a 100+ point improvement over 12 months through aggressive error correction and utilization management. Those with mid-range scores (620–720) might target 50–75 point improvements, while consumers with already-strong scores above 720 should focus on maintaining their excellent standing and perhaps gaining the final 20–30 points to reach the highest score tiers. Document your baseline scores from each bureau and set specific, measurable targets for improvement at 3, 6, and 12-month intervals.

Strategic Debt Management (6-12 Months Before Purchase)

Optimizing your credit utilization is a critical tactic when working to build credit for large purchase goals. A nuanced approach goes beyond simply paying down balances. Credit scoring algorithms assess both overall utilization across all accounts and the utilization on individual cards. For maximum impact, aim to keep all individual cards below 30% utilization while working toward an overall utilization under 10%. This two-tiered strategy delivers better results than concentrating debt on a single card—even if the total utilization remains unchanged.

When working to build credit for large purchase goals, managing existing debt efficiently is essential. Two primary repayment strategies stand out: the avalanche method and the snowball method. The avalanche approach prioritizes extra payments toward your highest-interest debt first, mathematically saving the most money over time. For example, if you have a credit card charging 22% interest and another at 16%, the avalanche method targets the 22% card first. In contrast, the snowball method focuses on paying off debts from smallest to largest, regardless of interest rate, creating psychological momentum. While less efficient financially, the snowball method can be more sustainable for those needing motivation, often resulting in higher success rates.

To build credit for large purchase readiness, revolving credit balances require strategic management. Credit bureaus typically report your statement balance, not your real-time balance, meaning high utilization may show even after recent payments. To optimize your credit score, make early payments—before your statement closing date—to ensure lower balances are reported. Interestingly, maintaining small balances (1–2% of your credit limit) on a few cards can be slightly more beneficial than showing all zero balances, as it reflects ongoing, responsible credit use.

Strategic credit limit increases can dramatically improve your utilization metrics without requiring additional debt reduction. When requesting increases, follow these guidelines for optimal results:

- Request increases on cards you’ve held for at least 6-12 months

- Make the request online when possible to avoid hard inquiries

- Space requests across different issuers and at least 3-6 months apart

- Prepare to justify increases with proof of income or improved financial circumstances

- Target accounts with perfect payment history and regular usage patterns

To build credit for large purchase readiness, avoid the common mistake of closing old credit accounts after paying them off. While it may feel like a step toward financial cleanliness, this action reduces your available credit—raising your utilization rate—and can shorten your credit history length, both of which can harm your score. Instead, keep older accounts open and active with occasional small purchases. If an account has a high annual fee, try downgrading to a no-fee version rather than closing it altogether to preserve your credit-building foundation.

To build credit for large purchase readiness, explore balance transfer options early in your 12-month timeline. Moving high-interest debt to a card with a lower or 0% promotional APR can help you pay down balances faster by focusing payments on the principal. Just keep in mind that most balance transfers carry fees (typically 3–5% of the amount transferred) and result in a new credit inquiry. To minimize any negative score impact, complete these transfers at least 6–9 months before your intended purchase.

Building Positive Credit History (3-6 Months Before Purchase)

To build credit for large purchase success, becoming an authorized user on someone else’s long-standing credit account is one of the quickest strategies. If you’re added to a credit card with a 5+ year history of perfect payments and low utilization, that positive record may be reflected on your own credit report. The best results come from accounts with no late payments and minimal balance, ideally owned by a trusted family member. Importantly, you don’t need access to the card itself—just being linked to the account can improve your credit profile.

If you’re looking to build credit for large purchase readiness, secured credit cards and credit-builder loans provide two of the most effective tools available—especially for those with limited credit history or previous challenges. A secured card requires a refundable deposit that becomes your credit limit, allowing safe and responsible credit use. Credit-builder loans, on the other hand, hold the loan amount in escrow while you make payments, releasing the funds only once repayment is complete. Both options report to credit bureaus, helping establish positive history essential for major financing. Always choose options with full bureau reporting, low fees, and clear graduation paths.

If you’re trying to build credit for large purchase approval, negotiating the removal of negative marks through goodwill adjustments can deliver significant score gains. This strategy is particularly effective when you have an isolated late payment on an otherwise strong credit history. For instance, a single 30-day late on an account with years of timely payments may be removed if you submit a goodwill letter. Explain the circumstances, accept responsibility, emphasize your positive payment record, and politely request the mark’s removal. Creditors are often more receptive if the late payment was due to unforeseen events like illness or a natural disaster.

During this critical 3-6 month period, maintaining perfect payment history becomes non-negotiable. Set up automatic payments for at least the minimum due on all accounts to prevent any new derogatory marks. Better yet, establish automatic payments for statement balances to simultaneously improve your utilization ratios. Calendar reminders, account alerts, and dedicated financial management apps can provide additional safeguards against missed payments. Remember that even a single 30-day late payment can drop your score by 50-100 points and remain on your report for seven years—a devastating setback when preparing for a major purchase.

To build credit for large purchase goals, your strategy should align with your current credit standing. Individuals with poor credit (below 580) need to focus on bringing all accounts current, disputing inaccuracies, and opening secured products to establish positive credit history. Those with fair credit (580–670) should manage utilization carefully and maintain on-time payments while requesting removal of old negatives. Borrowers in the good credit range (670–740) can optimize by fine-tuning utilization and ensuring a healthy mix of credit types. Those with excellent credit (740+) should preserve their strong standing by avoiding unnecessary applications and maintaining consistent, positive credit behavior.

The Final Push (1-3 Months Before Purchase)

To effectively build credit for large purchase goals, obtaining your actual FICO scores used by lenders becomes crucial in the final months before your purchase. While free credit score services offer helpful monitoring tools, they often use educational or proprietary models that differ from the FICO scores lenders rely on. For mortgage readiness, prioritize FICO Score 2, 4, and 5 from each bureau—still the standard in mortgage underwriting. For auto loans, focus on FICO Auto Score 8 or 9, which emphasize past auto loan performance. These industry-specific scores are available through myFICO.com or select premium credit monitoring platforms.

To build credit for large purchase readiness, it’s essential to freeze major credit activities during the final countdown. This means avoiding new credit applications, loans, or retail financing offers that can trigger hard inquiries and reduce your score. Even accepting a store credit card for a discount can jeopardize your progress. Maintain consistent credit usage patterns—avoid maxing out cards or making large, irregular purchases that raise your utilization ratio. If you must spend, pay it off before the statement closing date to prevent a spike in reported utilization and protect your score.

To build credit for large purchase success, it’s important to understand how pre-approvals affect your score. Mortgage pre-approvals usually trigger a hard inquiry, which can temporarily lower your credit score by 5–10 points. Fortunately, credit scoring models treat multiple mortgage inquiries within a 14–45 day window as a single inquiry, minimizing the overall impact. Auto loan shopping follows similar rules. To limit score damage, group your loan applications within a 14-day window. Alternatively, consider pre-qualifications, which involve soft inquiries and offer preliminary rate estimates without affecting your credit.

To build credit for large purchase readiness, timing your credit applications strategically is key to minimizing the impact of hard inquiries. If you anticipate needing other credit—like for a new cell phone plan or utility setup at a new address—try to apply well before your mortgage application (ideally six months in advance), or wait until after the loan has closed. Each hard inquiry can affect your score for 12 months and remains on your report for 24 months. While one inquiry has limited impact, several in a short span may lower your score and raise concerns with lenders about financial stability.

Creating a financial buffer becomes increasingly important as you approach your purchase date. Beyond the down payment, prepare for closing costs, moving expenses, and immediate post-purchase needs. Lenders scrutinize recent large deposits, so any funds you’ll use should ideally be seasoned in your accounts for at least 60-90 days before application. Avoid moving money between accounts unnecessarily during this period, as each transfer may require explanation and documentation. Maintain employment stability as well—changing jobs during the application process can delay or derail approval, even if the new position offers higher compensation.

Beyond the Score: Other Financial Factors That Matter

Build credit for large purchase efforts often go hand-in-hand with managing your debt-to-income ratio, especially when preparing for major financing like a home or car loan. This ratio compares your monthly debt obligations to your gross monthly income, with most conventional mortgages requiring a DTI below 43%. While you build credit for large purchase readiness, don’t overlook reducing debt payments through consolidation or increasing documentable income. Even small moves—like paying off a car loan with only a few payments left—can strengthen both your DTI and credit profile, improving your overall loan eligibility.

Employment stability significantly influences lending decisions beyond its impact on DTI ratios. Lenders typically prefer to see at least two years in the same field, with consistent or increasing income. Job changes within the same industry with comparable or improved compensation generally create fewer concerns than career field changes or moves from salaried to commission-based compensation. If your employment history includes recent changes, prepare thorough documentation explaining the professional progression and resulting financial benefits. Self-employed borrowers face additional scrutiny, typically needing to demonstrate at least two years of stable or increasing income through tax returns and business financial statements.

Savings reserves influence loan approval decisions by demonstrating financial resilience beyond the immediate transaction needs. Many lenders require reserves (assets remaining after closing) equivalent to 2-6 months of housing payments, particularly for jumbo loans or investment properties. These reserves provide a safety net for continued payment during financial disruptions like temporary job loss or unexpected expenses. Acceptable reserves typically include funds in checking, savings, retirement accounts (discounted by potential early withdrawal penalties), and sometimes cash value life insurance. Cryptocurrency holdings, while increasingly common, still face inconsistent treatment among lenders, with many either excluding them entirely or heavily discounting their value due to volatility concerns.

Documentation preparation streamlines the approval process and prevents last-minute scrambling. Begin organizing essential documents at least three months before application, including:

- Tax returns (personal and business) for the past two years with all schedules

- W-2s, 1099s, and other income verification for two years

- Pay stubs covering the most recent 30 days

- Bank statements for all accounts for the past 2-3 months

- Investment account statements showing additional assets

- Documentation of current debt obligations, especially those not appearing on credit reports

- Explanation letters for any credit issues, employment gaps, or unusual financial circumstances

Balancing credit improvement with down payment savings requires thoughtful financial prioritization. While a larger down payment reduces loan-to-value ratios and might eliminate the need for mortgage insurance, excellent credit often delivers greater long-term savings through reduced interest rates. For instance, a 0.5% rate reduction on a $300,000 mortgage saves approximately $30,000 over a 30-year term—potentially outweighing the benefits of a slightly larger down payment. Consider your specific financial situation, local market conditions, and loan program requirements when allocating resources between credit improvement efforts and down payment accumulation.

Conclusion: Build Credit for Large Purchase and Shape Your Financial Future

Transforming your credit profile for a major purchase isn’t a last-minute endeavor but a strategic 12-month journey that can yield substantial financial rewards. By methodically addressing credit report errors, optimizing utilization ratios, building positive payment history, and carefully timing applications, you’re positioning yourself for the strongest possible terms when financing matters most. A 50-point score improvement could translate to interest savings of $15,000-$30,000 over the life of a mortgage—making your preparation efforts one of the highest-return financial investments available to you.

Your credit score isn’t just a number; it’s the financial reputation you’ve built over years of financial decisions. The difference between approaching your next major purchase with a carefully cultivated credit profile versus an unexamined one often determines whether you’ll spend the next decades building wealth or simply servicing unnecessarily expensive debt. The choice between these two futures doesn’t depend on your starting point—it depends entirely on whether you’re willing to implement the strategic roadmap outlined above. What financial legacy will you choose to create?