The Ultimate Guide on How To Increase Your Credit Score

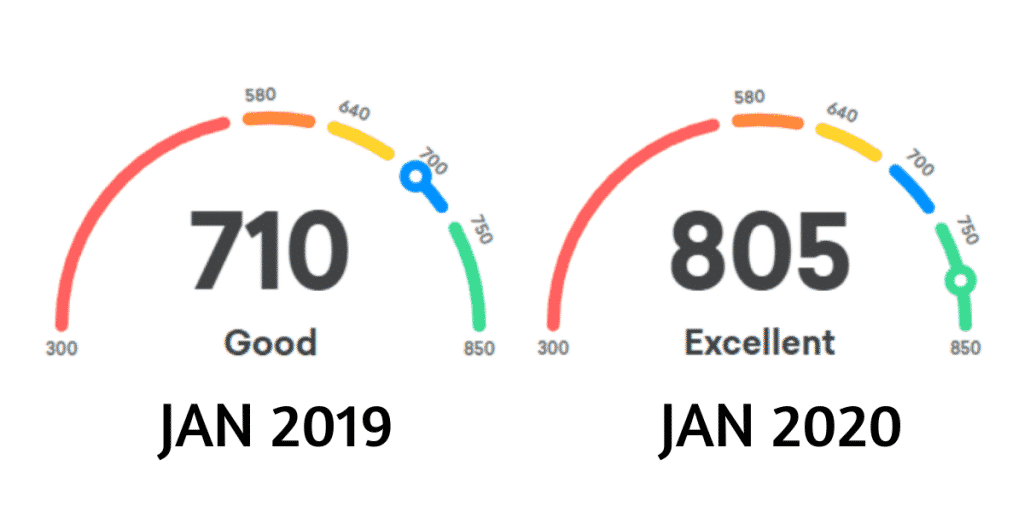

It’s almost a brand new decade, and there’s plenty of reason to celebrate. Maybe you have some New Year’s resolutions. One of the most common New Year’s resolutions is to be better with money. Check out this guide on how to increase your credit score in 2022.

Financial goals are some of the most widespread goals that people have for the new year. Not uncommon is the goal to increase one’s credit score! If you’re not convinced that your credit score could be an issue, keep reading.

Why You Should Improve Your Credit Score

A higher credit score makes it easier for you to get loans, and at lower interest rates. For people with better credit, borrowing money is cheaper, making it more difficult to land themselves into debt spirals due to high interest rates!

A higher credit score can prevent you from being disqualified from jobs on the basis of credit. Many jobs, especially those that require the handling of money, require a credit check to gauge an employee’s riskiness. If you want to advance in your career, and you’re afraid of jobs doing credit checks on you, improving your credit score will make this less of a worry!

A higher credit score could help you land a better place to live: a better apartment, or even help you qualify for a mortgage! Your dream home awaits you, but you can’t get it if your credit is too low for a mortgage you can afford. Keep reading our guide on how to increase your credit score in 2020.

We Wrote An Article On The Quick & Dirty Guide To Your Credit Score

If your resolution is to increase your credit score, check out these simple tips!

Tip #1 – Get Your Annual Free Credit Report & Dispute Any Errors

If you don’t know your credit history, you can’t possibly know what your credit score issues are!

To get your free credit report, go to https://annualcreditreport.com and apply. This is a US government website, and provides one free credit report per year, per credit bureau.

Once you get it, review it closely and look for errors. Common errors include:

- Common errors (mistyped dates, duplicates of loans on the credit history, and other odd looking things)

- Loans that are in your name, but don’t belong to you

- Fraudulent items

If you find any errors, you then have to call the credit bureaus and dispute the error. The bureaus you should call are the bureaus that gave you the report with the error.

Even if you don’t think there are any errors, there might be items on there that shouldn’t be there. We’re here to help you.

If you sign up for The Credit Pros, we will review your credit report for you. Our job is to find things on your credit report that aren’t legally allowed to be there; whether they’re old, or they’re settled, or they’re simply fraudulent.

After we find items, we go through the dispute process with the credit bureaus so you don’t have to.

Tip #2 – Snowball Your Credit Card Debt

One of the biggest problems with credit scores is the effect of credit card debt.

If you have lots of credit card debt, you’re hurting your credit score: period. Even if you make all your payments on time, excessive credit card debt is preventing you from having a good score!

So what does it mean to ‘snowball’ your debt? A term often associated with financial guru Dave Ramsey, snowballing is where you pay off the smallest balances, then pay down the larger balances later.

While you’re paying off the small balances, you just pay as much as you can on the larger ones: preferably enough so that you’re paying more than the interest that accrues. At the very least, pay the minimum!

The idea is that you want to take control of the debt that’s easiest to control, freeing up your money to make larger payments on the biggest debts later. Keep reading our guide on how to increase your credit score in 2022.

Tip #3 – Deal with Collection Items & Items in Default

Collections items and items in default can ruin your credit score. If your credit score is much lower than you would like it to be, chances are you have one of these items.

Items in default need to be addressed immediately. If it’s in default, it could move to collections, and that’s when things could get bad.

Once an item ends up in collections, you can no longer simply pay off that debt. That debt has been sold to a collections agency which then will try anything they can to get that money off of you. You’ll need to settle with the collections agency, and even then, the item will probably not be removed. You will need to request that the item be removed, which they will likely say they can’t do unless you pay a fee. If you choose this route, you will need to follow up with the credit bureau on the matter.

For items in default, you’ll want to settle for an amount you can pay, or possibly set up a payment plan. Most lenders would rather have a little bit of something, than nothing. However there are situations where lenders refuse to settle a debt unless it’s paid in full. In that case, you’ll want to hire a company to help settle that debt for you.

The best option you have with collections items, though, is working with professionals who understand how items get put on and removed from credit reports. The Credit Pros can help you navigate these issues and solve them, delete collection account, removing headache and ultimately improving your credit score.

Want to learn more about items in collections? Check out our article on collections items here!

Tip #4 – Set Up Payment Plans for Your Largest Loans

If you have a lot of debt, and the current payments are far too much for you, you’re going to want to negotiate a payment plan.

Your largest loans impact your credit score mainly due to how much they affect your amounts owed. The more you owe, the more it affects your credit! If you’re missing payments because they’re too expensive, it’s even worse for your credit score.

To negotiate a payment plan, you’ll need to call the lender directly and have them direct you to the department that handles the collection of debts, usually accounts receivables. Explain to them your situation, make sure they understand that you can’t afford the debt and you don’t want them to have to send it to collections. They’d rather restructure the debt and charge payments you can afford than send it to collections because many times, collections items simply never get paid back.

Have A Happy 2022 Everyone!