Table of Contents

Bad credit can leave you feeling stressed, embarrassed, and overwhelmed – three emotions which are not much fun to experience. In addition to making you feel horrible, bad credit can also be extremely expensive as well, causing you to be denied or to pay much more for even your basic needs of housing and transportation. The good news is that just as you can change your body with diet and exercise, you can take steps to improve bad credit as well.

Do you need credit repair? Find out below.

If you are tired of struggling to improve bad credit then it is time to decide if you are ready to ask for help. You definitely have the right to try to repair your credit problems completely on your own. However, you also have the right to seek out credit repair professionals with experience who may be able to increase your chances of success. If you are on the fence, not sure whether to try fixing your credit yourself or whether to hire a pro, check out the following 5 signs that professional credit repair might be in your best interest.

You Were Turned Down for a Loan

Getting denied for a loan may be a clear indication that you should speak with a credit repair professional about the potential problems on your credit reports, sooner rather than later. Although credit problems are not the only factors which can cause you to be turned down for financing, they are generally the most common issues leading to a denial of your loan application. If you are turned down for a loan it can be a good idea to let a credit repair professional help you to figure out why (from a credit standpoint) that you are being denied and to help you build a plan to being correcting those problems so that you do not continue to be denied for financing in the future.

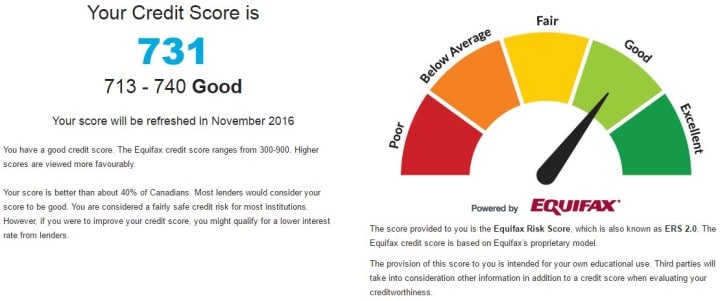

You Are Afraid to Check Your Credit Reports and Scores

When it comes to your credit, ignorance certainly is not bliss. Yet many people are afraid to check their credit reports and scores due to the fear of facing up to the problems they may find there. Of course owning up to your credit problems is exactly where your journey toward better credit begins. You can check your credit reports on your own for free each year (www.annualcreditreport.com) or you can allow a reputable credit repair professional to help you improve bad credit. Either way, if you are currently afraid of your own credit it is probably time to ask for help.

You Are Receiving Calls or Letters from Debt Collectors

Another tell-tale sign that you may want to pick up the phone and reach out to a credit repair professional (or, a credit pro) is if you are receiving calls or letters from debt collectors. Ignoring these calls and letters because you feel overwhelmed is a mistake; however, trying to deal with debt collectors by yourself can be potentially dangerous as well. As with any credit related issues, you always have the right to work on your own, but generally hiring a credit repair professional to work on your behalf and to help you avoid common mistakes just makes better sense.

You Cannot Qualify for a Credit Card

Credit cards can be a powerful tool, when used properly, to help you build better credit for the future. Additionally, properly managed credit cards can make your everyday life much more convenient (try checking out a rental car without one if you doubt this fact). However, if your credit reports are littered with problems then qualifying for a traditional credit card may be next to impossible. If your credit card application has been denied then it consulting with a credit repair professional is probably a great place to start.

You Are Ready for a Change

If you are tired of being afraid to apply for loans and credit cards, sick of being forced to rent instead of purchasing your own home, or fed up with being forced to pay higher interest rates and fees then it is time to take control of your credit situation. You do not have to be a victim to your circumstances. You can make a plan to change and improve bad credit. No one is saying that the change will take place over night. No one is saying that the change will be easy. However, making a change is certainly worth it and hiring a pro to work on your behalf can certainly make achieving that change much easier.

A Final Note: Be Aware

You should not trust just anyone to help you with your credit repair efforts. Do your homework and make sure that you are working with an ethical, honest company and not falling for a scam. There are many self proclaimed “credit repair” con artists who would, at best, steal your money or, at worst, steal your money and trick you into breaking the law. A good test to be sure you are working with a reputable credit repair professional is to see if the company is a member of NACSO (National Association of Credit Services Organizations). NACSO performs independent testing on its members before a company can be granted the associations’ “Standards of Excellence” seal of approval.

Frequently Asked Questions

How can you hurt your credit scores?

When you do not pay the bills on time, filing for bankruptcy, apply for too many credit cards, and carry high balances on your credit cards. These factors contribute to low down your credit score.

What is the use of credit repairs?

Credit repair services help people to improve their credit. It is a third-party organization that attempts to get information removed from your credit reports in exchange for payment. They are for-profit companies to help people.

How long will closed accounts last on your credit report?

An account with a good credit history of on-time payments and when you close it will stay on your credit report for 10 years. Accounts with adverse information will stay on your credit report for up to 7 years.