Facing a mortgage with bad credit isn’t easy, but it’s absolutely possible with the right preparation. Many Americans with FICO scores below 620 successfully secure a mortgage with bad credit every year, though they navigate a different path than those with excellent credit. The challenges are real—higher interest rates, larger down payment requirements, and fewer lender options—but understanding these hurdles upfront helps you develop a strategic approach to securing a mortgage with bad credit rather than facing repeated rejections. Preparing for a mortgage with bad credit requires diligence and knowledge. A mortgage with bad credit can still be achieved with the right steps.

What specific government programs might work for your situation? How much could saving for a larger down payment improve your approval odds? These questions represent just the beginning of your mortgage journey with bad credit. This guide will walk you through practical steps to strengthen your application for a mortgage with bad credit, explore specialized lending options designed for credit-challenged borrowers, and help you balance the urgency of homeownership with smart financial planning that protects your long-term interests while securing a mortgage with bad credit.

By addressing the factors that lead to a mortgage with bad credit, you can improve your chances of approval significantly. Understanding mortgage with bad credit options will empower you to make informed decisions.

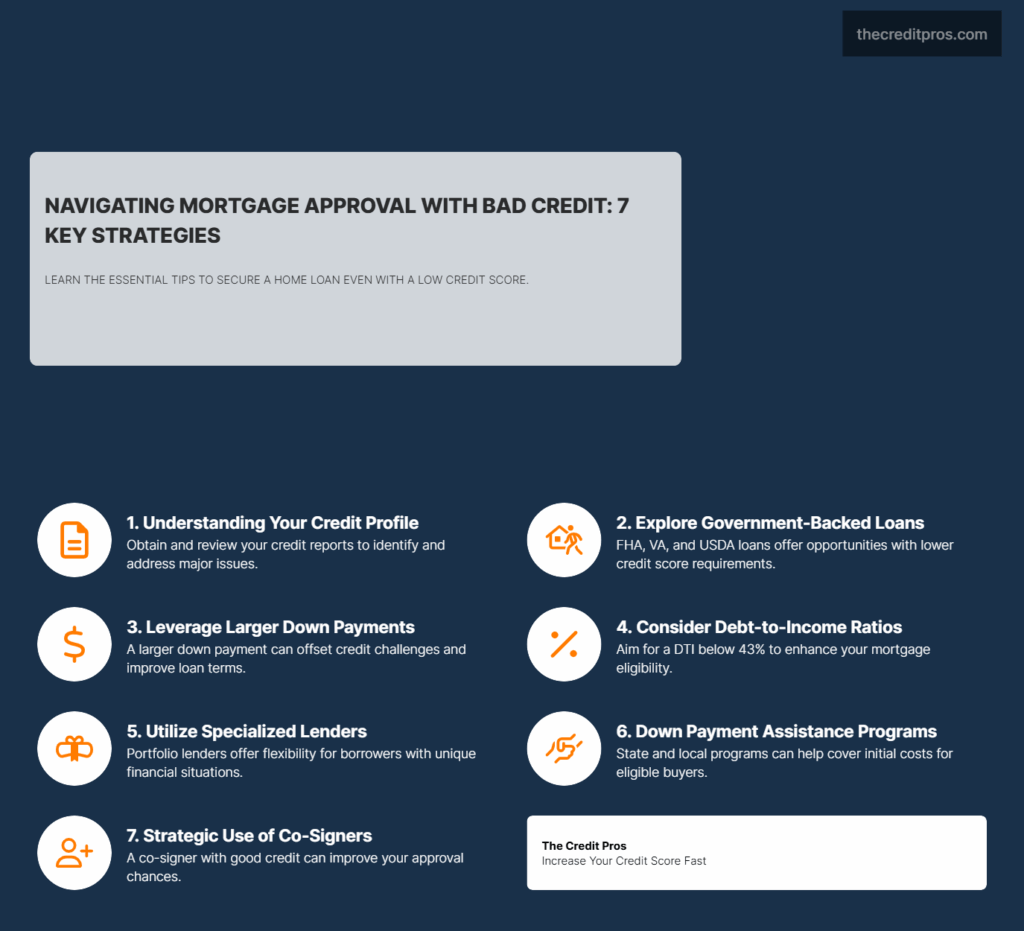

Assessing Your Current Credit Situation

How to Secure a Mortgage with Bad Credit

Know Where You Stand: Obtaining and Understanding Your Credit Reports

When securing a mortgage with bad credit, be proactive in monitoring your credit score and correcting inaccuracies that may hinder your application.

Additionally, lenders may offer specialized programs for a mortgage with bad credit, making it important to shop around and compare options available to you.

Reducing your credit utilization can improve not just your score but also your chances of securing a favorable mortgage with bad credit.

Before approaching any mortgage lender, you need a comprehensive understanding of your current credit profile. Start by requesting your credit reports from all three major bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com, which provides one free report from each bureau annually. These reports won’t include your actual FICO scores, which you’ll need to purchase separately or access through credit monitoring services.

Being well-informed about a mortgage with bad credit will help you avoid common pitfalls and keep your financial goals on track.

When you understand what lenders consider in a mortgage with bad credit, you can better present your case and increase your chances of approval.

Remember, a mortgage with bad credit doesn’t mean you’re out of options; there are tailored solutions to help you secure home financing.

When reviewing your reports, pay particular attention to derogatory marks like late payments, collections, charge-offs, and public records such as bankruptcies or foreclosures. These negative items significantly impact mortgage eligibility and terms. Note that mortgage lenders typically use specialized FICO score models that weigh certain factors differently than general-purpose scores. For instance, previous mortgage delinquencies carry more weight than retail credit card late payments when applying for home loans.

Don’t just focus on the numerical score—understand the specific reasons your credit score falls below the 620 threshold typically considered the minimum for conventional loans. This detailed analysis helps you address the most impactful issues first. For example, high credit utilization (using more than 30% of your available credit) can be addressed more quickly than waiting for bankruptcies to age off your report, which takes 7-10 years.

What Lenders Consider “Bad Credit” in the Mortgage World

Also, be prepared to explain any negative credit events when applying for a mortgage with bad credit. Transparency can often work in your favor.

Ultimately, understanding the full picture surrounding your mortgage with bad credit can make a significant difference in your quest for homeownership.

Prioritize improving your financial situation before seeking a mortgage with bad credit, as this will benefit you in the long run.

In mortgage lending, credit scores below 620 generally fall into the “subprime” or “bad credit” category, though this threshold can vary slightly between lenders. This classification isn’t arbitrary—it’s based on historical data showing significantly higher default rates among borrowers with scores in this range. Understanding where you fall within the credit spectrum helps set realistic expectations about available options.

The severity of credit challenges creates further distinctions within the bad credit category:

- 580-619: Considered “fair” but still below prime thresholds; may qualify for FHA loans with 3.5% down payment

- 500-579: “Poor” credit requiring larger down payments (10% for FHA) and facing more restrictions

- Below 500: “Very poor” credit with extremely limited conventional mortgage options, often requiring alternative financing approaches

Beyond your score itself, lenders examine your credit history’s timeline. Recent negative events (within the past 12-24 months) raise more red flags than older issues. For instance, a bankruptcy from five years ago with perfect payment history since then presents less risk than a score of 600 with multiple late payments in the past year. This timeline perspective explains why some borrowers with identical scores receive different lending decisions.

Beyond Scores: Other Crucial Financial Factors Affecting Eligibility

Working with a knowledgeable mortgage broker can also help you navigate the ins and outs of obtaining a mortgage with bad credit.

Your debt-to-income (DTI) ratio often proves just as important as your credit score when applying with less-than-perfect credit. This ratio compares your monthly debt obligations to your gross monthly income, with most conventional lenders capping this at 43%, though some loan programs allow up to 50% for otherwise qualified borrowers. With poor credit, lenders typically enforce stricter DTI requirements as a compensating factor.

Calculate both your front-end ratio (housing costs divided by monthly income) and back-end ratio (all monthly debts including housing divided by income). If your DTI exceeds 43%, focus on paying down existing debts before applying for a mortgage. This strategy serves double duty—it improves your DTI while potentially boosting your credit score through reduced utilization rates.

Employment stability also weighs heavily in lending decisions for credit-challenged applicants. Lenders typically want to see at least two years of consistent employment in the same field, though not necessarily with the same employer. Self-employed applicants face additional scrutiny, requiring at least two years of tax returns showing stable or increasing income. This stability requirement becomes even more stringent when your credit history already raises concerns about repayment reliability.

The Strategic Decision: Apply Now or Improve First?

Determining whether to apply immediately or implement a credit improvement strategy requires honest assessment of your homebuying timeline and financial situation. If your score hovers just below 620 with minor issues like high utilization, a focused three-to-six-month improvement plan might yield significant benefits in terms and rates. However, if major derogatory items like recent bankruptcies dominate your report, the improvement timeline extends to years rather than months.

Consider your housing needs alongside market conditions. In rapidly appreciating markets, waiting to improve your credit might mean higher purchase prices that offset the benefit of better interest rates. Conversely, in stable markets, a 12-month improvement strategy could save tens of thousands in interest over the loan term. This calculation becomes especially important when interest rate differences between prime and subprime mortgages exceed 2 percentage points.

Remember that each mortgage application generates a hard inquiry on your credit report, potentially lowering your score by 5-10 points temporarily. Multiple applications within a short timeframe (14-45 days depending on the scoring model) typically count as a single inquiry for scoring purposes, but repeated applications over several months can further damage already compromised scores. If immediate homeownership isn’t essential, consider working with a mortgage professional to develop a personalized credit improvement plan with clear benchmarks before formally applying.

Exploring Government-Backed Loan Options

FHA Loans: The Primary Pathway for Credit-Challenged Homebuyers

The Federal Housing Administration (FHA) loan program represents the most accessible path to homeownership for borrowers with credit challenges. Unlike conventional loans requiring minimum scores of 620 or higher, FHA loans accept scores as low as 500 with appropriate compensating factors. The program’s tiered approach to credit qualification creates opportunities even for those with significant credit issues—borrowers with scores between 580-619 can purchase with just 3.5% down, while those with scores between 500-579 need 10% down payment.

FHA’s more lenient approach extends beyond just credit scores. The program allows for higher debt-to-income ratios (up to 43% automatically and potentially higher with strong compensating factors) and considers borrowers with previous bankruptcies after shorter waiting periods than conventional loans. Chapter 7 bankruptcies require only a two-year waiting period for FHA eligibility compared to four years for conventional loans, while Chapter 13 bankruptcies may qualify after just 12 months of on-time payments under the court-approved plan.

When considering a mortgage with bad credit, it’s essential to understand the various types of loans available and how they cater to those facing credit difficulties. Explore how a mortgage with bad credit can be your entry point to homeownership.

The trade-off for this accessibility comes in the form of mortgage insurance. FHA loans require both an upfront mortgage insurance premium (UFMIP) of 1.75% of the loan amount (typically financed into the loan) and annual mortgage insurance premiums (MIP) ranging from 0.45% to 1.05% depending on loan term, amount, and down payment. Unlike conventional loan private mortgage insurance (PMI), FHA mortgage insurance remains for the life of the loan in most cases, regardless of equity position, unless you refinance into a different loan type.

Down Payment Assistance Programs: Making Government Loans More Accessible

Numerous down payment assistance (DPA) programs work in conjunction with government-backed loans to reduce the initial financial burden for credit-challenged borrowers. These programs operate primarily at state and local levels through housing finance agencies, offering assistance in various forms including grants, forgivable loans, and deferred payment loans. Most importantly, many of these programs specifically accommodate borrowers using FHA, VA, or USDA loans with credit scores below conventional thresholds.

Consider seeking out lenders who specialize in a mortgage with bad credit, as they may offer more flexible terms and conditions.

Don’t hesitate to inquire about the specific requirements for a mortgage with bad credit that can help you prepare better.

As you strive for a mortgage with bad credit, make sure to gather all necessary documentation to present to lenders.

The assistance amounts typically range from 3-5% of the purchase price, often enough to cover the minimum down payment requirement for an FHA loan. Eligibility usually depends on income limits relative to the area median income (AMI), first-time homebuyer status (defined as not having owned a home in the past three years), and completion of homebuyer education courses. These programs become particularly valuable for borrowers with scores between 580-620 who qualify for FHA’s 3.5% down payment requirement but lack savings.

When investigating down payment assistance, examine the long-term implications alongside immediate benefits. Some programs offer true grants requiring no repayment, while others structure assistance as silent second mortgages with deferred payments, forgiveness over time, or repayment upon sale or refinance. The latter may affect your future financial flexibility, though the trade-off often proves worthwhile for accessing homeownership sooner rather than later, especially in appreciating markets where building equity quickly outweighs the constraints of assistance program terms.

VA and USDA Loans: Specialized Options for Eligible Borrowers

Veterans, active-duty service members, and eligible surviving spouses should prioritize VA loans when facing credit challenges. While the Department of Veterans Affairs doesn’t set a minimum credit score requirement, most VA lenders impose their own minimums, typically around 580-620—still lower than conventional loan requirements. The program’s most significant advantage is the ability to purchase with zero down payment while avoiding mortgage insurance, creating substantial monthly payment savings compared to other loan types.

VA loans offer remarkable flexibility with credit issues, focusing more on the overall pattern of financial responsibility than isolated negative events. For instance, VA guidelines allow for consideration just two years after bankruptcy, foreclosure, or short sale—significantly shorter than conventional loan waiting periods. The program also permits higher debt-to-income ratios than conventional loans, sometimes exceeding 50% for otherwise qualified borrowers with residual income meeting VA’s regional requirements.

For rural and some suburban homebuyers, USDA Rural Development loans present another zero-down option worth exploring despite credit challenges. While USDA officially recommends a minimum score of 640 for streamlined processing, scores down to 580 may receive consideration with strong compensating factors. These loans require both an upfront guarantee fee (1% of the loan amount) and annual fee (0.35%), but these costs typically remain lower than FHA mortgage insurance. The program’s primary limitation is geographic—properties must be located in USDA-designated rural areas—and income restrictions capping eligibility at 115% of the area median income.

Understanding How Government Backing Creates Opportunities

Government backing fundamentally changes the risk calculation for lenders, enabling them to approve loans they would otherwise decline. When the FHA insures a mortgage, it promises to reimburse the lender for a substantial portion of losses if the borrower defaults. This government guarantee effectively transfers much of the risk away from the lender, creating willingness to work with borrowers whose credit profiles suggest higher default probability.

This risk transfer explains why government-backed loans consistently offer more favorable terms than private subprime lending alternatives. Without government insurance, lenders must self-insure against potential losses by charging significantly higher interest rates, requiring larger down payments, or imposing stricter qualification standards. The difference becomes particularly apparent for borrowers with scores below 600, where non-government-backed options might charge 2-4% higher interest rates if available at all.

The government backing also creates standardization across lenders. While individual lenders may impose their own overlays (additional requirements beyond the minimum government standards), the core qualification criteria remain consistent. This standardization allows borrowers to shop effectively among multiple FHA-approved lenders rather than facing wildly different terms and conditions with each application. When working with scores below 620, this consistency proves invaluable for finding the most favorable terms available within your credit profile.

The Long-Term Cost Impact of Mortgage Insurance Requirements

While government-backed loans create homeownership opportunities for credit-challenged borrowers, their insurance requirements significantly impact the total cost of homeownership over time. For FHA loans, the combination of 1.75% upfront premium and ongoing annual premiums adds substantial costs throughout the loan term. On a $250,000 loan with the minimum 3.5% down payment, the upfront premium adds $4,375 to the loan amount, while annual premiums of 0.85% add approximately $177 to the monthly payment.

These insurance costs create an important strategic consideration for borrowers with credit scores near conventional thresholds (620-640). If your score falls just below conventional loan minimums but improvement seems feasible within 6-12 months, the long-term savings from avoiding FHA mortgage insurance might justify delaying your purchase. Conventional loans with private mortgage insurance offer the advantage of automatic cancellation once you reach 22% equity (and possible cancellation by request at 20%), while FHA mortgage insurance remains for the life of the loan on most new FHA mortgages.

For those with scores well below conventional minimums, government-backed loans often represent the only viable path to homeownership in the near term. In these cases, view the additional insurance costs as a temporary necessity while you establish mortgage payment history and improve your credit profile. Many borrowers successfully use FHA loans as stepping stones, refinancing into conventional loans without mortgage insurance once their credit and equity position improve sufficiently, typically after 2-3 years of on-time payments and credit improvement.

Specialized Lenders and Programs for Bad Credit Borrowers

Portfolio Lenders vs. Traditional Mortgage Companies: Key Differences

Portfolio lenders—typically smaller banks and credit unions that keep loans on their own books rather than selling them to the secondary market—offer distinct advantages for credit-challenged borrowers. Unlike traditional mortgage companies bound by strict conforming loan guidelines, portfolio lenders establish their own underwriting criteria, allowing for greater flexibility when evaluating applications with credit issues. This autonomy enables them to consider the full context of your financial situation rather than relying primarily on automated approval systems.

The personalized approach of portfolio lending becomes particularly valuable when your credit challenges stem from specific life events like medical emergencies, divorce, or temporary job loss rather than chronic financial mismanagement. Portfolio lenders can evaluate these circumstances holistically, potentially approving loans that automated systems would reject based solely on credit score thresholds. Additionally, many portfolio lenders emphasize relationship banking, meaning your existing accounts and history with the institution influence lending decisions.

This flexibility comes with important trade-offs to consider. Portfolio loans typically carry higher interest rates than conforming loans, reflecting the increased risk and lack of secondary market liquidity. They also commonly feature shorter terms (15-25 years instead of 30) and may include prepayment penalties restricting your ability to refinance within the first few years. Despite these limitations, portfolio loans often represent the most accessible conventional (non-government) option for borrowers with scores below 620, particularly those with substantial compensating factors like large down payments or significant assets.

Quick-Close Options for Time-Sensitive Situations

Some specialized mortgage lenders focus specifically on expedited closings for credit-challenged borrowers facing time constraints. These situations commonly include pending foreclosures requiring refinance, contract deadlines on purchase agreements, or construction loans nearing maturity. These lenders streamline underwriting processes by focusing primarily on collateral value and down payment rather than perfect credit history, sometimes closing loans in as little as 7-10 business days compared to the typical 30-45 day timeline.

The expedited process typically involves alternative documentation requirements, accepting bank statements instead of traditional income verification for self-employed borrowers or using asset-based qualification methods that consider your total financial resources rather than monthly income alone. These non-traditional approaches accommodate borrowers with complex financial situations that don’t fit neatly into conventional underwriting models, such as those with irregular income patterns or recent career changes that would raise red flags in traditional underwriting.

The convenience of rapid closing comes at a premium—expect interest rates 1-3% higher than conventional loans and origination fees of 2-5% compared to the typical 0.5-1%. Additionally, these loans often feature shorter terms with balloon payments requiring refinance or sale within 3-5 years. Despite these costs, quick-close options provide valuable solutions for borrowers who need immediate financing to secure a property or prevent foreclosure while working toward credit improvement that will qualify them for better terms in the future.

Refinancing Pathways Designed for Credit-Challenged Homeowners

Existing homeowners with equity but damaged credit have access to specialized refinance programs designed specifically for their circumstances. These programs focus primarily on the property’s value and your equity position rather than credit scores, making them accessible even after significant credit deterioration. The most common option, cash-out refinancing with non-prime lenders, allows homeowners to tap equity while consolidating high-interest debts that may be contributing to credit issues.

For homeowners with FHA or VA loans, streamline refinance programs offer remarkably flexible credit requirements. FHA Streamline Refinance requires no credit check or income verification when refinancing an existing FHA loan, focusing instead on your payment history on the current mortgage. Similarly, the VA Interest Rate Reduction Refinance Loan (IRRRL) emphasizes mortgage payment history over credit score, helping veterans reduce their interest rates despite credit challenges that would prevent conventional refinancing.

When considering these specialized refinance options, evaluate the total cost compared to potential savings. Many non-prime refinance loans charge origination fees of 2-5% plus discount points to buy down the rate, significantly increasing the break-even timeline. Calculate how long you’ll need to stay in the home to recoup these costs through monthly payment savings. Additionally, consider whether debt consolidation through cash-out refinancing addresses the root causes of credit issues or simply converts unsecured debt to secured debt without changing underlying financial behaviors.

Non-QM Loans: Alternative Qualification Methods

Non-Qualified Mortgage (Non-QM) loans operate outside the Consumer Financial Protection Bureau’s “qualified mortgage” standards, allowing lenders to use alternative methods to determine your ability to repay. These loans have emerged as important options for credit-challenged borrowers who don’t fit traditional lending models, including those with recent credit events, high debt-to-income ratios, or non-traditional income sources. While conforming loans rely heavily on credit scores and standard DTI calculations, Non-QM loans evaluate borrowers through various alternative metrics.

Bank statement loans represent one of the most common Non-QM products, qualifying self-employed borrowers based on 12-24 months of bank deposits rather than tax returns. This approach benefits entrepreneurs whose tax returns show minimal income due to legitimate business deductions but who maintain strong cash flow. Similarly, asset depletion or asset utilization loans qualify borrowers based on their total liquid assets rather than monthly income, calculating a theoretical income by amortizing these assets over the loan term.

Recent-event loans specifically address borrowers recovering from major credit events like bankruptcy, foreclosure, or short sale, offering options just one day after these events rather than requiring the 2-7 year waiting periods imposed by conventional loans. These programs focus on the equity position (typically requiring 20-30% down payment) and the circumstances surrounding the credit event rather than the event itself. While interest rates typically range 2-4% higher than prime loans, these programs provide immediate homeownership opportunities during the conventional waiting period.

Balancing Accessibility Against Long-Term Costs

When evaluating specialized mortgage products for bad credit situations, the fundamental trade-off involves immediate accessibility versus long-term costs. Higher interest rates dramatically increase the lifetime cost of homeownership—a 2% rate increase on a $250,000 mortgage adds approximately $100,000 in additional interest over a 30-year term. This substantial difference makes it essential to view many bad credit mortgage solutions as transitional rather than permanent financing arrangements.

The optimal approach often involves accepting less favorable terms initially while implementing a deliberate strategy to refinance once your credit improves. Most specialized bad credit mortgage products charge prepayment penalties during the first 2-5 years, effectively locking you into the higher rate during this period. Plan your credit improvement timeline around this prepayment penalty period, focusing intensively on building payment history, reducing other debts, and addressing derogatory items to position yourself for conventional refinancing once the penalty expires.

Consider how long you expect to own the property when evaluating these cost trade-offs. For short-term homeownership (less than five years), the higher rate may prove less consequential than the opportunity to build equity instead of renting. Conversely, for long-term homeownership without clear prospects for credit improvement, the cumulative cost of above-market interest rates might outweigh the benefits of immediate purchase, suggesting a delay might better serve your financial interests. This calculation becomes especially important in stable or declining real estate markets where appreciation won’t offset the higher financing costs.

Strategic Steps to Strengthen Your Application

Leveraging Larger Down Payments to Offset Credit Concerns

When facing credit challenges, increasing your down payment represents one of the most effective strategies for improving approval odds and securing better terms. Larger down payments directly reduce the lender’s risk exposure by decreasing the loan-to-value ratio (LTV), creating an equity buffer that protects against potential foreclosure losses. This risk reduction often translates into tangible benefits despite credit issues—each 5% increase in down payment typically offsets approximately 20 points of credit score deficiency in lender risk assessments.

The impact becomes particularly significant at certain threshold points. Moving from 3.5% (FHA minimum) to 10% down not only improves approval odds but can reduce mortgage insurance premiums substantially. Similarly, reaching 20% down eliminates private mortgage insurance requirements on conventional loans and may qualify you for interest rate reductions of 0.25-0.75% depending on your credit tier. For borrowers with scores between 580-620, increasing the down payment from minimum requirements to 20-25% can sometimes secure approval from conventional lenders who would otherwise decline the application.

Beyond improving approval odds and terms, larger down payments create immediate equity that provides financial security during the early years of homeownership. This equity position becomes especially important for credit-challenged borrowers who may face higher risks of future financial difficulties. Having substantial equity provides options during hardship, including potential HELOC access for emergencies or the ability to sell without bringing money to closing if relocation becomes necessary. Consider redirecting funds from retirement accounts or seeking family gifts specifically to increase your down payment when credit issues present approval challenges.

Conclusion: Your Path Forward

Securing a mortgage with bad credit isn’t about settling for whatever you can get—it’s about making strategic choices that balance immediate homeownership with long-term financial health. Government-backed loans provide accessible entry points, while specialized programs offer alternatives when traditional paths remain closed. Your most powerful tools include larger down payments, careful timing of your application, and a thorough understanding of how lenders view your specific credit challenges. Remember that many successful homeowners started their journey with credit scores below 620, using their initial mortgage as a stepping stone to better terms through disciplined financial management.

The mortgage you accept today doesn’t have to be the one you carry for thirty years. Every on-time payment builds both equity and creditworthiness, gradually opening doors to refinancing opportunities with more favorable terms. The question isn’t whether bad credit will prevent homeownership—it’s whether you’re willing to approach the process with patience, preparation, and a clear-eyed view of the trade-offs that make your homeownership dreams possible despite past financial challenges.

Remember, navigating the mortgage process with bad credit can open avenues for financial recovery and homeownership, allowing you to create stability for your future.

Every mortgage with bad credit presents an opportunity; approaching the process thoughtfully can lead to long-term financial success.