FICO 10T – Credit Scoring Model & How to Fix Your Fico Score

Table of Contents

FICO 10T – Credit Scoring Model

FICO (formerly known as Fair Isaac) launched its latest credit scoring model – FICO 10T on January 2020. The Federal Housing Finance Agency (FHFA), on October 24, 2022, officially selected the FICO 10T model for use by Fannie Mae and Freddie Mac enterprises. What is FICO 10T? How does this credit scoring model surpass or dominate previous FICO scoring models? Let us explore the uses of FICO 10T and the significance of credit scoring models in this article.FICO 10T

The ‘T‘ in FICO 10T denotes the trended data. The FICO 10T applies a powerful set of predictive characteristics of consumers based on the input gained from both traditional, as well as trended credit bureau data. The purpose behind introducing a new scoring model is to give lenders quick insight into the spending behavior or pattern of borrowers and to predict and manage credit risk. With every update of the scoring model, FICO has improved its evaluation strategies and provides a feasible solution to lenders when approving a loan or new credit card. FICO scores, or credit scores in general, are used to determine the creditworthiness of borrowers. FICO 10T focuses on identifying the creditworthiness of individuals by monitoring their credit management history for a period of 24+ months. With this information gathered from credit bureaus, FICO identifies the credit risk of individuals, so that the lender has clarity on whether or not to approve debt.The Key Benefits of FICO 10T

Let us look at some of the key benefits of using this particular credit scoring model, rather than opting for a credit score model, like VantageScore.- Since the score is generated based on trusted and reliable sources, users can feel confident with the scores allotted.

- The level of accuracy in the prediction of credit scores using the information provided by bureaus is consistent.

- The FICO 10T credit scoring model has the same minimum credit score requirements, and the ranges don’t differ much either. It is prevalent in the older versions of FICO scores.

- Expand the chances of mortgage approval with a 5% increase rate, using the FICO score 10T.

- Due to the improvements in the predictive power of FICO 10T, mortgage lenders can eliminate unexpected credit risks to better control their credit approval.

Similar Credit Scoring Models

FICO 10T – Similar Credit Scoring Models

The top competitor of the FICO 10T is currently VantageScore 4.0, which was released back in 2017. This VantageScore model uses machine learning AI software to automatically generate credit scores based on financial data, and identify credit patterns. It was the first credit scoring system to use the trended credit data and examine borrower behavior over a period of time to generate accurate scores. The VantageScore 4 uses a predictive performance program named Gini, which is a statistical measure of the credibility of a consumer who is likely to pay or default. A higher Gini score implies that the consumer is more likely to pay the debt properly, while a lower Gini score implies the opposite.

Who Uses the VantageScore

The VantageScore, due to its predictive performance lift, was accepted by major credit industries and is still used and applicable for the following loan types:- Auto Loans

- Credit Cards

- Personal Loans

- Banking Sectors

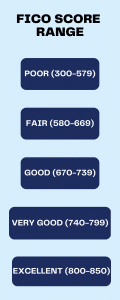

FICO Credit Score Range

VantageScore Range

Are VantageScore and FICO Score the Same All credit scoring systems are used to determine the creditworthiness of consumers. However, the methods and criteria that these scoring systems impose on their models help lenders give a precise picture of the credibility of borrowers. Whether you choose VantageScores or FICO credit scores, if you don’t have a good or excellent credit score, your loan or credit application can be rejected. If that’s the case, then the following question arises. How would you increase your credit score? There is no magic answer, or an instant answer to this question because it takes time and consistency in building your credit score. Your payment history plays an important role in determining your credit score and contributes 35% of your total credit score. Make sure you never miss any payments or stack up your debt without paying EMIs and interest. The way you manage your existing debt determines your credit score increase. If you are wondering what your FICO equivalent to your VantageScore is, apparently there are no ways to convert FICO scores to VantageScore. The reason is that both credit models use different criteria and methods to evaluate creditworthiness, and will never be compatible when put together. Related Articles:

- FICO Scoring Models – Best 3 Versions in 2023

- FICO 10 & 10T: How To Outshine Any Updates?

- FICO Score 8 – An Exclusive Review