Understanding your credit score is crucial for unlocking various financial opportunities, but how often do we really think about it? Maintaining a healthy credit score can significantly affect your financial health. A strong credit score can lead to better loan terms, lower interest rates, and even more favorable insurance premiums. But what exactly goes into a credit score fitness, and how can you improve yours?

In this guide, we’ll break down the components of a credit score, identify common errors that might be dragging yours down, and explore strategies to build and maintain a strong credit score fitness profile. From understanding the role of credit utilization to leveraging non-traditional credit data, we’ll cover practical steps you can take to boost your score. Ready to take control of your financial health? Let’s get started.

The Anatomy of a Credit Score

Breaking Down the FICO Score

A FICO score, ranging from 300 to 850, is a critical measure of your financial health. This three-digit number reflects your creditworthiness and can significantly influence your ability to secure loans and the interest rates you receive. Understanding the nuances of this score can help you better manage your financial planning and improve credit score fitness.

- Good Score (670-739): A score in this range is generally seen as favorable by lenders. It indicates that you are a reliable borrower, though you may not receive the best interest rates available.

- Very Good Score (740-799): This range opens up more financial opportunities. Lenders are more likely to offer you better terms and lower interest rates, reflecting your strong credit management.

- Excellent Score (800 and above): Achieving a score in this range places you in the top tier of borrowers. You are likely to receive the most favorable loan terms and the lowest interest rates, saving you significant amounts of money over time.

Factors Influencing Your Credit Score

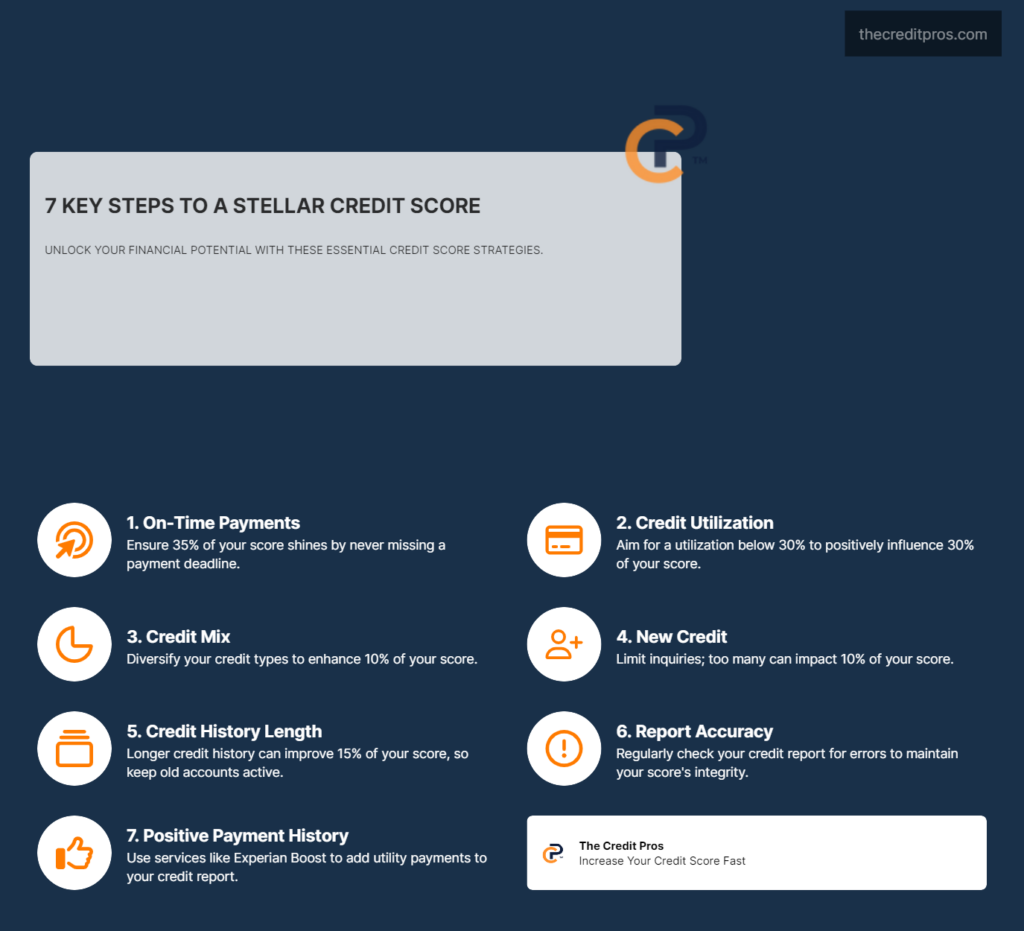

Several key factors contribute to your FICO score, each with varying degrees of impact:

- Payment History: This is the most significant factor, accounting for about 35% of your score. Consistently making on-time payments on your credit cards, loans, and other debts is crucial.

- Credit Utilization: This refers to the ratio of your current credit card balances to your credit limits. Ideally, you should aim to keep your utilization below 30% to positively impact your score.

- Types of Credit: Having a mix of credit types, such as installment loans (e.g., mortgages, car loans) and revolving credit (e.g., credit cards), can improve your score.

- New Credit Inquiries: Each time you apply for new credit, it can temporarily lower your score. Multiple inquiries in a short period can be particularly detrimental.

- Length of Credit History: The age of your oldest account, the average age of all your accounts, and the age of your newest account all play a role. Longer credit histories generally contribute to higher scores.

Diagnosing and Correcting Errors

The Role of Credit Reports

Credit reports from the three main bureaus—TransUnion, Equifax, and Experian—are the foundation of your credit score. Regularly reviewing these reports is essential for maintaining credit health. Each bureau may have slightly different information, so it’s important to check all three.

Identifying Common Errors

Errors in credit reports are not uncommon and can significantly impact your credit score fitness. Common mistakes include:

- Closed Accounts Listed as Open: This can falsely inflate your available credit, skewing your utilization ratio.

- Paid-Off Loans Showing a Balance: This can make it appear as though you have more debt than you actually do.

- Incorrect Late Payment Reports: Even one erroneous late payment can drop your credit score fitness significantly.

- Debts Listed as in Collections: This is particularly damaging and can linger on your report for years if not corrected.

Steps to Correcting Errors

To dispute inaccuracies, follow these steps:

- Gather Evidence: Collect any documentation that supports your claim, such as payment receipts or account statements.

- Contact the Bureau: Each bureau has an online dispute process. Submit your evidence and a detailed explanation of the error.

- Follow Up: After submitting your dispute, monitor your credit report to ensure the correction has been made. It may take several weeks for changes to reflect.

Leveraging Non-Traditional Credit Data

Adding Utility Bills and Other Payments

Traditional credit reports often overlook consistent payments on utility bills, phone bills, and streaming services. However, these can be valuable indicators of your reliability.

- Experian Boost: This service allows you to add your history of positive payments on utilities and other services to your Experian credit report. This can be particularly beneficial if you have a limited credit history or are looking to give your score a quick boost.

- Impact of Positive Payment History: Including these payments can improve your score by demonstrating consistent, responsible financial behavior.

Building a Long-Term Credit Score Fitness Strategy

Establishing Good Credit Score Fitness Habits

Developing and maintaining good credit habits is essential for long-term financial health:

- Pay Bills on Time: Set up reminders or automatic payments to ensure you never miss a due date.

- Address Collections: If any bills have gone to collections, contact the creditor to arrange payment. Clearing these can significantly improve your credit score fitness.

- Open New Accounts Cautiously: While new credit can help build your history, too many new accounts in a short period can hurt your credit score fitness.

Managing Credit Utilization

Effective management of your credit utilization is crucial:

- Pay Down Balances: Focus on reducing high balances on your existing credit cards.

- Request Limit Increases: If your credit card issuer agrees to raise your limit without a hard inquiry, this can lower your utilization ratio.

- Avoid Closing Old Accounts: Keeping older accounts open can help maintain a longer average credit history.

Starting from Scratch: Secured Credit Cards

For those new to credit or looking to rebuild, secured credit cards can be an excellent tool:

- How They Work: Secured cards require a deposit that serves as your credit limit. This minimizes risk for the lender and helps you build a positive payment history.

- Transitioning to Unsecured Cards: After demonstrating responsible use, you can often transition to an unsecured card, further boosting your credit profile.

By following these strategies and maintaining a proactive approach, you can significantly improve and maintain your credit score fitness, opening up a world of financial opportunities.

Wrapping Up: Your Path to Financial Fitness

Understanding and managing your credit score fitness is a vital aspect of your financial health. By breaking down the components of a FICO score, identifying common errors, and leveraging non-traditional credit data, you can take meaningful steps to improve your credit score fitness profile. Regularly reviewing your credit reports and correcting inaccuracies ensures that your score accurately reflects your financial behavior.

Building a long-term credit strategy involves establishing good habits, managing credit utilization, and considering tools like secured credit cards. These steps enhance your credit score and open doors to better loan terms, lower interest rates, and more favorable financial opportunities. Your credit score fitness reflects your financial reliability. By taking control of it, you’re investing in your future. Start your journey to financial fitness today and unlock the doors to a wealthier tomorrow.