As digital nomads navigate the freedom of working from anywhere in the world, they encounter unique financial challenges, particularly when it comes to credit repair for digital nomads and maintaining a healthy credit score. How does living internationally affect your credit, and what can you do to ensure your financial health doesn’t hinder your nomadic lifestyle? These questions are crucial, as credit scores play a significant role in everything from renting an apartment to securing loans.

This guide explores the essentials of understanding and managing credit as a digital nomad. Whether you’re dealing with credit issues from abroad or looking to build your credit in a new country, the strategies outlined here are designed to help you maintain financial stability no matter where your travels take you. By exploring how to use international credit facilities wisely and leveraging tools like The Credit Pros, you can navigate the complexities of credit repair for digital nomads while enjoying the flexibility of your nomadic life.

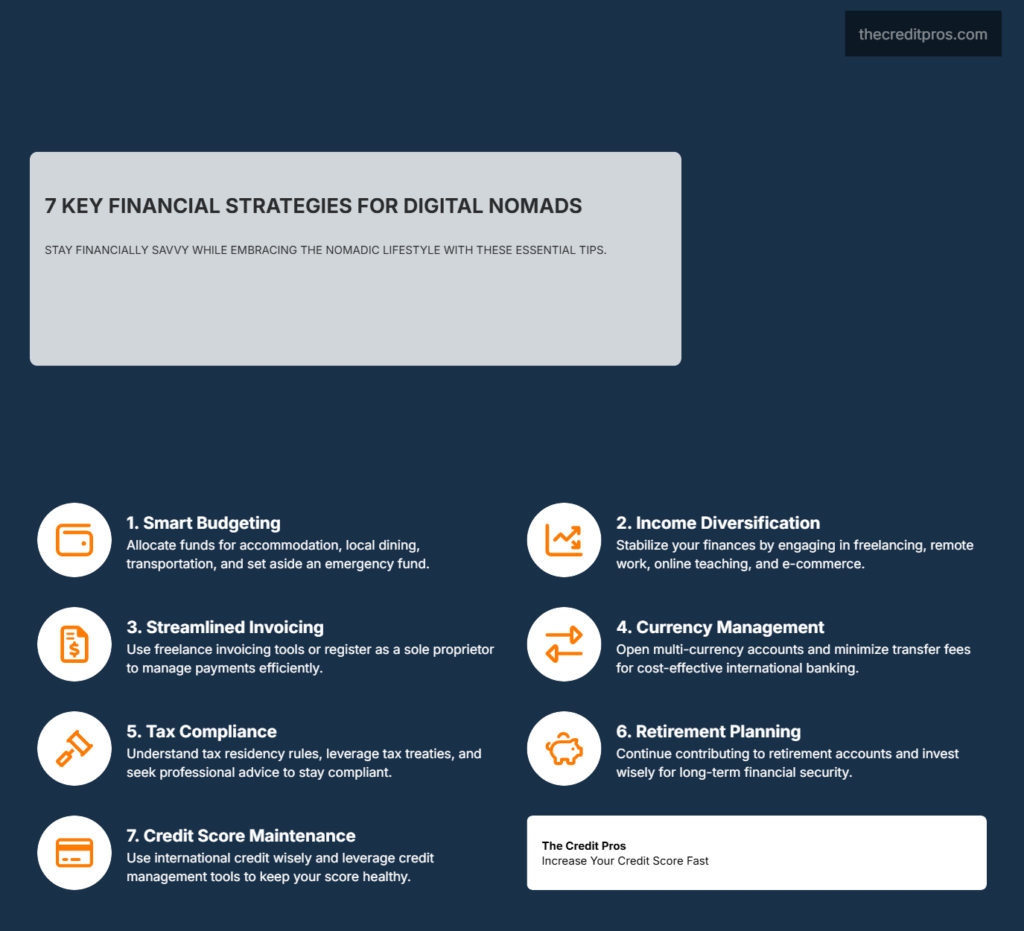

Budgeting for a Sustainable Digital Nomad Lifestyle

Proper budget management is crucial for digital nomads to maintain a sustainable, enjoyable lifestyle. In the context of credit repair for digital nomads, here’s how to manage your finances effectively:

- Accommodation: Opt for affordable housing that aligns with your income. Utilizing platforms like Airbnb, coliving spaces, or hostels can significantly reduce costs.

- Food and Transportation: Local costs can vary widely. Eating local foods and using public transportation or walking can help manage these expenses efficiently.

- Emergency Fund: It’s advisable to save at least 3-6 months’ worth of living expenses to cover unforeseen costs like medical expenses or flight cancellations.

- Travel Budgeting: While exploring is a key part of the digital nomad lifestyle, setting a specific budget for travel can help prevent financial overreach.

- Insurance: Investing in international health insurance and travel insurance is essential for covering medical costs and travel-related risks.

Diversifying Income Streams for Financial Stability

To ensure financial stability, digital nomads should consider diversifying their income sources, especially when navigating credit repair for digital nomads:

- Freelancing: Platforms like Upwork and Fiverr offer opportunities across various fields such as writing and digital marketing.

- Remote Jobs: Websites like We Work Remotely provide listings for full-time remote positions that often come with additional benefits.

- Online Teaching: Platforms like VIPKid allow for teaching languages or specific subjects remotely.

- E-commerce and Affiliate Marketing: Creating an online store or engaging in affiliate marketing can generate passive income.

- Consulting: Offering specialized consulting services in areas like marketing or IT can be highly lucrative.

Efficient Invoicing for Digital Nomads

Handling invoices without a company setup can be streamlined using these methods related to credit repair for digital nomads:

- Freelance Invoicing Tools: Tools like Invoice Simple allow for the creation of professional invoices and manage payments effectively.

- Register as a Sole Proprietor: This can simplify the invoicing and tax process, as seen in countries like Spain where freelancers can manage finances without a full company.

- Third-Party Services: Platforms like Upwork handle invoicing and payments, reducing administrative burdens for freelancers.

Managing Currency Exchange and Bank Accounts

When dealing with multiple currencies and international banking, consider the following tips for credit repair for digital nomads:

- Multi-Currency Accounts: Services like Wise offer accounts that handle multiple currencies with low fees, ideal for receiving international payments.

- Minimize Transfer Fees: Opt for services like Payoneer that offer competitive rates and lower fees for international transfers.

- Backup Bank Accounts: Maintaining multiple bank accounts in different currencies can provide a financial safety net during travels.

Navigating International Tax Issues

Understanding and managing tax obligations are critical for digital nomads:

- Tax Residency Rules: Be aware of the tax residency rules in your home country and any country you spend significant time in.

- Tax Treaties: Utilize tax treaties between countries to avoid double taxation and ensure compliance.

- Professional Tax Advice: Consulting with a tax advisor who specializes in digital nomad taxation can optimize your tax strategy and ensure compliance.

Saving for Retirement as a Digital Nomad

Planning for retirement is essential, even when enjoying the flexibility of a nomadic lifestyle:

- Retirement Accounts: Continue contributing to retirement accounts like IRAs or 401(k)s, depending on your residency status.

- Investment: Regular investment in a diversified portfolio can help secure long-term financial health, allowing you to enjoy your travels without financial worry.

By implementing these strategies, digital nomads can manage their finances effectively, ensuring a stable and enjoyable lifestyle while focusing on credit repair for digital nomads.

Conclusion: Navigating Credit Repair for Digital Nomads

The journey of a digital nomad involves exploring new environments and mastering the complexities of financial management across different countries. Maintaining a robust credit score, managing diverse income streams, and understanding international tax implications are essential for a stable and enjoyable nomadic lifestyle. By using tools like multi-currency accounts, freelance invoicing platforms, and by staying informed through services like credit repair for digital nomads, digital nomads can address financial challenges effectively, ensuring their adventures are free from monetary obstacles.

The strategies discussed here offer a comprehensive approach to financial health, highlighting the importance of preparation and adaptability. As you continue your journey in credit repair for digital nomads, keep in mind that every financial decision you make influences your future path. It involves not only sustaining a lifestyle but also thriving in a global setting, equipped with the knowledge and tools to manage your finances efficiently. Let this guide serve as a foundation for financial confidence, allowing you to explore the world with peace of mind.