How Credit Cards Offer better Protection than Debit Cards

Have you ever gotten into trouble with credit cards in the past? If the answer is yes and once upon a time you overextended yourself by charging up a big pile of credit card debt then you might feel a little gun shy about using credit cards again.

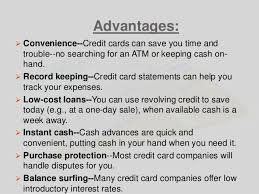

Understandably, using a credit card account again might be intimidating, especially if you ever had a credit card account go into default or collections. Yet even though it can be scary to get back on the proverbial horse, the truth is that the benefits of having a credit card account are worth the effort it may take to overcome your fears. Credit cards not only have great credit-building potential (when managed correctly), but they are also a safer way to pay. This article will express why credit cards

The Pros of a Debit Card

There is no disputing the fact that debit cards can be easier for many people to manage from a budgetary standpoint. After all, debit cards come with a bit of mandatory self-control – you can only spend as much money as you have in your account. Once you have spent those funds any additional transactions are going to be denied (unless you have overdraft protection). However, while debit cards may prevent you from getting into a pile of credit card debt, they will not correct your spending problems.

Also Read: Unexpected Times Your Credit Matters

Fixing an Overspending Problem

The truth is that with discipline a credit card is truly no more dangerous than a debit card from a budgetary standpoint either. Yes, you could potentially charge more on a credit card than you can afford to pay off in full at the end of the month (thus wasting money on interest fees), but you certainly do not have to overspend just because you have a credit card account.

There are tricks to help prevent overspending as well. For example, some people will wisely keep a running account ledger to track how much they can afford to spend on their credit cards each month. If $500 is what their budget will allow being spent on food, gas, etc. during the month then they start the ledger with $500 just as if they had deposited it in their account. Each purchase is subtracted from the ledger. Once the $500 is spent then they would know that the card is off-limits until the following month when more money will be available again, just as additional spending would not be an option on a debit card once available funds were exhausted.

The Pros of a Credit Card

If you can get past the temptation to overspend credit cards are a safer form of payment to use. The first reason credit cards are a safer form of payment is due to the significant fraud protection they offer.

Thanks to federal law you are unlikely to be held fully responsible for fraudulent transactions on either type of plastic. Whether your debit card information is stolen or your credit card information is stolen you have considerable consumer protections which limit your liability as long as your report the fraud, loss, or theft promptly. Yet if your debit card account information is stolen and unauthorized charges occur on your account then you could be in for a much bigger headache than you might have experienced if your credit card information had been stolen instead.

Why Credit Cards Are Safer than Debit Cards?

When a debit card is stolen it is your funds that will be tied up while the bank sorts through the fraudulent transactions made on your account. Therefore you may be without access to the money which you need to pay your bills and cover basic expenses for several days. Additionally, under the Electronic Funds Transfer Act (EFTA) you could be held liable for $50 of any fraudulent charges reported within 2 days and up to $500 of fraudulent charges reported within 60 days. If you wait longer than 60 days to report a lost card or fraudulent charges then you could be held liable for all of the unauthorized transactions made on your account.

Also Read: The Effect of New Credit On Your Credit Score

The Fair Credit Billing Act (FCBA) caps your liability for fraudulent credit card transactions to just $50, but the major credit card issuers all currently waive even this fee as a matter of customer service as long as the fraudulent charge is disputed within 60 days. The key difference between credit card fraud and debit card fraud is that when a credit card is stolen it is the bank that will be fighting to get back its own money. Your funds are never impacted. Conversely, when debit card information is stolen it is you who will be fighting to get your funds returned to your account.