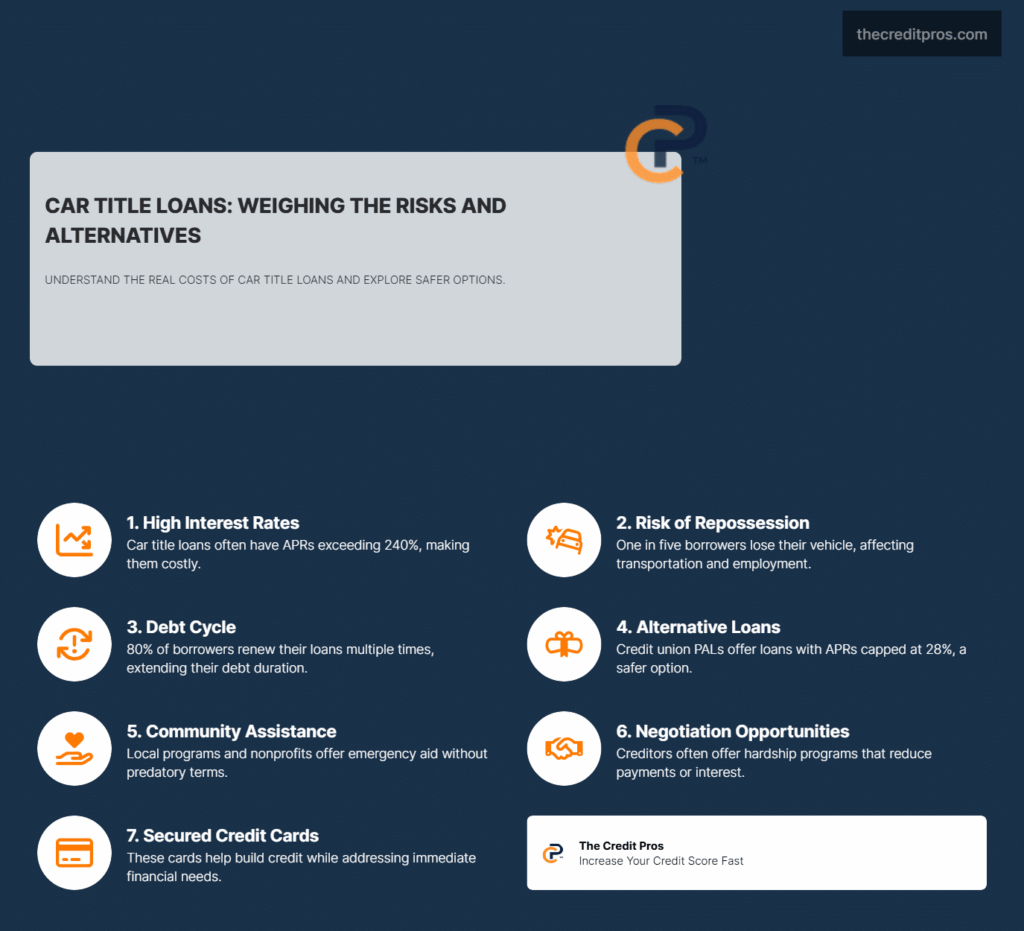

When you’re facing a financial emergency with poor credit, using your car as collateral might seem like an attractive solution. Car title loans offer quick cash without credit checks, allowing you to continue driving your vehicle while repaying the loan. But behind the promise of fast money lies a complicated reality: interest rates that can exceed 240% annually, substantial risks of vehicle repossession, and potential cycles of debt that trap many borrowers. Is the immediate relief worth the long-term financial impact?

Before making this decision, you need to understand exactly how using your car as collateral works, what it truly costs, and what alternatives might better serve your financial situation. The average car title loan borrower renews their loan eight times, paying far more in fees than the original loan amount. One in five borrowers ultimately loses their vehicle to repossession, often creating transportation problems that affect employment and essential daily activities. While these loans can provide temporary relief, knowing the full picture helps you determine if the solution might actually be worse than the problem.

Understanding Car Title Loans: The Mechanics and Market Reality

Car title loans operate on a straightforward premise: borrowers surrender their vehicle title using your car as collateral in exchange for a short-term loan, typically ranging from 15 to 30 days. The loan amount is determined by the vehicle’s assessed value, with lenders usually offering between 25% and 50% of the car’s worth. This percentage varies based on the lender’s policies, the vehicle’s condition, age, and market value. Most car title loans range from $100 to $5,500, though some lenders may extend up to $10,000 for newer, higher-value vehicles.

The application process is designed for speed rather than thoroughness. Unlike traditional loans, title lenders focus primarily on the vehicle’s value rather than the borrower’s creditworthiness. Using your car as collateral, the process typically requires applicants to present a clear title to the vehicle (though some lenders will work with partially-paid vehicles), valid identification, proof of insurance, and sometimes proof of income or residence. The physical inspection of the vehicle is crucial, as lenders evaluate its condition to determine the loan amount. Many lenders also require the installation of GPS trackers or ignition kill switches to facilitate potential repossession.

The fee structure of car title loans is where significant concerns arise. Instead of expressing interest rates in annual percentage rates (APRs), many lenders advertise monthly rates that appear deceptively low. A “25% monthly interest rate” translates to a staggering 300% APR. The Federal Trade Commission has found that the average APR on car title loans exceeds 240%, making them one of the most expensive borrowing options available. Using your car as collateral not only exposes you to high interest rates but also a range of hidden charges—application fees, processing fees, document fees, late fees, lien fees, and even roadside service plan fees—that can add 20–30% to the total loan cost beyond the stated interest rate.

The regulatory landscape for car title loans varies dramatically across states. Currently, 16 states outright prohibit car title lending through usury laws or specific prohibitions. Another 8 states have regulations that effectively limit these loans by capping interest rates. However, 26 states still permit high-cost title lending, with minimal consumer protections. In states where they operate, title lenders have demonstrated significant political influence, spending millions on lobbying efforts to maintain favorable regulatory environments. For consumers using your car as collateral, this patchwork of regulations creates confusion and enables lenders to structure their products to avoid restrictions.

Potential Benefits: When a Car Title Loan Might Make Sense

For individuals with damaged credit profiles, car title loans offer a rare opportunity to access funds when traditional financial institutions have closed their doors. The absence of credit checks removes a significant barrier for those with bankruptcies, foreclosures, or collections on their record. Lenders focus almost exclusively on the value of the vehicle rather than the borrower’s credit history, making approval possible for those who would be automatically rejected by conventional lenders. Using your car as collateral becomes a last-resort strategy for the approximately 12 million Americans who turn to auto title loans annually during financial emergencies with limited alternatives.

The speed of funding represents another significant advantage of car title loans. While traditional bank loans can take days or weeks for approval and disbursement, title loan processing often occurs within hours. Many title loan companies advertise “30-minute approval” processes, with funds available the same day. This rapid turnaround can be crucial during genuine emergencies such as unexpected medical bills, essential home repairs, or preventing utility disconnections. Using your car as collateral allows borrowers to access fast cash with minimal documentation, making the process far quicker than conventional lending options.

Title loans also allow borrowers to maintain possession and use of their vehicles throughout the loan term, a critical benefit for those who rely on their cars for work, medical appointments, or family responsibilities. Unlike pawning an item, where possession transfers to the lender, using your car as collateral in a title loan only transfers the legal title while the borrower continues driving the vehicle. This arrangement enables individuals to address financial emergencies without disrupting their daily transportation needs. For workers in areas with limited public transportation, maintaining vehicle access while accessing emergency funds can be essential for preserving employment and income.

- Potential advantages of car title loans:

- No credit check requirements, making them accessible to those with damaged credit

- Rapid funding, often within the same day of application

- Continued use of the vehicle during the loan period

- Higher loan amounts than typical payday loans

- Minimal documentation requirements

- Available in areas where other emergency funding options are limited

For specific short-term scenarios where repayment is guaranteed within the initial loan period, title loans can serve as a strategic financial tool. Consider a self-employed contractor who needs immediate funds to purchase materials for a project with guaranteed payment upon completion. If the project timeline aligns with the loan term and the profit margin sufficiently covers the loan costs, a title loan might represent a viable business decision. Similarly, individuals awaiting settlement disbursements, tax refunds, or other guaranteed funds might rationally use title loans as a bridge, provided they have absolute certainty about their incoming funds.

“Car title loans are based on the value of your car. These loans can be very expensive.”

Hidden Dangers: The True Cost of Car Title Loans

The astronomical interest rates associated with car title loans create a financial burden that many borrowers fail to fully comprehend. When properly calculated as annual percentage rates (APRs), these loans typically carry interest between 200% and 300%, with some reaching as high as 500%. To put this in perspective, a $1,000 title loan with a 25% monthly interest rate (300% APR) would require $250 in interest payments each month without reducing the principal balance. Over a year, a borrower would pay $3,000 in interest alone while still owing the original $1,000. Using your car as collateral under these terms can result in a debt cycle where borrowers pay exponentially more than they initially borrowed, often through rollovers and refinancing documented by the Consumer Financial Protection Bureau.

The cycle of debt begins when borrowers cannot repay the full loan amount by the due date. Rather than defaulting and losing their vehicle, most accept the lender’s offer to “roll over” the loan into a new agreement. Each rollover incurs additional fees and often extends only the interest payment, not the principal. This creates a debt trap where borrowers make payments month after month without reducing their original debt. Data from the Consumer Financial Protection Bureau reveals that more than 80% of title loans are renewed on the due date because borrowers cannot afford to pay them off with a single payment. Using your car as collateral in this way often leads to repeated rollovers, with the average borrower renewing their loan eight times and remaining in debt for about 10 months—even though the initial loan term was just 30 days.

The most devastating consequence of title loan default is vehicle repossession, which occurs with alarming frequency. Research from the Consumer Financial Protection Bureau found that one in five title loan borrowers eventually loses their vehicle to repossession. The repossession process often begins immediately after default, sometimes within days of a missed payment. Using your car as collateral means putting your transportation—and any equity you hold in the vehicle—at serious risk. Once repossessed, borrowers face additional repossession fees, storage charges, and administrative costs if they hope to reclaim their vehicle. Even more troubling, many states allow lenders to keep the entire proceeds from vehicle auctions, even when the sale price exceeds the outstanding loan balance. This practice, known as “surplus retention,” means borrowers lose both their transportation and any equity they had in the vehicle.

The loss of a vehicle extends far beyond the financial impact, creating cascading negative effects on borrowers’ lives. For the 85% of title loan borrowers who use their car to get to work, repossession can directly threaten their employment and income. A survey by the Pew Charitable Trusts found that 15% of borrowers who lost vehicles to repossession also lost their jobs as a direct result of lacking transportation. Using your car as collateral may seem like a temporary solution, but the risk of vehicle loss can undermine access to medical care, educational opportunities, and even basic necessities like grocery shopping—especially in rural areas or regions with limited public transit. These secondary effects transform a financial setback into a comprehensive crisis impacting multiple aspects of borrowers’ lives.

Title loan agreements often contain problematic clauses that further disadvantage borrowers. Mandatory arbitration provisions prevent borrowers from pursuing legal action in court or joining class-action lawsuits. Acceleration clauses allow lenders to demand immediate payment of the entire loan amount after a single missed payment. Some contracts include provisions allowing lenders to access borrowers’ bank accounts or garnish wages in certain jurisdictions. Using your car as collateral can subject you to contracts filled with ambiguous language around repossession timelines and procedures, giving lenders broad discretion in how and when they seize vehicles. These contractual elements significantly tilt the power balance toward lenders and away from vulnerable borrowers.

Alternative Options: Better Solutions for Low-Credit Borrowers

Credit unions offer substantially more affordable alternatives to using your car as collateral through their Payday Alternative Loans (PALs) program. Federally chartered credit unions can provide small-dollar loans ranging from $200 to $2,000 with terms extending from one to twelve months. The interest rates on these loans are capped at 28% APR—approximately one-tenth the rate of typical title loans. The National Credit Union Administration reports that PALs save borrowers between $300 and $500 per loan compared to high-cost alternatives. Credit unions also typically offer more flexible repayment terms, allowing borrowers to make multiple smaller payments rather than a single lump sum. Membership requirements have relaxed significantly in recent years, with many credit unions now accepting members based on geographic location rather than strict employment criteria.

Community assistance programs provide another viable pathway for individuals facing financial emergencies without using your car as collateral. Many municipalities, counties, and non-profit organizations offer emergency financial assistance for essential needs like housing, utilities, and medical expenses. The United Way’s 211 service connects individuals with local resources, including emergency grant programs and assistance funds. Faith-based organizations collectively provide over $7 billion annually in direct financial assistance to individuals in need. Community Development Financial Institutions (CDFIs) offer small-dollar loans with interest rates typically capped at 36% APR, serving as responsible alternatives to predatory lenders. While these programs may require more documentation than title loans, they provide genuine financial relief without the predatory features of high-interest lending.

Negotiating with existing creditors represents an underutilized strategy for addressing financial emergencies without using your car as collateral. Many creditors offer hardship programs that can temporarily reduce interest rates, waive fees, or modify payment schedules during financial difficulties. Medical providers frequently offer interest-free payment plans or significant discounts for patients in hardship—some hospitals reduce bills by up to 60% for eligible individuals. Utility companies across most states also offer flexible billing support. These alternatives help manage urgent financial needs without putting your car as collateral, preserving your transportation while avoiding predatory high-interest loans.

Secured credit cards offer a dual benefit: addressing immediate needs while building credit for future financial stability—without using your car as collateral. Unlike title loans that require putting your car as collateral and risk repossession, secured credit cards only require a refundable cash deposit, which typically becomes your credit limit (usually starting at $200–$500). While this involves some upfront funds, it creates a revolving credit line to manage ongoing needs. These cards report payment activity to credit bureaus, helping build or rebuild credit scores. With consistent use, many cardholders qualify for unsecured cards, opening access to better terms and higher limits.

Personal loans from online lenders have emerged as increasingly viable options for borrowers with damaged credit—without the need for using your car as collateral. Fintech companies utilizing alternative data for underwriting—including banking history, employment verification, and education—often approve borrowers with FICO scores as low as 580. While interest rates for poor-credit borrowers range from 18% to 36%, this remains substantially lower than title loan rates. These installment loans typically offer repayment terms of 24–60 months with fixed monthly payments, eliminating the lump-sum repayment challenge of title loans. Many online lenders report to credit bureaus, helping borrowers rebuild their credit profiles with each on-time payment. The application process is conducted entirely online, with funding often available within 1–3 business days—slower than title loans but still relatively quick for emergencies.

Non-profit credit counseling services provide both immediate assistance and long-term financial education for individuals in crisis—especially those who have risked using their car as collateral for high-interest title loans. These organizations offer free or low-cost financial counseling, debt management plans, and access to local resources. Certified counselors negotiate with creditors to reduce interest rates and waive fees, making debt more manageable without risking critical assets. Many agencies also provide emergency grants through partnerships with local foundations. Beyond resolving immediate problems, these services deliver budgeting and credit-building workshops to help clients avoid using their car as collateral in future financial emergencies.

Conclusion: Weighing the Cost of Using Your Car as Collateral

Car title loans offer immediate relief with significant long-term consequences that can’t be overlooked. While using your car as collateral provides accessible funds without credit checks and allows continued vehicle use, the staggering interest rates—often exceeding 240% APR—create cycles of debt that trap borrowers for months longer than anticipated. The statistics paint a sobering picture: 80% of borrowers renew their loans multiple times, one in five lose their vehicles to repossession, and many pay several times the original loan amount through rollovers and fees. Better alternatives to using your car as collateral exist, from credit union PALs with 28% APR caps to community assistance programs and secured credit cards that build credit while addressing immediate needs.

When facing financial emergencies, the appeal of quick cash shouldn’t overshadow the potential devastation of predatory lending terms. The temporary relief offered by using your car as collateral in a title loan often evolves into a financial burden far heavier than the original emergency. Before surrendering your vehicle title, explore alternatives that protect both your transportation and your financial future. After all, what good is solving today’s crisis if it creates tomorrow’s catastrophe? Your car represents not just transportation, but opportunity and independence—assets far too valuable to risk for a loan designed to profit from your financial vulnerability.