7 Ways To Achieve a 740 Credit Score

740 Credit Score – 7 Important Ways To Achieve it?

Do you want to achieve a 740 credit score easily?

A credit score is important to borrow loans and gain more financial advantages. Measuring your creditworthiness is necessary to get a loan amount quickly without any struggles.

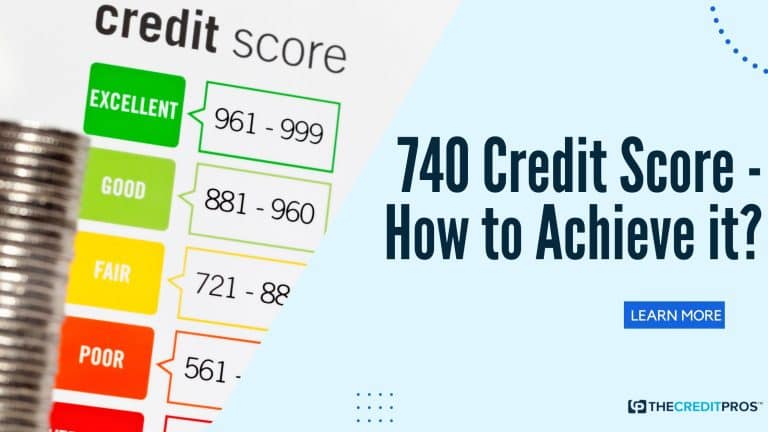

An excellent credit score range will help you reduce the extra fees and penalties. A 740 credit score is one of the highest credit scores with financial benefits as per the FICO credit scoring model. This blog post will help you understand the benefits of a 740 credit score and curate the ways to achieve it.

What is the Importance of Having a 740 Credit Score?

Determining your credit score is based on your credit history. If you have late or missed payments consistently, it will impact your credit score. Hence, paying your credit card bills on time and avoiding missing payments will help you gain a good credit score. Nevertheless, having a good credit score has several benefits. Here are a few significant benefits of a good credit score:

- Loan borrowers will get low-interest rates.

- If you want to qualify for an emergency loan amount, having a 740 credit score will help you qualify effortlessly for a personal loan.

- Borrowers will also get qualified for the loans such as cash-out refinance.

- The credit limits will get extended with a 740 credit score.

What are the Impacts of a Credit Score Below 700?

Having a 740 credit score is excellent for your financial benefits. However, credit card owners will also face a lot of drawbacks if their credit score is less than 700.

A credit score below 700 is not an excellent credit score, however, you can borrow secured loans such as home equity loans, equity lines of credit, etc. Loan borrowers should pay a high-interest rate with a credit score below 700 and 650. At times, if you need emergency cash, you will not be able to qualify for the loan amount easily with a low credit score.

Unsecured personal loans without any collateral will require a higher credit score such as 740 or above. This type of loan is also easy to qualify for emergency funds if you have a 740 credit score.

Can I Get a 740 Credit Score?

Achieving a 740 credit score is not a challenging task. Apart from paying your credit card bill on time and never missing the payments, you can also follow a few other steps to achieve a 740 credit score.

Check Your Credit Utilization Ratio Consistently

Checking your credit utilization ratio and maintaining it properly is essential to gain a good credit score. If you are wondering what is a credit utilization ratio, it is the division of the actual credit that you are utilizing by your total credit limit. The ideal credit utilization ratio is less than 30%.

Your credit score will take a hit if you have a high credit utilization ratio. Nevertheless, if you want to achieve a 740 credit score, your credit utilization ratio should be 15% or less.

Exemplary Credit History

Having a clear credit history for a long time will help you improve your credit score exponentially. When you miss payments consistently, you will not have a good credit history.

While paying your bills with a credit card, you should also make sure that you don’t have any debts. Credit history is also one of the significant ways to detect your financial behavior. With the help of your credit history, it is easy to determine your current credit report situation.

Borrow Various Types of Loans

Do you know that secured loans have a larger impact on your credit score? Borrowing secured loans with collateral will help you build your average credit score organically.

Loan borrowers will also have a positive credit history with secured loans. However, you must borrow different types of loans such as personal, equity, and refinance to maintain a positive credit history.

Reduce Your Debts

Debts are one of the reasons why you are not able to get a good credit score. Reducing your debts will help you fetch an excellent score.

If you are trying to achieve a 750 credit score, you should first pay your debts on a priority basis.

Obtain a Secured Credit Card

With the secured card, you will have a guaranteed credit line and it will boost your credit score. You are also backed up by the cash deposit in the secured credit cards which will help in making your loan borrowing process easy.

The cash deposit will act as collateral and help you showcase the better credit line to your lenders. If you have a low or no credit score, you should use secured credit cards.

Get a Balance Transfer Card

Disclosing a new credit card and transferring your balance will also help you build a good credit score. Your transaction pattern will get enhanced with the balance transfer card and in turn, builds your credit score.

With the balance transfer card, you can pay your debts easily and track your expenditure. Nevertheless, managing a balance transfer card is very significant, otherwise, it can hurt your credit score.

Frequently Asked Questions

Why is a 740 credit score is important?

A 740 credit score is an excellent score that will help you borrow the loan amount effortlessly. 740 improves your credit worthless and helps you to build trust with the loan lenders.

How will I get a 740 credit score?

One of the easiest ways to achieve a 740 credit score is to pay your credit card bills on time. Avoiding debts and not missing payments will exponentially increase your credit score.

How much loan amount is approved for a 740 credit score?

Usually, borrowers with a 740 credit score or above will get approved for up to $100,000 loan amount. A credit score is beneficial for borrowing both secured and unsecured loans, it will also help you borrow the loan amount quickly.

Related Articles

- Is 720 Credit Score A Good Credit Score

- 690 Credit Score – Is This A Good Credit Score

- Credit Score Ranges And Their Scores Limits

Summing Up

Imagine that you are trying to get emergency funds but your poor credit score is stopping you from qualifying for the loan amount! Credit score plays a vital role in your financial needs and helps you build trust with your loan lenders.

In this blog, we have listed six important ways to increase your credit score up to 740. Try these necessary ways and streamline your finances efficiently. You can also make use of the best credit repair services like TheCreditPros to get an professional credit repair support for your account.