Your credit score might be the most visible factor in loan approval, but it’s just one piece of a much larger puzzle that lenders examine. While many borrowers focus solely on that three-digit number, lenders are silently evaluating numerous other factors that could influence credit scores loan approval and ultimately make or break your application. What exactly are these hidden criteria that might outweigh even an excellent credit score? And why do some applicants with seemingly strong profiles still face rejection? Understanding how credit scores loan approval works can empower you to take proactive steps.

This article breaks down the comprehensive evaluation process lenders use when deciding your financial fate, including how credit scores loan approval plays a critical role in their assessments. We’ll examine how different lenders interpret the same credit information, why your debt-to-income ratio might be more important than your score, and what compensating factors can help overcome credit limitations. By understanding what lenders truly analyze beyond the surface-level number, you’ll be better positioned to strengthen your overall lending profile and approach your next loan application with realistic expectations.

In today’s competitive lending landscape, grasping the nuances of credit scores loan approval is crucial for every borrower. This knowledge can significantly improve your chances of securing favorable loan conditions.

The Anatomy of Credit Scores in Lending Decisions

Every borrower should be aware that credit scores loan approval is not a standalone metric, but rather part of a broader assessment that includes various financial responsibilities. Different lenders focus on different aspects of credit scores loan approval, making it essential to understand which factors might impact your application.

Credit scores serve as the cornerstone of lending decisions, but the intricate ways these numbers influence approvals often remain hidden from borrowers. Different scoring models can produce varied results for the same consumer, creating a complex landscape that affects lending outcomes. The relationship between credit scores loan approval and payment history is critical for prospective borrowers to understand. Understanding how different lending sectors interpret credit scores loan approval allows borrowers to tailor their applications accordingly.

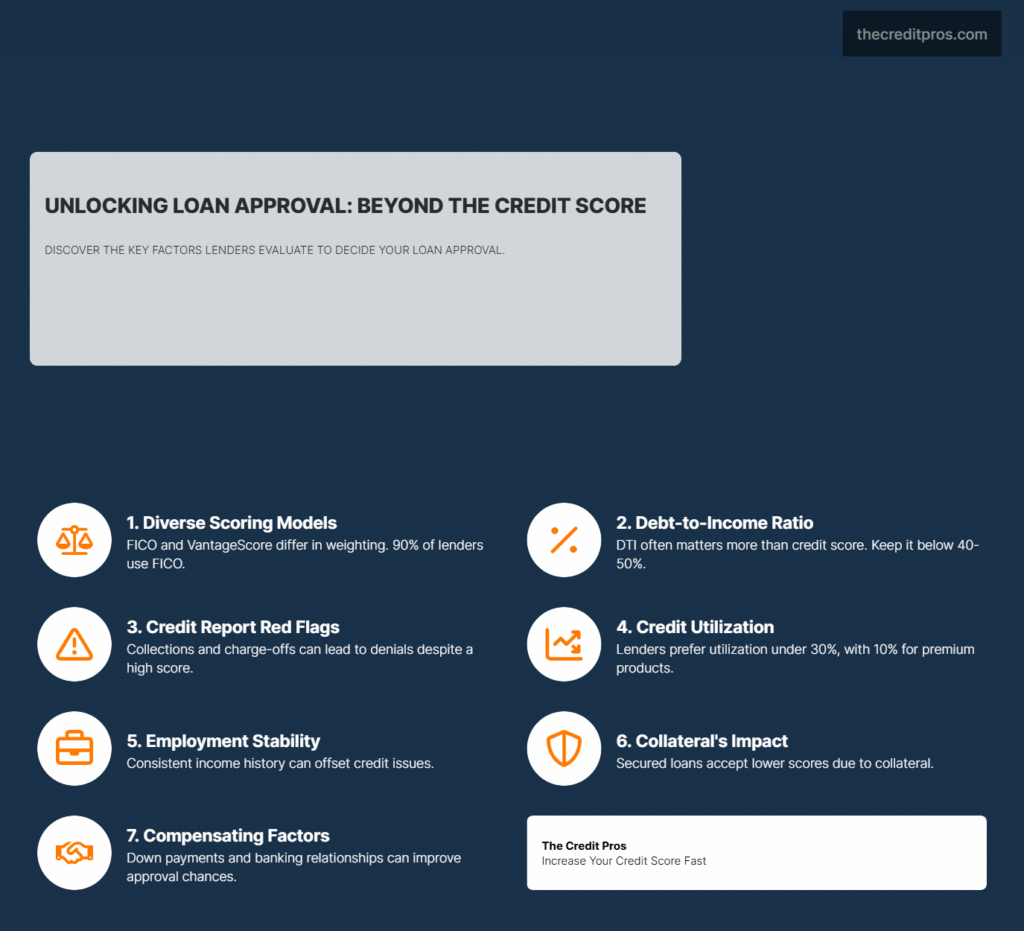

FICO and VantageScore, the two predominant scoring models, evaluate credit behaviors differently. While both use the same 300-850 scale, FICO typically weighs payment history more heavily at 35% of the total score, while VantageScore places greater emphasis on total credit usage and balances. This distinction matters significantly because approximately 90% of lenders use FICO scores in their decision-making process, though many are increasingly adopting VantageScore for its inclusion of alternative data. The practical implication is that a consumer might have a 720 FICO score but only a 680 VantageScore, potentially crossing the threshold between approval tiers at many lending institutions.

For many borrowers, knowing how credit scores loan approval factors into their applications can lead to better financial decisions. Credit scores loan approval is not just about numbers; it’s about understanding the story behind those numbers.

Secured and unsecured loans operate with distinctly different credit score requirements. Unsecured loans typically require excellent or good credit scores since the lender is appraising risk primarily on the borrower’s credit. For example, premium rewards credit cards often require FICO scores above 740, while unsecured personal loans may approve borrowers with scores as low as 660, albeit with higher interest rates. The influence of credit scores loan approval can be substantial here. Secured loans like mortgages and auto loans can be more forgiving, with FHA mortgages available to borrowers with scores as low as 580 with a 3.5% down payment.

Recognizing how credit scores loan approval correlates with the age and diversity of credit accounts can be a game changer for many borrowers. Hard inquiries can also impact credit scores loan approval, which is why understanding how they work is vital. When it comes to credit scores loan approval, manual underwriting can reveal nuances that automated systems may miss. Understanding the debt-to-income ratio in relation to credit scores loan approval can empower borrowers to make informed decisions.

Debt-to-income ratios often directly influence credit scores loan approval, making it essential for borrowers to focus here. In understanding credit scores loan approval, it’s critical to comprehend how lenders calculate DTI. Different loan types may have varying credit scores loan approval standards based on DTI thresholds.

Payment history carries exceptional weight in lending decisions, particularly for credit cards and personal loans. Late payments remain on credit reports for seven years, though their impact diminishes over time. Lenders evaluate not just the presence of late payments but their recency, severity, and frequency. A single 30-day late payment from four years ago might be overlooked by many lenders if recent history shows perfect payments, while multiple late payments within the past year could trigger automatic denials regardless of overall score.

Different lending sectors interpret identical credit scores through industry-specific lenses. Mortgage lenders typically adhere to the strictest underwriting standards, examining every aspect of credit history and often requiring manual explanation of derogatory items. Auto lenders, particularly those specializing in subprime markets, might approve loans with credit scores as low as 560 if income and down payment are sufficient. Credit card issuers often use proprietary “scorecard” systems that evaluate credit scores alongside internal risk metrics, including profitability models that assess spending and payment patterns. This explains why a consumer might be approved by one credit card company but rejected by another despite presenting identical credit information to both.

Beyond the Number: Additional Credit Report Factors Lenders Scrutinize

While credit scores provide a quick risk assessment snapshot, lenders dig deeper into credit reports to uncover potential issues that scores alone might mask. These nuanced evaluations often explain why applicants with seemingly adequate scores face unexpected denials.

Credit reports contain specific red flags that trigger heightened scrutiny regardless of overall score. Collections accounts, particularly those that remain unpaid, signal serious delinquency concerns even when they’re several years old. Tax liens and judgments, though no longer factored into FICO scores, remain visible on credit reports and are carefully reviewed during manual underwriting. Perhaps most concerning to lenders are charge-offs and settlements, which indicate that previous creditors absorbed losses. Even borrowers with rebuilt scores above 700 may face rejections if their reports contain multiple settled accounts from the past 24-36 months, as this pattern suggests a higher likelihood of future defaults despite the improved score.

Credit utilization ratio—the percentage of available credit being used—receives intense scrutiny during the underwriting process. While conventional wisdom suggests keeping utilization below 30%, lenders often apply more sophisticated analysis. Many evaluate both overall utilization and individual card utilization, with maxed-out cards raising red flags even when total utilization appears reasonable. Some lenders also examine utilization trends over time, with gradually increasing utilization suggesting financial distress even when still below threshold percentages. For premium financial products, many lenders prefer utilization below 10%, regardless of credit score, as this indicates more conservative credit management and lower risk of payment problems. The impact of credit scores loan approval often hinges on this ratio.

Understanding how credit scores loan approval interacts with DTI ratios can significantly affect your borrowing strategy. A positive DTI can enhance your chances of credit scores loan approval, creating a more favorable borrowing landscape.

The age and diversity of credit accounts provide lenders with insights about borrowing experience that raw scores cannot fully capture. Lenders typically prefer to see credit histories spanning at least 2-3 years, with multiple account types demonstrating the ability to manage various credit obligations. A thin credit file with only one or two accounts, even with perfect payment history and a respectable score, may be deemed insufficient for major loans. This explains why some young professionals with scores in the high 600s or low 700s face unexpected hurdles when applying for mortgages—their limited credit history fails to provide sufficient data for confident risk assessment.

Even with high credit scores, understanding DTI’s role in loan approval is essential for borrowers. The distinction between secured and unsecured loans can significantly impact credit scores loan approval outcomes.

Hard inquiries receive particular attention when they appear in clusters or patterns suggesting financial distress. While scoring models typically count multiple mortgage or auto loan inquiries within short periods as single inquiries, lenders can see each individual application. Multiple credit card applications within a few months often trigger manual review, as this pattern frequently precedes bankruptcy filings. Some lenders implement internal rules blocking approvals for applicants with more than a specific number of inquiries within 6-12 months, regardless of credit score, viewing inquiry patterns as predictive of future repayment behavior.

Understanding how collateral affects credit scores loan approval can guide your borrowing choices. Secured loans often have different credit scores loan approval thresholds that can benefit borrowers. When considering unsecured lending, knowing the implications for credit scores loan approval is vital for applicants. Understanding the impact of collateral on credit scores loan approval can lead to better financing options.

Manual underwriting processes allow lenders to evaluate circumstances beyond automated scoring systems. Approximately 15-20% of mortgage applications undergo some form of manual underwriting, where human analysts review explanatory letters, verify employment stability, and evaluate the context behind negative items. This process benefits borrowers with unusual circumstances that automated systems cannot properly assess, such as self-employed individuals, those with limited but positive credit histories, or borrowers with isolated negative events surrounded by otherwise perfect credit management. The manual process explains why lending decisions sometimes take longer than expected—human analysis requires additional time but often results in more nuanced decisions than algorithmic assessments alone.

As a borrower, knowing how to leverage secured loans can enhance your chances of credit scores loan approval. Incorporating compensating factors can positively influence credit scores loan approval. Income stability plays a crucial role in credit scores loan approval, especially for mortgage lenders. Making substantial down payments can help navigate credit scores loan approval when facing challenges.

The Debt-to-Income Ratio: The Hidden Deal-Breaker

Explanatory letters can clarify issues and positively influence credit scores loan approval outcomes. Alternative data can also enhance the chances of credit scores loan approval, especially for those with limited histories.

Debt-to-income ratio (DTI) frequently emerges as the unexpected obstacle in loan approvals, sometimes outweighing even exemplary credit scores. This critical metric receives intense scrutiny because it directly addresses a fundamental lending concern: regardless of past credit behavior, can the borrower realistically afford additional debt obligations?

Lenders calculate DTI by dividing total monthly debt payments by gross monthly income, typically expressing the result as a percentage. Most lenders evaluate two distinct DTI calculations: front-end ratio, which considers only housing costs (mortgage/rent, property taxes, insurance), and back-end ratio, which encompasses all debt obligations including auto loans, student loans, credit cards, and other recurring debts. The calculation methods vary by loan type, with significant differences in how lenders treat revolving debt. Mortgage lenders typically use minimum payment amounts for credit cards, while personal loan underwriters often calculate payments at 5% of outstanding balances, creating a more conservative assessment than what appears on credit reports.

Industry-specific DTI thresholds create varying approval standards across different loan types:

- Conventional mortgages: Typically require back-end DTI below 43%, though some programs allow up to 50% with compensating factors

- FHA loans: May approve back-end ratios up to 57% in exceptional cases, though generally prefer under 50%

- Auto loans: Often accept DTI ratios up to 50-55%, with subprime lenders sometimes extending to 60%

- Personal loans: Generally require DTI below 40%, with premium lenders often capping at 35%

- Credit cards: Frequently use undisclosed proprietary DTI calculations that incorporate internal risk models

These thresholds explain why borrowers sometimes receive mortgage pre-approvals for amounts significantly lower than expected, despite excellent credit scores—their existing debt obligations limit capacity for additional payments regardless of creditworthiness.

Credit scores and DTI ratios share a complex relationship in lending decisions, with higher scores sometimes offsetting borderline DTI concerns. Most lending institutions implement sliding scales where applicants with exceptional credit (typically 760+) may receive approval with DTI ratios 3-5 percentage points higher than those with merely good credit (680-720). This relationship becomes particularly evident in automated underwriting systems used by mortgage lenders, where the same applicant with identical income and debt might receive approval with a 740 score but denial with a 680 score based solely on DTI considerations. The underlying rationale is that borrowers with proven excellent credit management demonstrate greater resilience when operating near their financial capacity limits.

Improving DTI offers a faster path to loan approval than waiting for credit score improvements, providing a strategic advantage for borrowers facing tight timelines. While credit score improvements typically require months of positive payment history, DTI can be immediately enhanced through debt paydown strategies or income documentation improvements. Paying off or consolidating high-payment debts, particularly auto loans or high-interest credit cards, can dramatically reduce DTI calculations. Additionally, ensuring all household income receives proper documentation—including part-time work, consistent overtime, commission income, or self-employment—can significantly improve DTI ratios. For borrowers with borderline DTI ratios, providing documentation of ending obligations (such as car loans with only a few remaining payments) can sometimes tip approval decisions in their favor.

Even applicants with exceptional credit scores regularly face rejection due to DTI concerns, particularly in mortgage lending. This seemingly contradictory outcome stems from fundamental risk assessment principles: historical credit management (reflected in scores) cannot override mathematical affordability limitations. Mortgage lenders are particularly strict about DTI because housing payments represent long-term, inflexible obligations that typically consume the largest portion of household budgets. Even borrowers with perfect 850 credit scores face rejection when proposed housing payments would push total obligations beyond sustainable levels, as statistical models show that excessive DTI correlates strongly with default risk regardless of prior credit behavior. This explains why pre-qualification based solely on credit scores often leads to disappointment during formal application processes when DTI calculations reveal affordability constraints.

Secured vs. Unsecured Lending: Different Evaluation Criteria

The presence or absence of collateral fundamentally transforms how lenders evaluate credit risk, creating distinct approval pathways for secured and unsecured loans. This dichotomy explains why the same consumer might simultaneously qualify for a mortgage but face rejection for a credit card despite both applications being evaluated by the same financial institution.

Collateral significantly alters the weight assigned to credit scores during underwriting. When tangible assets back a loan, lenders can accept lower credit thresholds because they maintain recourse beyond the borrower’s promise to repay. This principle manifests in notable credit score requirement differences—conventional mortgages may approve scores as low as 620, while unsecured personal loans from the same lenders often require minimum scores of 660-680. The gap becomes even more pronounced with FHA and VA loans, which can accommodate scores in the high 500s when accompanied by sufficient down payments. This disparity reflects a fundamental risk calculation: when lenders can reclaim physical assets through foreclosure or repossession, they face reduced overall loss potential even when borrowers default.

While secured loans offer accessibility advantages for credit-challenged borrowers, they still maintain meaningful minimum score requirements that have gradually increased over time. Following the 2008 financial crisis, most auto lenders raised minimum score thresholds for traditional financing, with many now requiring at least 580-600 for approval with reasonable terms. Subprime auto financing remains available for scores below these thresholds but typically requires substantial down payments (20%+) and carries interest rates that may exceed 15-20%. Similarly, secured credit cards—which require cash deposits equal to credit limits—have implemented more stringent approval criteria, with many major issuers now declining applicants with recent bankruptcies or scores below 550 despite the seemingly eliminated risk. These evolving standards reflect lenders’ recognition that extremely low scores indicate fundamental financial management issues that collateral alone cannot fully mitigate.

Unsecured lending places extraordinary emphasis on credit history depth and quality, examining aspects that secured lenders might consider secondary. Credit card issuers and personal loan providers scrutinize the longevity of accounts, payment consistency across all obligations, and utilization patterns that suggest financial stability. Many unsecured lenders implement automatic denial rules for applications showing any charge-offs or collections within 24-36 months, regardless of overall score recovery, viewing these as predictive of future defaults. Additionally, unsecured lenders often place greater importance on income stability, preferring applicants with at least two years in their current employment and consistent or rising income patterns. These stringent criteria explain why consumers rebuilding credit often receive secured loan approvals long before qualifying for unsecured products, despite significant score improvements.

Risk assessment methodologies differ substantially when assets back loans, incorporating collateral valuation alongside borrower creditworthiness. Mortgage lenders employ comprehensive appraisal processes to establish property values, typically limiting loan amounts to 80-97% of appraised value depending on loan program and borrower qualifications. Auto lenders rely on established valuation guides (such as Kelley Blue Book or NADA) to ensure loan amounts align with vehicle values, often restricting loan-to-value ratios for borrowers with lower credit scores. This collateral-focused approach creates approval opportunities even when credit histories show imperfections, provided the underlying asset maintains sufficient value to offset potential losses. The practical outcome is that secured lenders can approve borderline applications that unsecured lenders would automatically reject, knowing they maintain recourse to valuable assets if repayment problems emerge.

Leveraging secured loan options provides strategic advantages when rebuilding damaged credit. Starting with secured credit cards or small secured personal loans establishes positive payment patterns that gradually improve credit scores, creating pathways to increasingly favorable financing options. Auto loans often serve as effective “credit ladders,” with borrowers progressively qualifying for better terms through timely payments and eventual refinancing. Credit unions frequently offer secured credit builder loans specifically designed for rehabilitation purposes, typically featuring modest interest rates and reporting to all three major bureaus. The most effective approach involves using secured products as deliberate stepping stones toward qualifying for unsecured options, recognizing that demonstrating responsible management of collateralized debt rebuilds lender confidence more quickly than other credit improvement strategies.

Compensating Factors: How to Overcome Credit Score Limitations

Beyond credit scores and standard financial metrics, lenders increasingly consider compensating factors that can overcome credit limitations. These alternative evaluation criteria create approval pathways for borrowers who might otherwise face rejection based on conventional standards alone.

Income stability and employment history provide powerful counterbalances to credit concerns, particularly for mortgage and auto lenders. Underwriters evaluate not just current income levels but consistency over time, viewing steady employment as indicative of future payment reliability. Most lenders prefer to see at least two years in the same field, though not necessarily with the same employer. Applicants with growing incomes—particularly those showing consistent advancement within their profession—receive favorable consideration even with moderate credit impairments. This explains why newly promoted professionals sometimes secure approvals despite borderline credit scores, while applicants with similar scores but erratic employment histories face rejection. For self-employed borrowers, demonstrating increasing or stable income through tax returns for 2-3 consecutive years can substantially offset credit limitations, particularly when accompanied by significant cash reserves.

Substantial down payments significantly mitigate credit requirements across virtually all lending categories. This compensating factor works by immediately reducing the lender’s exposure and demonstrating the borrower’s financial commitment and stability. In mortgage lending, down payments of 20% or more can facilitate approvals for borrowers with scores 30-40 points below standard minimums, particularly when accompanied by strong income ratios. Auto lenders similarly adjust credit requirements based on down payment size, with contributions of 30% or more sometimes enabling approvals for borrowers with scores in the low 600s or even high 500s. The underlying principle is straightforward: larger down payments create equity cushions that protect lenders from losses if market values decline, while simultaneously reducing monthly payment obligations for borrowers. This dual benefit makes substantial down payments among the most effective compensating factors for overcoming credit limitations.

Banking relationship advantages create meaningful approval pathways that may override standard credit criteria. Customers with established deposit relationships—particularly those maintaining significant balances or multiple accounts—often receive preferential consideration when applying for loans through their existing financial institutions. Many banks implement relationship-based pricing and approval models that adjust credit requirements based on the customer’s overall portfolio value and history. Some financial institutions offer explicit “relationship banking” programs that provide approval advantages for established customers, including lower interest rates and reduced fee structures. The practical benefit is most pronounced at credit unions and community banks, where relationship-focused lending models create opportunities for personalized evaluation that national lenders typically cannot match. For borrowers with credit challenges, establishing and maintaining robust banking relationships before applying for loans can create approval pathways that would otherwise remain closed.

Explanatory letters addressing past credit issues provide context that automated systems cannot capture. Lenders recognize that credit reports tell what happened but not why, creating opportunities for borrowers to explain extenuating circumstances. Effective explanation letters acknowledge responsibility while concisely describing specific events that caused credit problems—such as medical emergencies, job loss, divorce, or other significant life disruptions. The most compelling letters demonstrate that: (1) the problems resulted from circumstances unlikely to recur, (2) the borrower has taken specific steps to address underlying issues, and (3) recent history shows restored financial stability. While explanation letters rarely overcome severe or recent delinquencies, they frequently tip the scales in borderline cases, particularly during manual underwriting processes. This approach proves especially effective when credit issues stem from isolated events rather than patterns of financial mismanagement.

Alternative data sources increasingly supplement traditional credit information, creating opportunities for borrowers with limited or damaged credit histories. Lenders progressively incorporate rent payment history, utility payments, telecom accounts, and even subscription services to assess financial responsibility. Some financial institutions now utilize cash flow underwriting that examines banking transaction patterns rather than relying exclusively on credit reports. This evolving approach benefits consumers who maintain consistent bill payment habits that traditional credit reporting might not capture. Several specialized lending programs explicitly target “credit invisible” consumers—those with minimal credit histories but demonstrable financial responsibility through alternative channels. For borrowers facing credit challenges, proactively building positive alternative data through services that report rent and utility payments can create approval pathways while simultaneously rebuilding traditional credit scores.

Conclusion: Beyond the Three-Digit Number and Credit Scores Loan Approval

Understanding what truly drives lending decisions empowers you to approach the borrowing process with realistic expectations and strategic preparation. While your credit score remains an important indicator, it’s merely one component in a complex evaluation that includes credit scores loan approval, debt-to-income ratios, employment stability, credit utilization patterns, and relationship factors that often carry equal or greater weight. Different lenders interpret identical credit profiles through distinct lenses, explaining why approval from one institution doesn’t guarantee success with another.

The most successful borrowers recognize that loan approval isn’t determined by a single factor but by the comprehensive financial story their application tells. By focusing on holistic financial health—maintaining reasonable debt levels, establishing banking relationships, making substantial down payments when possible, and addressing credit issues proactively—you can overcome limitations that might otherwise prevent approval. Remember, the three-digit score that receives so much attention isn’t the final verdict on your creditworthiness; it’s just the beginning of a much deeper conversation between you and potential lenders.