Raising a 575 Credit Score: 5 Unexpected Strategies for Success

Statistics on credit scores say that one out of five Americans is aware of their credit scores. Do you have a 575 credit score or below? Do you want to understand the importance of credit scores?

Credit score plays a vital role in your financial life. If you have a poor credit score, applying for loans is a complicated task. Even if you get approved for the loan amount, the interest rates are high with a poor credit score.

575 is a very poor credit score that will hinder your financial benefits. This blog will help you with five crucial ways to improve your credit score from 575.

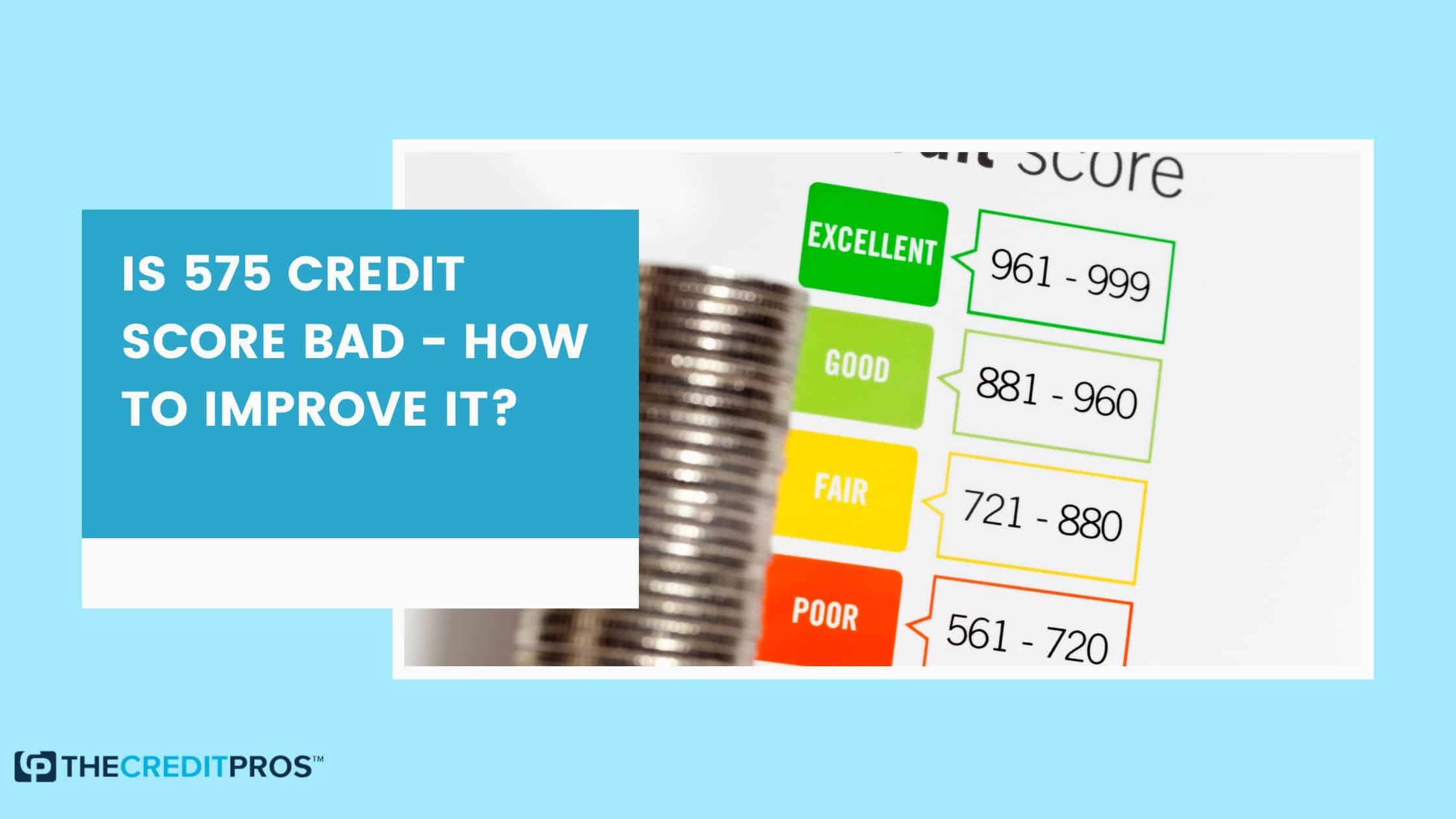

What is a Poor Credit Score?

If your credit score ranges from 300 to 579, it is a poor credit score. Loan lenders are reluctant to lend you the loan amount with these credit scores. For instance, different types of loans such as secured and unsecured loans require credit scores of at least 650.

There are a few instances where you qualify for the loan but you have to pay extra fees and high-interest rates with a 575 credit score.

What are the Impacts of Having a 575 Credit Score?

Apart from not qualifying for the loan amount, there are also several impacts of having a low credit score such as:

- The interest rates will be higher for poor credit scores.

- At times, employers will check your credit history as a background check before offering you a job. If your credit score is high, it will impact your job search.

- While borrowing the loan amount, you should always opt for secured loans such as equity loans which will make your property an asset. There is always a risk of foreclosure, unlike personal loans.

- Qualifying for an emergency fund will become a complicated task. You must go through a complicated qualifying process with a poor credit score.

How to Improve Your 575 Credit Score?

Your credit score will drop to 575 if you make many late and missed payments. Apart from these, there are also many factors that may prevent you from having a higher credit score.

Ideally, if you have a credit score above 700, you can immediately apply for the loans. The qualification process is also easy and flexible. It’s best to understand the five most important ways to improve your credit score from 575 credit score.

1. Don’t Miss Your EMI

Your equated monthly payment (EMI) will affect your credit score greatly. If you are opting for too many EMIs, your credit score will drop gradually.

Nevertheless, if you are paying your EMI bills on time, your credit card score will not drop. Nonpayment and overdue payments can affect your credit score. Generally, if your payment is delayed for 30 days, it will directly affect your credit score. Also, the payment minimum amount as the EMI bill is not a good practice for your credit score.

2. Low Credit Utilization Rate

Credit utilization ratio is how much credit you use divided by your credit balance. Apparently, when your credit utilization ratio is low, your credit score will increase.

Credit card owners should check their credit utilization ratio to increase their credit scores. For instance, if your credit score is more than 30, you should reduce the percentage to get a better percentage.

3. Applying For a New Credit Card

Are you wondering whether applying for a new credit card hurts your credit score? Applying for a new credit card will certainly fluctuate your credit score. At times, your credit score will increase, otherwise, you will see a decrease in your score.

When you transfer your credit balance to the new card, your credit utilization rate will increase, and therefore it will hurt your credit score. Hence, you should use caution while transferring your higher-interest debt to the new card as it decreases your credit score.

4. Enhance Your Payment History

While getting a credit card, you should also understand that the credit score will fluctuate based on your credit history.

The payment history on your credit card also includes missed and late payments. One of the best ways to get the best payment history and boost your credit score is to pay your credit card bills on time. If you are missing your payments consistently, lenders will identify you as a serial defaulter and it will greatly affect your credit score.

5. Low Balance or Zero Balance

If you want to improve your 575 credit score, you should keep your balance low. Keeping a low or zero balance will consistently improve your credit score.

When your credit balance increases more than your borrowing limit, your credit score will drop immediately. In addition to maintaining a low balance, you can also improve your credit score by paying the full balance without repaying it every month.

Frequently Asked Questions

1. Is a 575 credit score low?

Yes, a 575 credit score is low and comes under the range of poor credit score.

2. How to improve a 575 credit score?

There are several efficient ways to improve your poor credit score to the fair range such as not missing payments, not taking EMIs frequently, checking your credit utilization ratio, enhancing your payment history, and keeping a zero or low balance.

3. Will a low balance increase my credit score?

Yes, a low balance or zero balance will increase your credit score gradually.

Related Articles

- How o Boost Your Credit Scores By 100 in 30 days

- 5 Ultimate Factors of Bad Credit Rating

- Line Of Credit For Bad Credit Scores

Summing Up

Having a low credit score will largely impact your financial advantages. When it comes to borrowing loans, your credit score plays a vital role. Many loan lenders are reluctant to lend money to borrowers if their credit score is low. Creditworthiness will build trust while borrowing the loan amounts.

If you are planning to borrow a personal loan for emergency funds, the lenders will check your credit score to qualify you for the loan amount. Therefore, having a good credit score is essential to gain more financial advantages and eliminate struggles. If you have a 575 credit score, you need to improve it immediately. Now that you know the best ways to do that, you can improve your score and get out of the bad range to enjoy the benefits of a good credit score.

TheCreditPros is the cheap credit repair services that also makes sure to offer a quality service. For more details, you may reach them here.