Debt relief can be a lifeline for those feeling overwhelmed by financial obligations. But what exactly does it entail, and how can it make a difference in your life? By exploring various methods such as debt consolidation, debt settlement, credit counseling, and even bankruptcy, this article aims to shed light on practical solutions that can help you manage and reduce your debt. Understanding these options is crucial, as each has its own set of benefits and potential drawbacks.

Are you curious about how these strategies can impact your credit score and overall financial health? This article will guide you through assessing your financial situation, choosing the right debt relief option, and implementing effective strategies. You’ll also discover how improving your credit score and maintaining financial discipline can lead to long-term financial stability. Whether you’re looking to simplify your debt repayment or seeking professional advice, the insights provided here will help you make informed decisions on your journey to financial freedom.

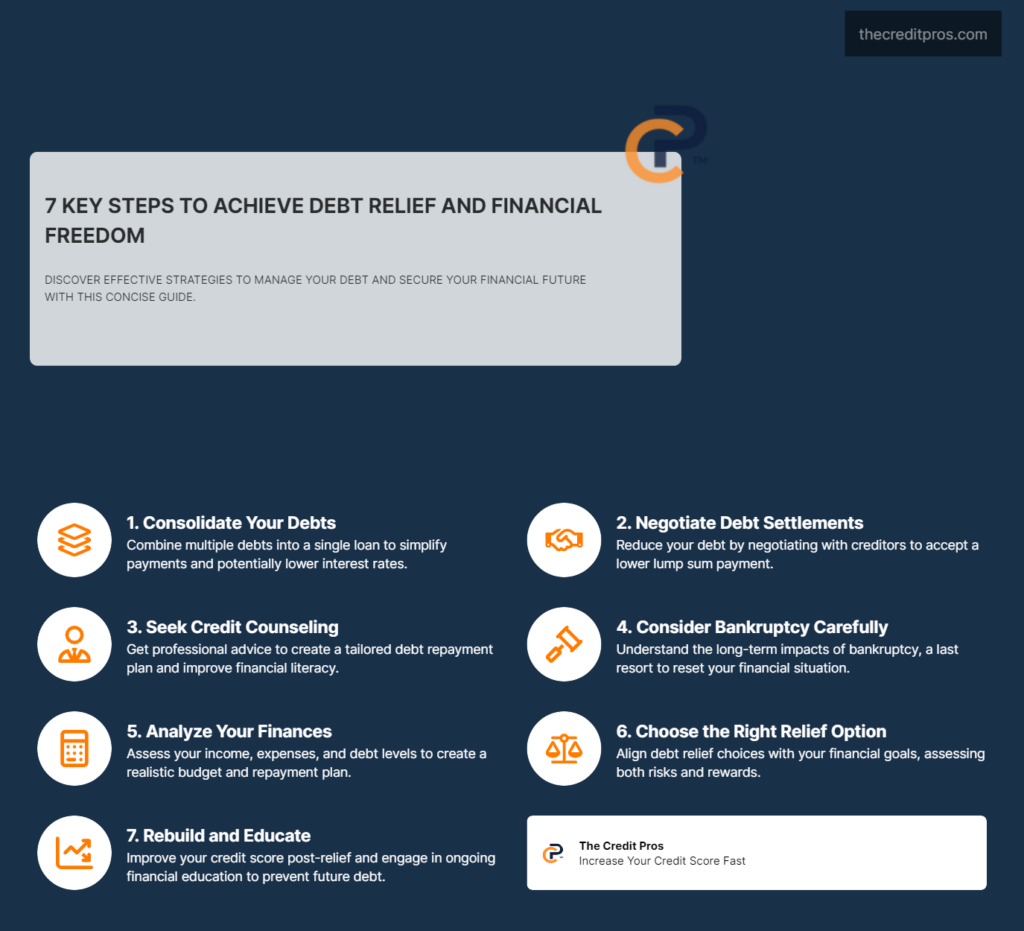

Types of Debt Relief Methods

Debt Consolidation

Debt consolidation is a popular debt relief method that involves combining multiple debts into a single loan. This approach can simplify repayment by reducing the number of monthly payments and potentially lowering the overall interest rate. By consolidating debts, individuals can streamline their financial obligations, making it easier to manage their payments and avoid missing due dates.

One of the primary benefits of debt consolidation is the potential for a lower interest rate. If you have high-interest credit card debt, consolidating it into a loan with a lower interest rate can save you money over time. Additionally, having a single payment can reduce the stress and confusion associated with managing multiple debts. However, it’s essential to ensure that the new loan terms are favorable and that the consolidation doesn’t extend the repayment period excessively, which could result in paying more interest in the long run.

Debt Settlement

Debt settlement involves negotiating with creditors to reduce the total amount owed. This method can be particularly beneficial for individuals who are struggling to make their minimum payments and are at risk of defaulting on their debts. By reaching a settlement, creditors agree to accept a lump sum payment that is less than the full amount owed, providing immediate relief to the borrower.

While debt settlement can significantly reduce the amount of debt, it can also have a negative impact on your credit score. Settling a debt for less than the full amount may be reported to credit bureaus, which can lower your credit score and remain on your credit report for several years. It’s crucial to weigh the pros and cons of debt settlement and consider seeking professional advice to navigate the negotiation process effectively.

Credit Counseling

Credit counseling provides individuals with professional guidance to create a manageable debt repayment plan. Credit counselors work with clients to assess their financial situation, develop a budget, and negotiate with creditors to establish a repayment plan that fits their needs. This method can be particularly helpful for those who need assistance in organizing their finances and creating a sustainable plan to pay off their debts.

Credit counseling agencies often offer educational resources and tools to help individuals improve their financial literacy and avoid future debt problems. While credit counseling can be a valuable resource, it’s essential to choose a reputable agency that is accredited and has a track record of success. Working with a credit counselor can provide the support and structure needed to regain control of your financial health.

Bankruptcy

Bankruptcy is often considered a last resort for individuals who are unable to repay their debts. There are different types of bankruptcy, such as Chapter 7 and Chapter 13, each with its own set of rules and implications. Chapter 7 bankruptcy involves liquidating assets to pay off debts, while Chapter 13 allows for a repayment plan over several years.

Filing for bankruptcy can provide immediate relief from debt collection efforts and legal actions, but it also has long-term consequences. Bankruptcy can significantly impact your credit score and remain on your credit report for up to ten years. It’s crucial to understand the implications of bankruptcy and seek legal advice to determine if it is the right option for your situation.

Assessing Your Financial Situation

Evaluating Debt Levels

Understanding your total debt is the first step in assessing your financial situation. Begin by listing all your debts, including credit cards, loans, and any other obligations. Calculate the total amount owed, the interest rates, and the minimum monthly payments for each debt. This comprehensive overview will help you understand the magnitude of your debt and identify which debts are the most urgent to address.

Income vs. Expenses Analysis

Analyzing your income and expenses is crucial to determine your repayment capacity. Start by calculating your monthly income from all sources, including salary, bonuses, and any other earnings. Next, list all your monthly expenses, such as rent, utilities, groceries, transportation, and discretionary spending. Subtract your total expenses from your total income to identify any surplus or deficit.

By understanding your cash flow, you can identify areas where you can cut back on expenses and allocate more funds towards debt repayment. Creating a budget can help you manage your finances more effectively and ensure that you are living within your means.

Credit Score Impact

Different debt relief methods can have varying impacts on your credit score. For example, debt consolidation may have a minimal impact if managed correctly, while debt settlement and bankruptcy can significantly lower your credit score. It’s essential to understand how each method affects your credit and what to expect during the process.

Monitoring your credit score regularly can help you track the impact of your debt relief efforts and identify any discrepancies or errors on your credit report. By staying informed about your credit score, you can take proactive steps to improve it over time.

Choosing the Right Debt Relief Option

Personal Financial Goals

Aligning your debt relief choices with your personal financial goals is essential for long-term success. Consider what you hope to achieve through debt relief, whether it’s becoming debt-free, improving your credit score, or reducing financial stress. Your goals will guide your decision-making process and help you choose the most suitable debt relief method.

Risk and Reward Assessment

Evaluating the pros and cons of each debt relief method is crucial to making an informed decision. Consider the potential benefits, such as reduced debt and lower interest rates, as well as the risks, such as credit score impact and potential fees. By weighing the risks and rewards, you can choose a method that aligns with your financial situation and goals.

Professional Advice

Consulting with financial advisors or credit counselors can provide valuable insights and guidance. These professionals can help you understand the nuances of each debt relief option and develop a personalized plan that fits your needs. Seeking professional advice can also help you avoid common pitfalls and make informed decisions.

Implementing Debt Relief Strategies

Creating a Repayment Plan

Setting up a realistic and effective debt repayment plan is crucial for success. Start by prioritizing your debts based on interest rates and urgency. Allocate more funds towards high-interest debts while making minimum payments on others. Consider using the snowball or avalanche method to pay off debts systematically.

- Snowball Method: Focus on paying off the smallest debts first while making minimum payments on larger debts. Once a small debt is paid off, move to the next smallest debt.

- Avalanche Method: Focus on paying off debts with the highest interest rates first while making minimum payments on lower-interest debts. This method can save you more money on interest over time.

Negotiating with Creditors

Approaching creditors for settlements or better terms can be challenging but rewarding. Be prepared to explain your financial situation and provide documentation to support your request. Negotiating lower interest rates, reduced balances, or extended repayment terms can provide immediate relief and make your debt more manageable.

Monitoring Progress

Tracking your repayment progress is essential to stay on course. Regularly review your budget, adjust your repayment plan as needed, and celebrate small victories along the way. Monitoring your progress can help you stay motivated and ensure that you are making steady strides towards financial freedom.

Long-Term Financial Health

Rebuilding Credit

Improving your credit score post-debt relief requires consistent effort and discipline. Focus on making timely payments, reducing credit card balances, and avoiding new debt. Consider using secured credit cards or becoming an authorized user on someone else’s account to rebuild your credit history.

Financial Education

Ongoing financial education is vital to prevent future debt issues. Take advantage of resources such as workshops, online courses, and financial literacy programs to enhance your understanding of personal finance. Educating yourself about budgeting, saving, and investing can empower you to make informed financial decisions.

Maintaining Financial Discipline

Maintaining financial discipline is key to sustained financial health. Create a budget, set financial goals, and track your spending to ensure that you are living within your means. Building an emergency fund can provide a safety net and prevent you from falling back into debt during unexpected financial challenges.

By implementing these strategies and maintaining a disciplined approach to your finances, you can achieve long-term financial stability and enjoy the benefits of a debt-free life.

Conclusion: Navigating Your Path to Financial Freedom

Debt relief offers a range of strategies to help you manage and reduce your financial obligations, from debt consolidation and settlement to credit counseling and bankruptcy. Each method comes with its own set of benefits and potential drawbacks, making it crucial to assess your financial situation and choose the right option for your needs. By understanding the impact on your credit score and overall financial health, you can make informed decisions that align with your personal financial goals.

Achieving long-term financial stability requires addressing your current debt and involves rebuilding your credit, continuing financial education, and maintaining disciplined financial habits. As you navigate your journey to financial freedom, remember that the choices you make today can pave the way for a more secure and prosperous future. Isn’t it time to take control of your financial destiny and embrace the possibilities that lie ahead?