Choosing between secured vs unsecured loans might be the most important decision you make when borrowing money. These two loan types differ fundamentally in how they work, what they require from you, and ultimately what they cost. While one demands collateral that backs your promise to repay, the other relies primarily on your credit history and financial standing. Understanding secured vs unsecured loans and these differences isn’t just academic—it directly impacts your financial flexibility, the interest rates you’ll pay, and even your ability to qualify for the loan amount you need. Always remember the differences when evaluating secured vs unsecured loans.

What factors should you consider when deciding which loan type fits your situation? The answer depends on your credit score, the loan amount you’re seeking, and your comfort level with risk. In the following sections, we’ll examine how collateral requirements affect everything from interest rates to approval odds, why lenders view secured vs unsecured loans differently, and how to determine which option makes the most sense for your specific financial circumstances. The right choice could save you thousands of dollars over the life of your loan.

As we delve deeper into secured vs unsecured loans, it’s essential to highlight the pros and cons of each, ensuring you have a comprehensive understanding.

When considering secured vs unsecured loans, it’s crucial to weigh the implications of each option carefully.

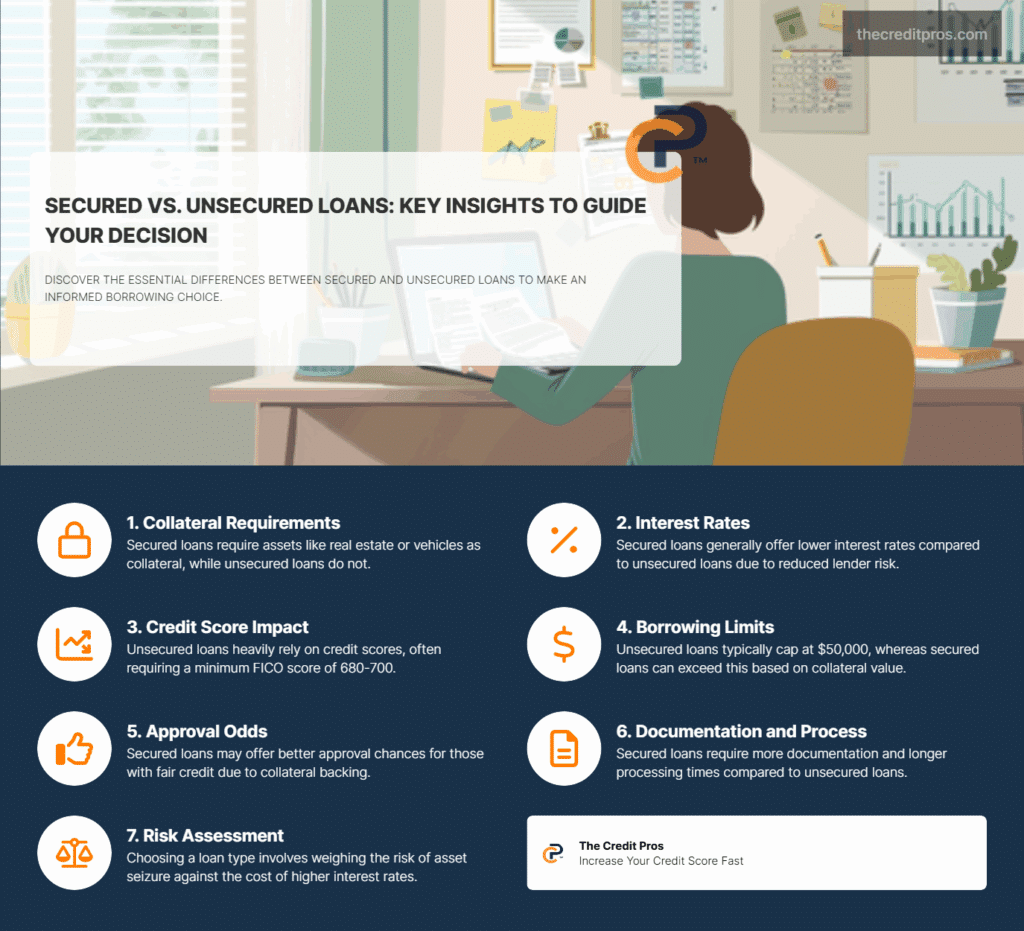

The Fundamental Difference: Collateral Requirements

Understanding secured vs unsecured loans can help you make the right borrowing decision for your financial needs.

When considering secured vs unsecured loans, it’s important to understand how collateral influences interest rates.

The implications of secured vs unsecured loans extend not only to personal finances but also to overall economic conditions.

This understanding becomes crucial when assessing the risks tied to secured vs unsecured loans.

Secured loans operate on a foundational principle that distinguishes them from all other borrowing options: they require collateral. Collateral represents specific assets that borrowers pledge to the lender as security for the loan amount. These assets typically hold substantial value and can include real estate properties, vehicles, investment accounts, certificates of deposit, or other valuable possessions. The critical function of collateral is to provide the lender with a tangible form of security that can be liquidated if the borrower defaults on their payment obligations. This arrangement creates a direct link between a physical asset and the borrowed funds, essentially converting an abstract financial agreement into one backed by concrete value. Understanding secured vs unsecured loans is crucial for making informed borrowing decisions.

When evaluating secured vs unsecured loans, many borrowers focus on their long-term financial health.

For example, a good grasp of secured vs unsecured loans can help you avoid pitfalls in your financial journey.

By understanding secured vs unsecured loans, you can enhance your borrowing strategies.

Understanding secured vs unsecured loans helps you compare your options effectively.

For many borrowers, the choice between secured vs unsecured loans hinges on their personal financial strategy.

The mechanics of collateral seizure deserve careful consideration by potential borrowers. When a secured loan goes into default, lenders have the legal right to initiate foreclosure or repossession proceedings to take ownership of the pledged asset. This process varies based on the type of collateral and relevant state laws, but generally follows established procedures that protect both parties’ interests while prioritizing the lender’s right to recover their investment. For instance, home equity loans secured by residential property typically require formal foreclosure proceedings that include notification periods and opportunities for the borrower to cure the default, whereas vehicle loans might allow for more immediate repossession actions.

Evaluating secured vs unsecured loans involves looking at your credit history and understanding the risk associated with each option.

Unsecured loans present a stark contrast by operating without any collateral requirements. Instead of relying on physical assets, these lending arrangements depend entirely on the borrower’s creditworthiness, income stability, and promise to repay. This fundamental difference shifts the entire risk equation of the lending relationship. Without collateral to seize in case of default, lenders must rely on legal remedies like collections processes, potential lawsuits, or debt sales to third-party collectors to recover unpaid balances. The absence of collateral creates a significantly different liability structure for borrowers – while their credit standing faces severe damage from default, their personal assets remain protected from direct seizure related to the loan agreement itself.

The collateral requirement fundamentally alters how lenders approach risk assessment. For secured loans, the evaluation process focuses heavily on the value, condition, and liquidity of the proposed collateral. Lenders typically conduct formal appraisals or valuations to ensure the asset provides sufficient coverage for the loan amount, often requiring loan-to-value ratios below certain thresholds (commonly 80% for mortgage loans). This asset-centered approach allows lenders to extend credit with greater confidence since they maintain a claim on specific property that can offset potential losses. The presence of valuable collateral essentially transforms the lending calculus from one based primarily on borrower characteristics to one that balances borrower qualifications with asset security.

Risk Assessment and Credit Score Implications

Credit scores take on heightened significance when applying for unsecured loans, serving as the primary risk assessment tool for lenders evaluating these applications. Without collateral to offset potential losses, lenders scrutinize credit histories with exceptional rigor, looking for patterns of responsible financial management and consistent repayment behavior. Unsecured loans require excellent or good credit scores since the lender is appraising risk primarily on the borrower’s credit. This requirement typically translates to minimum FICO scores of 680-700 for consideration, with the most favorable terms reserved for applicants scoring above 740. The credit score becomes not just a qualification threshold but a determinative factor in approval decisions, interest rate offers, and maximum loan amounts.

Beyond the simple numeric score, lenders evaluating unsecured loan applications conduct comprehensive analyses of credit reports, examining factors that provide deeper insights into repayment probability. These assessments typically include:

- Debt-to-income ratios, measuring existing financial obligations against income

- Length of credit history, indicating experience managing credit relationships

- Recent credit inquiries, suggesting potential new debt obligations

- Payment history patterns, especially regarding consistency and timeliness

- Credit utilization percentages, showing how aggressively existing credit is being used

- Presence of negative marks like collections, charge-offs, or bankruptcies

Secured loans offer a significantly different pathway for borrowers with imperfect credit histories. The presence of collateral fundamentally alters the risk equation, allowing lenders to extend credit to applicants who might otherwise be rejected for unsecured products. This accessibility stems from the lender’s ability to recover losses through asset liquidation rather than depending solely on the borrower’s voluntary repayment. While credit scores remain relevant in secured lending decisions, they often serve more to determine interest rates and terms rather than outright eligibility. Many secured loan products establish minimum credit thresholds 50-100 points lower than their unsecured counterparts, creating borrowing opportunities for those with fair or rebuilding credit profiles.

The relationship between credit requirements and loan approval probabilities creates distinct demographic patterns among borrowers. Unsecured loans tend to serve those with established credit histories and higher income levels, while secured options often become the primary financing vehicle for borrowers with limited credit experience, previous financial challenges, or lower income levels. This differentiation extends beyond simple approval odds to impact fundamental aspects of the borrowing experience. Applicants with excellent credit might receive instant approvals for unsecured loans with minimal documentation requirements, while those pursuing secured options often navigate more complex processes involving asset verification, title searches, and potential appraisals – creating significantly different customer journeys based on the loan type and the borrower’s credit profile.

Interest Rate Structures and Cost Comparison

The interest rate disparities between secured and unsecured loans stem directly from their fundamentally different risk profiles. Unsecured loans are not backed by collateral, making them riskier for lenders. As a result, these loans typically come with higher interest rates – often 2-5 percentage points above comparable secured options. This premium represents the lender’s compensation for accepting increased default risk without the safety net of collateral. The interest rate structure for unsecured products typically incorporates risk-based pricing models that create substantial rate variations based on credit score tiers. A borrower with excellent credit might secure rates in the 7-10% range, while someone with good-but-not-excellent credit could face rates of 15-18% for the same loan amount and term.

Secured loans are considered lower risk than unsecured lending. Consequently, these loans typically have a lower interest rate than an unsecured counterpart. This rate advantage derives from the lender’s ability to recover principal through collateral liquidation, reducing potential loss severity even if default occurs. The collateral itself effectively subsidizes the cost of borrowing by absorbing a portion of the lender’s risk exposure. This security allows lenders to offer more aggressive pricing while maintaining profitability targets. The interest rate benefit becomes particularly pronounced for secured loans backed by high-quality collateral with stable values and established liquidation channels – such as residential real estate or new vehicles – where lenders can predict recovery amounts with greater confidence.

The compounding effect of interest rate differences creates substantial long-term financial implications that many borrowers fail to fully appreciate during the loan selection process. Even modest rate disparities generate significant cost variations over multi-year repayment periods. For example, a $25,000 loan with a five-year term at 8% (secured) versus 12% (unsecured) produces a total interest cost difference exceeding $2,800 – more than 11% of the original principal amount. This calculation becomes even more dramatic when comparing longer-term products like home equity loans against unsecured personal loans, where the secured option might save borrowers tens of thousands in interest over a 15-20 year period.

The nuances of secured vs unsecured loans can greatly affect your financial future.

If you’re unsure which to choose, understanding secured vs unsecured loans will guide you.

Interest rate structures also diverge in their stability characteristics based on loan type. Secured loans, particularly those backed by real estate, frequently offer fixed-rate options with consistent payments throughout the entire loan term. This predictability allows borrowers to budget with confidence, knowing their obligation remains unchanged regardless of broader economic conditions. Conversely, many unsecured loan products feature variable rates tied to market indexes, creating potential payment volatility if interest rates rise substantially. The combination of higher starting rates and greater potential for increases creates a double financial risk for unsecured borrowers – paying more initially while also bearing greater exposure to future rate movements.

Loan Amount Considerations and Accessibility

Unsecured loans operate within distinct amount parameters that reflect their collateral-free nature and the lender’s risk tolerance. Unsecured loans are commonly for smaller amounts than secured loans, often ranging from $10,000 to $50,000. This ceiling exists because lenders must limit their exposure on loans backed solely by the borrower’s promise to repay. The upper boundaries typically correlate with income levels and credit quality, with lenders establishing maximum debt-to-income ratios that effectively cap borrowing potential. Even borrowers with exceptional credit profiles rarely qualify for unsecured amounts exceeding $100,000 from mainstream lenders, as the risk concentration becomes prohibitive beyond certain thresholds. This limitation makes unsecured options less viable for major expenses like home purchases or comprehensive business expansions.

Recognizing the differences between secured vs unsecured loans is essential for your financial health.

In summary, secured vs unsecured loans present different advantages based on your financial situation and risk tolerance.

Ultimately, the choice between secured vs unsecured loans requires careful consideration of your circumstances.

Secured loans enable significantly higher borrowing capacity by leveraging asset values rather than relying exclusively on income metrics. Mortgage loans routinely reach hundreds of thousands or even millions of dollars because the underlying real estate provides proportional security. Similarly, commercial equipment loans can finance seven-figure purchases when the equipment itself serves as collateral. This expanded borrowing power creates access to capital that would otherwise remain unavailable through unsecured channels. The direct relationship between collateral value and borrowing capacity allows secured loans to scale with asset prices, creating natural alignment between loan amounts and the underlying security’s worth.

In essence, your choice between secured vs unsecured loans reflects your financial priorities.

Loan purpose frequently dictates the appropriate loan type, creating natural alignment between borrowing needs and collateral requirements. Major asset purchases inherently lend themselves to secured financing, as the acquired item provides built-in collateral that simplifies the security arrangement. Mortgage loans, auto loans, and equipment financing exemplify this pattern, offering streamlined processes where the purchased asset simultaneously serves as loan collateral. Conversely, funding needs without associated tangible assets – such as debt consolidation, medical expenses, or wedding costs – naturally gravitate toward unsecured options. This purpose-based segmentation creates distinct markets for each loan type, with secured loans dominating asset acquisition financing while unsecured products serve discretionary spending and intangible needs.

The decision on secured vs unsecured loans hinges on understanding your financial landscape.

Accessibility factors beyond credit scores create additional differentiation between secured and unsecured lending landscapes. Documentation requirements typically intensify for secured loans, requiring property records, title searches, insurance verification, and sometimes formal appraisals – creating potential barriers for borrowers with limited financial documentation or complex asset situations. Processing timelines also diverge significantly, with many unsecured loans offering same-day funding while secured options frequently require weeks for completion. These practical considerations often influence borrower decisions as much as financial factors, particularly when funding needs carry time sensitivity. The combination of amount limitations, purpose alignment, and process requirements creates a multidimensional decision matrix that extends well beyond simple interest rate comparisons when selecting between secured and unsecured borrowing options.

Making Your Final Choice: Secured vs. Unsecured

Choosing between secured and unsecured loans ultimately comes down to balancing risk, reward, and your specific financial situation. Secured loans offer lower interest rates and higher borrowing limits but require you to pledge valuable assets that could be seized if you default. Unsecured loans provide freedom from collateral requirements but demand stronger credit profiles and typically come with higher costs. Your decision should reflect both immediate needs (loan amount, approval likelihood) and long-term considerations (interest costs, asset protection).

Ultimately, understanding the nuances of secured vs unsecured loans will empower you to make informed decisions.

The loan type that best serves you isn’t just about what you can qualify for—it’s about what aligns with your financial goals and risk tolerance. A secured loan might save you thousands in interest, but are you comfortable putting your home or vehicle on the line? An unsecured loan provides peace of mind that your assets remain protected, but at what premium? The most expensive loan isn’t always the one with the highest interest rate—it’s the one that doesn’t fit your unique financial journey.