Credit repair apps promise to fix your credit score with just a few taps on your smartphone, but the reality behind these digital solutions is far more complex than their marketing suggests. Millions of Americans have downloaded these apps hoping for quick fixes to damaged credit, yet many find themselves questioning whether the monthly fees and automated processes actually deliver meaningful results. While some users see genuine improvements, others discover that their specific credit challenges require more than what an algorithm can provide.

The appeal is obvious – who wouldn’t want to improve their credit score from the comfort of their couch? But before you hand over your financial data and commit to another monthly subscription, you need to understand what these apps can realistically accomplish and where they fall short. The truth about their effectiveness, hidden costs, and potential privacy risks might surprise you. Your credit score affects everything from mortgage rates to job opportunities, so making the right choice about repair methods could save you thousands of dollars and months of frustration. In this credit repair app review, we will explore the various features and limitations of these tools, helping you make an informed decision.

Each credit repair app review helps users identify the best option for their specific needs. In this credit repair app review, we will discuss the pros and cons of various applications available. Additionally, this credit repair app review highlights the convenience of using these tools for everyday consumers. Through this credit repair app review, users can grasp the efficiency of real-time monitoring. This credit repair app review emphasizes user accessibility and interface design improvements. As noted in this credit repair app review, the limitations of automated systems are significant. One critical aspect of any credit repair app review is the understanding of monitoring capabilities.

This credit repair app review aims to provide insights into how these tools function. This particular credit repair app review addresses the subscription models users should consider. A thorough credit repair app review will also reveal hidden fees that may arise. This credit repair app review showcases how freemium models can mislead users. Users should refer to this credit repair app review to determine their eligibility for these services. It’s crucial to understand the data-backed findings in this credit repair app review. The effectiveness of these tools is a focal point in the credit repair app review. The statistics shared within this credit repair app review underline success rates for various corrections. This credit repair app review highlights the importance of human expertise for complex disputes. In this credit repair app review, we see how the timeline for results can vary widely.

The Automated Advantage: How Apps Streamline Credit Repair Processes

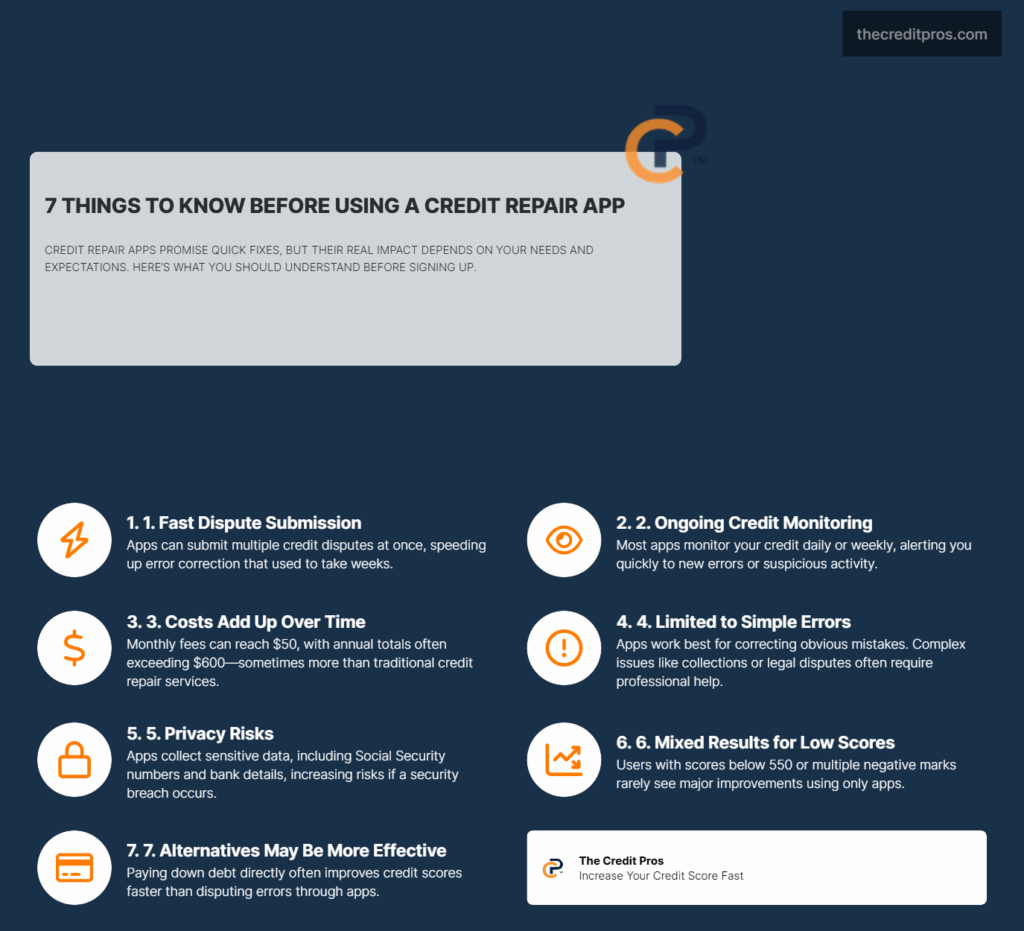

This credit repair app review serves as a reminder that legitimate marks cannot be removed. Understanding the limitations of these applications is essential, as per this credit repair app review. Credit repair apps have revolutionized the speed at which consumers can initiate disputes and monitor their credit profiles. Traditional credit repair methods often require weeks or months to process a single dispute letter, while apps can submit multiple disputes simultaneously within minutes of identifying errors. The automated systems can process disputes 24 hours a day, seven days a week, eliminating the delays associated with business hours and postal mail delivery times.

The continuous monitoring capabilities of these apps represent a significant advancement over manual credit checking methods. Most apps refresh credit reports daily or weekly, immediately flagging new errors, unauthorized accounts, or suspicious activity that might impact your score. This real-time surveillance allows users to address problems before they compound, potentially preventing significant credit damage that could take years to repair through traditional means.

User interface design in credit repair apps removes many psychological barriers that prevent people from addressing their credit issues. The dashboard presentations transform complex credit reports into digestible visual elements, using color coding and progress bars to make credit improvement feel achievable rather than overwhelming. However, this gamification approach can create a false sense of progress when users see activity without understanding the underlying complexity of credit disputes.

The automation process reveals critical limitations that app marketing rarely addresses. While apps excel at identifying obvious errors like incorrect account balances or duplicate entries, they struggle with nuanced disputes that require human judgment and personalized documentation. According to Consumer Reports research, 44 percent of people who could access their credit reports found at least one error, indicating significant opportunities for automated correction systems.

Apps typically offer surface-level monitoring that focuses on score changes and basic error detection, but they lack the comprehensive analysis that experienced credit professionals provide. The automated systems cannot assess the strategic timing of disputes, understand the relationships between different credit factors, or develop personalized action plans that address your specific financial situation and goals.

The Cost-Benefit Reality: Financial Implications Beyond Monthly Fees

The subscription model structure of credit repair apps creates long-term financial commitments that can exceed the cost of traditional credit repair services. Monthly fees typically range from $15 to $50, accumulating to $180 to $600 annually, while many users require 12 to 24 months to see meaningful results. This extended timeline means total costs can reach $1,200 or more, often surpassing the fees charged by full-service credit repair companies.

Hidden fee structures within credit repair apps frequently catch users off guard through premium feature upgrades, identity monitoring add-ons, and credit score access charges. Many apps advertise low introductory rates but automatically escalate to higher-tier pricing after trial periods, while others charge separately for features like credit report access from all three bureaus or detailed dispute tracking. These additional costs can double or triple the advertised monthly fees.

The freemium trap operates by offering basic credit monitoring for free while restricting essential dispute functions to paid tiers. Users invest time learning the platform and building their credit profile within the app, creating switching costs that make them reluctant to leave when upgrade pressures begin. The psychological investment in progress tracking and dashboard familiarity often leads to continued payments even when results plateau.

This credit repair app review also touches on the importance of data privacy. In the context of this credit repair app review, data security concerns are paramount. As discussed in this credit repair app review, the standards for data protection can vary. Return on investment calculations reveal that credit repair apps provide value primarily for users with minor credit errors and scores above 600. For individuals with multiple complex issues or scores below 550, the extended timeline and limited dispute capabilities often result in minimal score improvements relative to the ongoing costs. The opportunity cost becomes significant when monthly app fees could be applied directly to debt reduction, which typically provides faster credit score improvements.

This credit repair app review also covers the implications of sharing your data with third parties. The risks highlighted in this credit repair app review can lead to significant consequences for users. The comparative analysis shows that investing app subscription fees into paying down credit card balances often yields better credit score improvements per dollar spent. A $30 monthly app fee applied to credit card debt reduction can lower credit utilization ratios, providing immediate score benefits that automated disputes cannot match. This direct approach addresses the root cause of credit problems rather than focusing solely on report errors. In conclusion, this credit repair app review provides a well-rounded view of the options available.

Effectiveness Under the Microscope: What Apps Can and Cannot Achieve

Dispute success rates for credit repair apps vary dramatically based on the type of error being challenged. Apps demonstrate highest effectiveness with clear factual errors like incorrect account balances, wrong payment dates, or accounts that should have been removed due to age. These straightforward disputes typically see success rates between 60% and 80% because they require minimal documentation and clear evidence.

However, automated dispute systems struggle with complex scenarios that require detailed explanations, supporting documentation, or legal arguments. Disputes involving medical debt, student loan rehabilitation, or creditor settlement agreements often require human expertise to craft persuasive letters and gather appropriate evidence. Apps cannot replicate the relationship-building and negotiation skills that experienced credit professionals use to resolve challenging cases.

The timeline for meaningful credit score improvements through apps extends much longer than marketing materials suggest. While users may see initial score increases within 30 to 60 days from removing obvious errors, comprehensive credit repair typically requires 6 to 18 months of consistent effort. Apps cannot accelerate this timeline because credit scoring models need time to reflect positive changes and creditors have legally mandated response periods for dispute investigations.

Credit repair apps excel at removing inaccurate information but cannot address legitimate negative marks that accurately reflect past financial behavior. Late payments, collections, bankruptcies, and foreclosures that are correctly reported will remain on credit reports regardless of app intervention. As Andrew Smith, director of the Federal Trade Commission’s Bureau of Consumer Protection notes, “A good credit score can help you buy a home, get a business loan or finance an education,” but this requires addressing legitimate credit issues through proper financial management rather than disputing accurate information.

The psychological impact of unrealistic expectations often leads to user frustration and abandonment of credit improvement efforts. App marketing frequently emphasizes dramatic score improvements and rapid results, but the reality involves gradual progress with potential setbacks. Users who expect quick fixes may become discouraged when facing the normal ups and downs of credit repair, leading them to abandon beneficial long-term strategies.

Key limitations of automated credit repair include:

For those considering credit repair apps, this credit repair app review will be invaluable in assessing their choices.

- Inability to handle complex disputes requiring documentation

- No access to creditor relationships or negotiation capabilities

- Limited effectiveness with legitimate negative marks

- Cannot provide personalized financial planning advice

- Restricted ability to time disputes strategically

- No human oversight of dispute quality or accuracy

“While credit repair services can provide assistance, it comes at a cost and they can’t promise measurable results. Ultimately, aim to choose the solution that best aligns with your financial goals.” – Credit repair industry analysis

Privacy and Security Concerns: Your Financial Data in Digital Hands

Credit repair apps require extensive access to your most sensitive financial information, including Social Security numbers, bank account details, credit reports, and transaction histories. This data aggregation creates comprehensive profiles that extend far beyond what traditional credit repair services typically collect. The digital nature of this information makes it vulnerable to breaches, unauthorized access, and potential misuse by third parties.

Data protection standards vary significantly among credit repair apps, with some maintaining bank-level encryption and security protocols while others operate with minimal protection measures. The regulatory landscape for financial apps remains fragmented, with some companies falling under strict financial services regulations while others operate in less regulated spaces. This inconsistency creates varying levels of consumer protection depending on which app you choose.

Third-party data sharing practices represent a significant concern that many users overlook when agreeing to app terms of service. Credit repair apps often partner with financial institutions, marketing companies, and data brokers to monetize user information beyond subscription fees. Your credit improvement journey becomes a data product that generates ongoing revenue streams for app companies through targeted advertising and financial product recommendations.

The trade-off between convenience and privacy becomes particularly stark when considering the long-term implications of data sharing. While apps provide immediate access to credit information and dispute tools, users surrender control over how their financial data is used, shared, and stored indefinitely. This information can influence everything from insurance rates to employment opportunities, extending the impact far beyond credit repair activities.

Security breach implications for credit repair app users can be devastating due to the comprehensive nature of stored financial information. Unlike breaches of retail or social media accounts, compromised credit repair app data provides criminals with everything needed for identity theft and financial fraud. The centralized storage of multiple users’ complete financial profiles creates high-value targets for cybercriminals.

Data aggregation by credit repair apps can impact your credit profile in unexpected ways through automated account linking and financial behavior analysis. Some apps use artificial intelligence to analyze spending patterns and financial decisions, potentially sharing these insights with partners or using them to influence credit recommendations. This analysis can create digital footprints that affect your financial reputation beyond your actual credit reports.

Making the Strategic Choice: When Apps Work and When They Don’t

Credit repair apps provide genuine value for specific user profiles with particular credit challenges and financial situations. Users with credit scores between 600 and 700 who have identifiable errors on their reports often see meaningful improvements through automated dispute processes. These individuals typically have stable financial situations with minor credit issues that don’t require complex resolution strategies.

The ideal candidates for credit repair apps are financially literate consumers who understand credit scoring basics and can realistically assess their credit situations. These users can effectively utilize app features without falling into the trap of unrealistic expectations or unnecessary premium upgrades. They typically have the patience for gradual improvement and the financial stability to maintain consistent payments while working on credit repair.

Red flag situations that indicate professional intervention is necessary include multiple bankruptcies, ongoing collections activity, identity theft recovery, or complex debt settlement scenarios. Users facing foreclosure, student loan default, or business credit issues require specialized expertise that automated systems cannot provide. These situations often involve legal considerations and creditor negotiations that demand human intervention and professional experience.

Credit score thresholds play a crucial role in determining app effectiveness, with users below 550 often requiring more intensive intervention than apps can provide. At this level, credit problems typically involve multiple serious delinquencies, collections, or public records that need strategic handling beyond automated disputes. The complexity of rebuilding severely damaged credit requires personalized planning that considers individual financial circumstances and goals.

Timing considerations significantly impact app effectiveness, with certain points in your credit journey being more suitable for automated assistance than others. Apps work best during stable financial periods when you can focus on report accuracy rather than addressing ongoing financial crises. Users experiencing active financial distress, recent major life changes, or immediate credit needs for major purchases often require more comprehensive assistance than apps provide.

The strategic integration of credit repair apps with other credit improvement methods can maximize results for users who understand their limitations. Combining app-based dispute processes with debt reduction strategies, secured credit card usage, and financial education creates a comprehensive approach to credit improvement. This integrated strategy addresses both credit report accuracy and underlying financial behaviors that impact long-term credit health.

The Bottom Line: Making an Informed Credit Repair Decision

Credit repair apps offer genuine convenience and value for users with minor credit errors and stable financial situations, but they’re not the universal solution their marketing promises. While automated dispute processes can effectively handle straightforward inaccuracies and provide valuable credit monitoring, they fall short when dealing with complex credit challenges that require human expertise, strategic timing, and personalized approaches. The monthly subscription costs can quickly add up, often exceeding traditional credit repair services without delivering proportional results for users with severely damaged credit.

Your credit score impacts too many aspects of your financial life to leave improvement efforts to chance or incomplete solutions. The choice between credit repair apps and professional services shouldn’t be based on convenience alone – it requires honest assessment of your credit situation’s complexity, your financial literacy level, and your timeline for results. Apps work best as tools for financially savvy consumers with minor issues, while complex situations demand professional intervention. Remember, the most expensive credit repair option isn’t necessarily the app that fails to deliver results – it’s the months or years of lost opportunities while your credit remains damaged.