Your credit report isn’t just a document—it’s the financial story that banks, employers, and landlords read before making decisions about you. This three-bureau narrative follows you through life’s biggest moments, from buying a home to starting a new job, often determining whether doors open or close. While most people focus solely on their credit score, the underlying report data, including accurate credit reports, is what truly matters, as even small errors in your accurate credit reports can cost thousands in higher interest rates or lead to unexpected application denials.

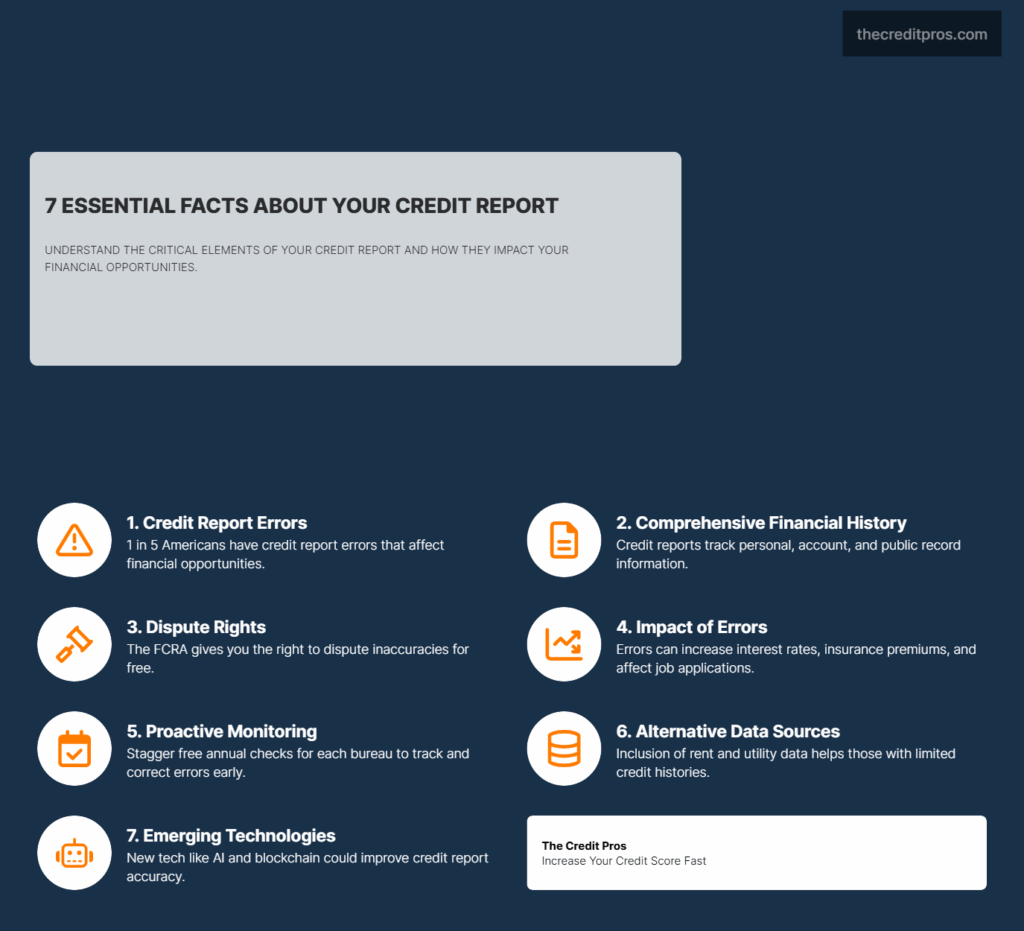

What happens when this crucial financial identity contains mistakes? Nearly one in five Americans have errors on their credit reports serious enough to affect their financial opportunities. Understanding what information appears on your report, how long it stays there, and your legal rights to dispute inaccuracies puts you in control of your financial narrative. The difference between accepting your report as-is versus actively monitoring its accuracy can significantly impact your financial options for years to come.

Ensuring you have accurate credit reports is crucial for your financial stability. Regular checks help identify discrepancies that could hinder your opportunities.

Regularly reviewing your accurate credit reports can help you catch errors early and maintain a healthy financial profile, ensuring that your accurate credit reports reflect your true financial standing.

The Anatomy of a Credit Report: What’s Really Being Tracked

Understanding Accurate Credit Reports

Accurate credit reports can significantly improve your chances of loan approval and favorable interest rates.

Understanding your accurate credit reports allows you to take action against any potential inaccuracies that could negatively impact you.

Cleaning up your accurate credit reports by resolving disputes can open up new financial opportunities.

Maintaining accurate credit reports helps in avoiding complications related to credit-based insurance scores.

The Fair Credit Reporting Act protects your rights, ensuring your accurate credit reports are treated with the seriousness they deserve.

Understanding your rights under the law will help keep your accurate credit reports in check.

Credit reports contain far more extensive information than most consumers realize, functioning as comprehensive financial biographies rather than simple payment histories. Each report is structured into four major sections that collectively paint a detailed picture of your financial behaviors and patterns over time. The personal information section includes not just your name and address, but also tracks your residential history, employment changes, and sometimes even aliases you’ve used. This historical tracking helps lenders verify your identity and stability, with frequent address changes sometimes raising flags about potential risk factors.

The account history section forms the core of your credit report, documenting every credit account you’ve opened in the past 7-10 years. This includes revolving accounts like credit cards, installment loans such as mortgages or auto loans, and open accounts like home equity lines of credit. Each entry contains meticulous details about your payment patterns, recording not just whether you paid, but precisely how many days late payments occurred. Credit bureaus track your credit utilization ratios, available credit limits, and account age – factors that significantly impact lending decisions but aren’t directly reflected in your credit score number. Many consumers are surprised to discover that closed accounts remain visible for years, continuing to influence their creditworthiness long after they’ve stopped using those financial products.

Inaccuracies in your accurate credit reports can lead to severe financial consequences, so it’s essential to remain vigilant.

Errors in your accurate credit reports may lead to misunderstandings that affect your personal and financial life.

Many individuals face hardships as a result of inaccurate information in their accurate credit reports.

The public records and collections section documents financial events that have entered the public domain, including bankruptcies, tax liens, civil judgments, and accounts that have been sold to collection agencies. Bankruptcies can remain on reports for up to ten years, creating a long-lasting impact on credit accessibility. The inquiry section records every instance where a business has requested to view your credit information, distinguishing between hard inquiries (those you initiate when applying for credit) and soft inquiries (background checks from existing creditors or pre-approved offers). Multiple hard inquiries in a short timeframe can temporarily lower your credit score by 5-10 points each, as they may indicate financial distress. What many consumers don’t realize is that credit bureaus also track patterns in your applications, flagging behaviors like multiple credit applications across different lenders as potential risk indicators.

Taking proactive steps to ensure your accurate credit reports is essential for long-term financial health.

Lesser-known information that appears on credit reports includes rent payment history (when reported by property management companies), utility payment records (primarily when negative), medical collections (though these are increasingly weighted differently under newer scoring models), and even information about authorized user accounts where you’re not the primary borrower. Credit bureaus are increasingly incorporating alternative data sources to create more comprehensive profiles, including subscription service payments and even social media financial behaviors in experimental models. The report may also contain consumer statements you’ve added to explain specific circumstances around negative items, though these statements rarely influence automated lending decisions.

The Fair Credit Reporting Act: Your Legal Shield

The Fair Credit Reporting Act (FCRA) emerged in 1970 during a period when unregulated credit reporting practices were causing significant consumer harm through inaccurate, outdated, and sometimes deliberately damaging information. This landmark legislation established the first comprehensive framework for regulating how consumer information could be collected, stored, and shared by credit bureaus. Over the decades, the FCRA has evolved through amendments like the Consumer Credit Reporting Reform Act of 1996 and the Fair and Accurate Credit Transactions Act of 2003, each strengthening consumer protections in response to emerging challenges in the credit reporting ecosystem. The law represents a carefully crafted balance between legitimate business needs for risk assessment and individual rights to privacy and accuracy.

The FCRA grants consumers specific rights that serve as powerful tools for maintaining financial health, though these protections remain underutilized. Beyond the well-known right to obtain free annual reports from each major bureau, consumers have the right to dispute inaccurate information with both the credit bureau and the original furnisher of that information. Both entities must conduct a reasonable investigation within 30 days (occasionally extended to 45 days), and information that cannot be verified must be removed. Consumers can demand that corrections be sent to anyone who received their report in the previous six months, preventing errors from continuing to cause harm after they’ve been identified. The FCRA also gives consumers the right to know when information in their report has been used against them in an adverse action, such as a loan denial or unfavorable terms, providing transparency into how their credit data affects real-world outcomes.

The law carefully balances the power dynamics between consumers, credit bureaus, and data furnishers. While credit bureaus have significant influence as the gatekeepers of financial information, the FCRA imposes strict accuracy requirements, mandating that they follow reasonable procedures to ensure maximum possible accuracy. Data furnishers (like banks and creditors) must conduct thorough investigations when disputes arise and cannot simply confirm negative information without verifying its accuracy. The FCRA also places time limitations on how long negative information can remain on reports: most negative items must be removed after seven years, while bankruptcies can remain for up to ten years from the filing date. These time restrictions prevent consumers from being perpetually penalized for past financial mistakes, creating a pathway to credit rehabilitation that balances accountability with the opportunity for financial recovery.

The Ripple Effect of Credit Report Errors

Credit report inaccuracies create consequences that extend far beyond the immediate frustration of loan denials. When errors appear on your report, they can trigger a domino effect of financial complications that affect virtually every aspect of your economic life. Mortgage applications with erroneous negative information can result in interest rates up to 3.5 percentage points higher than deserved, translating to tens of thousands of dollars in additional costs over the life of a typical 30-year loan. Auto loans similarly reflect this pattern, with credit report errors potentially increasing rates by 2-4 percentage points. Insurance companies increasingly use credit-based insurance scores to determine premiums, meaning report errors can lead to unnecessarily higher costs for home, auto, and even life insurance policies. These financial penalties accumulate silently, often without consumers realizing the connection between report inaccuracies and their elevated costs of living.

Regular reviews of your accurate credit reports can help safeguard your financial future.

Effective strategies for disputing inaccuracies will help maintain the integrity of your accurate credit reports.

Documentation is critical for ensuring your accurate credit reports reflect your true financial history.

The impact of credit report errors extends well beyond traditional lending contexts, affecting fundamental aspects of daily life. Approximately 72% of employers conduct credit checks on at least some job candidates, particularly for positions involving financial responsibility or security clearances. Errors suggesting financial irresponsibility can cost job opportunities without candidates ever knowing why they were rejected. Housing opportunities face similar constraints, with landlords routinely screening potential tenants through credit reports. Utility companies may require substantial security deposits based on credit information, while mobile phone carriers might deny preferred plans to those with seemingly problematic credit histories. These barriers create a compounding effect where credit report errors not only limit financial options but also restrict access to basic necessities and opportunities for advancement.

Alternative data sources may also impact the creation of your accurate credit reports.

New technologies can help ensure your accurate credit reports remain reliable and up-to-date.

Understanding the key consequences of inaccuracies in your accurate credit reports can empower you to take action.

As regulations evolve, expect improvements in the accuracy of your accurate credit reports.

Key consequences of credit report errors include:

- Financial Penalties: Higher interest rates across all credit products, increased insurance premiums, and larger security deposits for services

- Opportunity Limitations: Restricted access to employment, housing, and essential services

- Administrative Burden: Hours spent gathering documentation, filing disputes, and following up on unresolved issues

- Psychological Impact: Stress, anxiety, and diminished financial confidence affecting overall wellbeing

- Compounding Disadvantages: Errors creating cascading effects where each negative consequence makes resolving others more difficult

Proactive Strategies for Maintaining Report Accuracy

Strategic timing for credit report reviews provides a systematic approach to monitoring accuracy across all three major bureaus. Rather than checking all reports simultaneously once a year, staggering your free annual reviews creates a quarterly monitoring system without additional cost. Requesting your Experian report in January, TransUnion in April, and Equifax in July establishes a regular cadence for identifying potential issues before they compound. This approach proves particularly valuable because credit bureaus don’t share information with each other, meaning an error might appear on one report but not others. For consumers planning major financial transactions like mortgage applications or auto loans, implementing this staggered review schedule 6-12 months before applying provides sufficient time to address any inaccuracies. Additionally, supplementing these official annual reviews with regular monitoring through free services can create an early warning system for suspicious activity or unexpected changes.

Effective dispute filing requires a technical approach that maximizes success rates while navigating the bureaucratic processes of credit bureaus. When identifying potential errors, consumers should categorize them by type—identity errors, account status inaccuracies, data management mistakes, and balance errors—as each requires different documentation and approach strategies. While online dispute systems offer convenience, written disputes sent via certified mail with return receipt requested create a stronger paper trail and trigger specific FCRA protections. The dispute letter should be concise yet comprehensive, clearly identifying each error with account numbers, correct information, and the specific reason for disputing. Including supporting documentation like payment confirmations, account statements, or court orders significantly increases the likelihood of successful resolution. Following up precisely 30 days after filing if no response has been received maintains pressure on bureaus to complete investigations within legally mandated timeframes.

Documentation systems strengthen your position when challenging credit report errors by creating an indisputable record of both the inaccuracies and your efforts to resolve them. Maintaining a dedicated credit file with copies of all credit reports, correspondence with bureaus and creditors, and supporting evidence provides crucial reference materials for ongoing disputes. Screenshots of online disputes with confirmation numbers, copies of mailed letters, delivery confirmations, and detailed notes from phone conversations with customer service representatives all contribute to establishing a comprehensive record. This documentation becomes particularly valuable if disputes require escalation to regulatory complaints or legal action. When handling legitimate negative information that cannot be disputed as inaccurate, consider adding brief explanatory statements to your credit report that provide context for specific circumstances like medical emergencies or natural disasters that contributed to payment issues. While these statements rarely influence automated scoring systems, they may factor into manual reviews by underwriters in borderline approval decisions.

The Future of Credit Reporting: Emerging Trends and Technologies

Alternative data sources are revolutionizing the credit reporting landscape, expanding beyond traditional payment histories to create more nuanced financial profiles. Credit bureaus now increasingly incorporate rental payment data, utility bill payments, and telecommunications account information to evaluate consumers with limited traditional credit histories. This expansion particularly benefits the approximately 45 million “credit invisible” Americans who lack sufficient conventional credit data for scoring. Financial technology companies are pioneering the use of cash flow data from bank accounts to assess creditworthiness, analyzing spending patterns, income stability, and savings behaviors rather than just debt management. Some experimental models even evaluate non-financial behaviors like social media usage patterns and online shopping habits as potential indicators of reliability, though these approaches raise significant privacy concerns. The integration of these alternative data sources creates both opportunities for previously excluded consumers to establish credit and challenges regarding data accuracy, privacy, and potential algorithmic bias.

Financial technology has dramatically transformed transparency and consumer access in credit reporting, shifting power dynamics in favor of informed consumers. Mobile applications now provide real-time access to credit information, with alerts for changes to scores or new account activities enabling immediate identification of potential errors or fraud. Open banking initiatives allow consumers to selectively share financial data across platforms, creating more comprehensive pictures of financial health beyond traditional credit metrics. Blockchain technology is being explored as a potential solution to credit reporting accuracy issues, with its immutable record-keeping potentially reducing disputes about payment histories or account statuses. Artificial intelligence systems increasingly help consumers identify specific behaviors impacting their creditworthiness and suggest personalized improvement strategies. These technological advances collectively democratize access to credit information while creating new challenges around data security and the potential for more opaque decision-making processes as algorithms become more complex.

Regulatory changes on the horizon may substantially alter credit reporting standards as policymakers respond to evolving financial landscapes and consumer protection concerns. Proposals for more standardized dispute processes across bureaus could streamline error corrections while reducing consumer confusion about varying procedures. Medical debt reporting faces potential significant reform, with some legislation proposing complete removal of medical collections from credit reports or extended waiting periods before reporting. Credit bureaus are under increasing pressure to improve accuracy verification processes, with potential requirements for more rigorous validation before negative information can be added to consumer files. The Consumer Financial Protection Bureau has signaled interest in more oversight of credit repair organizations and stricter enforcement against furnishers who repeatedly report inaccurate information. As financial services become increasingly digital, regulations regarding data ownership, consent for information sharing, and transparency in algorithmic credit decisions will likely expand, potentially giving consumers greater control over how their financial data is collected, shared, and interpreted in lending decisions.

Conclusion: Your Financial Reputation Deserves Protection

Your credit report, especially your accurate credit reports, serves as the financial biography that follows you through life’s most significant milestones—a narrative that’s too important to leave unchecked. While one in five Americans face report errors serious enough to affect their opportunities, those who actively monitor their accurate credit reports and dispute inaccuracies gain control over their financial futures.

Your accurate credit reports aren’t just documents—they are your financial reputation in numerical form. The information they contain shapes opportunities you’ll be offered and doors that will open throughout your life. When you consider that a single reporting error could cost more than a year’s worth of retirement savings in higher interest rates, the question isn’t whether you can afford to monitor your accurate credit reports—it’s whether you can afford not to. What financial opportunities might you be missing right now because of information you don’t even know exists in your accurate credit reports?