High-interest debt can feel like a weight that grows heavier each month, dragging down your credit score and limiting your financial options. When you’re making payments but barely seeing progress, it’s not just frustrating—it’s financially draining. The debt avalanche method offers a mathematically sound approach to breaking free from this cycle by targeting your highest interest debts first, while maintaining minimum payments on all other accounts. This strategy directly addresses the root cause of persistent debt: the compounding interest that keeps your balances stubbornly high despite your best efforts.

What makes the debt avalanche method particularly effective for improving your credit score? By systematically eliminating debts with the highest interest rates first, you reduce the total amount paid over time and accelerate your path to financial freedom. While it requires discipline and a clear understanding of your debt landscape, the long-term benefits extend far beyond simple debt elimination. How much could you save by restructuring your payment strategy? The answers might surprise you—and they form the foundation of a debt repayment plan that works with the numbers, not against them.

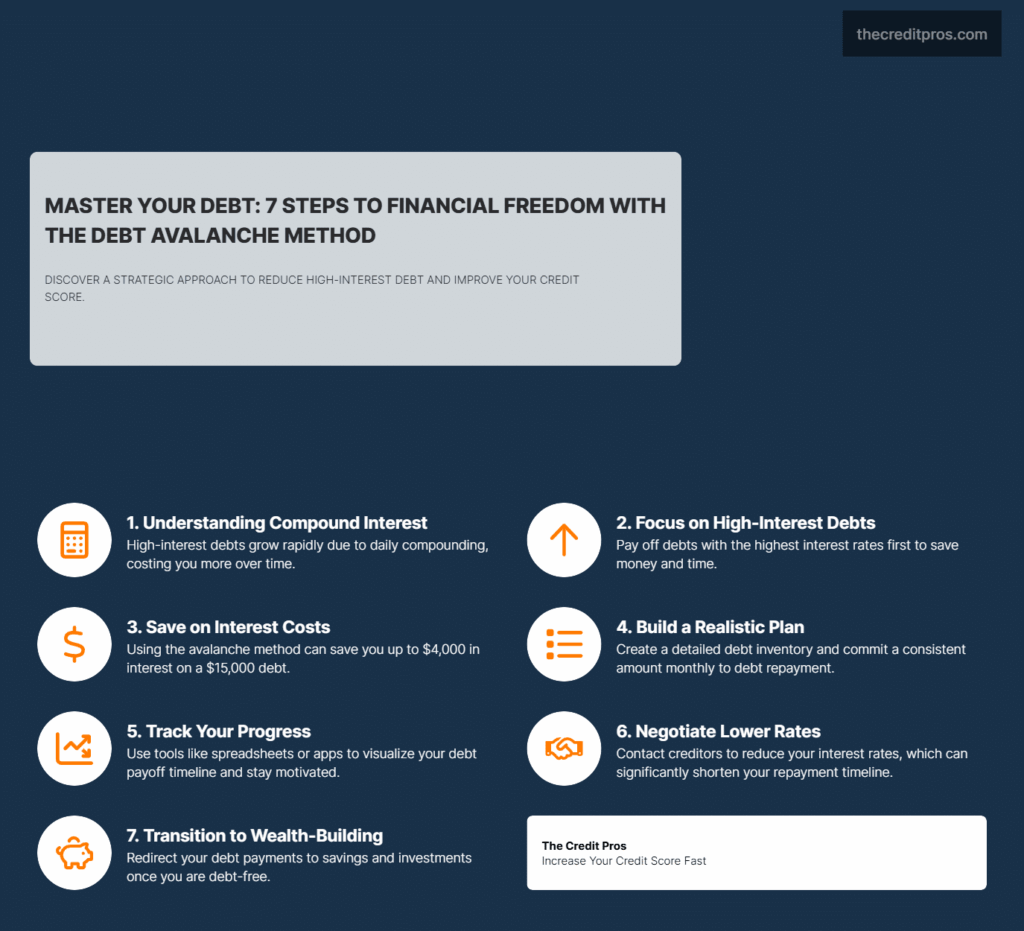

The Science Behind the Debt Avalanche Method

The debt avalanche method works by exploiting a fundamental financial principle that many consumers overlook: the compounding nature of interest. When you carry high-interest debt, you’re not just paying back what you borrowed—you’re paying for the privilege of borrowing that money over time. This cost accumulates exponentially through compounding, where interest generates more interest in a self-perpetuating cycle that can quickly spiral out of control.

Consider what happens with a typical credit card carrying a 26% APR. For every $1,000 in debt, you’re accruing approximately $260 in interest annually—that’s over $21 each month before you’ve made any progress on the principal. Most credit cards compound interest daily, meaning each day your balance grows slightly larger than the day before. This daily compounding creates a mathematical urgency to address high-interest debts first, as each day of delay literally costs you money.

The mathematical advantage of the debt avalanche method becomes clear when comparing long-term outcomes. A consumer with $15,000 spread across multiple debts (credit cards, personal loans, and store cards) with interest rates ranging from 8% to 26% would pay approximately $4,000 less in interest by using the debt avalanche method versus making equal payments across all debts. This savings represents not just money kept in your pocket, but also a significantly faster path to becoming debt-free—often by many months or even years.

“The debt avalanche is mathematically the most efficient way to pay off debt because it minimizes the total interest paid over time. By targeting high-interest debt first, consumers can save hundreds or even thousands of dollars compared to other repayment methods.” – Thomas Brock, CFA and CPA

Setting Up Your Personal Debt Avalanche Plan

Creating an effective debt avalanche method begins with a comprehensive inventory of every debt you currently hold. This step requires complete honesty and thoroughness—overlooking even small debts can undermine your strategy. For each debt, document four critical pieces of information: the current balance, the interest rate (APR), the minimum monthly payment, and any special terms (such as promotional rates with expiration dates). This detailed inventory serves as the foundation for your entire repayment strategy.

With your debt inventory complete, the next step involves determining your total monthly debt allocation—the maximum amount you can consistently commit to debt repayment each month. This figure should be realistic yet ambitious, ideally derived from a thorough budget analysis that identifies non-essential spending that can be redirected toward debt elimination. The difference between this total allocation and the sum of all your minimum payments represents your “avalanche power”—the extra money that will accelerate your debt payoff when applied to your highest-interest debt.

Establishing a realistic timeline requires mathematical precision rather than wishful thinking. Using your debt inventory and monthly allocation, calculate how long it will take to eliminate each debt in sequence. Free online debt calculators can help with this process, allowing you to visualize your progress over time. This timeline serves multiple purposes: it sets realistic expectations, provides measurable goals for tracking progress, and helps maintain motivation by showing the light at the end of the tunnel. Many successful debt eliminators use spreadsheet templates or dedicated apps like Undebt.it or the Debt Payoff Planner to maintain visibility into their progress and adjust strategies as needed.

- Essential components of your debt avalanche method:

- Complete debt inventory with balances, interest rates, and minimum payments

- Calculated monthly debt repayment allocation from your budget

- Prioritized list of debts arranged by interest rate (highest to lowest)

- Projected payoff dates for each debt based on your allocation

- Tracking system to monitor progress and maintain motivation

Implementing the Method: Beyond the Basics

Successfully implementing the debt avalanche method requires more than just making the right payments—it demands consistent execution and strategic adaptation. The foundation of this method is maintaining minimum payments across all debts without exception, as missed payments can trigger penalty APRs and late fees that undermine your progress. Meanwhile, direct all extra funds toward the highest-interest debt until it’s completely eliminated. This singular focus accelerates your progress on the most expensive debt while preventing the balance from growing through compound interest.

Variable interest rates present a particular challenge in the debt avalanche method approach, as they can shift your repayment priorities. Credit cards with promotional rates that expire after a certain period require special attention—mark these expiration dates in your calendar and recalculate your debt priority list when these dates arrive. In some cases, it makes mathematical sense to prioritize a debt with a temporary low rate if that rate will increase dramatically before you could reasonably pay it off. This strategic flexibility preserves the mathematical advantage of the debt avalanche method while adapting to the realities of modern debt products.

Negotiating with creditors represents an often-overlooked acceleration strategy that can dramatically improve your debt avalanche method. Many creditors will reduce interest rates for customers who have maintained consistent payments, especially if you mention competing balance transfer offers you’ve received. A successful negotiation that reduces a credit card’s APR from 24% to 19% could save hundreds or thousands of dollars and significantly shorten your payoff timeline. When these negotiations succeed, recalculate your debt priority list immediately, as the interest rate reduction might change which debt should receive your extra payments.

Overcoming Psychological Barriers to the Avalanche Method

The debt avalanche method’s greatest weakness isn’t mathematical—it’s psychological. Many people struggle with motivation when their highest-interest debt also has a large balance, as progress can seem painfully slow. This perception challenge occurs because our brains are wired to respond to visible progress rather than abstract concepts like interest savings. When months pass with seemingly little headway on a large balance, the temptation to switch strategies or abandon the plan entirely can become overwhelming, despite the mathematical advantages of staying the course.

Creating meaningful milestone celebrations can combat this motivation deficit without compromising your financial progress. Rather than focusing solely on complete payoff dates, establish smaller milestones—perhaps for every $500 or $1,000 in principal reduction—and celebrate these achievements in ways that don’t involve spending money. These celebrations might include a special home-cooked meal, a movie night with friends, or posting your achievement in a supportive online community. The key is recognizing progress in smaller increments that your brain can register as success, fueling continued motivation.

Visualization techniques provide another powerful tool for maintaining commitment to the debt avalanche method. Many successful debt eliminators create visual representations of their debt journey—from simple thermometer-style charts to elaborate digital dashboards—that translate abstract numbers into visual progress. These tools make the invisible process of interest savings more tangible by illustrating how much of your payment is going toward principal rather than interest as your balance decreases. Additionally, calculating and displaying the total interest saved compared to minimum payments provides concrete evidence of your strategy’s effectiveness, reinforcing your commitment during challenging periods.

Transitioning from Debt Reduction to Credit Score Improvement

As your debt avalanche method gains momentum and accounts begin to reach zero balances, your focus should shift toward maximizing the credit benefits of your improved financial position. Paid accounts affect your credit history in complex ways that aren’t immediately obvious. While the reduction in overall debt positively impacts your credit utilization ratio—a major factor in credit scoring—the way you handle paid accounts can have long-term implications for your credit profile. Contrary to popular belief, immediately closing paid accounts often hurts rather than helps your score by reducing your available credit and potentially shortening your credit history.

Strategic account management after debt elimination requires balancing multiple factors. For credit cards and revolving accounts, keeping them open maintains your credit utilization ratio and average age of accounts—both positive factors for your credit score. However, this approach requires discipline to avoid falling back into debt. Consider keeping these accounts open but removing them from your wallet and digital payment methods, using them only occasionally for small purchases that you pay off immediately. For installment loans like personal loans or auto loans, the completed payment history remains on your credit report for years, continuing to demonstrate your reliability as a borrower.

While completing your debt avalanche method, you can simultaneously rebuild positive credit history through strategic account management. This dual approach accelerates your credit score improvement beyond what debt reduction alone would achieve. Consider using one of your lower-interest credit cards for a small, recurring expense (like a streaming subscription) that you pay in full each month. This creates a pattern of on-time payments and responsible usage that credit scoring algorithms reward. Meanwhile, as accounts reach zero balances, request goodwill letters from creditors asking them to remove any past late payments from your credit report—a strategy that succeeds surprisingly often with creditors who have received full payment of the debt.

The financial discipline developed during your debt avalanche method creates a foundation for wealth-building habits that can transform your financial future. The consistent monthly amount you’ve been allocating to debt repayment can be redirected toward emergency savings and investments once your debts are eliminated, maintaining the same budgetary discipline but with a different financial goal. This transition represents the ultimate victory of the debt avalanche strategy—not just becoming debt-free, but transforming the financial behaviors that led to debt in the first place. The mathematical efficiency of the debt avalanche method thus extends beyond debt elimination to wealth creation, as the interest that once worked against you begins working in your favor through savings and investments.

Conclusion: The Transformative Power of Mathematical Debt Elimination

The debt avalanche method stands as a mathematically superior approach to debt elimination, directly addressing the compounding interest that keeps millions financially trapped. By systematically targeting your highest-interest debts first while maintaining minimum payments across all accounts, you’re not just reducing balances—you’re potentially saving thousands in interest and accelerating your journey to financial freedom. The strategy’s effectiveness extends beyond mere debt elimination to credit score improvement, creating a foundation for long-term financial health through disciplined payment management and strategic account handling.

The psychological barriers to implementing this method can be substantial, but the financial rewards are undeniable for those who persevere. With each high-interest debt conquered, you reclaim not just money but financial agency—turning the mathematical principles that once worked against you into powerful tools for building wealth. The question isn’t whether you can afford to implement the debt avalanche method; it’s whether you can afford not to when every day of delay compounds the financial burden that’s already weighing you down.