You’ve probably heard the standard advice: never close a credit card because it will hurt your credit score. But what if that guidance is oversimplifying a much more complex financial decision? The reality is that closing credit accounts creates a cascade of changes across your entire credit profile, some immediate and others that unfold over years. While your closed account might continue boosting your credit age for the next decade, the sudden shift in your utilization ratios could impact your score within weeks. Understanding the closing credit accounts impact is crucial for making informed decisions. The closing credit accounts impact can affect your ability to get credit in the future, so it’s essential to weigh the pros and cons carefully.

The decision to close an account isn’t just about whether it will lower your score — it’s about understanding exactly how different closure scenarios play out across various scoring models, and when the long-term benefits might actually outweigh the short-term costs. What happens when you close your oldest card versus your newest one? How do business cards factor into the equation differently than personal cards? And why does the reason for closure — whether you initiated it or your creditor did — matter more than most people realize? The closing credit accounts impact can vary significantly based on these factors and your financial circumstances.

The Hidden Mechanics: How Account Closure Disrupts Your Credit Architecture

Understanding the closing credit accounts impact is essential for anyone looking to maintain a healthy credit score. Analyzing the closing credit accounts impact can provide insight into your credit utilization and score fluctuations. Being aware of the closing credit accounts impact is necessary for making informed financial decisions. It’s important to understand the closing credit accounts impact for managing your credit effectively. The closing credit accounts impact can be more significant than many borrowers realize. The closing credit accounts impact will shape your financial future in ways that require attention. Understanding the closing credit accounts impact is crucial for managing your finances.

The closing credit accounts impact can lead to unexpected challenges if not carefully managed. Keeping in mind the closing credit accounts impact can help you navigate financial decisions wisely. Being mindful of the closing credit accounts impact is key for maintaining a positive credit profile. The closing credit accounts impact deserves serious consideration before deciding to close accounts. Before closing accounts, assess the closing credit accounts impact on your overall financial health. The closing credit accounts impact can vary based on individual circumstances and credit strategies. Developing an understanding of the closing credit accounts impact can prevent costly mistakes.

Your credit report operates on a complex timeline that extends far beyond the moment you close an account. When you request account closure, the actual impact unfolds across multiple phases, each carrying distinct implications for your credit score trajectory. The initial closure triggers immediate changes to your available credit calculations, but the account itself continues contributing to your credit profile in ways that most borrowers never anticipate.

The closing credit accounts impact is a factor that should not be overlooked in credit management. Being aware of the closing credit accounts impact allows for better decision-making. The closing credit accounts impact affects different aspects of your financial life. The closing credit accounts impact is an essential consideration in managing credit wisely. Understanding the closing credit accounts impact can help you avoid pitfalls in credit management. The closing credit accounts impact should guide your decisions regarding credit account management. The closing credit accounts impact can shape your credit journey in significant ways. A thorough understanding of the closing credit accounts impact can improve your credit strategy.

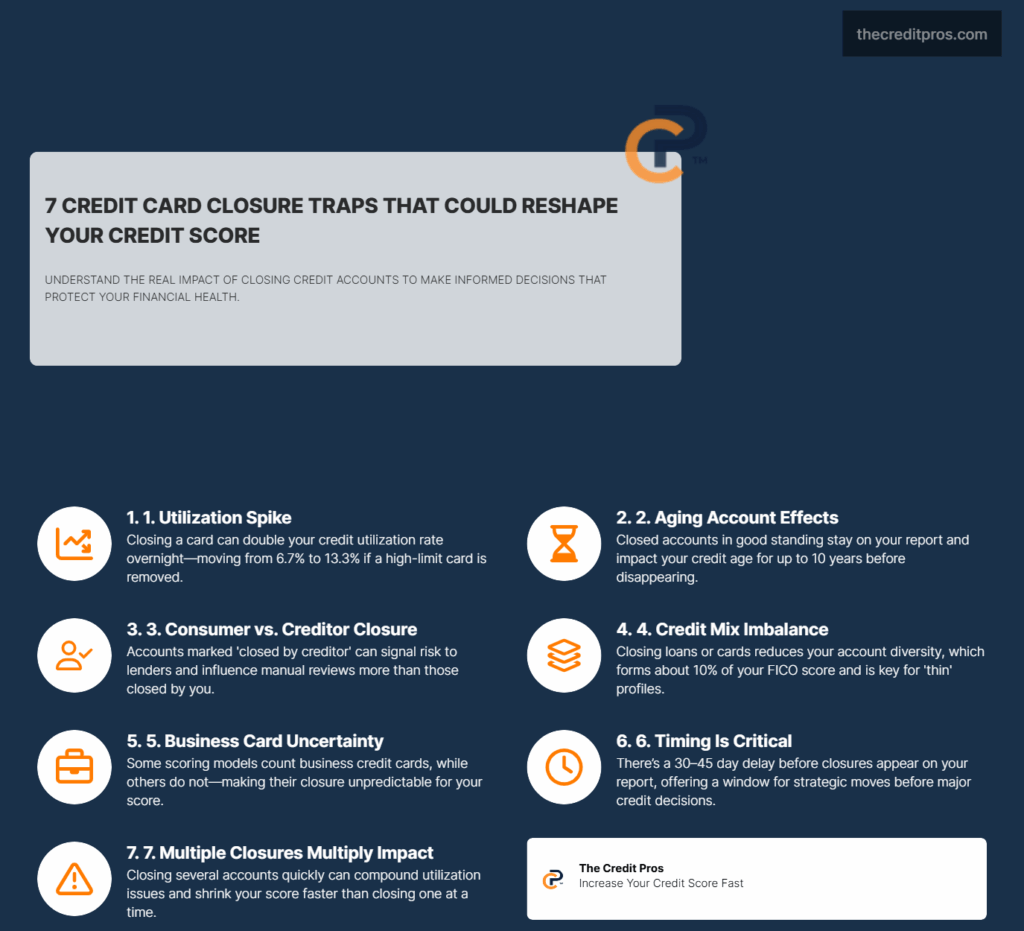

Credit bureaus process account closure information according to their own reporting cycles, which typically span 30 to 45 days from the lender’s notification. This processing window creates a strategic opportunity for borrowers who understand the timing mechanics. During this interim period, your closed account maintains its previous status on your credit report, meaning your utilization ratios and available credit calculations remain unchanged even though you can no longer access the credit line. Savvy borrowers leverage this delay by timing their closures strategically around major credit applications or score-sensitive financial decisions.

The closing credit accounts impact can influence your financial opportunities in the long run. Ultimately, understanding the closing credit accounts impact will empower you to make better financial decisions. As you navigate credit management, the closing credit accounts impact should be at the forefront of your mind. Therefore, always consider the closing credit accounts impact when revising your credit strategy. In summary, the closing credit accounts impact is a pivotal factor in managing credit effectively.

The distinction between “closed by consumer” and “closed by creditor” carries lasting consequences that extend well beyond the closure date. Accounts closed by the consumer typically reflect neutral or positive closure reasons, while creditor-initiated closures often signal financial distress or policy violations. This notation remains visible on your credit report for the entire duration the account appears, influencing how future lenders interpret your credit management history. The reporting difference affects not just your score calculation but also manual underwriting decisions where lenders review your credit report details directly.

Dormant accounts present a particularly nuanced scenario in credit architecture. Even accounts with zero balances and no recent activity continue aging on your credit report, contributing positively to your average account age calculation. This aging process continues for closed accounts until they eventually fall off your report, typically after ten years for accounts closed in good standing. The ongoing age contribution means that closing an old account doesn’t immediately eliminate its positive impact on your credit history length, providing a buffer period for your credit profile to adjust to the change.

The Utilization Trap: Beyond the Basic 30% Rule

Credit utilization calculations operate on multiple levels that create compound effects when you close accounts. Your credit score considers both your overall utilization across all accounts and your per-card utilization rates, with each calculation weighted differently in the scoring algorithm. Closing a credit card immediately removes its available credit from your total credit limit, potentially pushing your overall utilization percentage into higher, more damaging ranges even if your debt levels remain constant.

The “phantom utilization” effect emerges when borrowers close cards with substantial credit limits while maintaining balances on their remaining cards. Consider a scenario where you carry $2,000 in total debt across three cards with limits of $5,000, $10,000, and $15,000 respectively. Your overall utilization sits at a manageable 6.7% across $30,000 in total available credit. However, closing the card with the $15,000 limit instantly pushes your utilization to 13.3% across the remaining $15,000 in available credit, doubling your utilization rate without any change in your actual debt levels.

Business credit cards introduce additional complexity to utilization calculations, as different scoring models handle these accounts inconsistently. Some credit scoring algorithms exclude business cards from personal credit utilization calculations entirely, while others include them in specific circumstances. This inconsistency means that closing a business credit card may have minimal impact on your personal credit utilization in some scoring models while significantly affecting others. The variability creates challenges in predicting the exact score impact of business account closures.

Multiple account closures within short timeframes create compound utilization effects that can devastate credit scores rapidly. Each closure reduces your available credit pool, concentrating your existing debt across fewer accounts and potentially pushing individual cards into high-utilization territory. The cumulative effect often proves more damaging than the sum of individual closures, as the reduced credit diversity combines with elevated utilization rates to trigger multiple negative scoring factors simultaneously. Recognizing the closing credit accounts impact can make a significant difference in your financial health.

Credit History Length: The Aging Algorithm Most People Misunderstand

Credit scoring models calculate account age through sophisticated algorithms that extend far beyond simple arithmetic averages. The “age of oldest account” metric captures the length of your longest-standing credit relationship, while “average age of accounts” considers the collective age of all accounts on your credit report. These calculations weight different account types variably, with installment loans often carrying different age considerations than revolving credit accounts in the scoring formula.

Authorized user accounts complicate credit age calculations in ways that most borrowers never consider. When you’re added as an authorized user to someone else’s account, that account’s age history typically transfers to your credit report, potentially extending your apparent credit history beyond your actual credit management experience. However, the removal of authorized user accounts or closure of the primary account can suddenly eliminate years of apparent credit history, creating dramatic shifts in your average account age calculation.

The ten-year rule for closed accounts creates a strategic timeline for long-term credit planning. Accounts closed in good standing continue aging on your credit report for exactly ten years from the closure date, after which they disappear entirely from your credit history. This creates a predictable timeline where the positive aging effects of closed accounts gradually diminish as newer accounts assume greater weight in the average age calculation. Understanding this timeline allows for strategic planning around major financial decisions that require optimal credit scores.

“The average age of your credit accounts is carefully examined by credit bureaus. Closing older accounts shortens your credit history, which can lower your credit score. Lenders tend to prefer a long and established credit history.”

Closed accounts continue contributing to your credit age calculation until they fall off your report, but their weight in the calculation changes over time. Newer accounts gradually assume greater influence in your average age calculation as they accumulate their own aging history. This shifting weight means that the impact of closing an old account may not manifest immediately but becomes more pronounced as your credit profile evolves over the subsequent years.

Credit Mix Optimization: The Underestimated 10% of Your Score

Credit mix accounts for approximately 10% of your FICO score calculation, yet most borrowers underestimate its strategic importance in credit portfolio management. The scoring algorithm evaluates your ability to manage different types of credit responsibly, rewarding borrowers who successfully handle both revolving credit accounts and installment loans. Closing specific account types can create imbalances that reduce your credit mix diversity, particularly impacting borrowers with limited credit histories.

Installment loans such as mortgages, auto loans, and personal loans affect your credit mix differently than revolving credit accounts when closed. The closure of an installment loan typically has less immediate impact on your utilization calculations but can significantly reduce your credit type diversity. This reduction proves particularly problematic for borrowers with “thin files” who maintain relatively few total accounts, as losing an installment loan may eliminate an entire category of credit from their profile.

The “thin file” phenomenon describes credit profiles with limited account diversity or short credit histories, conditions that make borrowers more vulnerable to score fluctuations from account closures. Borrowers with thin files often lack the credit diversity buffer that protects more established credit profiles from the negative effects of individual account closures. A single account closure can push a thin file borrower into an even more limited credit category, potentially affecting their access to future credit opportunities.

Different credit scoring models weight credit mix factors variably, creating inconsistencies in how account closures affect different score versions. FICO scoring models generally place greater emphasis on credit mix diversity than VantageScore models, meaning that the same account closure may produce different score impacts depending on which scoring model a lender uses for evaluation. This variability complicates strategic planning around account closures, as borrowers cannot predict which scoring model will be used for their next credit application.

Key Credit Mix Categories and Their Strategic Value:

- Revolving Credit: Credit cards, lines of credit, home equity lines

- Installment Credit: Mortgages, auto loans, personal loans, student loans

- Open Credit: Charge cards, some business accounts

- Service Credit: Utility accounts, cell phone contracts (in some models)

Strategic Timing and Damage Control: When Closure Makes Financial Sense

The cost-benefit analysis for account closure requires evaluating multiple financial factors beyond immediate credit score impact. Annual fees, interest rates, credit limit utilization, and long-term financial goals all contribute to the decision matrix. High annual fees on rarely used cards may justify closure despite potential score impacts, particularly when the ongoing costs exceed the credit benefits over time.

Strategic preparation for account closure can minimize negative score impacts through careful credit management leading up to the closure date. Paying down balances across all accounts reduces overall utilization before losing available credit from the closed account. Requesting credit limit increases on remaining accounts can help offset the lost credit capacity, though these requests should be timed carefully to avoid multiple hard inquiries during the closure period.

“Before closing a credit card, ensure you’re not carrying high balances on other cards. This is crucial to avoid the possibility of a lower credit score.”

The optimal sequence for closing multiple accounts requires understanding the compound effects of successive closures on your credit profile. Closing accounts with smaller credit limits first preserves maximum available credit during the transition period, while closing newer accounts before older ones maintains more favorable average age calculations. The sequence should also consider the timing of other financial applications, ensuring that credit score impacts don’t coincide with major lending decisions.

Post-closure monitoring becomes critical for identifying unexpected score changes and implementing corrective measures. Credit scores may fluctuate for several months following account closure as the full effects work through the scoring algorithms. Regular monitoring allows for early detection of utilization spikes, credit mix imbalances, or reporting errors that may require immediate attention to prevent long-term damage to your credit profile.

The 90-day rule for major credit applications takes on additional significance following account closures, as your credit score may remain volatile during the adjustment period. Lenders often prefer to see stable credit profiles for at least 90 days before major lending decisions, making this window crucial for allowing your score to stabilize after closure. Planning major applications outside this window helps ensure that closure-related score fluctuations don’t interfere with important financial opportunities.

Conclusion: Mastering the Strategic Art of Credit Account Management

The decision to close a credit account isn’t the binary choice between “good” and “bad” that conventional wisdom suggests. Instead, it’s a complex strategic decision that requires understanding the intricate mechanics of credit scoring algorithms, timing considerations, and your individual financial landscape. The cascade effects we’ve explored – from utilization ratio shifts and credit mix disruptions to the nuanced aging algorithms – demonstrate that successful credit management demands a sophisticated approach that looks beyond simple rules of thumb.

Your credit profile operates as an interconnected system where every account closure creates ripple effects across multiple scoring factors simultaneously. While the standard advice to “never close accounts” provides a safe default, it ignores scenarios where closure actually serves your long-term financial interests. The key lies in understanding exactly how these closures will impact your unique credit architecture and timing them strategically around your broader financial goals. The real question isn’t whether closing accounts hurts your credit – it’s whether you have the knowledge and strategic insight to make these decisions work in your favor rather than against it.