Credit card churning, the practice of frequently opening and closing credit card accounts to maximize rewards, can be an enticing strategy for those looking to capitalize on sign-up bonuses and other perks. The allure of free travel, cashback, and other benefits can be strong, but what are the hidden costs? How does this practice impact your credit score, and what steps can you take to mitigate potential downsides?

Understanding the mechanics of credit card churning is crucial for anyone considering this approach. Identifying the most lucrative cards, navigating issuer restrictions, and managing multiple accounts are key factors to consider. This article will explore these aspects in detail, providing insights into the credit score implications and offering practical advice on how to churn responsibly. Whether you’re a seasoned churner or just curious about the practice, this guide will help you weigh the risks and rewards effectively.

The Mechanics of Credit Card Churning

Identifying Lucrative Credit Cards

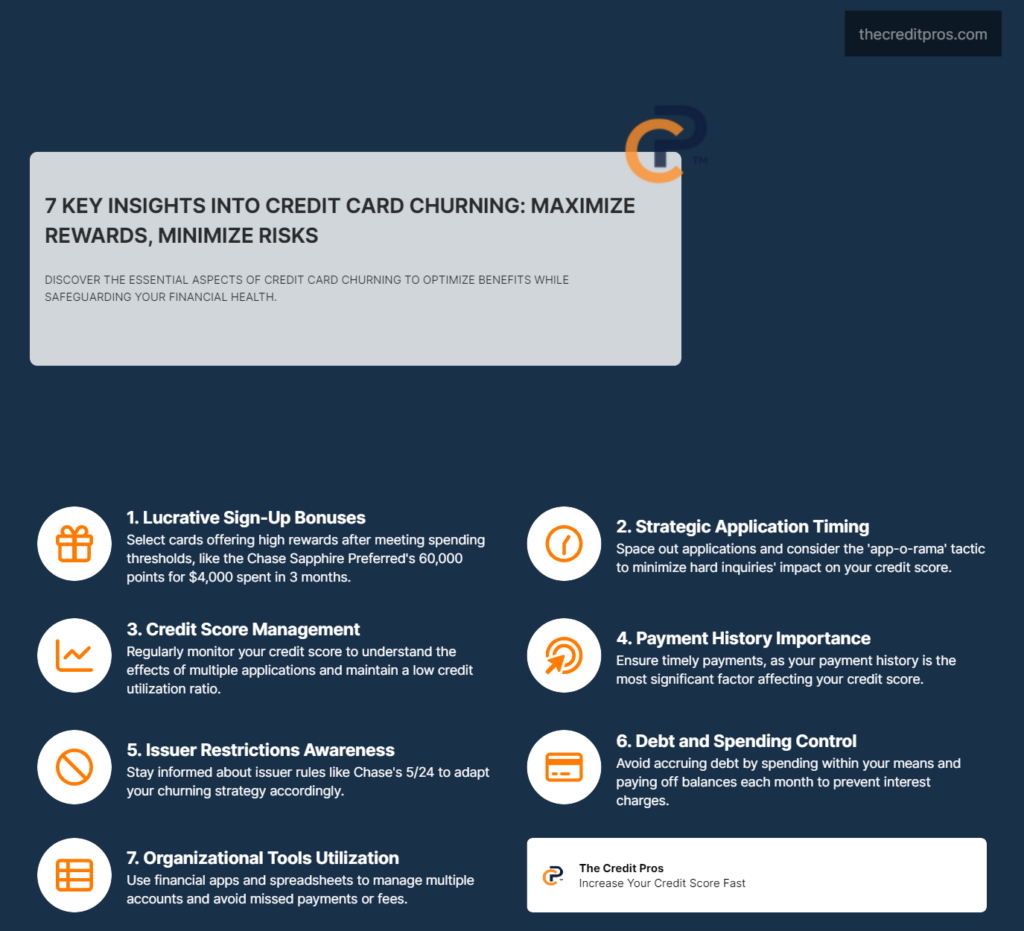

When starting a credit card churning strategy, the first critical step is identifying the most lucrative credit cards. The primary criterion for selection is the sign-up bonus, which can offer substantial rewards in the form of points, miles, or cashback. These bonuses often require meeting a minimum spending threshold within a specified period, typically three months.

Popular cards among churners include those from major issuers like Chase, American Express, and Citibank. For instance, the Chase Sapphire Preferred® Card is renowned for its generous sign-up bonus of 60,000 points after spending $4,000 in the first three months. Similarly, the American Express® Gold Card offers a substantial bonus of 60,000 Membership Rewards® points after spending $4,000 in the first six months.

Criteria for Selecting Cards:

- Sign-up Bonuses: Look for cards with high initial rewards.

- Rewards Currency: Choose cards that offer points or miles that align with your travel or cashback goals.

- Annual Fees: Consider cards with waived first-year fees to maximize net gains.

- Spending Categories: Opt for cards that reward spending in categories where you naturally spend the most.

The Application Process

Timing and strategy are crucial when applying for multiple credit cards. Applying for several cards in quick succession can raise red flags with issuers and negatively impact your credit score. To mitigate this, many churners apply for multiple cards on the same day, a tactic known as “app-o-rama.” This approach minimizes the impact of hard inquiries on your credit report, as they are often counted as a single inquiry if done within a short period.

Managing application frequency is also essential. A good rule of thumb is to wait at least six months between applications to avoid being flagged as a high-risk borrower. However, those with excellent credit scores may have more flexibility in their application timing.

Managing Application Frequency:

- App-o-rama Strategy: Apply for multiple cards on the same day to minimize the impact of hard inquiries.

- Six-Month Rule: Wait six months between applications to maintain a healthy credit profile.

- Credit Score Considerations: Tailor your application strategy based on your current credit score and financial situation.

Credit Score Implications

Impact of Multiple Applications

Each time you apply for a new credit card, a hard inquiry is recorded on your credit report. While a single inquiry may only reduce your score by a few points, multiple inquiries in a short period can have a more significant impact. This is because lenders may view frequent applications as a sign of financial distress.

To mitigate this, it’s essential to space out your applications and monitor your credit score regularly. Utilizing tools like credit monitoring services can help you keep track of your score and understand the impact of your churning activities.

Credit Utilization Ratio

Your credit utilization ratio, which is the amount of credit you’re using compared to your total available credit, is a significant factor in your credit score. A lower ratio is generally better, as it indicates responsible credit management. When churning, it’s crucial to keep this ratio low by paying off balances in full each month and avoiding large balances across multiple cards.

Balancing Spending and Credit Limits:

- Pay Off Balances: Ensure all balances are paid in full each month to avoid interest charges and maintain a low utilization ratio.

- Monitor Spending: Keep track of your spending to ensure it stays within manageable limits.

- Increase Credit Limits: Request higher credit limits on existing cards to improve your utilization ratio.

Payment History Management

Payment history is the most critical factor in your credit score, accounting for 35% of the total. Missing a payment can significantly damage your score, so it’s vital to stay organized and ensure all payments are made on time. Setting up automatic payments and reminders can help you stay on top of due dates.

Tools and Tips for Staying Organized:

- Automatic Payments: Set up auto-pay for at least the minimum payment to avoid missed payments.

- Payment Reminders: Use calendar alerts or financial apps to remind you of upcoming due dates.

- Consolidate Due Dates: If possible, align the due dates of your credit cards to simplify payment management.

Length of Credit History

The length of your credit history also plays a role in your credit score. Opening and closing accounts frequently can shorten the average age of your accounts, which can negatively impact your score. To mitigate this, consider keeping older accounts open, even if you no longer use them actively. Downgrading to a no-annual-fee card can help maintain the account without incurring additional costs.

Strategies to Maintain a Healthy Credit History:

- Keep Old Accounts Open: Retain older credit cards to preserve the length of your credit history.

- Product Changes: Downgrade cards with annual fees to no-fee versions to keep the account active.

- Monitor Account Ages: Regularly review your accounts to understand their impact on your credit history.

Navigating Issuer Guardrails

Understanding Issuer Rules

Credit card issuers have implemented various rules to curb churning activities. These rules are designed to prevent users from exploiting sign-up bonuses without maintaining a long-term relationship with the issuer. Understanding these rules is crucial for successful churning.

For example, Chase’s 5/24 rule restricts users from opening more than five personal credit cards in the past 24 months. American Express has a once-per-lifetime rule for welcome offers, meaning you can only receive the sign-up bonus for a specific card once. Bank of America’s 2/3/4 rule limits the number of cards you can open within specific time frames.

Adapting to Restrictions

To navigate these restrictions, churners employ various strategies. One common technique is product changing, where you downgrade a card to a no-annual-fee version instead of closing it. This allows you to keep the credit line open without incurring additional costs. Another approach is to stagger applications across different issuers to avoid hitting their limits simultaneously.

Techniques to Work Within Issuer Limits:

- Product Changes: Downgrade cards to no-fee versions to keep accounts open.

- Stagger Applications: Apply for cards from different issuers to avoid hitting limits.

- Monitor Issuer Policies: Stay updated on issuer rules and adapt your strategy accordingly.

Potential Pitfalls and How to Avoid Them

Risks to Credit Health

Credit card churning can pose significant risks to your credit health if not managed properly. Frequent applications and account closures can lower your credit score, making it harder to secure loans or favorable interest rates in the future. Additionally, missing payments or carrying high balances can further damage your credit.

Long-term Consequences of Poor Credit Management:

- Loan Approval Challenges: Lower credit scores can make it difficult to obtain loans or credit lines.

- Higher Interest Rates: Poor credit can result in higher interest rates on loans and credit cards.

- Credit Score Recovery: It can take years to recover from significant credit score damage.

Financial Hazards

Accumulating debt is a significant risk associated with credit card churning. The temptation to spend more to meet sign-up bonus requirements can lead to high balances and interest charges. To avoid this, it’s essential to only spend what you can afford to pay off in full each month.

Avoiding Interest Charges and Fees:

- Spend Within Means: Only charge what you can pay off in full each month.

- Track Spending: Regularly review your spending to ensure it aligns with your budget.

- Avoid Unnecessary Fees: Be mindful of annual fees and other charges that can erode your rewards.

Organizational Challenges

Managing multiple credit cards can be overwhelming, leading to missed payments and financial mismanagement. Staying organized is crucial to successful churning. Utilize financial apps, spreadsheets, or other tools to keep track of your accounts, due dates, and spending requirements.

Tools and Practices for Effective Management:

- Financial Apps: Use apps like Mint or Personal Capital to track spending and due dates.

- Spreadsheets: Maintain a detailed spreadsheet of your credit card accounts and their respective details.

- Regular Reviews: Conduct monthly reviews of your accounts to ensure everything is on track.

Conclusion: Weighing the Risks and Rewards

Credit card churning can be a lucrative strategy for maximizing rewards, but it comes with hidden costs that shouldn’t be overlooked. The practice impacts your credit score through multiple applications, affects your credit utilization ratio, and requires meticulous management of payment history and account ages. Understanding issuer restrictions and adapting your approach accordingly are essential for successful churning.

While the allure of sign-up bonuses and travel perks is strong, the potential pitfalls, including risks to your credit health and financial stability, demand careful consideration. By staying organized and spending within your means, you can mitigate these downsides. Ultimately, credit card churning isn’t for everyone, but for those who navigate it responsibly, the rewards can be substantial. Remember, the key to successful churning lies in balancing the immediate gains with long-term financial health. Are the rewards worth the risks? Only a well-informed strategy can answer that.