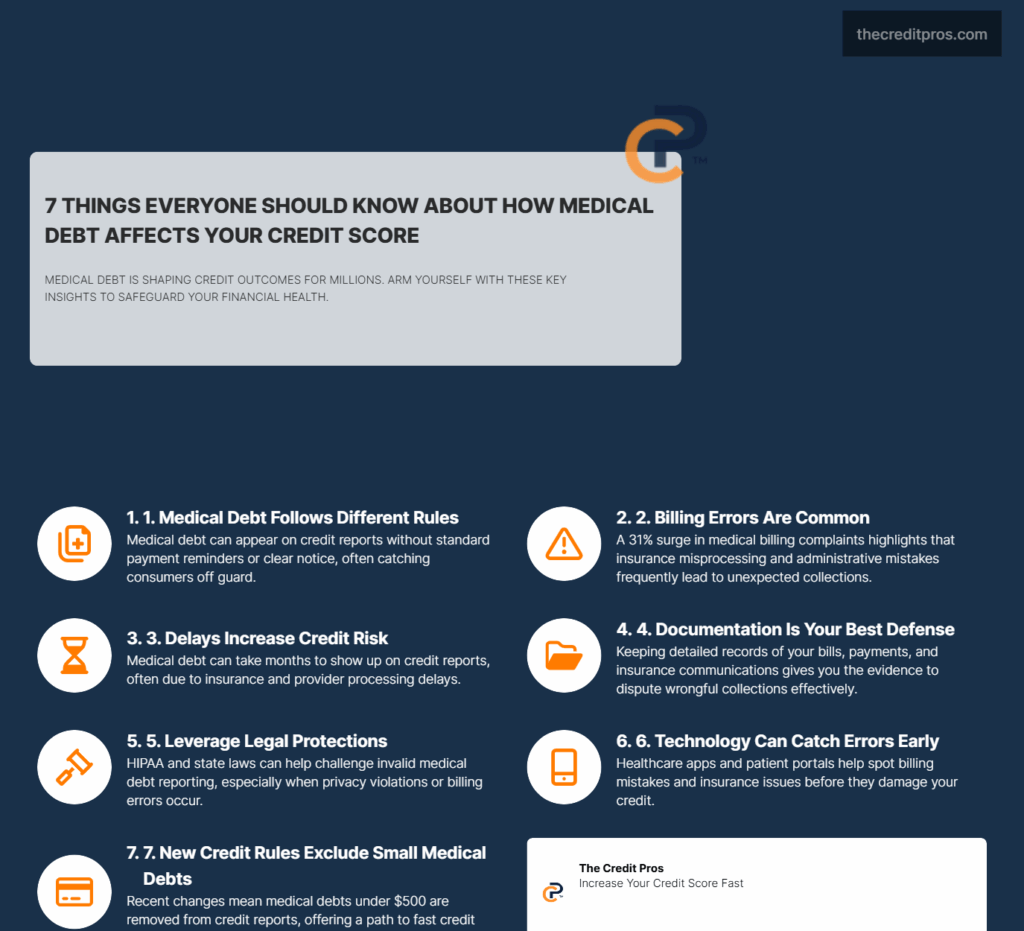

Medical debt has quietly become one of the most damaging forces affecting American credit scores, yet it operates by completely different rules than traditional debt. While you might pay your credit cards and loans on time religiously, a single medical bill that gets lost in insurance processing can tank your credit score months later. With medical billing complaints surging 31% recently, millions of consumers are discovering that their creditworthiness is being judged by healthcare expenses they never saw coming. Understanding the effects of medical debt on credit score is crucial for consumers navigating healthcare expenses.

One major concern is the effects of medical debt on credit score, especially when unexpected bills arise. What makes medical debt particularly insidious is how it bypasses the normal warning systems that protect your credit. Unlike other debts where you typically receive multiple notices before credit damage occurs, medical collections often appear on credit reports without adequate patient notification, sometimes even when the bill was legitimately paid. The question isn’t whether you’ll encounter medical billing issues—it’s whether you’ll be prepared to protect your credit score when they inevitably arise. It is essential to recognize how medical expenses can alter the effects of medical debt on credit score.

Understanding the Medical Debt-Credit Score Connection: Beyond Simple Payment History

A proactive approach is necessary to mitigate the effects of medical debt on credit score effectively. Medical debt operates under fundamentally different rules than traditional consumer debt when it comes to credit reporting. Unlike credit cards or loans where you receive monthly statements and payment reminders, medical bills often enter the collections process without adequate patient notification, creating a unique pathway to credit damage that bypasses normal consumer protections. Many people overlook the effects of medical debt on credit score when they settle disputes with their providers.

Understanding pay-for-delete agreements is essential for managing the effects of medical debt on credit score. The Consumer Financial Protection Bureau’s data revealing a 31% surge in medical billing complaints from 2018 to 2021 highlights a critical distinction between paid medical bills that resurface in collections versus legitimate unpaid debts. Many consumers discover that bills they believed were settled through insurance or direct payment have somehow entered the collections process, often due to administrative errors rather than actual non-payment. This phenomenon occurs because medical billing systems frequently lack the sophisticated tracking mechanisms found in traditional lending, creating gaps where legitimate payments get lost in complex insurance processing chains. Technological solutions can also help address the effects of medical debt on credit score significantly.

The time lag between medical services and credit reporting consequences creates additional vulnerability for consumers. While credit card companies typically report payment activity within 30 days, medical debt can remain dormant for months before suddenly appearing on credit reports. This delay stems from the multi-layered nature of medical billing, where charges must first be processed through insurance systems, then potentially through multiple collection agencies before reaching credit bureaus. The psychological stress factor compounds this issue, as individuals dealing with medical debt anxiety often make poor financial decisions, such as prioritizing medical collections over more strategically important credit obligations. The delay in reporting can exacerbate the effects of medical debt on credit score, leading to surprise impacts.

HIPAA violations in collection notices represent another layer of complexity that can compound credit damage. In addition, HIPAA violations can influence the effects of medical debt on credit score by complicating disputes. When collection agencies include detailed medical information in their communications, they not only violate patient privacy but also create additional legal leverage that consumers can use to challenge the debt’s validity. Medical debt collections often bypass standard verification processes used for other types of debt, partly because the original creditor (the healthcare provider) may not maintain the same level of documentation required for traditional debt validation. Understanding the timeline can help consumers manage the effects of medical debt on credit score. Using HIPAA regulations can help mitigate the effects of medical debt on credit score during negotiations.

Proactive Billing Verification: Your First Line of Defense

The art of medical bill auditing before debt collection begins requires a systematic approach that differs significantly from reviewing other financial statements. Medical billing statements contain multiple layers of coding, insurance adjustments, and provider charges that create numerous opportunities for errors. Understanding how to decode these statements involves recognizing common billing patterns that lead to erroneous charges, such as duplicate procedure codes, unbundled services that should be billed together, and charges for services that were never actually provided. Being aware of how insurance processes work helps reduce the effects of medical debt on credit score.

Creating a strong paper trail can help combat the effects of medical debt on credit score. Strategic timing of payment disputes plays a crucial role in preventing credit bureau reporting. Most healthcare providers have internal collection processes that span 90 to 120 days before transferring accounts to external collection agencies. During this window, billing disputes can be resolved without any impact on credit scores. The key lies in understanding that once a medical debt is sold to a collection agency, the dispute process becomes significantly more complex and the likelihood of credit damage increases exponentially. Negotiation tactics should consider the effects of medical debt on credit score to achieve optimal outcomes.

Insurance claim processing delays create a particularly vulnerable period for consumers, as bills may appear overdue even when insurance coverage is pending. Healthcare providers often begin their collection processes based on the age of the original bill rather than the status of insurance claims, leading to situations where patients receive collection notices for bills that insurance will ultimately cover. Building relationships with healthcare billing departments during this critical period can prevent escalation to external collections. Requesting itemized bills allows consumers to address the effects of medical debt on credit score more effectively.

Creating a comprehensive paper trail involves maintaining detailed records of all insurance communications, payment confirmations, and billing inquiries. This documentation becomes essential when challenging erroneous collections and can often resolve disputes immediately when presented to collection agencies. The strategic approach involves treating every medical encounter as a potential future credit issue and documenting accordingly. Tracking tools provide insights into the effects of medical debt on credit score before issues escalate.

Strategic Communication with Healthcare Providers and Collection Agencies

Negotiation tactics specific to medical debt differ fundamentally from other collection scenarios due to the unique regulatory environment surrounding healthcare billing. Healthcare providers operate under different legal constraints than traditional creditors, including HIPAA privacy requirements and state-specific medical debt collection laws. These regulations create opportunities for consumers to leverage patient rights in ways that aren’t available with other types of debt. Blockchain applications could potentially minimize the effects of medical debt on credit score by improving accuracy.

Utilizing patient portals can highlight the effects of medical debt on credit score early on. The power of requesting itemized bills often resolves disputes immediately because many healthcare providers struggle to produce detailed documentation for charges that may have been processed months earlier. This request forces providers to review their billing accuracy and often reveals errors that can be corrected without further dispute. When dealing with collection agencies, the same itemized bill request can expose weaknesses in the debt validation process, as collection agencies frequently purchase medical debt without complete documentation. Keeping an organized record can help manage the effects of medical debt on credit score effectively.

Using HIPAA privacy concerns as leverage in collection negotiations represents a sophisticated approach that many consumers overlook. When collection agencies include medical information in their communications or discuss medical details without proper authorization, they create legal vulnerabilities that can be used to negotiate favorable settlements or complete debt dismissals. The optimal timing for payment plans versus lump-sum settlements depends on the specific circumstances of the debt and the collection agency’s policies, but medical debt often offers more flexible negotiation options than traditional consumer debt. Using budgeting apps can reduce the effects of medical debt on credit score through better financial planning.

Requesting “pay-for-delete” agreements specific to medical collections requires understanding that medical debt collectors often have different motivations than traditional debt collectors. Healthcare providers may be more willing to remove credit reporting in exchange for payment because their primary goal is collecting payment rather than maintaining credit reporting relationships. Collection agencies that specialize in medical debt also tend to be more flexible with pay-for-delete arrangements, particularly when presented with documentation of billing errors or insurance processing issues. Insurance tracking systems can also help mitigate the effects of medical debt on credit score.

Leveraging Technology and AI Solutions for Billing Accuracy

Healthcare automation represents a double-edged sword in medical debt prevention, offering both opportunities for improved accuracy and new sources of billing errors. AI-driven billing systems in healthcare practices can benefit patients by cross-referencing insurance benefits with actual charges, identifying potential coverage issues before bills are generated. However, these same systems can also create new types of errors when algorithms misinterpret complex insurance rules or fail to account for patient-specific coverage variations. Analyzing medical bills can provide clarity on the effects of medical debt on credit score.

Patient-side technology tools for tracking and managing medical finances have evolved significantly, with healthcare apps now offering sophisticated features for monitoring insurance claims and identifying billing discrepancies. These tools can cross-reference explanation of benefits statements with actual provider charges, alerting consumers to potential issues before they escalate to collections. The key advantage lies in real-time monitoring rather than reactive dispute resolution after credit damage has occurred. Utilizing credit monitoring can help prevent negative effects of medical debt on credit score.

The emerging trend of blockchain verification in medical billing promises to address many of the transparency issues that lead to credit problems. Blockchain systems can create immutable records of medical services and payments, reducing the likelihood of duplicate billing or charges for services never received. While still in early adoption phases, these systems represent a potential solution to the documentation problems that plague medical debt disputes. Patient portals can serve as a critical resource for the effects of medical debt on credit score.

Patient portals serve as early warning systems for potential credit issues when used strategically. These systems often provide the first indication of billing problems, allowing consumers to address issues directly with healthcare providers before external collection processes begin. The most effective approach involves regularly monitoring portal activity and immediately addressing any unexpected charges or insurance processing delays. Understanding credit repair strategies is vital for addressing the effects of medical debt on credit score.

Key technology tools for medical debt prevention include:

- Healthcare-specific budgeting apps that track insurance deductibles and out-of-pocket maximums

- Insurance claim tracking systems that monitor payment processing timelines

- Medical bill analysis tools that identify common billing errors and overcharges

- Credit monitoring services with medical debt-specific alerts

- Patient portal management systems that consolidate information from multiple healthcare providers

Credit Repair Strategies Specific to Medical Debt

Standard credit repair approaches often fail with medical debt because they don’t account for the unique legal and procedural aspects of healthcare billing. Medical debt disputes require specialized knowledge of healthcare regulations, insurance processing procedures, and the specific documentation requirements that apply to medical collections. Traditional credit repair strategies that work for credit card debt or loan defaults may actually be counterproductive when applied to medical collections. Specialized knowledge can enhance the understanding of the effects of medical debt on credit score.

Specialized dispute letter techniques for medical collections must address the specific vulnerabilities inherent in medical debt reporting. These letters should focus on the medical provider’s compliance with HIPAA regulations, the accuracy of insurance processing, and the validity of the original charges rather than generic credit reporting disputes. The most effective approach involves challenging the medical debt at its source rather than simply disputing the credit bureau reporting. Dispute techniques must be tailored to the effects of medical debt on credit score for effectiveness.

Understanding state laws regarding medical debt can alter the effects of medical debt on credit score. The unique statute of limitations considerations for medical debt vary significantly by state and can create opportunities for debt resolution that don’t exist with other types of collections. Some states have shorter limitation periods for medical debt, while others provide specific consumer protections that can be leveraged in dispute resolution. Understanding these state-specific variations is crucial for developing effective long-term credit repair strategies. Goodwill letters can play a role in mitigating the effects of medical debt on credit score.

Goodwill letters work differently with healthcare providers versus collection agencies because healthcare providers often have different motivations and decision-making processes. Healthcare providers may be more responsive to goodwill requests that emphasize the patient relationship and the circumstances surrounding the medical debt, while collection agencies typically respond better to more formal dispute processes. The strategic use of credit monitoring to catch medical debt before it impacts scores requires understanding the specific timing patterns of medical debt reporting and the early warning signs that indicate potential credit bureau reporting. Recent reporting changes emphasize the importance of understanding the effects of medical debt on credit score.

Recent changes in credit reporting for medical debt under $500 have created new opportunities for credit repair, as these smaller debts are now excluded from credit reports entirely. This change affects a significant portion of medical debt and can provide immediate credit score improvements for consumers with multiple small medical collections. Understanding how to leverage these regulatory changes requires staying current with evolving credit reporting standards and their specific application to medical debt scenarios. Ultimately, recognizing the effects of medical debt on credit score is essential for financial stability.

Conclusion: Taking Control of Your Credit Future

Medical debt’s impact on credit scores represents a systemic vulnerability that affects millions of Americans, but understanding its unique characteristics transforms it from an uncontrollable threat into a manageable challenge. The strategies outlined—from proactive billing verification to specialized dispute techniques—provide concrete tools for protecting your creditworthiness against healthcare system failures. Unlike traditional debt, medical collections often contain inherent weaknesses that savvy consumers can exploit through proper documentation, strategic timing, and targeted communication approaches. Understanding the effects of medical debt on credit score empowers consumers to take control of their finances.

The question posed at the beginning—whether you’ll be prepared when medical billing issues inevitably arise—now has a clear answer. Preparation isn’t just about having emergency funds; it’s about understanding the complex interplay between healthcare billing, insurance processing, and credit reporting systems. As regulatory changes continue to evolve and technology solutions advance, consumers who master these specialized skills will find themselves increasingly protected against one of the most unpredictable threats to financial stability. Your credit score shouldn’t be held hostage by a healthcare system that operates by different rules—it’s time to learn those rules and use them to your advantage. In conclusion, awareness of the effects of medical debt on credit score is vital for effective financial management.