Latest Posts

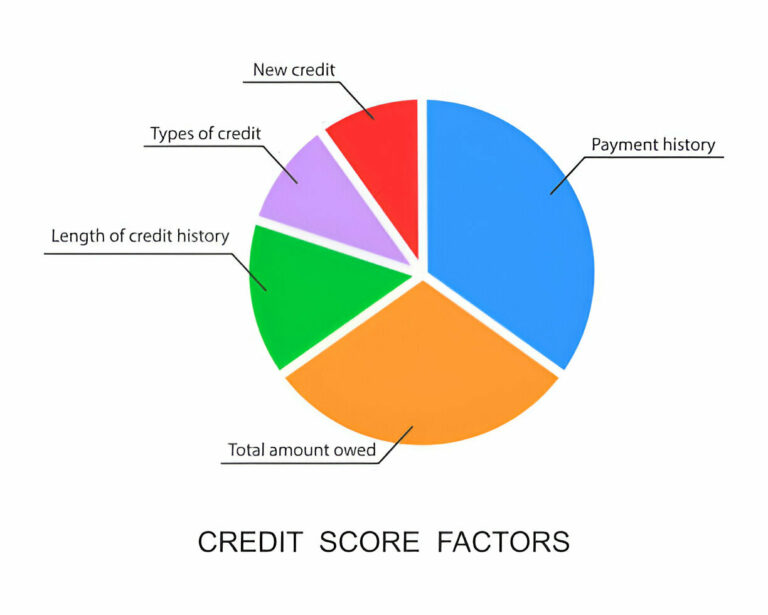

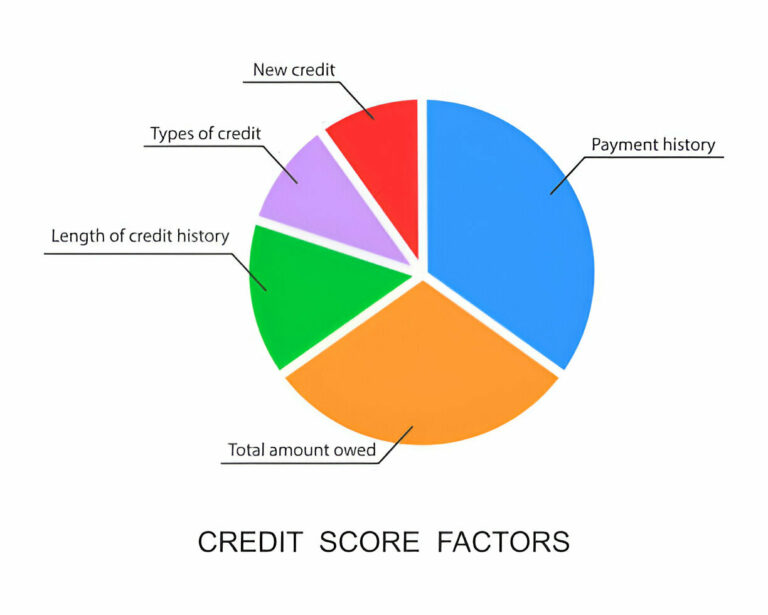

How to Understand the Weight of Different Credit Score Factors

Have you ever wondered how a three-digit number could possibly summarize your financial reliability? A credit score, often seen as a financial passport, profoundly influences

Exploring the Relationship Between Credit Scores and Insurance Rates

Did you know that your credit score could be secretly inflating your insurance premiums? Credit scores are crucial in the finance sector, often determining the

Blog Categories

Sign up for Credit Building Tips & Helpful Information

Your privacy matters! We only uses this info to send content and updates. You may unsubscribe anytime.

Credit Repair

How to Fix Credit Score After Identity Theft

Identity theft is distressing, impacting credit score & financial health. Recognize signs

Revitalize Your Credit Score: Rebuilding After Bankruptcy

Maintaining good financial habits is the cornerstone of rebuilding your credit score.

The Role of Credit Scores in Mortgage Approvals

When it comes to securing a home loan, your credit score is

Credit Score Improvement

Exploring the Relationship Between Credit Scores and Insurance Rates

Did you know that your credit score could be secretly inflating your

Securing Your Financial Identity: The Essentials of Credit Privacy Numbers

The key to protecting your financial identity isn’t in purchasing a dubious

How a Budget Can Boost Your Credit Score

Budgeting is all about managing your finances. It helps you keep track

Credit "How To's"

How to Understand the Weight of Different Credit Score Factors

Have you ever wondered how a three-digit number could possibly summarize your

How to Check Your Credit Report for Medical Debt

Did you know a single medical emergency could misalign your financial health

Does Paying Rent Build Credit?

Could your monthly rent payments be the untapped resource that boosts your

Debt Reduction

How to Negotiate Debt with Creditors to Maintain Your Credit Score

Debt settlement is an agreement between a debtor and a creditor where

The Benefits of Having A High Credit Score

High Credit Score Benefits – Table of Contents A high credit score

How Long Do Late Payments Stay on Your Credit Report?

How Long Do Late Payments Stay on Your Credit Report? According to

Credit Industry News

Is Credit Repair Legal? – Super Guide

If you are pondering over the question, “Is credit repair legal”? Do not worry much. The American government has established various laws to ensure the rightness of the process. Here are some of the initiatives of the government which make credit repair service as legal.

Loan Default – An Ultimate Guide 2022

The Ultimate Guide to Loan Default Loan Default – An

Paycheck Protection Program Round 3 – An Ultimate Guide

Paycheck Protection Program Round 3 – An Ultimate Guide Table

Sign up for Credit Building Tips & Helpful Information

Your privacy matters! We only uses this info to send content and updates. You may unsubscribe anytime.

Follow Us on Social Media

Why wait? Get started today

It only takes 90 seconds to sign up. Start fixing errors on your credit report and get help to increase your credit score. Your information is safe with us. We treat your data as if it were our own.