It may seem hard to justify saving money when you have a low income and high amounts of debt. But there are plenty of good reasons to have a growing savings account, even if you’re putting most of your excess cash into debt repayment.

You Need A Rainy Day Fund

Life happens. Your car breaks down. Your dishwasher ends up needing replacement. You have a medical emergency. A close family member passes away and you need to help cover funeral costs. These things happen to everyone and it would be silly not to plan for them.

We recommend having around $3,000 saved in case of emergency. This money would not be touched at all, and only used if you’re in a situation that you cannot pay for with your job income.

You Want To Have Runway

Runway is a term used to describe the amount of time someone can be without income before they have to resort to taking out debt.

We recommend building up your runway to the point where you have a full year’s worth of expenses saved up.

Once you have 12 months of expenses saved up, you’re much more free to take risks such as going back to school, switching to a higher paying (or more fulfilling) career, starting a business, or investing in real estate.

You might think that it will take years for you to save up this amount of money, and that’s true. But we recommend saving up for this anyway, even if you have debt to pay back.

We’re also going to talk about how you can cut down expenses in such a way that makes this goal a much more manageable one. It’s a lot easier to save $24,000 than $36,000, for example.

How To Save Money

Here are the easy ways to save money:

Look at your income and expenses.

Take a look at all usable sources of income. Only include what you can consider to be income. This includes:

- Your job income (W-2)

- Pensions, military benefits

- Side hustle income

- Business income

- Investment income that isn’t being reinvested

If you have unpredictable income (for example, if you’re a freelancer or business owner), you will need to take an average of the last 3-6 months and do budgeting quarterly. The result is that you end up saving money every quarter, piling it up in advance.

Break your expenses down.

Categorize each of your expenses based on what they’re for. Your biggest expenses are likely your rent/mortgage, transportation costs, and debt repayment.

Here are some expense categories you can use:

- Rent/mortgage

- Transportation

- Utilities

- Groceries and necessities

- Entertainment (include takeout and restaurants here)

- Childcare & children’s activities

- Other expenses

How you categorize your expenses is up to you. Then, you need to take an honest look at your spending. Look at your bank and credit card statements and get the real numbers! Don’t estimate. We recommend using a tool such as YNAB or Mint in order to track how you actually spend your money.

You may notice that we excluded debt repayment. For debt repayment, we recommend snowballing your debt and paying low amounts on the rest of the debt. You’ll need to use a calculator to figure out how much you’re paying every month using this strategy. Learn more about snowballing your debt!

Decide which expenses are the most important.

Take some time to think about this, because even though you want to have all of the benefits of what you currently pay for, not all of them are worth keeping.

For example, you might have an unlimited data plan when your data usage (which you can check on your phone) indicates that you only need a few GB.

Rank your expenses from most to least important. The least important ones will eventually be cut out to support your savings goals!

Cut out any expenses deemed unnecessary.

You decide how you live your life, and you need to choose which expenses you can live without in order to achieve your financial goals.

For example, you might be spending less on groceries and more on takeout. This might seem like it’s saving you time, but it’s actually costing you a fair bit. However, this may not be an unnecessary expense if you find yourself unable to cook your own meals.

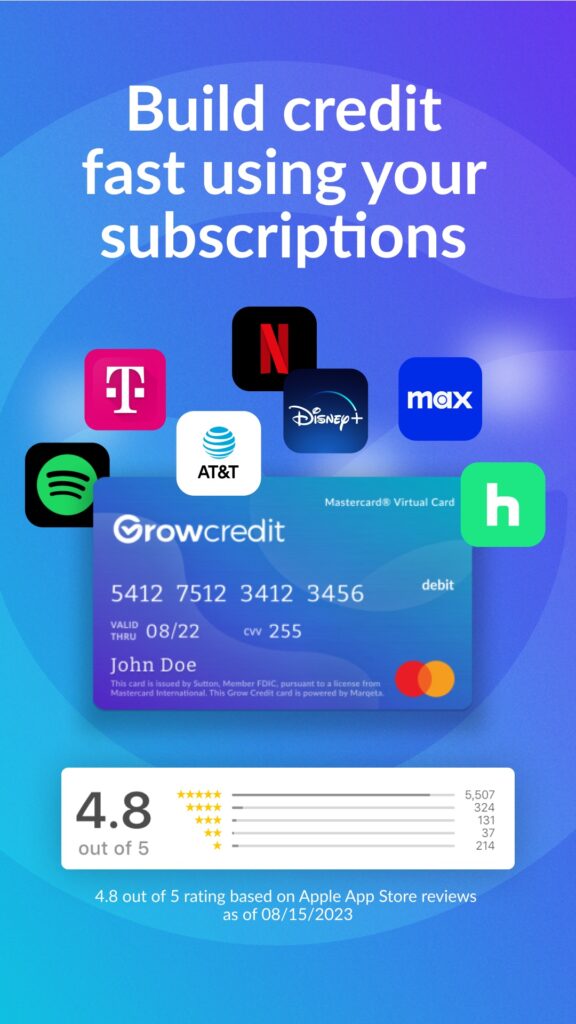

Subscriptions are one of the biggest sources of budget burn. There might be a few subscriptions that you use regularly, but most subscriptions provide only a small amount of benefit for a high annual cost. $10/month ends up being $120/year, which could have done into your savings.

Look for any other opportunity to reduce your expenses.

It’s likely that you haven’t made the best financial decisions in the past. That’s okay: many of those can be corrected. For example, if you have an expensive car note, you may be able to sell that car, purchase one for less, and pay down the rest of your car note. This could save you thousands of dollars.

Or, you might find that you’re paying a great deal of money on your mortgage. You may be able to refinance. We have another article on refinancing your debt: check it out for more info!

Decide how much you will save.

Essentially, whatever is remaining after your expenses, debt repayment, and investments should go into a savings account. Your savings accounts should be categorized as such:

-

- Rainy Day Fund (put up $3,000-$5,000 in this fund)

- Runway Fund (put up to 12 months expenses in this fund)

- Large Purchase Goals

Our recommendation is to focus on these things, in this order. If you don’t have $3,000 for a rainy day, or if you recently spent your rainy day fund, you need to put money in that fund before you put money elsewhere!

How much you save and how much you invest will depend on your own personal preferences. We recommend maxing out your 401(k) plan and taking advantage of employer matching.

Keep in mind: someone WITH debt should not be saving as much of their income as someone without debt! If you have debt, you should be putting your money into paying it off, as that will save you the most money in the long run due to accruing interest!