Credit repair scams target millions of Americans each year, preying on people who feel overwhelmed by poor credit scores and mounting debt. These fraudulent operations have perfected their approach, using emotional manipulation and false promises to extract money from consumers who desperately want to improve their financial situation. But what makes someone fall for these schemes, and how do scammers make their operations appear legitimate enough to fool even careful consumers? Awareness of avoiding scams in credit repair is essential. Understanding the importance of avoiding scams in credit repair can empower consumers to make informed choices. By being vigilant about avoiding scams in credit repair, you can safeguard your financial health.

The stakes are higher than just losing money to a scam. When you engage with fraudulent credit repair companies, you risk damaging your credit further, facing legal consequences, and losing precious time that could be spent on legitimate improvement efforts. Understanding the specific tactics these companies use—from their carefully crafted marketing messages to their suspicious payment structures—gives you the power to protect yourself and your financial future. The warning signs are often hiding in plain sight once you know what to look for, especially in avoiding scams in credit repair.

Knowledge is key in avoiding scams in credit repair and can help you avoid unnecessary pitfalls. Avoiding scams in credit repair requires understanding the warning signs and staying informed. To effectively navigate the landscape, focus on avoiding scams in credit repair rather than getting caught in the trap. Seek out resources that emphasize avoiding scams in credit repair to enhance your knowledge base. In your journey, be mindful of avoiding scams in credit repair to ensure you’re on the right path. Awareness of avoiding scams in credit repair can save you from falling into common traps. Informed consumers are better equipped for avoiding scams in credit repair that can lead to financial losses.

Be proactive about avoiding scams in credit repair to enhance your financial well-being. Taking steps toward avoiding scams in credit repair is essential in today’s financial landscape. Prioritize avoiding scams in credit repair to maintain control over your financial future. Even the most desperate situations can be navigated by avoiding scams in credit repair. Your journey to financial recovery should start with avoiding scams in credit repair. Focus on avoiding scams in credit repair to align your actions with your recovery goals. Being proactive about avoiding scams in credit repair can significantly affect your results. Stay educated about avoiding scams in credit repair to make sound financial decisions. Your financial journey will benefit from a commitment to avoiding scams in credit repair. By staying informed, you can enhance your chances of avoiding scams in credit repair. Emphasizing the importance of avoiding scams in credit repair can protect you from opportunists. Remain vigilant about avoiding scams in credit repair for a secure financial future. Your ability to identify pitfalls hinges on avoiding scams in credit repair.

The Anatomy of Credit Repair Scam Operations

In the realm of credit improvement, being informed about avoiding scams in credit repair can save you from costly mistakes. Credit repair scammers operate sophisticated psychological manipulation campaigns designed to exploit consumers at their most vulnerable moments. These operations understand that people with damaged credit often feel overwhelmed, embarrassed, and desperate for quick solutions. The scammers craft their approach around these emotions, using language that promises immediate relief while creating artificial urgency to prevent potential victims from researching their claims or seeking second opinions.

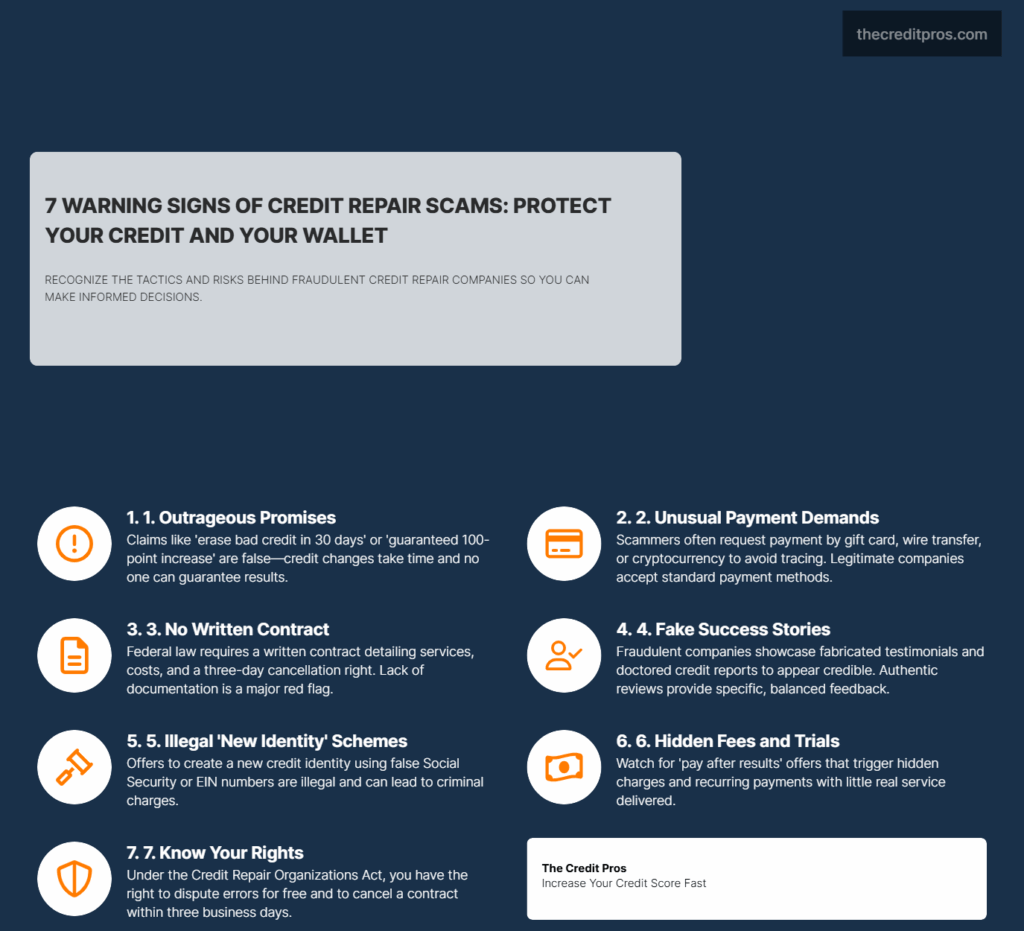

The fraudulent marketing tactics employed by these operations follow predictable patterns that prey on financial desperation. Scammers frequently use phrases like “remove bankruptcies overnight,” “erase bad credit in 30 days,” or “guaranteed 100-point credit score increase.” These claims exploit the average consumer’s limited understanding of how credit reporting actually works, particularly the legal requirements governing how long negative information can remain on credit reports and the legitimate dispute process timeline.

Lead generation companies play a crucial role in feeding victims to credit repair scams, often operating through seemingly innocent online advertisements or “free credit report” websites. These companies collect personal information from consumers searching for credit help, then sell this data to multiple scam operations. The result is a coordinated assault on vulnerable consumers who suddenly receive calls, emails, and text messages from various fraudulent companies, each claiming to offer the perfect solution to their credit problems.

The construction of legitimate-looking websites and fake testimonials represents another sophisticated element of these scam operations. Fraudulent companies invest significant resources in creating professional-appearing websites complete with fabricated customer success stories, fake before-and-after credit reports, and manufactured endorsements from supposed financial experts. These websites often include elements designed to build trust, such as security badges, professional photography, and detailed explanations of their “proprietary” credit repair methods.

Deceptive Promises and Impossible Guarantees

Ultimately, avoiding scams in credit repair leads to greater financial resilience. Keep the focus on avoiding scams in credit repair to ensure your financial interests are protected. Awareness and education are key to effectively avoiding scams in credit repair. Avoiding scams in credit repair is essential for your financial health and peace of mind.

The “100-point guarantee” represents one of the most persistent and dangerous myths perpetuated by credit repair scammers. This promise exploits consumers’ misunderstanding of credit scoring algorithms and the factors that influence credit score changes. Legitimate credit score improvements typically occur gradually over months or years as consumers demonstrate consistent positive payment behavior, reduce debt levels, and allow negative information to age off their reports naturally.

Scammers deliberately blur the distinction between credit report errors and accurate negative information to create false hope in their victims. While consumers have the legal right to dispute inaccurate information on their credit reports, scammers often promise to remove accurate negative marks such as legitimate late payments, charge-offs, or collections accounts. These companies may claim to use “secret” methods or “legal loopholes” to accomplish these removals, when in reality, accurate negative information can only be removed through legitimate means such as negotiating with creditors or waiting for the information to age off naturally.

The “new credit identity” scheme represents one of the most dangerous fraudulent promises in the credit repair industry. Scammers may offer to help consumers obtain new Social Security numbers or Employer Identification Numbers to create fresh credit profiles. This practice violates federal law and can result in serious criminal charges for both the company and the consumer. These schemes often target consumers who feel their credit is beyond repair, offering them what appears to be a complete fresh start but actually exposing them to potential prosecution for fraud. “Pay after results” offers often signal more sophisticated scam operations rather than legitimate business practices, as they typically involve hidden fees and impossible performance metrics.

The false promise of “pay after results” structures often masks more complex fraudulent schemes. While this payment model might seem consumer-friendly, scammers use it to extract multiple payments over time while providing little to no actual service. These companies may define “results” in ways that benefit them rather than the consumer, such as claiming success when they submit disputes regardless of outcome, or they may provide minimal improvements that technically fulfill their promises while leaving consumers’ credit largely unchanged.

Financial Red Flags and Payment Scheme Warnings

Requests for unusual payment methods serve as one of the most reliable indicators of credit repair fraud. Legitimate businesses typically accept standard payment methods such as credit cards, checks, or bank transfers, which provide consumers with some level of protection and recourse if services are not delivered as promised. Scammers often demand payment through gift cards, wire transfers, or cryptocurrency because these methods are difficult to trace and nearly impossible to reverse once completed.

The refusal to provide written contracts or service agreements represents another significant warning sign that consumers should never ignore. Federal law requires legitimate credit repair companies to provide detailed written contracts that specify the services to be performed, the timeline for completion, and the total cost before any work begins. Companies that operate through verbal agreements or provide only vague written materials are likely attempting to avoid the legal accountability that comes with proper documentation.

Scammers frequently exploit “trial periods” and “money-back guarantees” as tools to extract multiple payments from the same victim. These offers create an illusion of consumer protection while actually serving the scammer’s interests. The trial period allows the company to collect initial payment and personal information, after which they may claim the consumer failed to meet certain conditions or that the guarantee only applies to specific, narrowly defined circumstances. Many victims find themselves charged multiple times before realizing they have been defrauded.

The legal implications of paying for services that violate federal law extend beyond the immediate financial loss to the consumer. When consumers pay credit repair scammers, they may unknowingly become participants in illegal activities such as submitting false information to credit bureaus or attempting to defraud lenders. This participation can expose consumers to civil liability and, in extreme cases, criminal prosecution, particularly in schemes involving identity fraud or systematic misrepresentation of financial information.

Legal Protections and Your Rights Under Federal Law

The Credit Repair Organizations Act (CROA) provides comprehensive protections for consumers seeking credit repair services, yet many people remain unaware of their rights under this federal law. CROA prohibits credit repair companies from making false or misleading statements about their services, requires them to provide written contracts detailing all services and fees, and mandates a three-day cancellation period during which consumers can cancel their contracts without penalty. Understanding these protections empowers consumers to identify companies that operate outside the law.

Your right to dispute information directly with credit bureaus represents a fundamental consumer protection that credit repair scammers often try to obscure. Under the Fair Credit Reporting Act, consumers can dispute inaccurate information on their credit reports at no cost by contacting the credit bureaus directly. This process, while sometimes time-consuming, provides the same legal foundation that legitimate credit repair companies use, making their services unnecessary for many consumers who are willing to invest the time in managing their own disputes.

The distinction between nonprofit credit counseling and for-profit credit repair services often confuses consumers, creating opportunities for scammers to exploit this confusion. Legitimate nonprofit credit counseling agencies focus on helping consumers develop budgets, manage debt, and understand their financial options. These organizations typically charge minimal fees and provide comprehensive financial education. In contrast, for-profit credit repair companies focus specifically on disputing credit report information and often charge significantly higher fees for services that consumers can perform themselves.

State licensing requirements add another layer of consumer protection, though enforcement varies significantly across jurisdictions. Many states require credit repair companies to obtain licenses, post bonds, and comply with specific disclosure requirements. However, scammers often ignore these requirements or operate across state lines to avoid regulation. Consumers can verify a company’s licensing status through their state’s attorney general office or consumer protection agency, providing an additional tool for identifying legitimate service providers.

The three-day cancellation right mandated by CROA serves as a crucial consumer protection that scammers frequently violate. This provision allows consumers to cancel their credit repair contracts within three business days of signing without penalty or obligation. Legitimate companies will clearly explain this right and honor cancellation requests, while scammers often ignore cancellation attempts or claim that work has already begun, making cancellation impossible.

Building Your Defense Strategy Against Credit Repair Fraud

Developing skills to research and verify credit repair companies requires understanding where to find reliable information about these businesses. State licensing boards maintain databases of licensed credit repair companies, while the Better Business Bureau provides ratings and complaint histories for many businesses. However, consumers must approach these resources with a critical eye, as scammers may create fake licenses or manipulate online reviews to appear legitimate.

Understanding legitimate DIY credit repair methods provides consumers with alternatives to hiring professional services while building knowledge about the credit repair process. The Federal Trade Commission provides free resources explaining how to dispute credit report errors, negotiate with creditors, and develop strategies for improving credit over time. These self-help approaches require more time and effort than hiring a service, but they provide consumers with direct control over their credit improvement efforts while avoiding the risks associated with fraudulent companies.

Creating a personal action plan for authentic credit improvement involves setting realistic expectations and timelines based on your specific credit situation. Legitimate credit improvement typically occurs over months or years rather than weeks, and the extent of possible improvement depends on factors such as the types of negative information on your credit report, your current payment behavior, and your overall debt levels. Understanding these factors helps consumers evaluate whether professional credit repair services are necessary or whether self-help methods would be more appropriate.

The importance of reading actual customer reviews versus manufactured testimonials cannot be overstated when evaluating credit repair companies. Genuine customer reviews typically include specific details about the services received, realistic timelines for results, and balanced perspectives that acknowledge both positive and negative aspects of the experience. Manufactured testimonials often use generic language, make unrealistic claims about results, and lack the specific details that characterize authentic customer experiences.

Verification of company credentials through multiple sources provides the most reliable method for identifying legitimate credit repair services. This process should include checking state licensing databases, reviewing complaint histories with consumer protection agencies, and verifying business registration information. Consumers should also research the company’s principals to ensure they have relevant experience and have not been involved in previous fraudulent activities.

Building realistic timelines for credit improvement helps consumers avoid the temptation of companies promising immediate results. Most legitimate credit improvements require several months to become visible in credit scores, and significant improvements may take a year or more depending on the severity of the credit issues involved. Understanding these realistic timelines helps consumers identify companies making impossible promises while setting appropriate expectations for their own credit improvement journey.

Conclusion: Your Shield Against Credit Repair Fraud

Credit repair scammers have perfected their psychological manipulation tactics, but their success depends entirely on consumers’ lack of awareness about legitimate credit improvement processes and federal protections. The warning signs we’ve explored—from impossible guarantees to suspicious payment methods—aren’t just red flags; they’re your roadmap to avoiding financial devastation and legal complications. Understanding that legitimate credit improvement takes time, that you have powerful rights under federal law, and that you can dispute errors yourself for free transforms you from a potential victim into an informed consumer who can’t be easily fooled.

The emotional desperation that drives people toward these scams is real, but so is your power to protect yourself through knowledge and realistic expectations. Whether you choose to improve your credit independently or work with a legitimate service provider, you now possess the tools to distinguish between authentic help and sophisticated fraud. Your financial future depends not on quick fixes or miracle solutions, but on your ability to recognize that anyone promising to transform your credit overnight is selling you a lie wrapped in false hope.