Most people approach debt consolidation like a simple math problem: find a lower interest rate, combine your debts, and save money. But what if that straightforward logic is missing critical pieces that could make or break your financial future? The reality is that successful debt consolidation depends on factors most borrowers never consider—from the timing of your payments within billing cycles to the psychological traps that cause even well-intentioned plans to backfire. Understanding what is debt consolidation can help clarify these complexities. Understanding what is debt consolidation can simplify your payment options. When exploring your options, knowing what is debt consolidation is essential.

You might qualify for consolidation on paper, but qualification doesn’t guarantee success. The difference between consolidation that genuinely improves your financial position and consolidation that simply reshuffles your problems lies in understanding the hidden mathematics, credit score dynamics, and behavioral patterns that traditional advice overlooks. Before you sign on the dotted line, you need to know why some people emerge from consolidation debt-free while others find themselves deeper in the hole despite lower monthly payments. Knowing what is debt consolidation is crucial in this decision-making process. To appreciate the full impact of your decisions, understand what is debt consolidation. Deciding on what is debt consolidation will guide your financial future.

The Hidden Mathematics of Debt Consolidation Success

By realizing what is debt consolidation, you can improve your financial strategy. The break-even analysis that determines whether debt consolidation will actually save you money involves calculations that extend far beyond comparing interest rates. Most borrowers focus exclusively on the monthly payment reduction or lower APR, missing the compound effect of payment timing and loan structure that can either amplify or eliminate their expected savings. When considering your options, think carefully about what is debt consolidation and how it applies to your specific financial situation. Understanding what is debt consolidation helps you plan accordingly. Learning what is debt consolidation is vital for making informed choices. One must grasp what is debt consolidation to avoid pitfalls in the process.

The mathematical foundation behind the 12-18 month threshold for debt payoff versus consolidation centers on the intersection of compound interest accumulation and opportunity cost. When you can eliminate existing debt within this timeframe using current payment schedules, the fees associated with consolidation—balance transfer costs, origination fees, and potential rate increases after promotional periods—often exceed the interest savings. This calculation becomes more complex when factoring in the behavioral tendency to extend payment periods through consolidation, which can increase total interest paid despite lower monthly obligations.

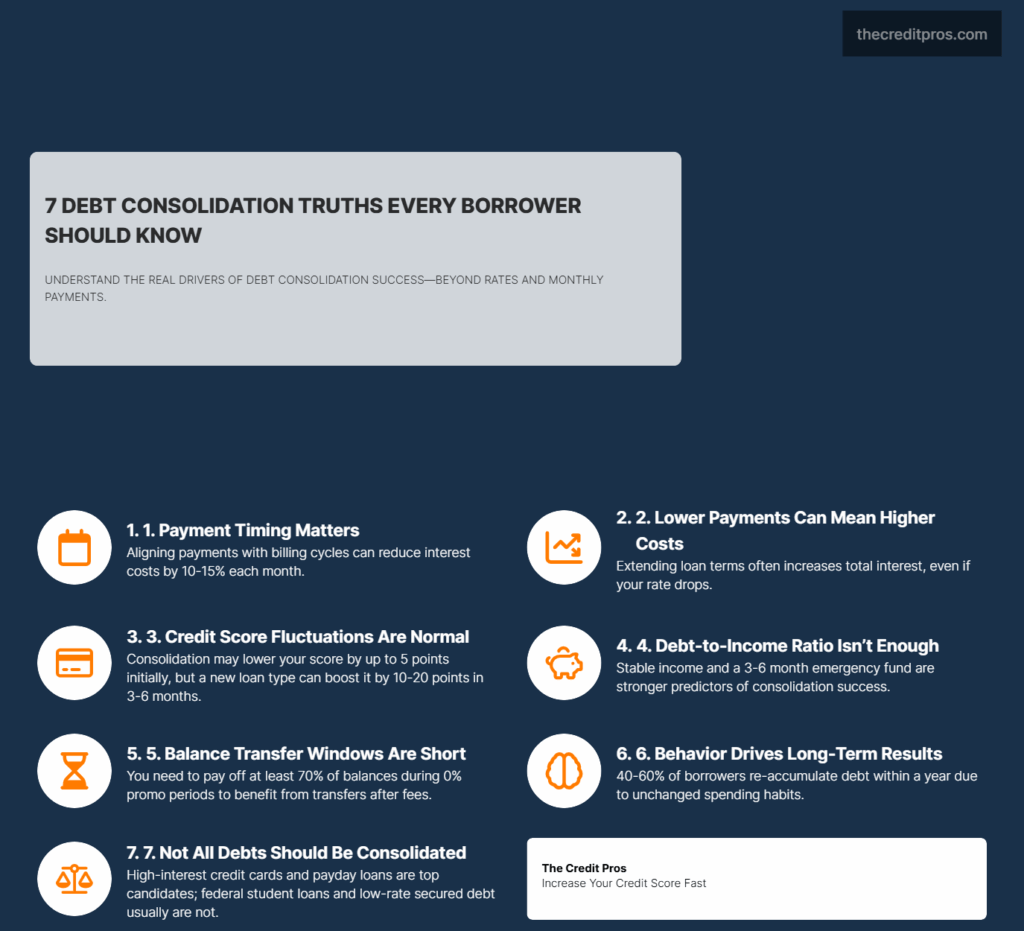

Payment timing within billing cycles creates a leverage effect that most consolidation guides overlook entirely. Credit card interest compounds daily based on your average daily balance, meaning that consolidating multiple cards with different billing cycles into a single payment can either concentrate or distribute your interest accumulation. The timing of when you make consolidated payments relative to your new due date can create monthly interest savings of 10-15% beyond the rate differential alone.

The relationship between loan term length and total interest paid becomes particularly nuanced in consolidation scenarios. While extending your repayment period reduces monthly payments, the extended timeline often results in paying more total interest than your original debt structure, even at lower rates. A $20,000 debt consolidation loan at 8% APR over five years costs $4,332 in interest, while the same debt paid off in three years costs only $2,529—a difference that can negate years of interest rate savings from consolidation.

Credit Score Dynamics: The Consolidation Paradox

Debt consolidation creates a temporary credit score paradox where your financial position improves while your credit metrics initially decline. The hard inquiry from loan applications typically reduces your score by 3-5 points, while the sudden change in credit utilization patterns can cause additional fluctuations that persist for 30-60 days after consolidation.

The counterintuitive effects of account closure decisions during consolidation often determine long-term credit health more than the consolidation itself. Closing paid-off credit cards after balance transfers eliminates available credit, potentially pushing your utilization ratio above optimal thresholds even with reduced total debt. However, keeping multiple zero-balance accounts open requires ongoing management to prevent inactive account closures by issuers, which can unexpectedly reduce your available credit months later.

Credit mix diversification through consolidation loans provides an often-unexpected boost to credit scores within 3-6 months of loan origination. Adding an installment loan to a credit profile dominated by revolving accounts demonstrates credit management across different product types, typically increasing scores by 10-20 points once payment history establishes. This effect proves particularly pronounced for borrowers whose credit profiles consisted entirely of credit cards before consolidation.

Strategic timing of balance transfers can maximize credit utilization benefits by coordinating transfer completion with billing cycle reporting dates. Credit utilization ratios report to bureaus based on statement closing dates, not payment due dates, creating opportunities to optimize reported balances through careful transfer timing. Executing transfers to arrive just after statement closing on destination cards while just before closing on origin cards can create a one-month window where total reported utilization reflects the improved post-consolidation picture.

Income-to-Debt Ratio Thresholds: Beyond the 50% Rule

Recognizing what is debt consolidation can lead to better financial health. Evaluating what is debt consolidation is integral to your financial success. Identifying what is debt consolidation can open new opportunities for savings. The traditional guideline suggesting debt consolidation works best when non-mortgage debt represents less than half your income oversimplifies the relationship between income stability and consolidation success. Variable income earners require different debt-to-income calculations that account for seasonal fluctuations, commission structures, and irregular payment schedules that can make fixed consolidation payments challenging during lean periods.

Having clarity on what is debt consolidation is crucial in financial planning. Practicing what is debt consolidation can lead to effective debt management. Comprehending what is debt consolidation can enhance your financial literacy. Delving into what is debt consolidation provides critical insights. Understanding what is debt consolidation forms the basis of sound financial decisions. When you appreciate what is debt consolidation, you can make empowered decisions. Recognizing what is debt consolidation helps mitigate future financial risks. The journey starts with acknowledging what is debt consolidation. Comprehending what is debt consolidation equips you for financial challenges ahead.

Income stability affects consolidation success rates through its impact on payment consistency rather than absolute earning levels. Borrowers with steady $50,000 annual incomes often achieve better consolidation outcomes than those earning $75,000 through variable sources, as payment reliability determines whether consolidation reduces or increases financial stress. The debt service coverage ratio—your ability to make loan payments from your lowest monthly income rather than average income—provides a more accurate predictor of consolidation sustainability. Ultimately, knowing what is debt consolidation could change your financial destiny.

Future income projections should influence current consolidation decisions through their effect on opportunity cost calculations. Career professionals expecting significant salary increases within 2-3 years might benefit from shorter-term, higher-payment consolidation strategies that eliminate debt before income growth, while those facing potential income reductions should prioritize payment flexibility over interest savings. The timing of consolidation relative to career transitions, retirement planning, or major life changes can determine whether the strategy enhances or constrains future financial flexibility.

Emergency fund adequacy plays a critical role in determining consolidation readiness that extends beyond simple debt-to-income ratios. Borrowers with inadequate emergency reserves often find themselves accumulating new debt shortly after consolidation when unexpected expenses arise, negating the benefits of their debt reduction efforts. The relationship between emergency fund size and consolidation success suggests that borrowers should maintain 3-6 months of expenses in liquid savings before pursuing consolidation, even if this delays the debt reduction process.

Strategic Consolidation Method Selection: Balance Transfers vs. Loans

The specific scenarios where balance transfer cards outperform consolidation loans depend on your ability to eliminate debt during promotional periods and your discipline in avoiding new charges on cleared cards. Balance transfers excel when you can pay off transferred balances within 12-21 months, as promotional rates of 0-3% APR provide substantial savings compared to personal loan rates of 6-15% APR. However, the average balance transfer promotional period of 15-18 months creates a narrow window for success that requires precise payment planning.

Hidden costs in balance transfer strategies often include fees ranging from 3-5% of transferred amounts, which can add $600-1,000 to a $20,000 consolidation before considering interest charges. These upfront costs must be weighed against the interest savings during promotional periods and the potential for rate increases to 18-25% APR once promotional terms expire. The mathematical break-even point typically requires paying off at least 70% of transferred balances during the promotional period to achieve meaningful savings over personal loan alternatives.

“Debt consolidation can bring down the interest rates you’re paying on each individual loan and help you pay off your debts faster, but it requires strategic planning and disciplined execution to achieve meaningful results.”

Promotional interest rate strategies create timing-dependent opportunities that require careful coordination with existing debt payment schedules. The optimal approach involves continuing minimum payments on existing debts while applying for balance transfer cards, then executing transfers to maximize the promotional period utilization. This timing strategy can extend your effective promotional period by 30-45 days compared to immediate transfer execution upon card approval.

Existing credit relationships significantly impact loan approval and terms in ways that can favor either balance transfers or personal loans depending on your banking history. Credit unions often provide personal loan rates 2-4 percentage points below market rates for established members, while credit card issuers may offer enhanced balance transfer terms to customers with strong payment histories. The relationship factor can shift the mathematical advantage between consolidation methods by hundreds or thousands of dollars over the loan term.

- Debt types that should always be consolidated: High-interest credit cards (above 15% APR), store credit cards, payday loans, and other unsecured high-cost debt

- Debt types that should rarely be consolidated: Federal student loans with income-driven repayment options, low-interest auto loans, mortgages, and secured debt with favorable terms

- Debt types requiring case-by-case analysis: Private student loans, home equity lines of credit, and promotional financing arrangements

Behavioral Finance Factors: Why Good Plans Fail

The psychological relief trap represents the most common cause of consolidation failure, where the immediate reduction in monthly payments or elimination of multiple bills creates a false sense of financial improvement. This relief often triggers increased discretionary spending within 30-90 days of consolidation, as borrowers interpret lower monthly obligations as increased disposable income rather than a debt management tool. The behavioral pattern proves so consistent that lenders often see re-accumulation of debt within the first year of consolidation in 40-60% of cases.

Payment automation affects long-term consolidation success rates by removing the monthly decision-making process that can lead to payment delays or reductions during financially stressful periods. Automated payments eliminate the behavioral tendency to prioritize immediate expenses over debt reduction, but they also reduce the psychological engagement with debt repayment that helps maintain spending discipline. The optimal approach involves automating minimum payments while maintaining manual control over additional principal payments to preserve psychological ownership of the debt reduction process.

Financial accountability systems become more critical after consolidation because the simplified payment structure can reduce awareness of total debt levels and repayment progress. Borrowers managing multiple debts often maintain heightened awareness of their financial situation through the complexity of payment scheduling, while consolidated debt can fade into background awareness as a single monthly obligation. Implementing tracking systems, regular progress reviews, and accountability partnerships helps maintain the financial discipline that consolidation requires for long-term success.

The spending habit reset that must accompany successful debt consolidation requires addressing the behavioral patterns that created the original debt accumulation. Consolidation without behavioral change simply creates a more efficient path to re-accumulating debt, as the underlying spending triggers and financial management weaknesses remain unchanged. The most successful consolidation strategies include concurrent implementation of budgeting systems, spending tracking, and behavioral modification techniques that address the root causes of debt accumulation rather than just the symptoms.

The Bottom Line: Making Consolidation Work for You

The gap between debt consolidation’s promise and reality isn’t found in the math alone—it’s in understanding the complete picture that traditional advice overlooks. While lower interest rates and simplified payments offer genuine benefits, success depends on mastering the hidden variables: timing your payments strategically, maintaining credit health during the transition, and most critically, addressing the behavioral patterns that created your debt in the first place. The borrowers who emerge truly debt-free aren’t just those who qualified for the best rates; they’re the ones who recognized consolidation as a tool requiring discipline, not a quick fix.

Your financial future hinges not on whether you can consolidate your debt, but on whether you can transform the habits that made consolidation necessary. The most dangerous assumption isn’t that consolidation won’t work—it’s believing that moving debt around solves the underlying problem without changing how you manage money moving forward.