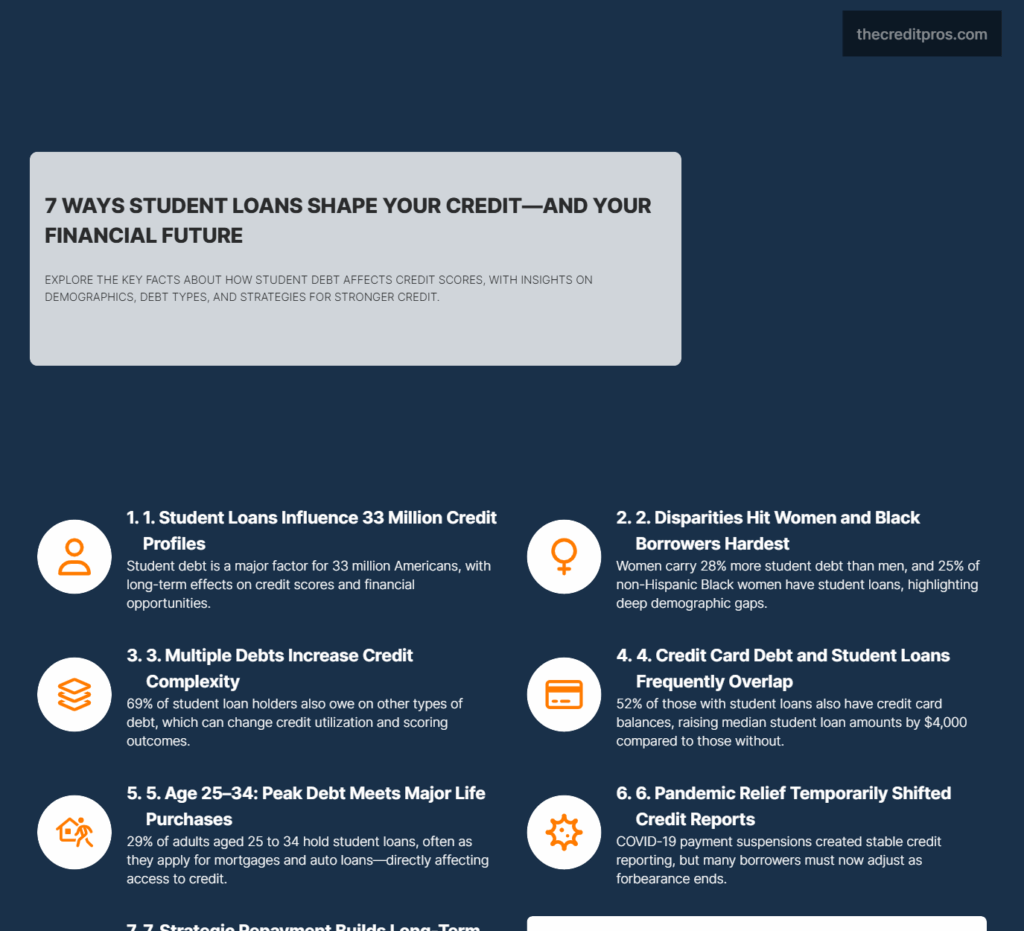

Student loans affect more than just your monthly budget—they quietly influence your credit score in ways that can impact your financial future for decades. With 33 million Americans carrying educational debt, this isn’t a small concern. The relationship between student loans and credit scores creates unique challenges that go far beyond making payments on time, especially when you consider that most borrowers don’t carry student debt alone. Understanding the weight of student loans on credit score is crucial for anyone managing educational debt.

The weight of student loans on credit score can significantly affect one’s financial decisions. What makes student loan debt particularly complex for your credit profile? The answer lies in how these loans interact with other types of debt, affect different demographics unequally, and create timing conflicts with major life purchases. Women carry 28% more student debt than men, while certain racial groups face double the burden through higher debt rates and additional credit barriers. When you add the fact that 69% of student loan holders carry multiple debt types, the credit score implications become even more intricate.

Understanding these connections can mean the difference between student loans dragging down your credit or actually helping you build it. Many are unaware of the weight of student loans on credit score until they apply for major loans.

The Disproportionate Credit Impact on Vulnerable Demographics

Strategizing around the weight of student loans on credit score can lead to better outcomes. The intersection of educational debt and existing economic inequalities creates compounded credit challenges that extend far beyond simple payment obligations. Non-Hispanic Black adults face a particularly stark reality in the student loan landscape, with 21% carrying educational debt compared to the national average of 15%. This disparity becomes even more pronounced when examining specific demographics within this group, where non-Hispanic Black women represent the highest student debt burden of any gender-race combination at 25%. It’s essential to consider the weight of student loans on credit score when planning for the future.

The credit implications of this demographic divide extend beyond debt amounts to fundamental differences in credit access and scoring. Non-Hispanic Black adults at every educational level demonstrate higher student loan rates than their White counterparts, creating a systemic pattern where educational advancement paradoxically increases credit vulnerability. The data reveals that non-Hispanic Black adults who attended college but didn’t complete a degree carry student debt at rates comparable to non-Hispanic White adults with advanced degrees—21% and 22% respectively—yet without the corresponding earning power to manage this debt effectively. Recognizing the weight of student loans on credit score can empower borrowers to make informed choices.

Women’s student debt burden creates unique credit timing challenges that compound throughout their career-building years. Carrying 28% more student debt than men, women face credit utilization pressures during periods when they’re simultaneously establishing careers, potentially starting families, and making major financial decisions. Non-Hispanic Black women exemplify this challenge most acutely, with their 25% student debt rate creating a perfect storm of gender and racial credit disadvantages. The median debt burden of roughly $20,000 for both non-Hispanic Black women and White women demonstrates how debt amounts remain similar while earning potential and credit access opportunities differ significantly. The weight of student loans on credit score often complicates the borrowing process.

The age demographics of student debt create particularly problematic credit scenarios during what should be prime credit-building years. Understanding the weight of student loans on credit score is vital for effective financial planning. Adults ages 25 to 34 carry student debt at a 29% rate, precisely when they’re most likely to seek mortgages, auto loans, and other major credit products. This timing conflict means that peak educational debt service coincides with other significant credit utilization needs, potentially limiting access to favorable terms or requiring difficult financial prioritization decisions.

The most precarious credit position belongs to those with some college education but no degree completion. This demographic faces the dual burden of educational debt without the corresponding earning benefits, creating what amounts to a credit trap. Their debt burden exists without the income enhancement that typically justifies educational investment, making debt service more challenging relative to earning capacity. The incomplete education credential also limits employment opportunities that might otherwise provide the income stability lenders prefer for favorable credit terms. The weight of student loans on credit score plays a key role in financial stability.

How Multiple Debt Types Compound Credit Score Challenges

Awareness of the weight of student loans on credit score is essential for responsible borrowing. Student loan debt rarely exists in isolation, creating complex credit utilization scenarios that traditional scoring models struggle to accurately assess. The reality that 69% of student loan holders carry additional debt types fundamentally alters how educational debt impacts credit scores. This overlapping debt structure means that student loans often represent just one component of a complex financial obligation network that includes credit cards, vehicle loans, and medical debt.

Credit card debt represents the most common additional burden, affecting 52% of student loan holders. The relationship between these debt types creates a compounding effect on credit utilization that extends beyond simple addition. Strategies to mitigate the weight of student loans on credit score can lead to better financial outcomes. Those carrying both student and credit card debt demonstrate median student loan amounts of $20,000 compared to $16,000 for those without credit card obligations. This $4,000 difference suggests that multiple debt types create escalating financial pressure that increases borrowing across categories.

The intersection of student loans with medical debt affects 18% of educational debt holders, creating particularly complex credit reporting scenarios. Medical debt collection practices differ significantly from educational debt management, often resulting in unexpected credit report entries that can dramatically impact scores. Many borrowers find the weight of student loans on credit score is an obstacle to financial progress. The combination creates unpredictable credit profile changes that can affect loan applications and credit decisions in ways that borrowers might not anticipate.

Vehicle loans represent another common overlap, affecting 33% of student loan holders. This combination creates particular challenges for debt-to-income ratio calculations that lenders use for risk assessment. Understanding the weight of student loans on credit score can influence repayment strategies. The long-term nature of both debt types means that borrowers carry extended obligation periods that can limit financial flexibility for decades. Traditional credit scoring models often struggle to accurately assess risk when multiple long-term debt obligations exist simultaneously.

The multiple debt ecosystem fundamentally alters credit utilization calculations in ways that can disadvantage student loan holders. Addressing the weight of student loans on credit score can help individuals manage their debt more effectively. Credit scoring algorithms typically focus on revolving credit utilization, but the presence of multiple installment loans creates different risk profiles that may not be accurately reflected in standard scores. This creates situations where student loan holders with otherwise responsible financial behavior may receive lower credit scores due to the complexity of their debt portfolio rather than their actual payment behavior or financial stability.

COVID-19’s Lasting Impact on Student Loan Credit Reporting

The COVID-19 pandemic created unprecedented disruptions in student loan credit reporting that continue to influence credit scores and lending decisions. Federal student loan payment suspensions, while providing necessary relief, created confusion in credit reporting systems and altered the typical relationship between student loans and credit scores. The payment freeze meant that many borrowers’ credit reports showed consistent payment status without actual payment activity, creating artificial stability in credit profiles. People need to understand the weight of student loans on credit score to protect their future.

The stimulus payment distribution revealed significant behavioral patterns among student loan holders that directly impacted credit scores. With 75% of stimulus recipients using payments immediately and approximately half directing funds toward debt reduction, the pandemic created an unusual debt paydown period. Being proactive about the weight of student loans on credit score is crucial for financial health. Student loan holders demonstrated particularly high rates of debt reduction spending, with women and racial minorities showing even stronger tendencies to use stimulus funds for debt management rather than consumption. Ultimately, the weight of student loans on credit score is a significant factor in achieving financial goals.

The demographic groups most likely to carry student debt also experienced disproportionate employment disruption during the pandemic. The pandemic highlighted the weight of student loans on credit score as many borrowers struggled. Those with some college but no degree faced particular employment instability, creating situations where existing student debt became more burdensome relative to reduced income. This created credit utilization pressure that extended beyond student loans to affect overall credit profiles, particularly when unemployment benefits proved insufficient to maintain previous payment patterns across multiple debt types.

The forbearance and deferment options available during the pandemic created complex credit reporting scenarios that borrowers often didn’t fully understand. While these programs provided payment relief, their appearance on credit reports varied depending on the specific program used and the reporting practices of individual servicers. Some programs appeared as positive payment status, while others showed as deferred or modified payment arrangements, creating inconsistent credit report presentations that could affect future lending decisions. Managing the weight of student loans on credit score requires careful planning and execution.

The pandemic period also revealed the limitations of traditional credit scoring models when dealing with government intervention in debt markets. The weight of student loans on credit score is often misunderstood by many borrowers. The artificial stability created by payment suspensions masked underlying financial stress that became apparent as programs ended. This created situations where credit scores maintained artificial elevation during the suspension period, potentially leading to overextension when normal payment obligations resumed.

Strategic Credit Management During Student Loan Repayment

Effective credit management during student loan repayment requires understanding how payment timing and structure influence credit scoring algorithms. Student loan payments typically report to credit bureaus monthly, but the timing of these reports relative to your credit utilization calculation can significantly impact your score. Making student loan payments early in the billing cycle can improve your debt-to-income appearance when credit reports generate, particularly important when applying for additional credit products. Understanding the weight of student loans on credit score can provide clarity to borrowers.

The choice between loan consolidation and maintaining individual loans creates different credit impacts that borrowers should evaluate carefully. Paying attention to the weight of student loans on credit score can improve financial literacy. Consolidation can simplify payment management and potentially reduce the number of accounts reporting to credit bureaus, but it also eliminates the positive impact of multiple accounts with good payment history. Individual loans provide more opportunities to demonstrate consistent payment behavior across multiple accounts, which can strengthen credit mix scores and payment history depth.

Income-driven repayment plans create unique credit considerations that extend beyond monthly payment amounts. Evaluating the weight of student loans on credit score is essential for effective credit management. These programs often result in payments that don’t cover accruing interest, leading to growing loan balances that can affect debt-to-income ratios over time. While these plans provide payment relief, the increasing balance can create long-term credit challenges, particularly when seeking additional financing for major purchases like homes or vehicles.

“Student debt was tied to educational attainment or the highest degree someone has received. About 1 in 4 adults with advanced degrees had at least some student debt, compared to fewer than 1 in 5 adults with an associate or two-year degree.”

The rehabilitation process for defaulted student loans offers a structured path to credit recovery that requires careful timing and planning. This process typically involves making nine consecutive on-time payments, after which the default status can be removed from credit reports. The rehabilitation process can provide significant credit score improvements, but borrowers must understand that the underlying payment history remains visible, though the default notation disappears. Students need to grasp the weight of student loans on credit score early on in their education.

Credit mix diversification while carrying student debt requires strategic planning to avoid overextension while building comprehensive credit history. Student loans provide installment credit history, but borrowers often need revolving credit to optimize their credit mix. The key lies in maintaining low utilization on revolving accounts while demonstrating consistent payment behavior across all debt types.

Key strategies for optimizing credit during student loan repayment include:

- Setting up automatic payments to ensure consistent payment history

- Monitoring credit reports for accurate student loan reporting

- Timing major credit applications to avoid multiple inquiries during active repayment periods

- Maintaining emergency funds to prevent missed payments during financial disruption

- Understanding how different repayment programs appear on credit reports

Building Long-Term Credit Strength with Student Loans

Student loans, despite their burden, offer unique opportunities for long-term credit building that savvy borrowers can leverage strategically. The extended repayment terms typical of educational debt—often 10 to 30 years—provide consistent opportunities to demonstrate payment reliability over time. This extended payment history can become one of your strongest credit building tools, particularly when maintained without interruption throughout the repayment period. The weight of student loans on credit score should not be taken lightly when planning finances.

The age of accounts component in credit scoring algorithms particularly benefits student loan holders who maintain their original loans throughout repayment. Student loans often represent some of the oldest accounts in a borrower’s credit profile, contributing significantly to credit history length calculations. This factor becomes increasingly valuable over time, as the average age of accounts grows and strengthens overall credit scores. During repayment, understanding the weight of student loans on credit score becomes increasingly important.

Refinancing decisions require careful timing considerations that balance interest savings against credit score impacts. While refinancing can reduce interest rates and monthly payments, it also creates new account origination that can temporarily lower credit scores and reset the age of the account. The optimal timing for refinancing typically occurs when the interest rate savings justify the temporary credit impact and when the borrower doesn’t anticipate needing additional credit in the immediate future.

Building emergency funds while managing student debt creates credit protection that extends beyond the educational loans themselves. Emergency funds prevent the need to rely on credit cards or other high-interest debt during financial disruptions, maintaining the positive payment history across all accounts. This financial cushion also provides flexibility to continue student loan payments even during periods of reduced income, protecting the long-term credit building benefits of consistent payment history.

The post-payoff credit landscape requires preparation to maintain strong credit scores after student loan completion. Many borrowers experience temporary credit score decreases when major installment loans are paid off, as this reduces credit mix diversity and can affect utilization calculations. Preparing for this transition involves maintaining other forms of credit and understanding how the completion of student loan payments might affect overall credit profiles. The rehabilitation process highlights the weight of student loans on credit score as a key concern.

Conclusion: Transforming Student Debt from Credit Burden to Building Block

Student loans don’t have to be the credit score destroyer that millions of Americans fear—they can actually become one of your most powerful long-term credit building tools when managed strategically. The key insight from examining 33 million borrowers’ experiences is that the relationship between educational debt and credit scores isn’t predetermined by the debt itself, but by how you navigate the complex interactions with other debts, timing decisions, and demographic challenges that disproportionately affect women and minorities. Those in debt should always consider the weight of student loans on credit score when planning.

The path forward requires understanding that your student loans exist within a broader financial ecosystem where 69% of borrowers carry multiple debt types. Success comes from viewing your educational debt as part of a comprehensive credit strategy rather than an isolated burden. Whether you’re building payment history over decades, managing the transition through income-driven repayment plans, or preparing for life after payoff, the choices you make today will echo through your credit profile for years to come. The question isn’t whether student loans will affect your credit—it’s whether you’ll let them define your financial future or use them to build the foundation for decades of strong credit health. Recognizing the weight of student loans on credit score is integral to long-term financial health.